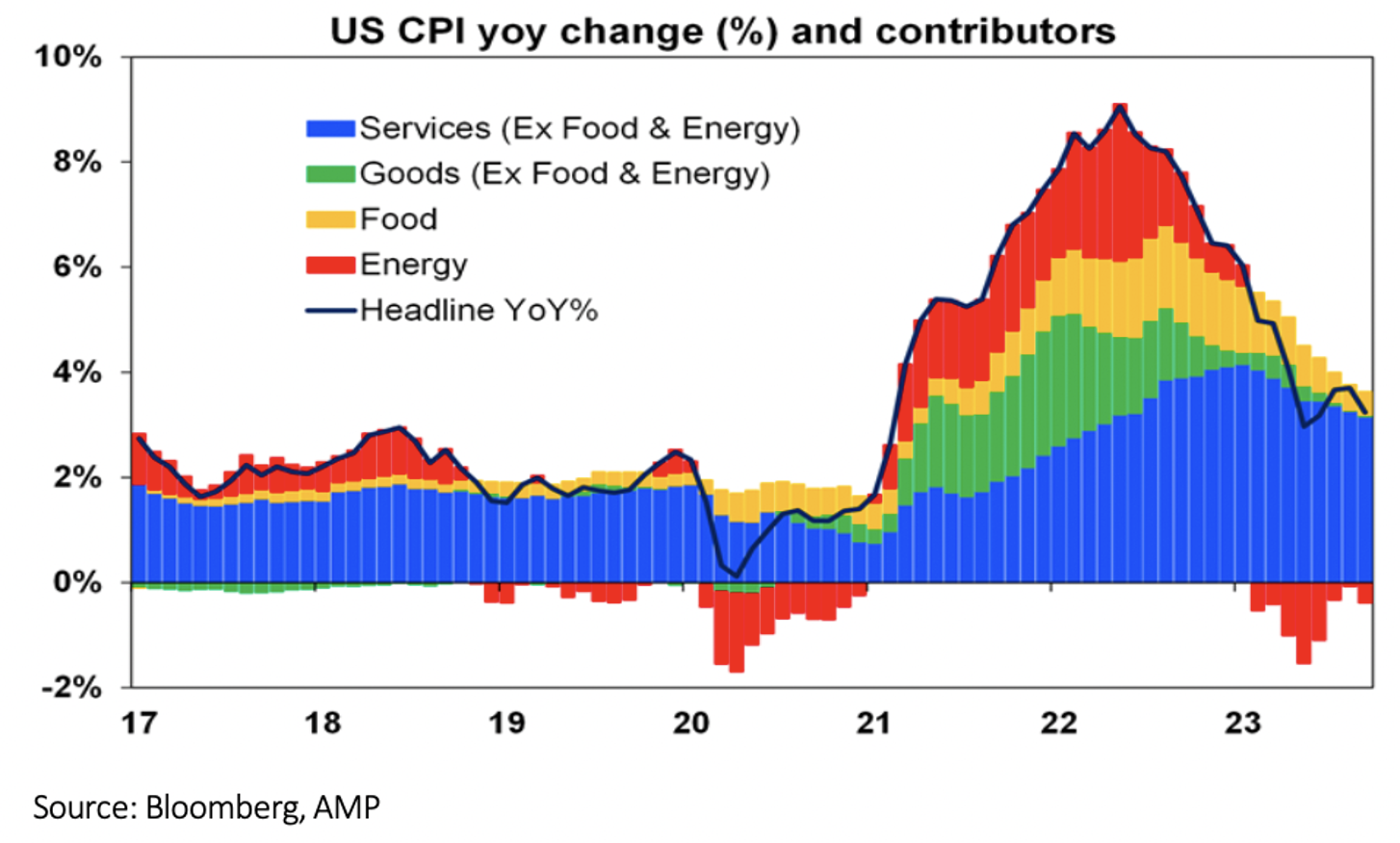

What a difference data of a positive economic kind can make! I tipped the US Consumer Price Index number was going to be a ‘make it or break it’ figure, and the lower-than-expected reading sent share market indexes in New York city heading skyward over the week.

