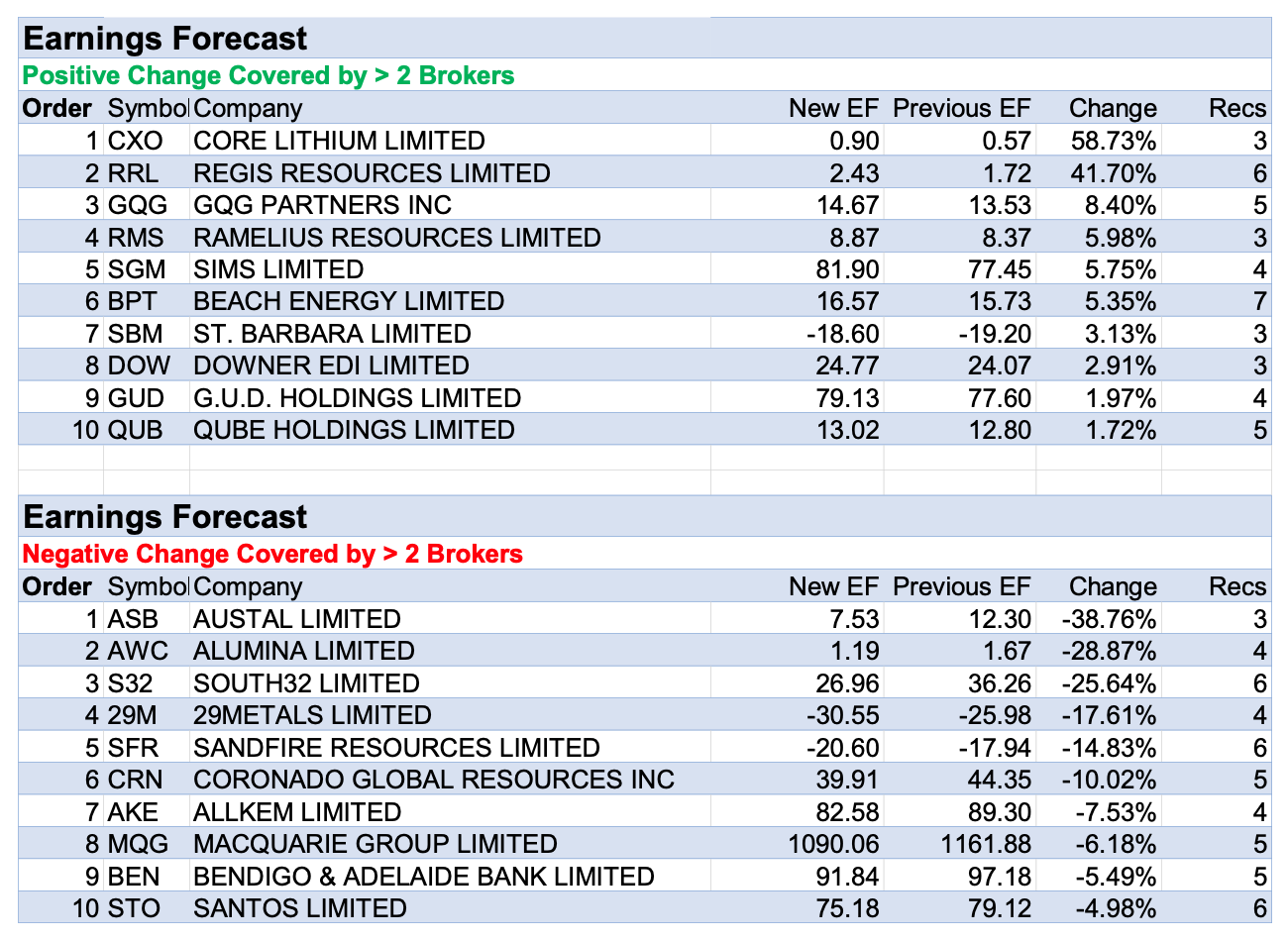

Once again, percentage upgrades to earnings forecasts were smaller than downgrades, with Resources sector companies filling seven of the top ten placings in the downgrades table below.

