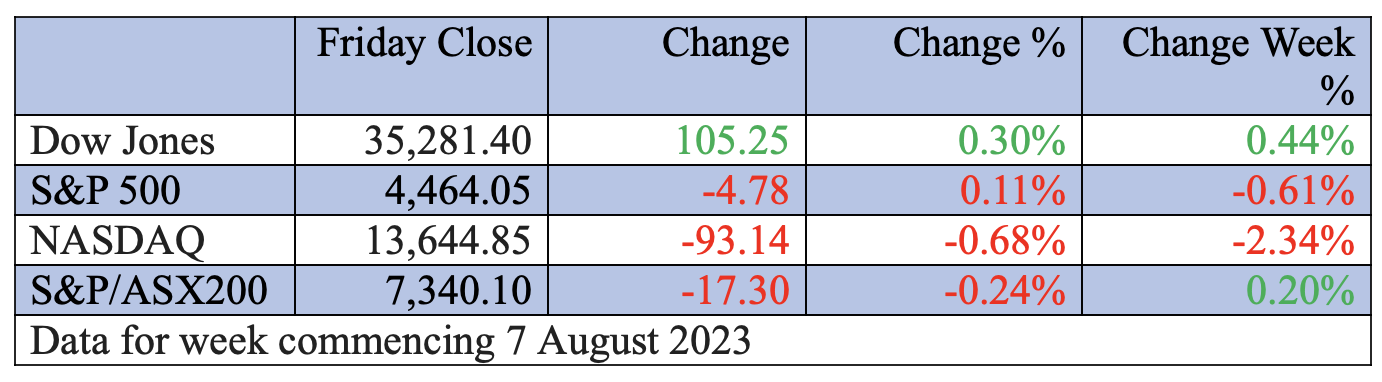

The US registered another loser week for stocks, which makes it two in a row, but historically speaking, this conforms with the past as the Stock Traders Almanac says this is what often happens in the first two weeks of August. Trying to work out why is a bit of a puzzle but that’s always the way with share markets.

The only overnight negative was a Producer Price Index (PPI) number that was 0.3% for July when economists were tipping 0.2%. This has raised some questions about the new worry for Wall Street — inflation stickiness and what the Fed might do with rates. There’s a growing belief that the US central bank could be done and dusted with rate rises.

This positive for stocks adds to a belief that the US will dodge a recession, or at least a worrying one. Then there’s the fact that inflation is falling with the CPI showing prices had climbed by 3.2% on an annual basis, which was less than the consensus estimate of 3.3%. And all this has been happening with unemployment not spiking as inflation falls, which isn’t usual economics.

But wait, there are more reasons for stocks to be rising rather than falling.

June quarter earnings reports for US companies are now more than 90% complete, with 80% beating earnings expectations. This compares to the norm of 76%. The average beat on earnings for these better-than-expected performing companies was 7%. As a consequence, the consensus on earnings expectations for the year to the June quarter has been revised up from a 7% decline to a 4.7% slide.

After the week’s run of data, this is what Shane Oliver (AMP’s Chief Economist and Head of Investment Strategy) saw in his economic crystal ball: “The next 12 months are likely to see a further easing in inflation pressures and central banks moving to get off the brakes. This should make for reasonable share market returns, provided any recession is mild”.

Shane points out that recession worries are still understandable, given there’s been so many rate rises in so many countries. But also, we’re waiting to see more company earnings stories, which could hit optimism, along with the potential of more surprise hikes in rates from central banks. And then there’s the “seasonality out to September/October” concerns. Yep, market crashes tend to happen in those two months. When they don’t happen, that’s why we often see US stocks surge in the December quarter and then the March one.

If you need more reasons to understand why markets could be a little worried now, you can think about China’s slower-than-expected growth, higher energy prices and there’s even another potential US government shutdown from October 1.

Congress has until then, which is the start of the new fiscal year, to act on government funding. The US news agency, pbs.com, says Congress “…could pass spending bills to fund government agencies into next year, or simply pass a stopgap measure that keeps agencies running until they strike a longer-term agreement. No matter which route they take, it won’t be easy”.

Senator Chris Coons put this debt debacle into potential future context: “We’re going to scare the hell out of the American people before we get this done”.

