A rally for stocks (on the back of a lower job creation figure for the American economy) U-turned when hourly wage numbers in the state of the labour market report rose more than expected. This put to bed any certainty that the Fed has stopped worrying about inflation and might be done with interest rate rises.

That said, the smart money and bond market assessments are still betting that the US central bank will play a ‘wait and see’ game with upcoming economic data before announcing “mission complete” on beating down inflation.

Economists guessed the rise in jobs would be 200,000 but the official figure was 187,000, which was good news for those hoping rate rises were over. However, the unemployment rate actually fell from 3.6% to 3.5%, but against that there were “…downward revisions to the monthly job total for May and June (down 25,000 jobs and 24,000 jobs respectively), [which] are further indications that the nation’s labour market is gradually cooling off,” CNN reported.

“It’s kind of the Goldilocks economy,” Brian Bethune, economist and professor at Boston College, told CNN. “It’s not too fast, and it’s not too slow, and that’s precisely where you want to be.”

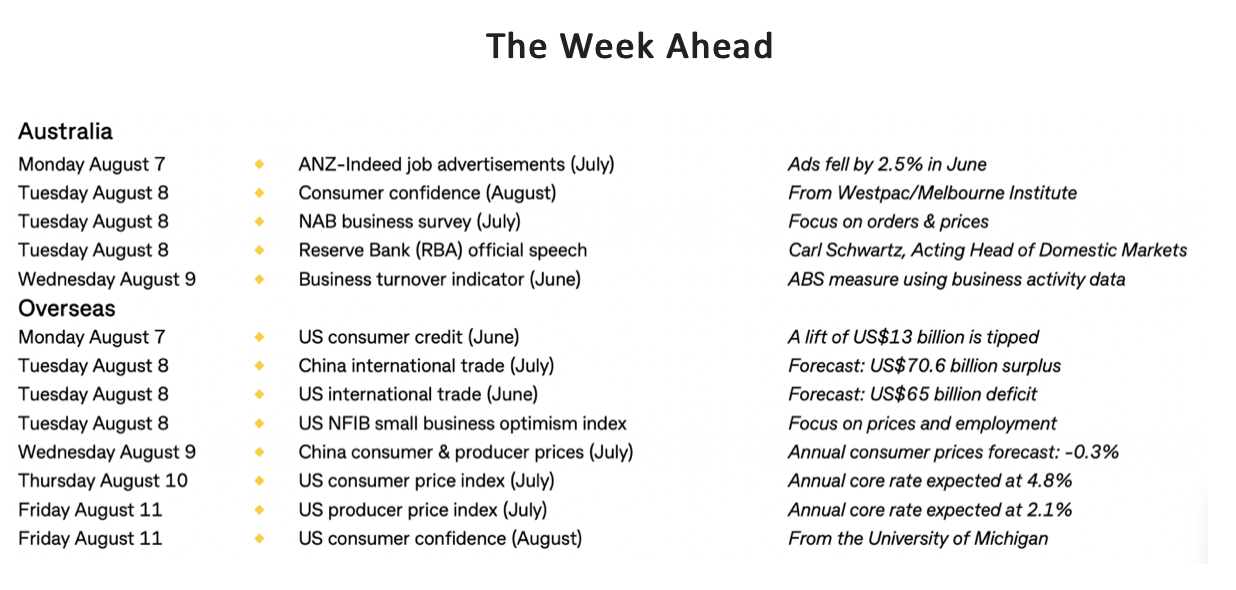

You have to hope that this better-than-expected economic outlook can be sustained next week when the Yanks get the July Consumer Price Index. Market optimists need to see what has been happening in the US lately, and now here, where inflation has fallen even without a notable spike in the jobless rate.

I’m seeing the current sell-off inclination as more a profit-taking action by those shorter-term stock players who’ve made good money with the recent surge in global stock markets. Sure, the Fitch downgrading of US Government debt was no help and it explained a slight rise in bond yields, but US stocks have surged of late.

The Nasdaq had a rough week, off 3%, but is up 17% in six months. The Dow is up 3.5% over the same time, though it did put on 5.6% in the week before this one. Meanwhile, it’s interesting that the small cap index (i.e., the Russell 2000) has been on a notable rebound. It’s up nearly 12% year-to-date, while the Dow is up less than 6%.

It’s not all that surprising that stocks are on the slide now, especially when you learn that the Stock Trader’s Almanac tells us that the first nine trading days in August are historically weak for share prices.

