Another negative week for US stocks, so put on your market-panic seatbelts but don’t make them too tight because at some time over the next few weeks you’ll want to be a buyer of quality companies caught up in this temporary sell-off. Why do I say that?

Well, a part of this sell-off is that the US economy is looking stronger than most would’ve expected, so there could be more rate rises ahead than was thought when the stock market was roaring higher in July.

And it’s worth noting that July is a good month for stocks but August rolling into September can be really ‘crappy’. While August’s first nine trading days is nearly always negative, as the Wall Street Journal tells us: “September is traditionally the weakest month for U.S. stocks. This year, investors say the turning of the calendar should be especially worrying. Stocks have risen sharply after last year’s selloff, defying any number of risks along the way.”

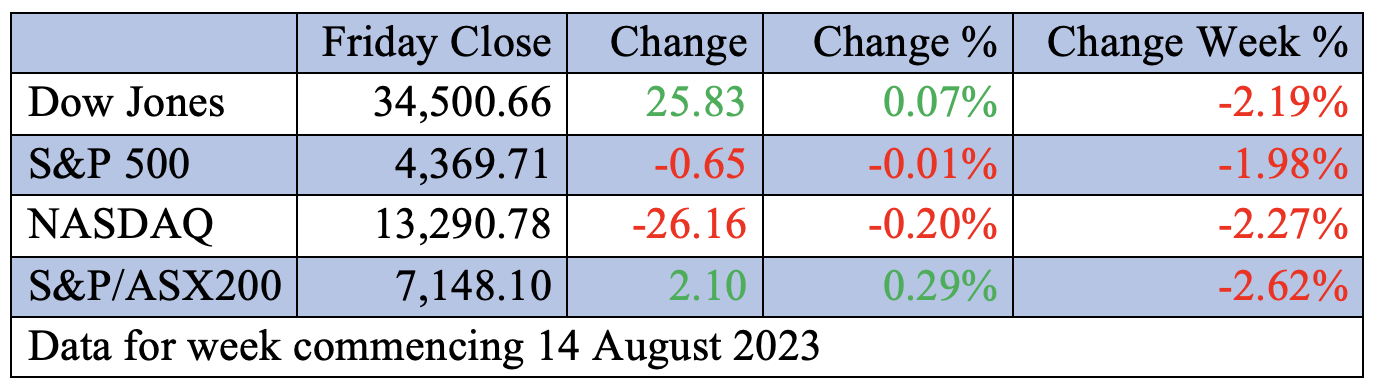

Right now, the three big US indexes are below their 50-day moving average. The S&P 500 and Nasdaq have been down three weeks in a row and the small-cap index (the Russell 2000) has had the worst week since March and is below the 200-day moving average, which hasn’t happened since June.

In simple terms, we’re in a correction, with the Dow off 3% since the 2023 high, while the S&P 500 is down 5% and the Nasdaq is off 8%. However, the Nasdaq is up nearly 28% year-to-date! Meanwhile, our S&P/ASX 200 is up only 2.9% over that time, so in the US there’s a lot of profit-taking going on over the two months that are seldom great for stocks.

It’s why I say there’s a buying opportunity for the December quarter, which is historically a good time to be exposed to stocks.

Sam Stovall of CFRA (who I rate as a great market-data oracle) has noted this in the past: “The S&P 500 has gained an average of 1.6% during December, the highest average of any month and more than double the 0.7% gain of all months. September, meanwhile, is the worst month on average for stocks, with a 0.7% average decline”.

What else has been going on to rattle the confidence of investors? Try these negatives for stocks:

- US central bank minutes imply more rate rises ahead than was expected a few weeks ago, as I said.

- Bond yields spiked about 1% during the week, because growth looks stronger than was once tipped, which isn’t good for rate rises and the start of rate cuts.

- Sticky inflation concerns.

- Even recession worries, if rate rises continue.

- China has growth concerns and a re-emergence of property problems, but these are often over-hyped by the media.

This is how Reuters reported this issue: “Missed payments on investment products by a leading Chinese trust firm and a fall in home prices have added to worries that China’s deepening property sector crisis is stifling what little momentum the economy has left. Zhongrong International Trust Co., which traditionally had sizable real estate exposure, missed payments on dozens of investment products since late last month, a senior official told angry investors”.

