Every now and then I get asked about what I think are the best stocks to buy right now. This question especially comes with our weekly Boom, Doom Zoom show that as you know we hold on Thursday at 12 noon (EST). So I’ve decided to do my homework in advance of our next show.

Here’s why I like Megaport

Despite its ups and downs, one tech stock I’ve stuck with is Megaport. The fund manager Firetrail is a big fan of the stock and has been known to increase its holding when it has dipped.

Megaport is said to have few rivals out there. Its main business is to give businesses online capacity that might be seasonal or occasional. The best example of when a business needs more digital capacity is the VRC when the Melbourne Cup carnival is on and that’s when its website would face an enormous boost in traffic. It buys capacity to ensure they don’t have business-killing website crashes from Megaport.

But it’s a tech business and isn’t known for profits but more like future profits as it pursues growth when growth companies are out of favour.

That’s a ‘now’ problem but I’m betting when tech stocks get re-loved when inflation and interest rates peak, a company such as Megaport will be the first to be bought up by those trying to cash in on a more tech-friendly future.

And the analysts on FNArena agree, with the average rise tipped to be a whopping 70.5%. But this is an average rise, so it implies there are those who expect the price rebound to be bigger. Citi tips a huge 133.33% gain out there, while UBS has topped this going for a 135% rise.

To reinforce the support for this company, know that not one of seven analysts were sellers of the stock and the smallest predicted rise was 18.33%.

Other tech stocks I like

I do like other tech companies such as Audinate, which has a 25% rise tipped by analysts, and Xero with a 23.7% rise expected, while Wisetech (+2%) and Altium (-5.2%) have never been tech-rejected like so many of these stocks in this sector.

My next favourite growth stock

For my next favourite growth stock play, I have to opt for CSL, with the average stock price rise tipped to be a good 10.3%. And that’s a target price of $324.78, but I see this as the bottom case price target for 2023.

Most of you know I believe 2023 will be good for a stock price rebound, and when rates top out and inflation dips, the pent-up demand for growth/tech stocks will see quality plays such as CSL get a big take-up from fund managers who will want a reliable performer.

Also the Yanks are already talking about the health sector coming more into favour in the months ahead. CSL is bound to get caught up in the growth and health sector enthusiasm.

Six out of six analysts have higher price targets, with Citi being the most supportive with a +15.5% call. The weakest rise is 5.3% from Credit Suisse, but remember these are not one-year calls and are shorter term forecasts. I believe CSL will relive its many comebacks in its stock price and show what a first-class investment it is.

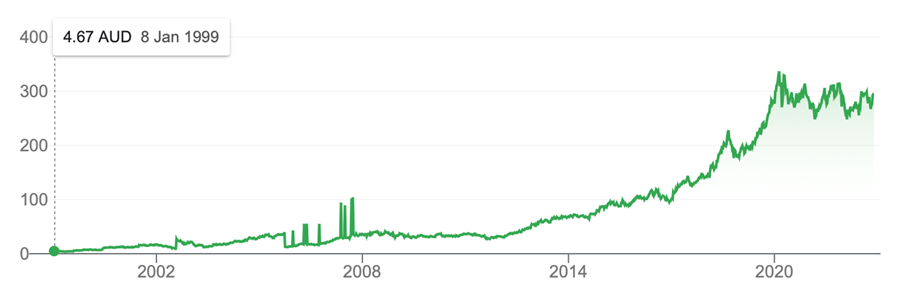

This chart of 23 years shows what this company can do after a period of sideways price action. And remember this was a $336 stock in February 2020.

CSL

If the company get to $336 again it will be a 14% rise and I’m prepared to try my luck with a quality company that might give me 14% and a small dividend of around 1%.

Let’s talk about GEAR

My final punt on the future has to be a safe kind of play because I’m not renowned for overtalking higher risk companies out there. Off the record, I’m actually having a small stab at higher risk plays such as GEAR and less risky overall market plays such as IOZ and IHV, but I can’t call these my favourite stock plays, so I’m opting for JB Hi-Fi, which I think is a great business.

And what about JB Hi-Fi?

Here the analysts (six out of seven) have a positive outlook on the company that has an average stock price rise of 11.7%. But the analyst at Credit Suisse has plumped for a 28.94% jump.

Macquarie is the only dissenter with a 3.37% fall, but this could be a more short-term view as the first-half of this year could be challenging for retail as mortgagees on fixed rate home loans are forced on to higher variable rate loans. Also the unemployment rate is going to rise as an economic slowdown takes place.

Over the past year, JBH has fallen 13.6% as the chart below shows.

JB Hi-Fi

But look at its long run chart, if you need proof that this is a reliable business.

Three out of the six analysts who assess the company have a rise ahead of over 16%. And the dividend looks likely to be 5% plus before franking. History has taught me that JBH is a great buy when everyone wants to sell it.

Let’s summarize my best buys

Here are my best buys for 2023’s expected market bounceback:

My three favourite stocks:

1. MP1

2. CSL

3. JBH

Other tech companies:

4. XRO

5.AD8

6. CAR

Index plays:

7. IOZ or VAS

8. IHVV for hedged play on the S&P 500.

Risky big return plays:

9. GEAR, which magnifies both rises and falls in the local market

10. HNDQ which is a hedged play on the top 100 stocks in the Nasdaq Composite.

Clearly, these are not advice recommendations but purely what I think look like good ideas for 2023.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.