“Since 1987, August has been the worst month for the Dow and the second-worst month for the S&P 500, the almanac said,” CNBC reported.

Against this negative tendency, US second quarter earnings continue to come in better than expected. Around 83% of companies have reported and 80% have beaten earnings expectations, while the historical norm is 76%. Expectations are that earnings will fall by a better-than-forecasted 5.2% over the year to June, which isn’t consistent with a recession.

We’re also approaching the two scariest months of the year — September and October — when big market slumps have happened. But against this, the third year of a US President is historically the best for stocks. Since 1945, the S&P 500 has risen an average of 15.9% during the last full year before an election, compared to an overall average of 9.2% for every year. Year-to-date, that market index is up 17%, so seeing some nervousness around now makes sense. However, an average of 15.9% would be made up of years both under and over 15.9%, so believing there’s still upside for stocks isn’t naïve.

We need to see inflation keep falling, a recession not imminent and interest rates to stop rising and then stock prices will take-off again.

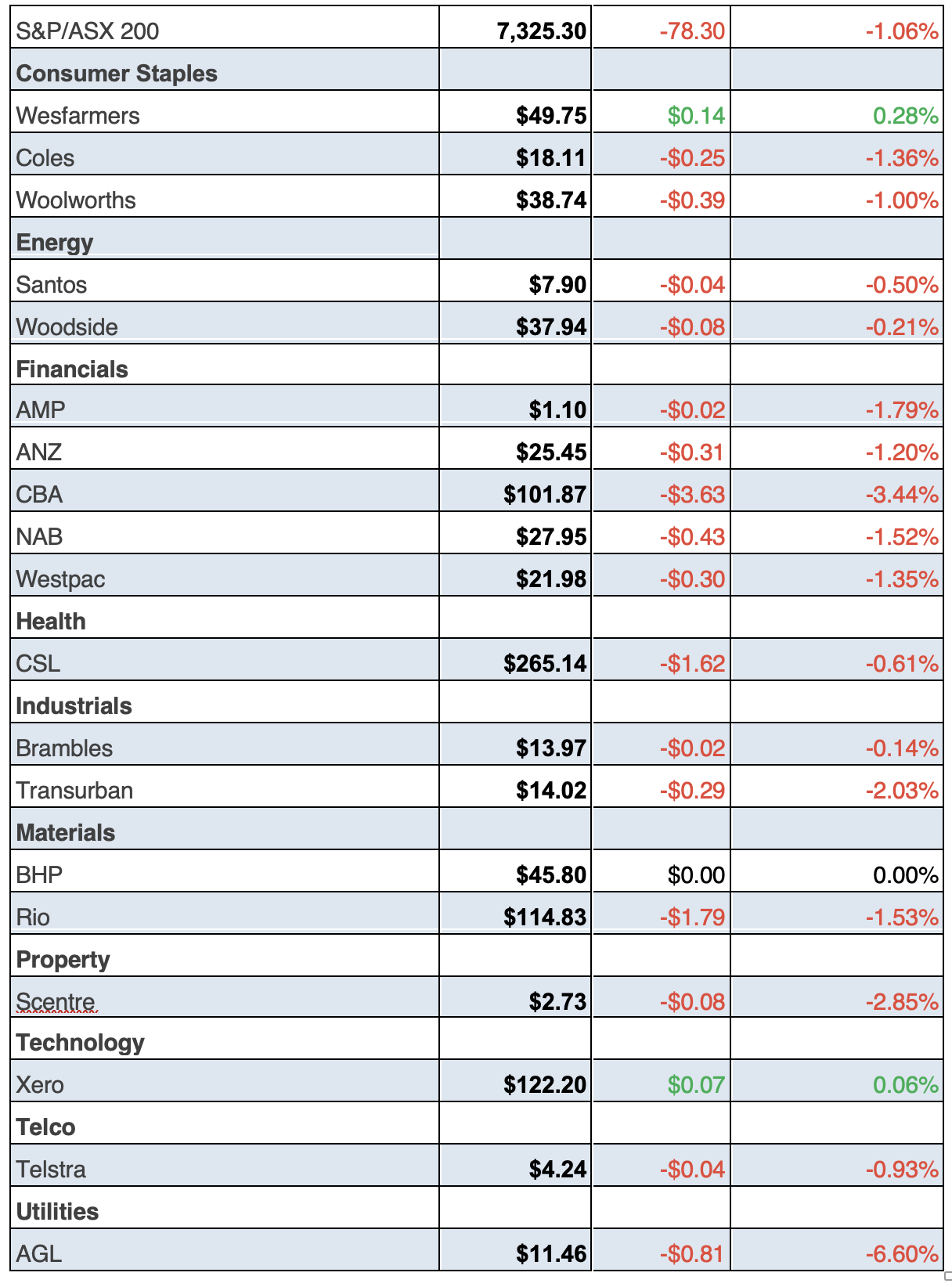

To the local story and the AFR underlined the shockers for

Mesoblast, Block and ResMed on Friday. Block lost 5.8%, Resmed 9.3% and Mesoblast a whopping 56.8%!