Before the Wall Street close, the three most-watched indexes were on pace to post their third straight positive week. That’s the longest streak for each index in months. And the once vulnerable Nasdaq, with interest rates on the rise over the past 18 months, was on track for three up-weeks in a row. This hasn’t happened since June this year, when there were thoughts that US rate rises were possibly at the top.

Then economic data spooked the market, but now data is bringing home the bacon for those hungry investors who’ve been hoping for a more believable turnaround in investing sentiment.

While this from Scott Ladner, chief investment officer at Horizon Investments in the US, is a clunky way at looking at what lies ahead, it looks on the money: “I think the story for the rest of this year isn’t ‘are we going to finish with a bit of a rally?’, because it does appear likely that we’re going to finish with a bit of a rally.”

But his follow-up question of what we should chase with this rally is a little more insightful. “Is it going to be small caps and emerging [markets], kind of like the losers of 2023? Are they going to be the things that lead? Or are we going to get a continuation of the mega-cap tech rally that we’ve had basically all year long?” he asked.

As you should know, I’ve been thinking that small caps and those smashed tech/growth stocks as interest rates rose would win in 2024, but I also think emerging economy plays should do well as rates come down.

By the way, the US small cap index, the Russell 2000, was up close to 6% this week!

Adding support for this positive view on stocks going forward is this from Reuters’ Lewis Krauskopf: “Investor optimism on equities has grown over the last few weeks, as markets rebounded from a months-long drop that ran from August through much of October. Stock exposure by active investment managers has shot to its highest level since August, from a one-year low hit last month, the National Association of Active Investment Managers (NAAIM) exposure index showed”.

Experts will tell you that the NAAIM index isn’t predictive, when the readings make higher highs and higher lows (as the blue line in the graph below shows), the S&P 500 (this is the green line in the chart below the blue one) tends to head in the same direction.

Switzer TV

- Boom Doom Zoom: had a failed recording on Thursday, but Evan is back from Japan in the week ahead, so our recording calibre will be back to normal. Sorry to our BDZ fans but that’s life in the fast digital lane!

- SwitzerTV: 13th November 2023 [1]

Switzer Report

- Here’s why Breville & Endeavour are worth adding to your portfolio watchlist [2]

- “HOT” stock: CSL [3]

- Questions of the Week [4]

- Good omens for market recovery in coming months [5]

- Is Treasury Wines capital raising appealing? [6]

- HOT stock: Treasury Wines (TWE) [7]

- 3 top cancer fighters [8]

- Buy, Hold, Sell — What the Brokers Say [9]