So, prima facie, it appears somewhat discordant the two largest increases to average earnings forecasts were for Core Lithium and Regis Resources with moves of 59% and 42%, respectively.

A higher FY23 forecast for Core Lithium following the release of its June quarter activities report was misleading as minor changes were made to very small numbers in analyst forecasts, triggering large percentage moves.

The real story lay in the FY24 and FY25 outlook which fell well short of consensus forecasts and resulted in the largest (-30%) decrease last week in average target price for companies covered daily by FNArena.

The Finniss operations in the Northern Territory are now expected to produce 80-90,000t of spodumene concentrate in FY24, with FY25 output expected to be marginally lower.

Macquarie had previously assumed volume growth would be stronger and decided to slow its forecast for the ramp-up by two years. Peak production rates of 170,000t per year are now expected in FY27, which is dependent on the ramp-up of the BP33 underground mine.

Investors should wait for a better entry point, according to Hold-rated Morgans, or more clarity on long-term economics before adding to positions.

This broker noted lithium recoveries are currently quite low with a large portion of fine material being diverted from the plant, and highlighted mismatches between mining rates and the processing plant capacity in FY25.

A similar scenario to Core Lithium played out for Regis Resources last week, with the company coming second place on both the earnings upgrade and target price downgrade tables.

While fourth quarter gold production and all-in sustaining costs were in line with consensus forecasts, FY24 guidance for both measures were well below consensus expectations.

Consensus was expecting FY24 production of around 500kz of gold, according to Morgans, but guidance was in the range of 415-455koz due to the exclusion of marginal ounces at the Duketon gold project in WA.

Macquarie felt increasing costs will likely see Duketon North suspended at the end of FY24, although this asset comprises only a small part of the broker’s overall net asset value for Regis Resources.

All-in sustaining cost (AISC) guidance of between $1,995-$2,315/oz also disappointed versus the less than $2000/oz anticipated, and Morgans downgraded its rating to Hold from Add (which is not shown in the list below, due to an input error).

Macquarie and UBS updated research for Downer EDI last week in anticipation of first half results due on August 10, which resulted in the largest percentage increase (17%) in average target price last week.

The company operates in sectors linked to investment driven by population growth, urbanisation and the energy transition. These include transport (which comprised 49% of core revenue in FY22), power, gas, water telecommunications, health, defence and other government sectors.

Given the proximity to earnings results and working on the theory no guidance news is good news, Macquarie suggested Downer EDI is on track to deliver on the 170-$190m range for FY23.

Given solid demand, normal weather and no project issues (as occurred in the first half), Macquarie anticipates 26% earnings growth in FY24 and raised its target to $4.40 from $3.30 after also adopting a new valuation method.

UBS listed Downer EDI among three stocks which are expected to reveal EPS growth outlooks of around 20% into FY24 during the upcoming results season.

Returning to negative updates, Austal received the largest percentage downgrade to average forecast earnings with revised FY23 earnings guidance now aiming for a loss between $0 and -$10m compared to Bell Potter’s forecast for $56.2m.

The Austal USA (AUSA) division has experienced problems with the Navajo-class Towing, Salvage and Rescue Ship (T-ATS) program, which is the first ship to be built on the company’s steel line.

An increase in commodities prices, slower-than-excepted efficiency in building the ships and changes in the ship design from the Navy prompted the overruns, according to management.

While the update was disappointing, Bell Potter retained its Buy rating and reminded investors key drivers of the stock include the size and duration of the contract book, increasing demand in the US and private equity interest.

As noted previously, mining companies featured heavily in the earnings downgrade table and included material moves for Alumina Ltd, South32, 29Metals and Sandfire Resources.

Citi’s 2024 and 2025 earnings forecasts for Alumina Ltd were reduced by -26% and -7%, respectively.

Earnings forecasts also went backwards for South32 last week, despite June quarter production meeting Citi’s estimate, while cost guidance for FY24 was largely maintained.