All this helps explain why there’s market nervousness around now, but I think it will eventually turn into strong support for stocks across the December quarter and into 2024, with the end of interest rate rises critical for driving share prices higher in the second-best year for stocks, which is the fourth year of a US Presidency.

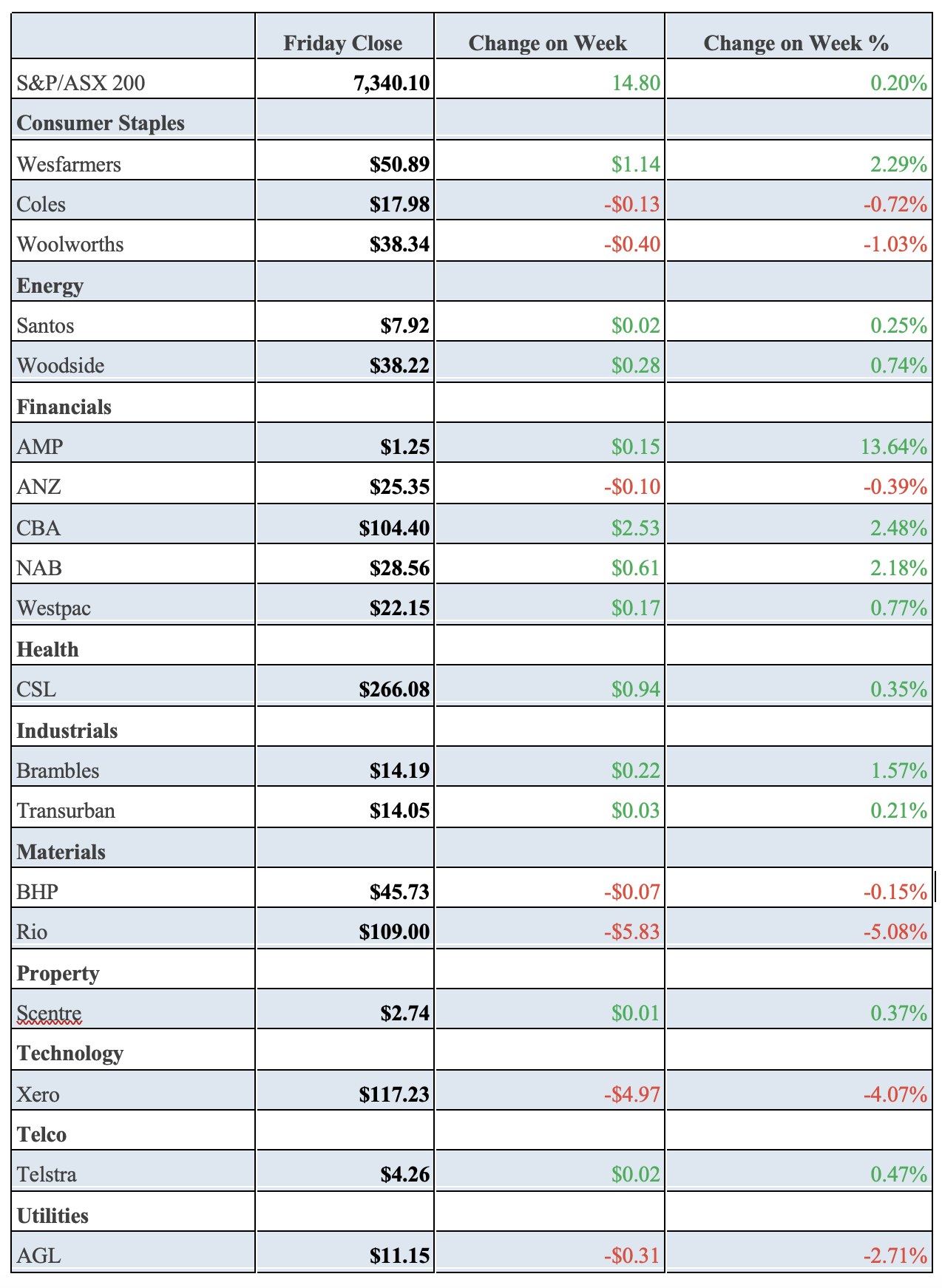

To the local story, and we didn’t succumb to US stock market softness, with our S&P/ASX 200 index up 14.8 points (or 0.2%) for the week finishing at 7340.1, which means we’re up 5.6% year-to-date.