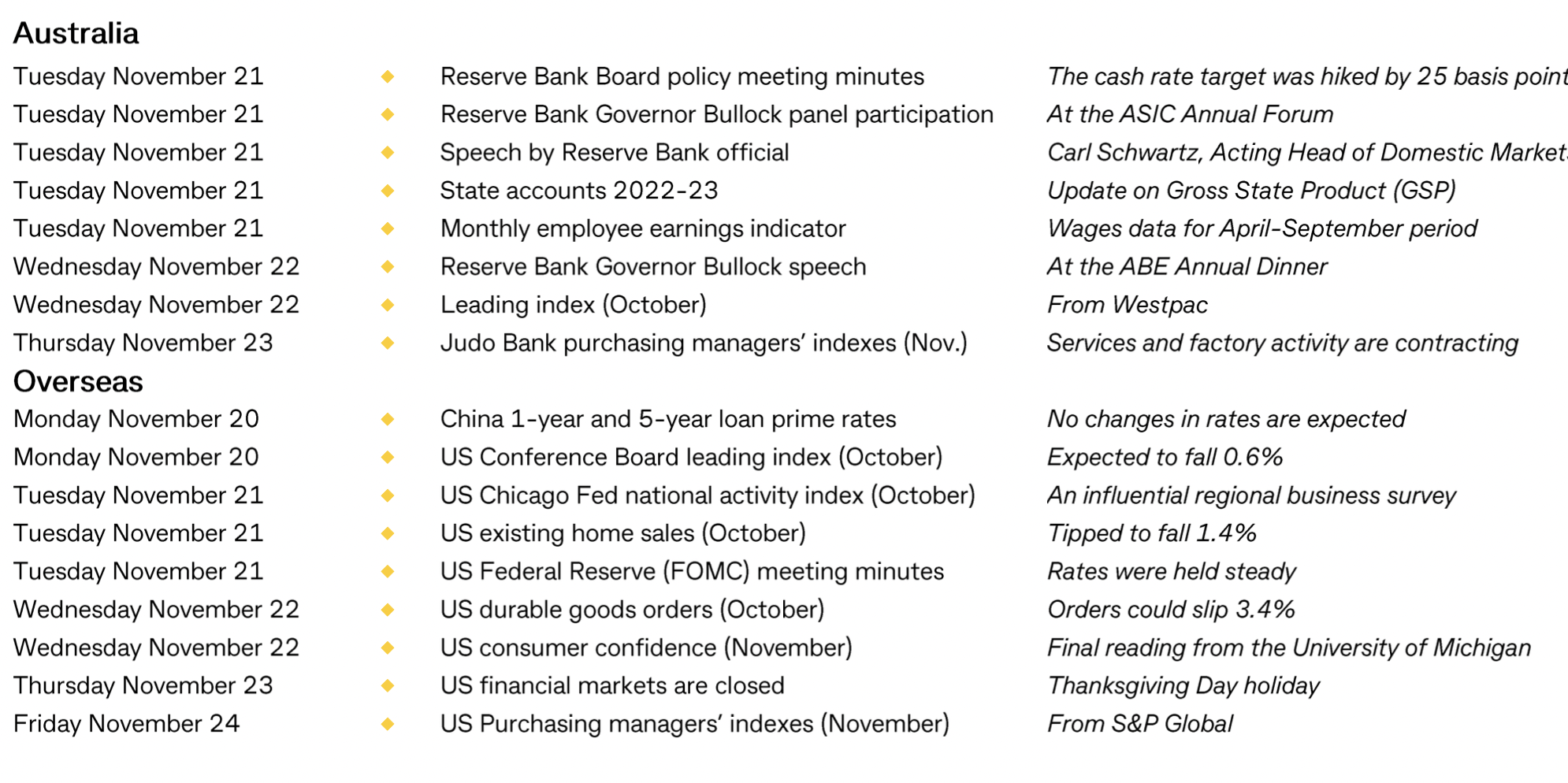

The Week Ahead

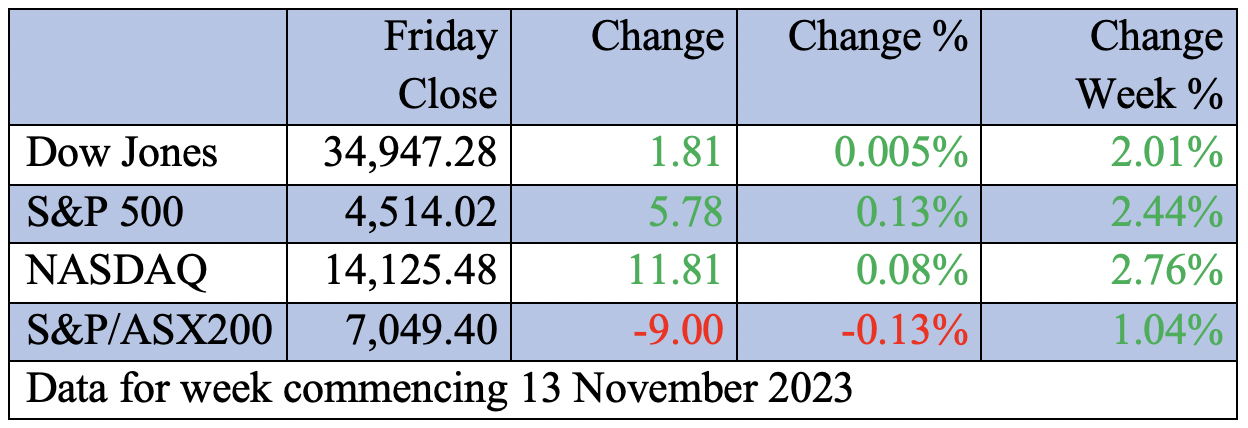

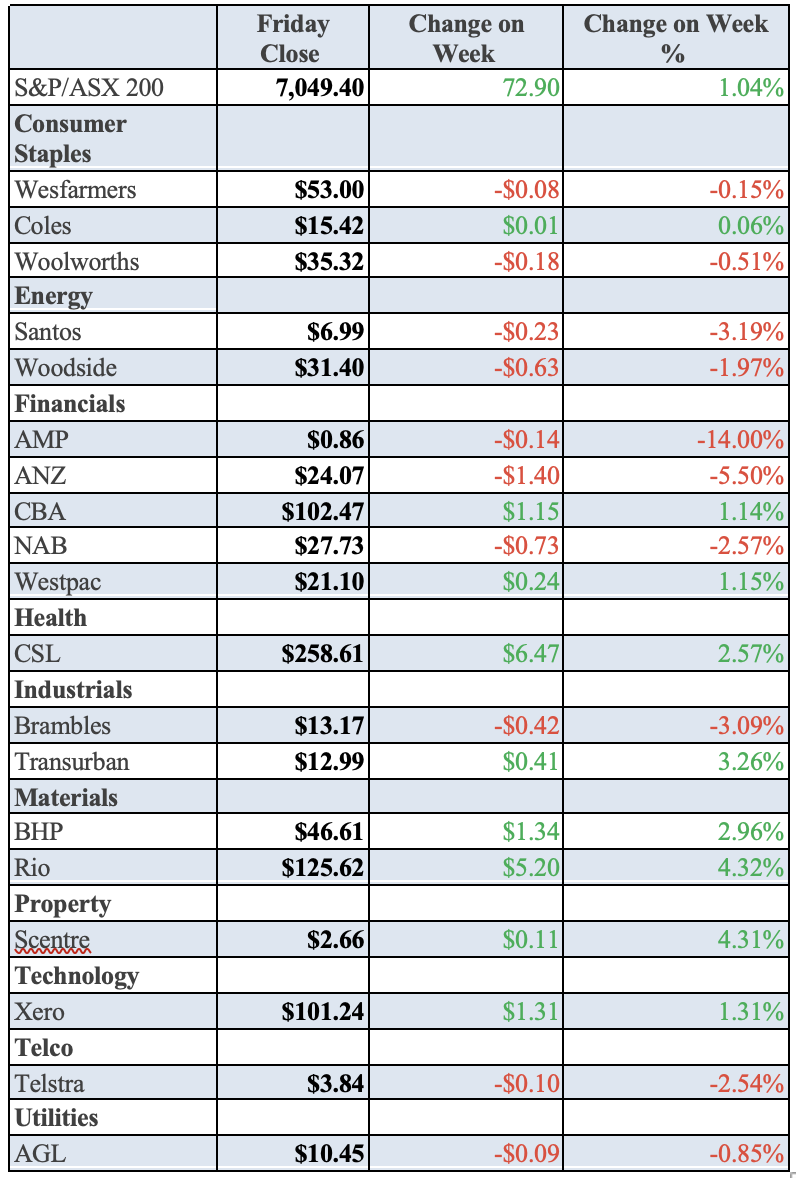

Top Stocks — how they fared

Chart of the Week

This is the chart that set stocks flying high this week.

Revelation of the Week

“It’s hard sometimes in the moment to recognize when something has significantly changed, [but] I think there was a tremor on Tuesday, and things have changed,” EMJ Capital founder and president Eric Jackson said on CNBC’s “Closing Bell [10]” on Thursday. “The Fed has done a Punxsutawney Powell, and gone back into hibernation for I think the next six years.”

Stocks Shorted

The Switzer Report sorely misses Evan Lawrence who not only is our video and website director but knows how to create our most shorted stocks table. Evan is back on Monday — thank the Lord! — and we will get the Most Shorted Stocks table out to you then in Monday’s Report.

Also note last Monday’s TV show, which features my long chat with Rudi Filapek-Vandyck on investing in 2024, is worth watching and is now on the Switzer Report website. The link is above in the Switzer Report This Week section.

Disclaimer

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.