Resmed reported less revenue than the market expected, while Block reported OK but referred to spending by local consumers being more challenged.

Meanwhile, that disappointing company Mesoblast saw its share price slump again after the US drug regulator asked for more information before it could think about approving its remestencel-L, which aims to fight a pediatric steroid refractory disease.

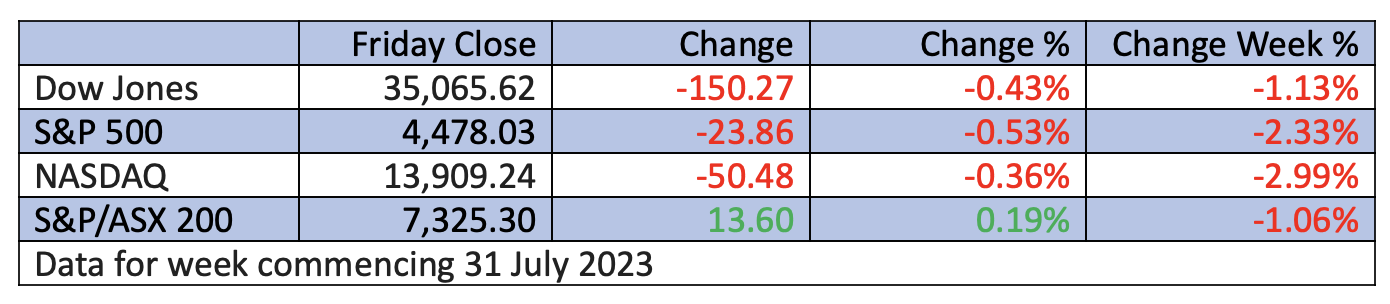

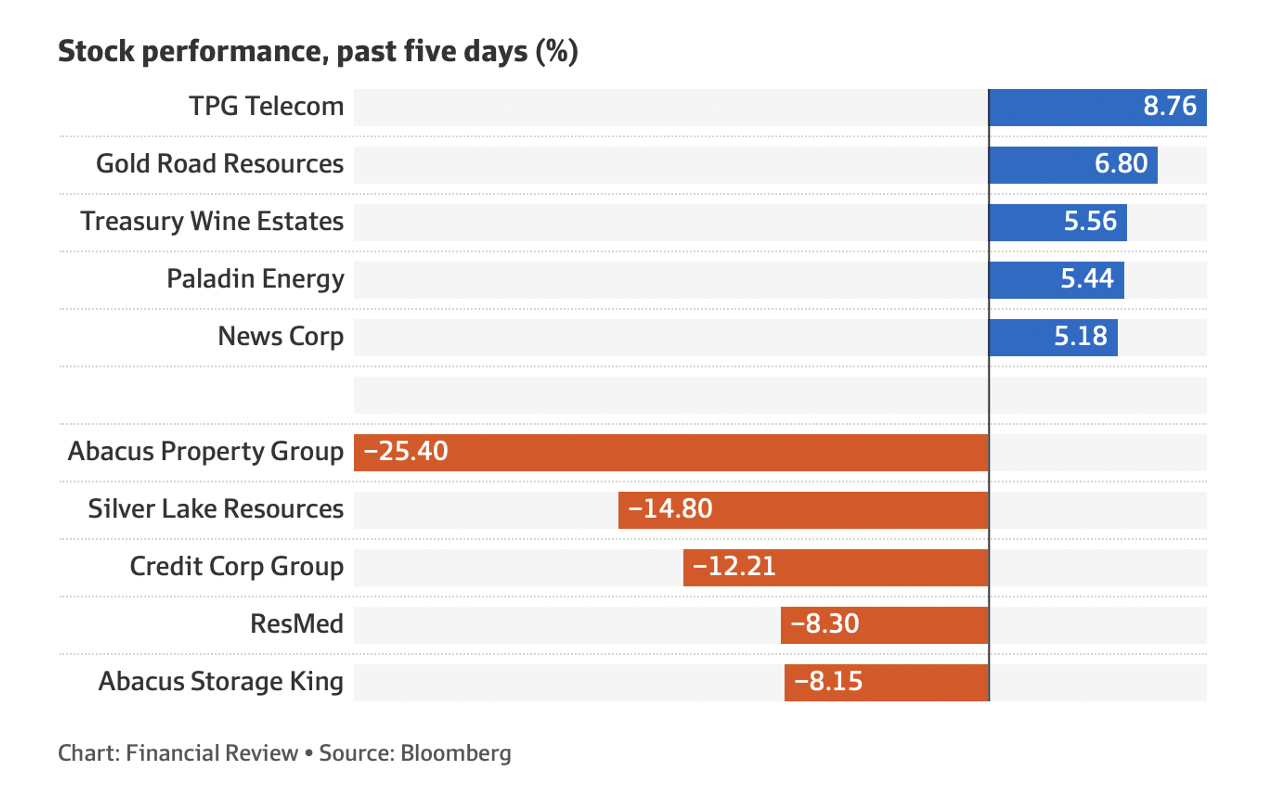

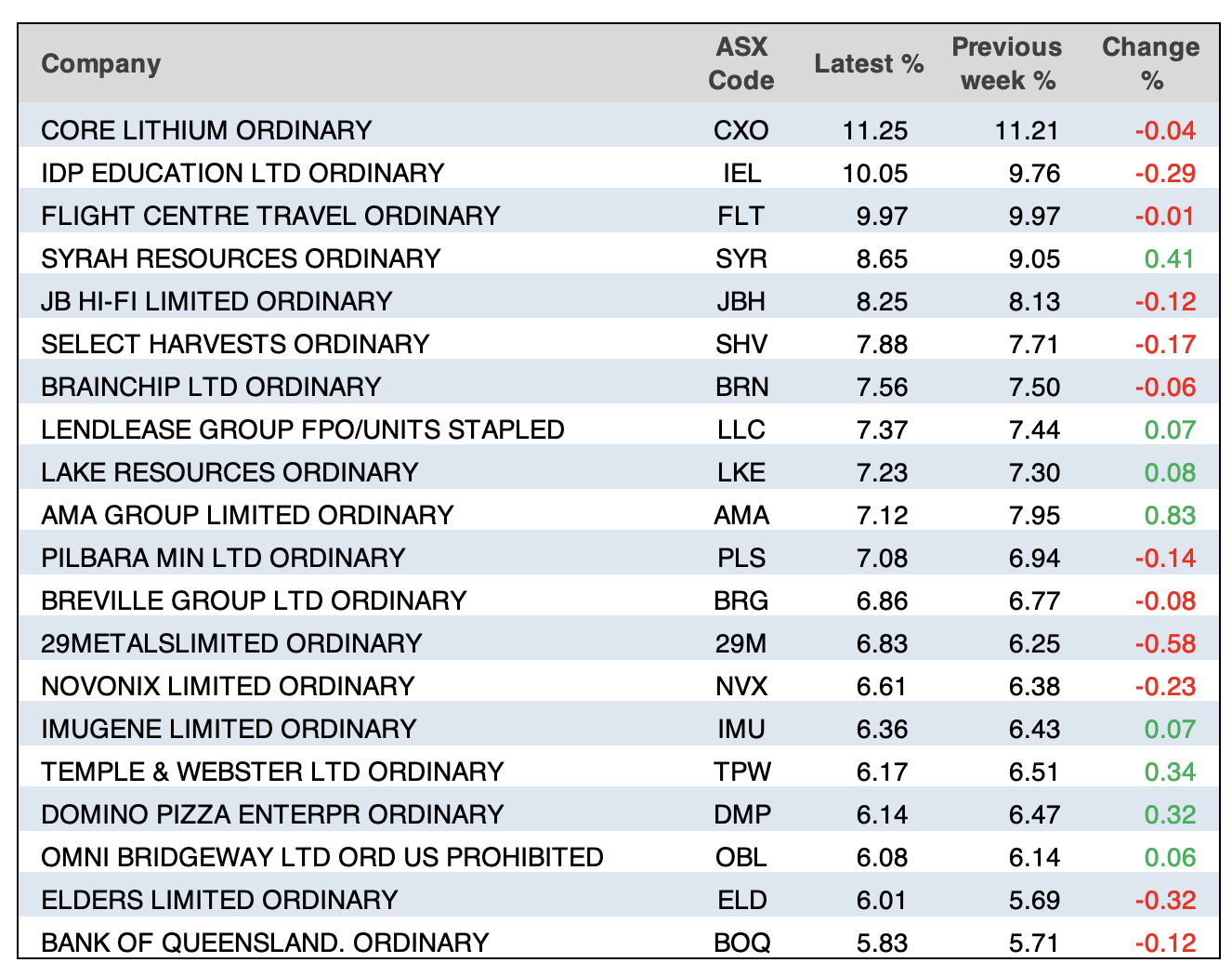

The overall S&P/ASX 200 lost 78 points (or 1.06%) over the week to finish at 7325.3. We’re now up 5.46% for the year-to-date. Here are the big winners and losers for the week:

The big news out on Friday was the ACCC saying no to the ANZ- Suncorp merger, which ANZ is set to challenge. ANZ’s share price rose 0.75% on the news to finish at $25.45, while Suncorp put on 0.6% to end at $14.13.

What I liked

- The RBA now expects headline inflation to be 4.1% in the fourth quarter of 2023 and 3.3% in the further quarter of 2024. CBA expects inflation at 3% in the fourth quarter of next year.

- The value ofhousing lending (which measures the flow of lending) fell by 1% over June,with owner-occupied lending down by 2.8% and investor lending up 2.6%. Lending growth has slowed by a massive 18.2% over the past year as the RBA has been raising rates. This must help the RBA think twice about rate rises.

- The RBA now expects annual GDP growth to be 0.9% in the fourth quarter of 2023, before recovering to 1.6% in the further quarter of next year.