As a consequence, Barclays lowered its China growth forecast to 4.5% from 4.9%, which isn’t great for Australian miners, but could be a plus for this sector if Beijing goes for the stimulus lever. That might be a positive factor in the December quarter.

So, we’re in the hands of US data drops, where again inflation readings will be critical to what’s tipped for the Fed moves on interest rates. Our market will be heavily influenced by US economic stats and Wall Street’s reaction, while we have our own negative issues with China.

And by the way, the Yanks face another debt debate in Washington come October that always unsettles markets. All this explains why stocks are on the slide right now.

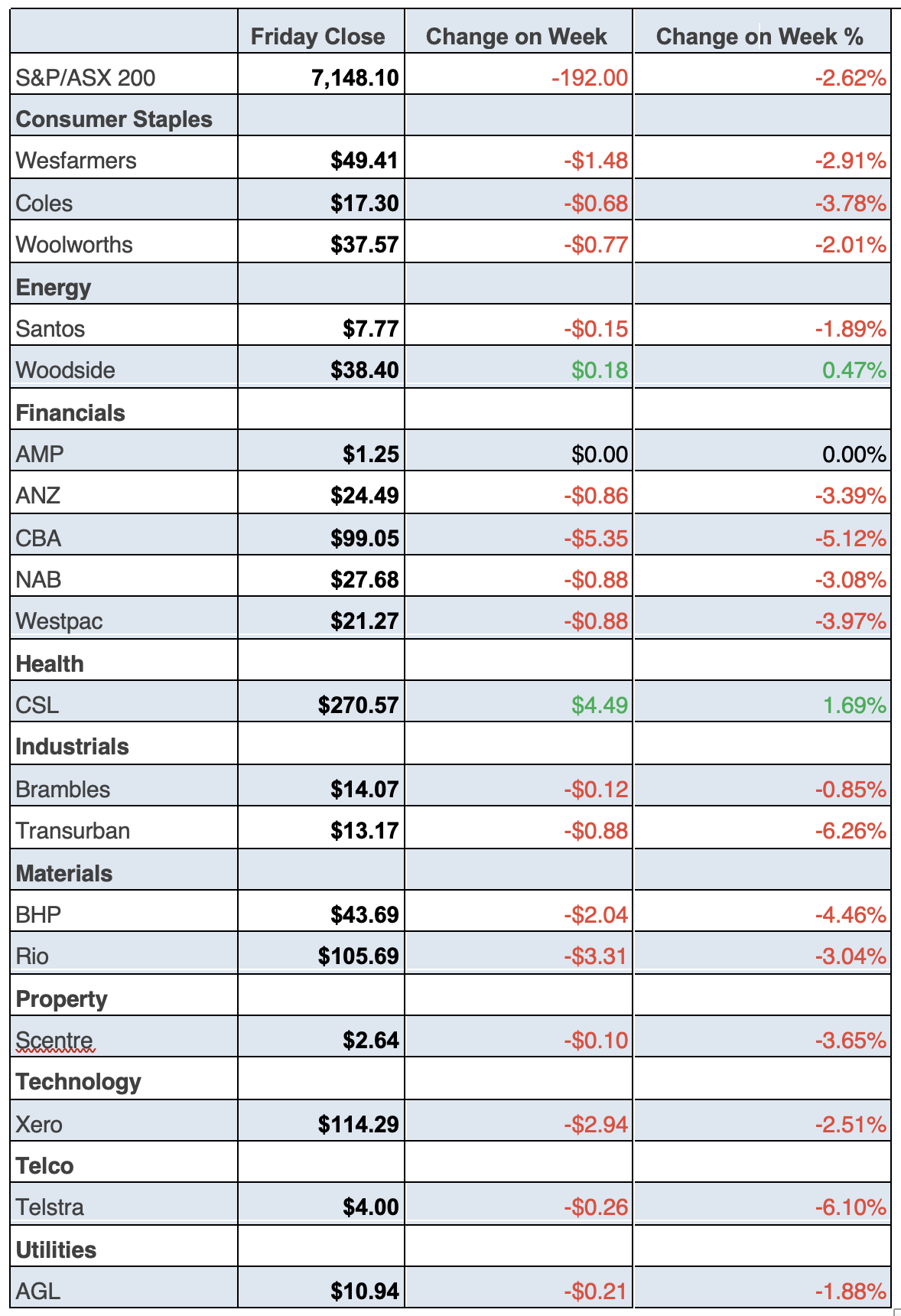

To the local story and China wasn’t good for our market, with the S&P/ASX 200 off 2.6% (or 192 points) for the week. Miners copped the China backwash, with the sector down 4.3% for the week. There are some negative reports that Beijing won’t create a rescue that would help our big iron ore miners.

The iron ore price dropped to the $US100 a tonne region. Not surprisingly, the dollar dropped to a nine-month low at 64.07 US cents.

An interesting Friday development were bounce-backs for BHP, up 1.4% to $43.69, while Rio and Fortescue won back friends, as the table lower in this Report shows.

Meanwhile, the banks copped it as bond yields rose. Also, CBA, which lost 5.1%, did go ex-dividend to finish at $99.05. Their rivals dropped around 3% for the week.