The Dow is up 6.37% over that timeframe, while the S&P 500 has risen 16.67%, while the Nasdaq is up a whopping 31.2%! The big rises of the latter two indexes go a long way to explain the recent sell-offs for the S&P 500 and Nasdaq. Alternatively, it’s more understandable that the Dow and our market rose this week.

The AFR reported that Woodside Petroleum lost 2% to $38.22 and Whitehaven Coal dropped 3% to $7.23 on Friday, but both were higher for the week with energy prices on the rise.

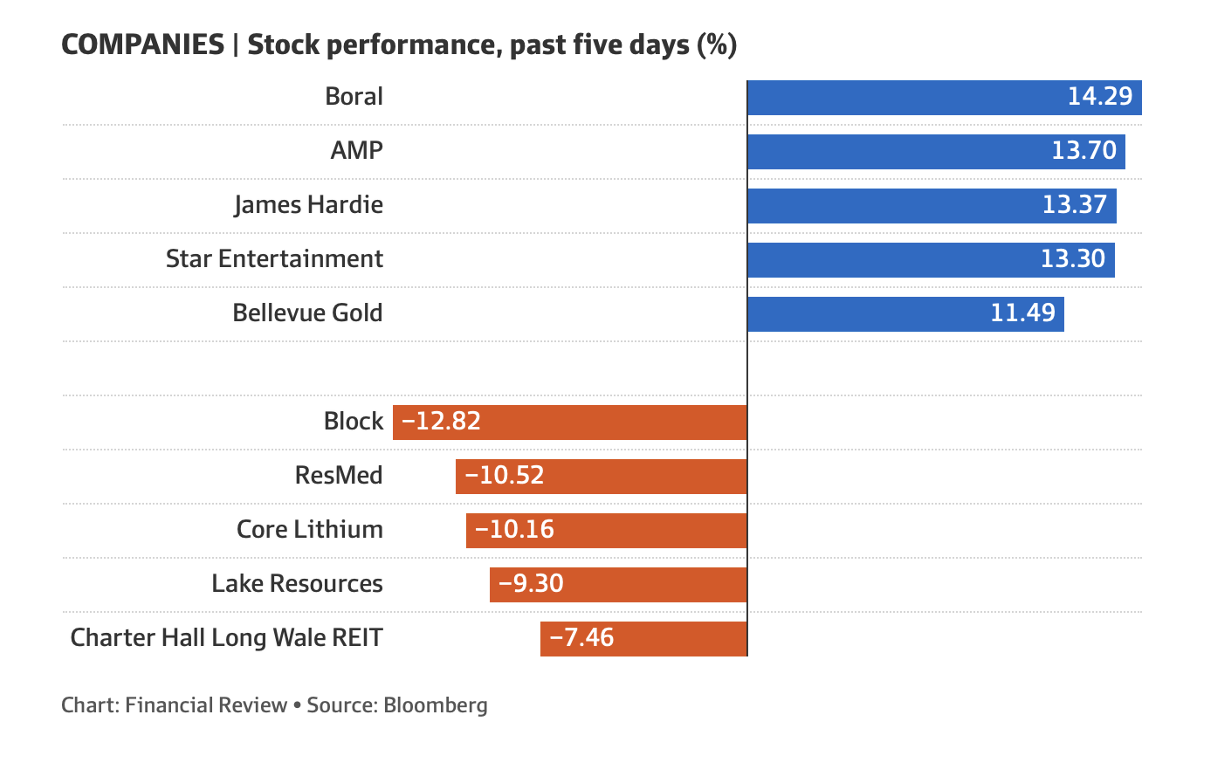

Here are the big winners and losers of the week.

Star Entertainment surged 17.95% to $1.15 after the NSW state government proposed law changes to ensure the company doesn’t go out of business. Meanwhile, retail stocks went higher after Nick Scali Ltd reported better than expected on Friday. Its share price spiked 13.3% to $12.12. Other retailers such as Harvey Norman and JB Hi-Fi saw their share prices rise between 2-3% as well.