However, there was a non-cash impairment of -US$1.3bn for the Taylor deposit (zinc/lead/silver) at the Hermosa project in Arizona, where management also flagged higher capex. On the flipside, the measured mineral resource for Taylor increased by 41%.

Apart from lowering earnings forecasts, Morgan Stanley and Citi expressed concerns around 29Metals’ balance sheet following second quarter results.

While production of copper and zinc was in line with Morgan Stanley’s forecast, gold was a -44% miss, as were all-in sustaining costs (AISC) – which missed by -45% – leading to negative cash flow over the period.

The analysts remain cautious on the stock given debt facilities are now fully drawn and any improvement to liquidity must come from either a second half lift for the Golden Grove mine in WA or success on an insurance claim. The latter is for loss of equipment and business interruption losses.

Citi suggested the timing and size of the insurance payout will be key as it is “touch and go” for the balance sheet and the next 12 months will be critical.

Meanwhile, June quarter copper production at Sandfire Resources was -12% adrift of the consensus forecast. Guidance for FY24 was also mixed, in Macquarie’s view, with lower copper output at the Matsa operations in Spain offset by a much stronger ramp-up at the Motheo copper mine in Botswana.

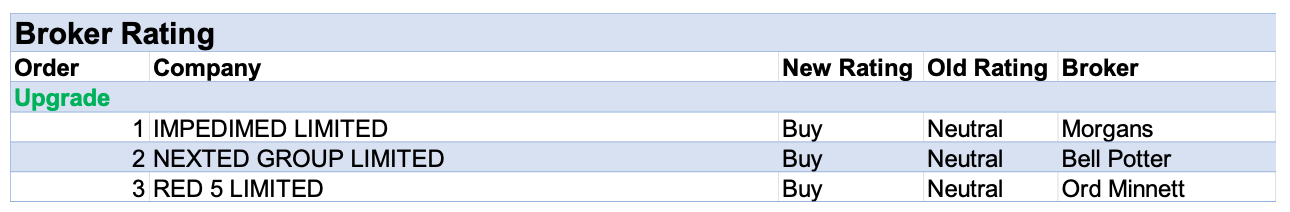

In the good books

Upgrades

IMPEDIMED LIMITED ((IPD)) was upgraded to Speculative Buy from Hold by Morgans. B/H/S: 1/0/0

As the pace of payor coverage in the US for ImpediMed’s bioimpedance spectroscopy (BIS) technology is set to increase, Morgans sees upside to the current share price and upgrades its rating to Speculative Buy from Hold.

The broker assesses a solid 4Q cash flow report, which came in ahead of expectations largely due to the broad private payor coverage.

The analyst raises longer-term forecasts and increases the target to 25c from 19c.

NEXTED GROUP LIMITED ((NXD)) was upgraded to Buy from Hold by Bell Potter. B/H/S: 2/0/0

NextEd Group has provided new guidance below Bell Potter’s prior forecasts. Reported EBITDA is now expected to be $16.5-17.0m with operating cash flow of $25m.

The broker observes there was no detail as to where the weakness came from and assumes the strong English language student numbers provided in May lead indicators are largely unaffected. Hence, the weakness is suspected to have come from the domestic vocational segment as well as technology and design.

Rating is upgraded to Buy from Hold as a recent weakness in the share price is considered an opportunity. Target is reduced to $1.70 from $1.90.

RED 5 LIMITED ((RED)) was upgraded to Speculative Buy from Hold by Ord Minnett. B/H/S: 1/0/0

Despite better-than-expected production in the second half Ord Minnett observes Red 5 is underperforming peers, finding there is nothing fundamental over the last two quarters to justify this.

The broker assesses the risk is weighted to the upside as key balance sheet concerns have been alleviated, and there is value appeal.

Rating is upgraded to Speculative Buy from Hold as a result, with the Speculative qualifier added given ramp-up and reconciliation risk remains. Target rises to $0.23 from $0.18.