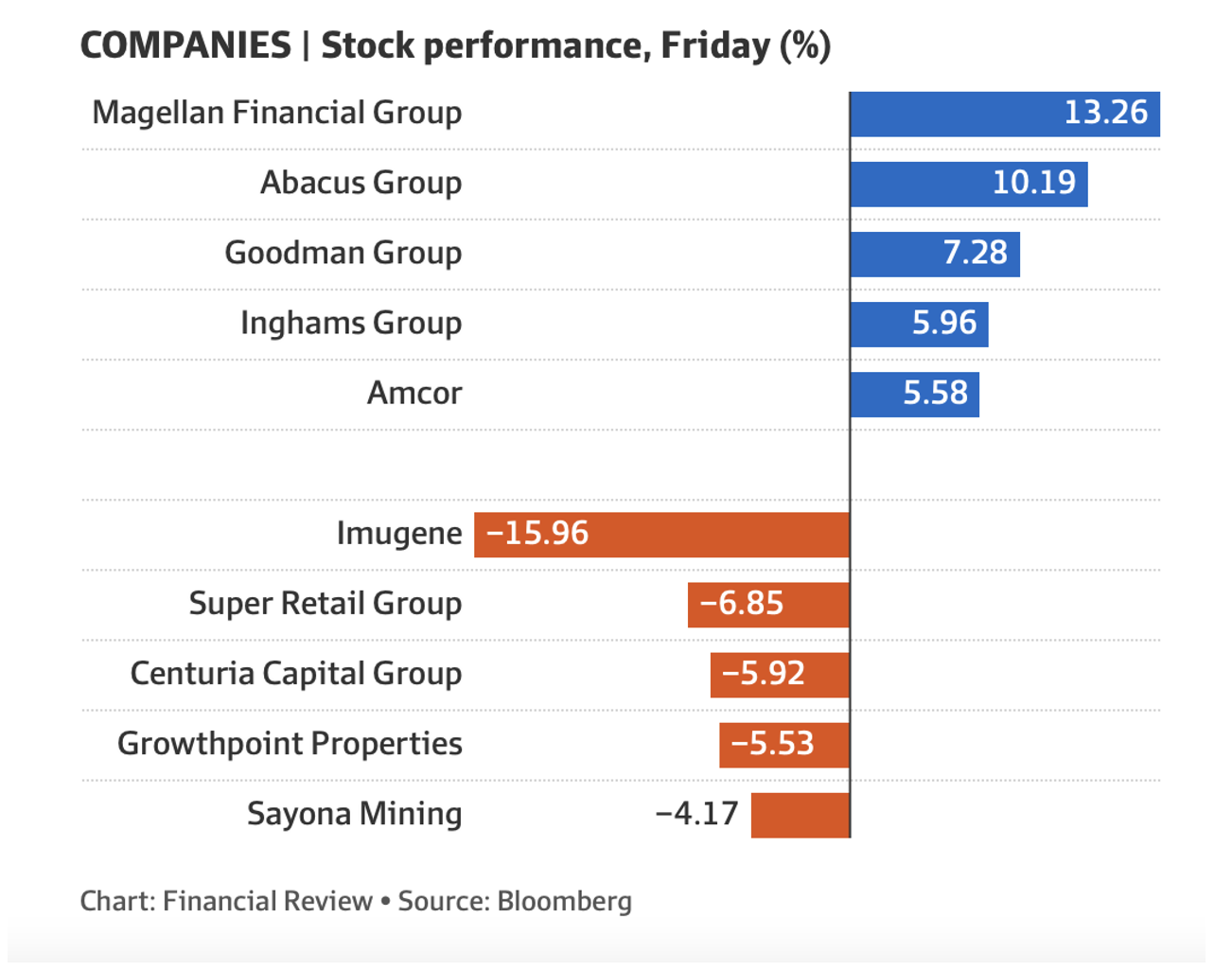

The AFR usually uses Bloomberg’s weekly winners and losers, but this week focussed on Friday only, so note that. But Magellan’s one day jump looks more like a weekly gain.

Why the surprise good news for the embattled fund manager? Better costs news and a special dividend of 30 cents were big helps but this company still has a lot to do to really get its share price moving.