What I liked

- This from AMP’s Shane Oliver: “Mixed messages on Australian interest rates in the last week from data releases – but our base case remains that we have seen the top or if not are now very close to it”.

- NAB business confidence readings remains at average levels and business conditions remain OK.

- US CPI inflation rose to 3.2% year-on-year from 3% in June due to base effects, as a lower monthly rise a year ago dropped out, but the rise was less than expected and core (ex food and energy) inflation fell further to 4.7% year-on-year. Core goods inflation was negative at minus 0.3% month-on-month. Just as goods price inflation led services inflation on the way up, it’s also leading on the way down, with services inflation continuing to slow.

- US core services inflation excluding shelter, which the Fed has been focussing on, has slowed to 2.3% annualisedover the last three months.Shelter inflation is continuing to fall, which is consistent with falling inflation in rents that landlords are asking for.

- The ABS Household Spending Indicator has slowed to a crawl in nominal terms, suggesting that overall real consumer spending may have gone backwards in the June quarter, which should help the Reserve Bank remain on pause.

What I didn’t like

- The reaction to the US Producer Price Index (PPI), where a 0.3% rise in July was seen as a worrying issue.

- According to the July Westpac/MI consumer survey, consumer confidence fell slightly in August, remaining at recessionary levels, despite the RBA’s decision to leave rates on hold again, indicating that the lagged impact of rate hikes and cost-of-living pressures continue to impact.

- The NAB survey showed that while cost and price pressures are still down from their highs, they rebounded sharply in July. This was particularly the case for labour costs. This possibly reflects the flow through of faster minimum and award wage rises this year and their influencing effect on other wages, along with the increase in the Super Guarantee and higher power prices.

- Company insolvencies are still on the rise.

- The slump in exports and imports worsened in July, with exports down 14.5% year-on-year and imports down 12.4% year-on-year, with the latter indicating weak domestic demand.

- China slipped back into deflation, with the CPI down 0.3% year on year, while their PPI was down 4.4%.

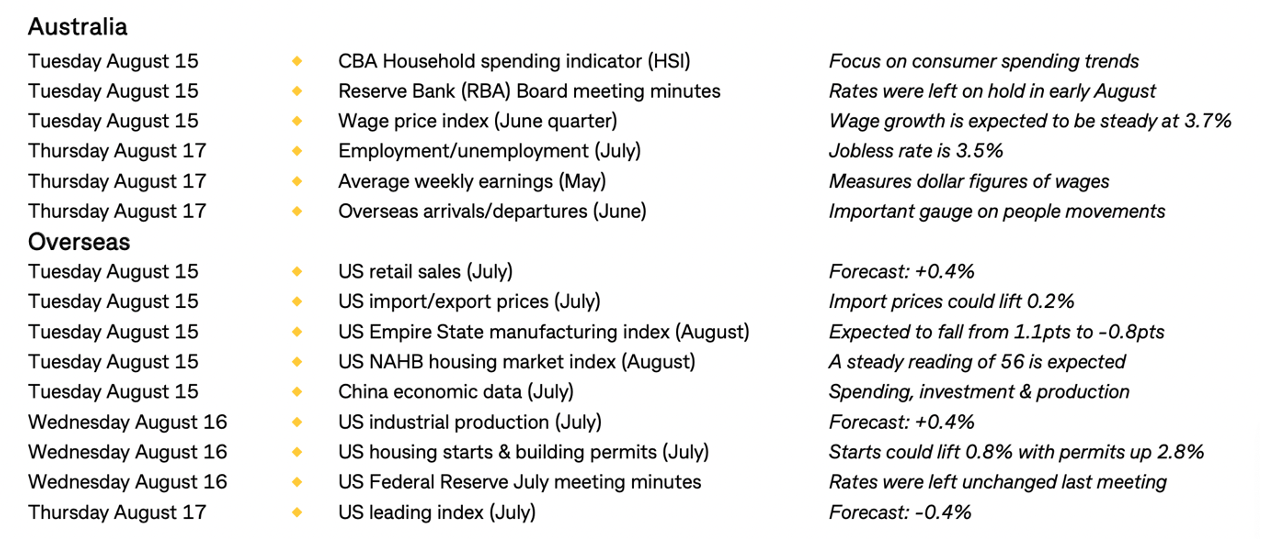

Big week ahead for economy and stocks

Along with wage price data, unemployment numbers here will be important for inflation and interest rate worriers this week. In fact, there’s a lot of economic data here and in the US that will help or hurt stock prices. (See The Week Ahead table below)

But there’s a lot of big-name companies reporting. Here’s a snapshot:

- JB Hi-Fi(Monday).