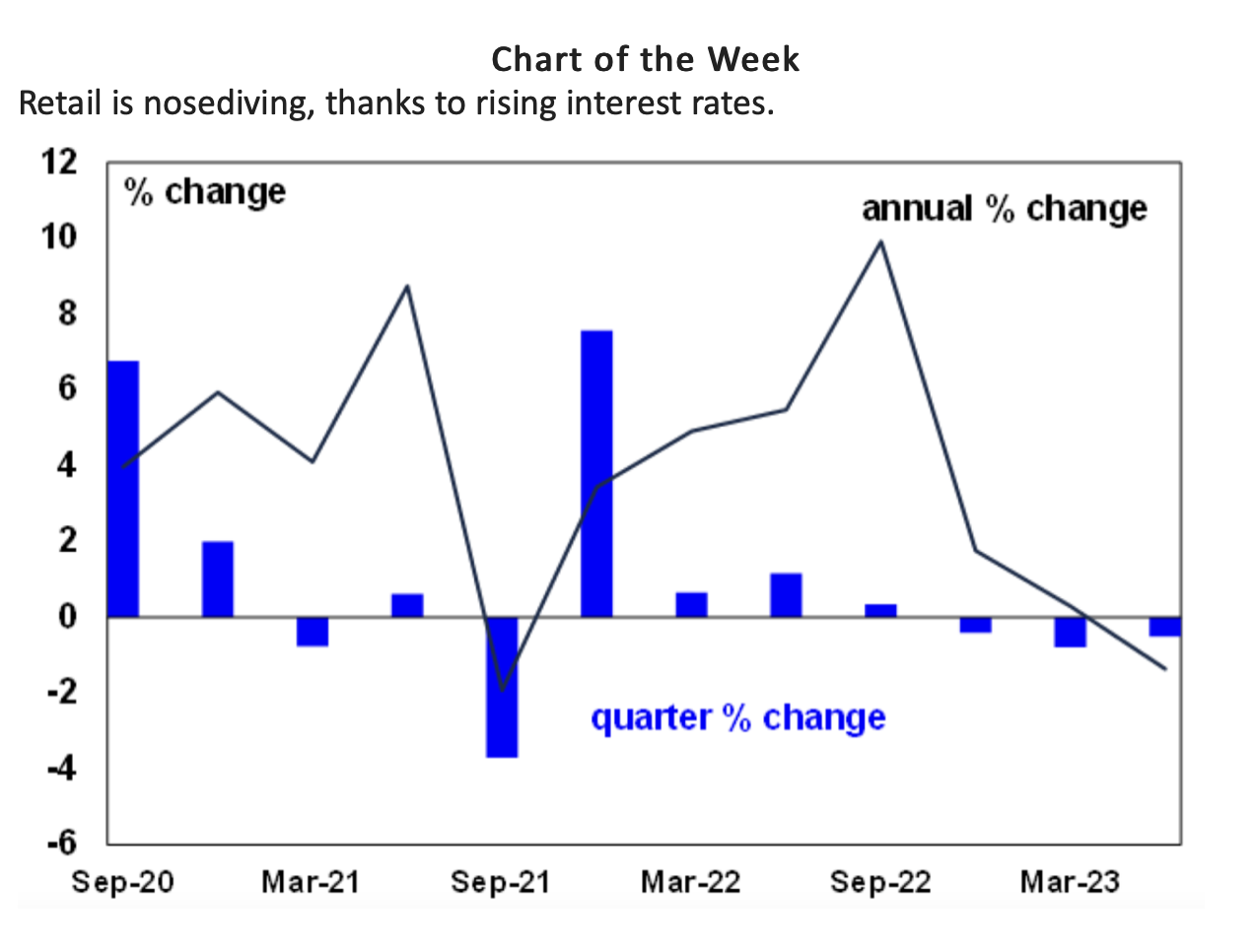

- Retail trade volumes fell by 0.5% in the June quarter, the third consecutive quarterly decline, which should help the RBA ease up on rate rises.

- The CBA has shifted our base case and now expects the cash rate to remain on hold at 4.1% for an extended period.

- Building approvals fell by 7.7% in June, after a lift of 20.6% in May. This approvals number is another reason for the RBA to hold on rates.

- TheUS ISM manufacturing indexremained low in July, coming in at 46.4 from 46 last month and disappointing expectations, which is good for US inflation. The services ISM index also fell in July to 52.7 (from 53.9 last month) but is still in positive “expansionary” territory.

- Eurozone GDPrebounded by 0.3% in the June quarter after a flat March quarter. GDP is up by 0.6% over the year to June.

What I didn’t like

- TheMelbourne Institute monthly inflation gaugerose by 0.8% over July (or 5.4% over the year), which looks like a large lift, but this follows a small rise in the prior month, which shows the sensitivity of inflation to seasonal impacts and is still consistent with a softening in inflation.

- Ratings agency Fitch downgraded the US from AAA to AA+because of an expected deterioration in the fiscal position in the next three years (i.e., no improvement in the budget deficit, a high and increasing government debt load and an erosion of governance related to AA and AAA rated peers.

- In China, the Caixin manufacturing PMI fell to 49.2, below the “neutral” level of 50 and similar to the signal from the official manufacturing PMI,while the Caixin services PMI rose to 54.1 (from 53.9 last month).

- The services ISM index also fell in July to 52.7 (from 53.9 last month).

- The Bank of England hiked interest rates by 0.25% which was expected, taking the bank rate to 5.25%and taking the total increase in interest rates to 5.15%.