What I liked

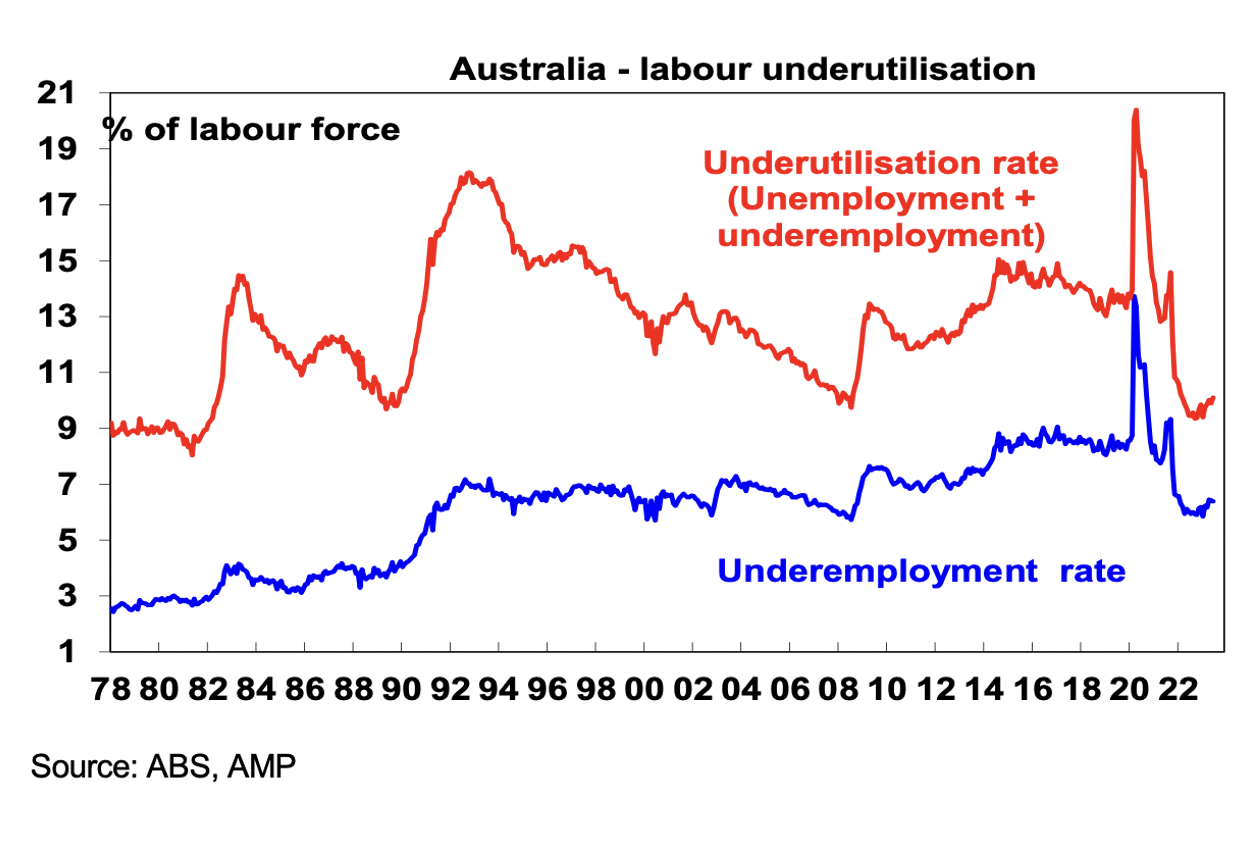

- Wages rose by 0.8% for the quarter and annual wages growth decelerated to 3.6%.

- Employment fell by 14,600 jobs in July, after strong jobs growth in recent months. Economists were looking for a 15,000 rise.

- The unemployment rate bottomed at 3.4% in October 2022 and at its current level of 3.7% remains around its lowest levels since 1974.The jobs data is showing that interest rate rises are starting to work.

- This from the CBA after reading the RBA minutes from the last meeting on rates: “The Minutes today affirm our view that the hurdle to hike the cash rate again is high. Our base case remains the peak in the cash rate is the current 4.1%.”

- CBA economics team again: “We expect rate cuts to occur in the first quarter of 2024, with the cash rate moving down to 3.1% by the end of 2024. But the risk is a later start date to the easing cycle, if the labour market remains more resilient than we expect.”

- Australian companies reporting season is now about 40% done. So far, it has been a bit better than expected, with 45% of companies surprising on the upside, which is just above the norm of 43% and up on the February reporting season when it was just 27%.

- Here’s AMP on growth: “Our Economic Activity Trackers are still not providing any decisive indication of recession (or a growth rebound)”.

What I didn’t like

- The minutes from the Fed’s last meeting had a somewhat hawkish tone, leaving the door open to more rate hikes on the back of “significant upside risks” to inflation and a “very tight” labour market.

- The ‘unreliable’ bond market and its yield spike this week. If the bond market is so smart, how come yields have been 1% lower for a long time this year? Were they wrong then or now?

- UK inflation at 6.8% and wages growth at 7.8% year-on-year came in stronger than expected, keeping the Bank of England on track for another 0.5% hike at its next meeting.