- CSL, Cochlear, NAB, Treasury Wine Estates(Tuesday).

- Bapcor, Endeavour Group, Transurban, Mirvac(Wednesday).

- Amcor, ASX, Goodman Group, Origin Energy, Telstra, Westpac(Thursday).

- Magellan(Friday).

The Week in Review

Switzer TV

- Switzer Investing: SwitzerTV Monday 7th August 2023 | Paul Rickard talks with Marcus Borden and Adam Dawes [1]

- Boom Doom Zoom: 10th August 2023 [2]

Switzer Report

- Two radio stocks to watch! [3]

- “HOT” stock: Evolution Mining (EVN) [4]

- Questions of the Week [5]

- 13 shorted stocks that the analysts like [6]

- Portfolios gain in July as market nears high for the year [7]

- HOT stock: Orora Ltd (ORA) [8]

- Three great aussie manufacturers [9]

- Buy, Hold, Sell — What the Brokers Say [10]

Switzer Daily

- Beware! Fraudsters are using AI to steal from you [11]

- Fair Work Commission finds work-from-home worker was not working at home! [12]

- Two Aussie sisters create a billion dollar retail brand as retail sinks [13]

- Passenger scolding American Airlines pilot gives lessons on leadership [14]

- Here’s a way to get even with banks [15]

The Week Ahead

UPDATED CHART ABOVE

Top Stocks — how they fared.

Chart of the Week

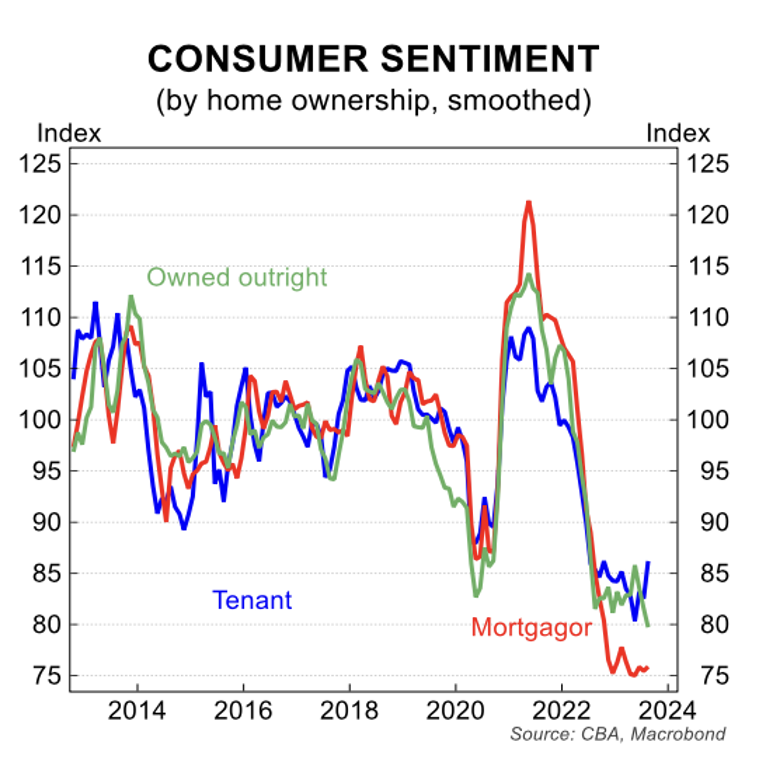

The CBA on this Westpac measure of consumer sentiment: “The Westpac-Melbourne Institute consumer sentiment index fell by 0.4% to 81.0 in August 2023. The index remains in deeply pessimistic territory The move lower is somewhat surprising given the RBA has held interest rates steady in two consecutive meetings. The majority of respondents still anticipate further hikes and cost of living pressures remain acute which likely explains the continued weakness in the series.”