Apologies for Thursday’s Report gremlin

The tech-heads at HubSpot, who are paid to make sure you get your Switzer Report, grappled with a gremlin on Thursday and if you didn’t get your report, you weren’t alone, as I even missed out! The Report was on the Switzer Report website, and I have provided the links for the entire week’s offerings down below in today’s Report.

And it didn’t help when our in-house expert on all things digital was trying to fly to Vanuatu on Thursday. Ironically, that airline had a gremlin issue and poor Evan had to fly on Friday instead at 8pm.

I’m hoping his wi-fi in the French enclave helps him get today’s Report out on time! Fingers and toes are firmly crossed.

The Week in Review

Switzer TV

- Switzer Investing: Will stocks rise in the year ahead. [1]

- Boom Doom Zoom: 3rd August 2023 [2]

Switzer Report

- Two solid auto part dealers [3]

- “HOT” stock: Lynas Rare Earths (LYC) [4]

- Questions of the Week [5]

- 31 Jul 202331 Jul 2023 Why I have a positive outlook for investing into 2024 [6]

- Keep the faith with Macquarie [7]

- HOT stock: Macquarie (MQG) [8]

- 3 stocks under $1 [9]

- Buy, Hold, Sell — What the Brokers Say [10]

Switzer Daily

- Economy starts to burn under heat of rate rises [11]

- 10 tips to earn extra money during this tough time [12]

- Economists split on future rate rises [13]

- Message to RBA: Do not raise rates today [14]

- Conservatives retain banished Boris Johnson’s old Commons Seat – Malcom Mackerras [15]

Top Stocks — how they fared.

The Week Ahead

Stocks Shorted

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before

Quote of the Week

AMP’s senior economist, Diana Mousina on our retail slide: “June quarter retail volumes fell by 0.5%, the third consecutive quarterly decline in volumes, which has only ever happened in history once before during the GFC in 2008.”

Disclaimer

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.