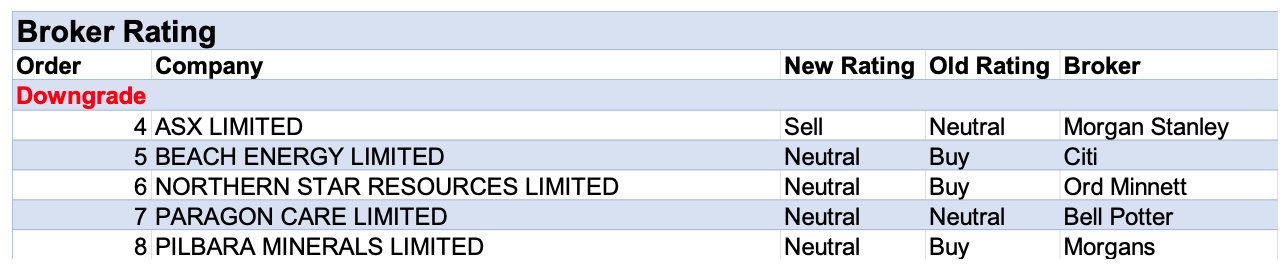

In the not so good books

Downgrades

ASX LIMITED ((ASX)) was downgraded to Underweight from Equal weight by Morgan Stanley. B/H/S: 2/2/2

Morgan Stanley downgrades its rating for ASX to Underweight from Equal-weight on valuation compared to global peers, an ongoing slump in market activity and increasing competition from CBOE Australia. EPS growth is not anticipated until FY25.

The analyst highlights the company’s earnings (EBITDA) margin has eroded to a forecast 67% in FY23 from more than 76% prior to FY19.

The broker’s target falls to $55.55 from $62.40 due to weaker forecast markets revenues and slightly higher expense growth. Industry view: In-Line.

BEACH ENERGY LIMITED ((BPT)) was downgraded to Neutral from Buy by Citi. B/H/S: 4/2/1

Citi doubts Beach Energy’s Waitsia guidance will be reinstated in August and the broker also expects guidance to reveal schedule uncertainty.

While Citi forecasts a recovery in the oil price in September quarter, the recent rally in the share price has consumed the upside.

Rating downgraded to Neutral from Buy. Target price steady at $1.65.

NORTHERN STAR RESOURCES LIMITED ((NST)) was downgraded to Hold from Accumulate by Ord Minnett. B/H/S: 1/3/1

Northern Star Resources has guided to FY23 cash earnings that were better than Ord Minnett expected while production and costs in the June quarter were broadly in line expectations.

That said, the broker notes the market is struggling with the weaker FY24 outlook for production/costs as well as higher capital expenditure.

Incorporating the outlook reduces the target to $12.30 from $14.00 and the rating to Hold from Accumulate. Ord Minnett finds better valuation appeal further down the curve in the mid-cap coverage.

PARAGON CARE LIMITED ((PGC)) was downgraded to Hold from Buy by Bell Potter. B/H/S: 0/1/0

Paragon Care now expects FY23 EBITDA from continuing business to be $38m. This implies like-for-like growth of 35%. The closure of the Lovell manufacturing business will entail -$3m in one-off charges in FY23.

Bell Potter acknowledges the stock is inexpensive, noting a well-defined strategy to support its ambition for $100m in EBITDA by FY27. Still, EPS expansion is modest and the growth outlook for FY24 is unclear as it appears dependent on revenue earned in Asia.

The broker downgrades to Hold from Buy and reduces the target to $0.26 from $0.45.

PILBARA MINERALS LIMITED ((PLS)) was downgraded to Hold from Add by Morgans. B/H/S: 2/2/1

Fourth quarter realised spodumene concentrate prices for Pilbara Minerals declined faster than Morgans anticipated, while production beat the forecasts of the broker and consensus by 9% and 7%, respectively.

Management expects to pay a fully franked dividend in FY23, and the analyst sees strong potential for a buyback despite the planned production expansion at Pilgangoora.

Following a strong share price performance, Morgans downgrades its rating to Hold from Add, while the $5 target is unchanged.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.