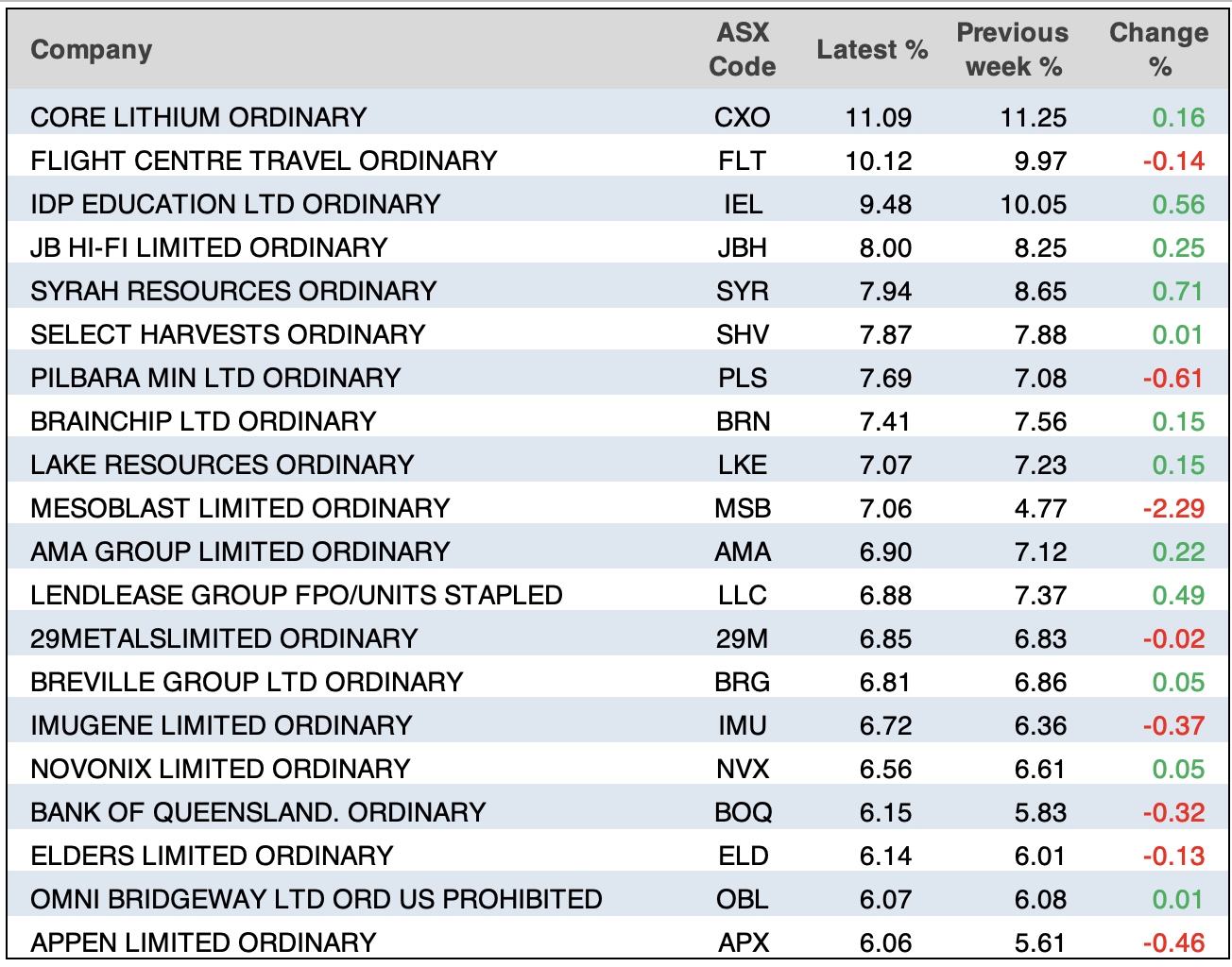

Stocks Shorted

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before

Quote of the Week

“US inflation data indicated a further cooling of price pressures in July, adding to optimism that the Federal Reserve may be able to call time on rate rises for the cycle,” said UBS Global Wealth Management’s Solita Marcelli. “While the continued downward trend in inflation should support equity market sentiment, a rosy economic outlook was already priced into stocks.”

Disclaimer

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.