- Bond market movements, as explained by Shane Oliver: “From their lows in April, 10-year bond yields have increased around 100 basis points, pushing US yields to their highest since 2007 and Australian yields to their highest since 2014. The main driver has been stronger-than-expected economic data fuelling expectations of higher for longer central bank interest rates”.

How worried should we be?

I’ll deal with the lie of the land with stocks in my Monday piece. For now, expect some annoying negative headlines, like those linked to China, and you have to expect sell-offs ahead. That said, I’m calling this a buying opportunity and will be like Imran Khan when he was a cricketer, who became famous for his pouncing “like a tiger”, when I see good companies at discount prices. That should deliver me some real gifts by Christmas.

The Week in Review

Switzer TV

- Switzer Investing: SwitzerTV Monday 14th August 2023 [1]

- Boom Doom Zoom: 17th August 2023 [2]

Switzer Report

- Two infrastructure services stocks worth watching [3]

- “HOT” stock: Premier Investments (PMV) [4]

- Questions of the Week [5]

- How can you mend a broken company? [6]

- CBA’s dividend boost signals higher bank dividends [7]

- HOT stock: Helloworld Travel Ltd (HLO) [8]

- 3 examples of bad CEO behaviour affecting the stock price [9]

- Buy, Hold, Sell — What the Brokers Say [10]

Switzer Daily

- What are Australia’s economic and social wins from the Matildas? [11]

- Finally, an adult is in charge of irresponsible social media platforms! [12]

- Lower-than-expected wages gets Albo out of a sticky situation [13]

- Should we get a public holiday if the Matildas win the World Cup? [14]

- Did ATO ignore bank warning about $4 billion tax scam? [15]

- Malcolm Mackerras – Dutton’s Voice ploy kicks own goal [16]

The Week Ahead

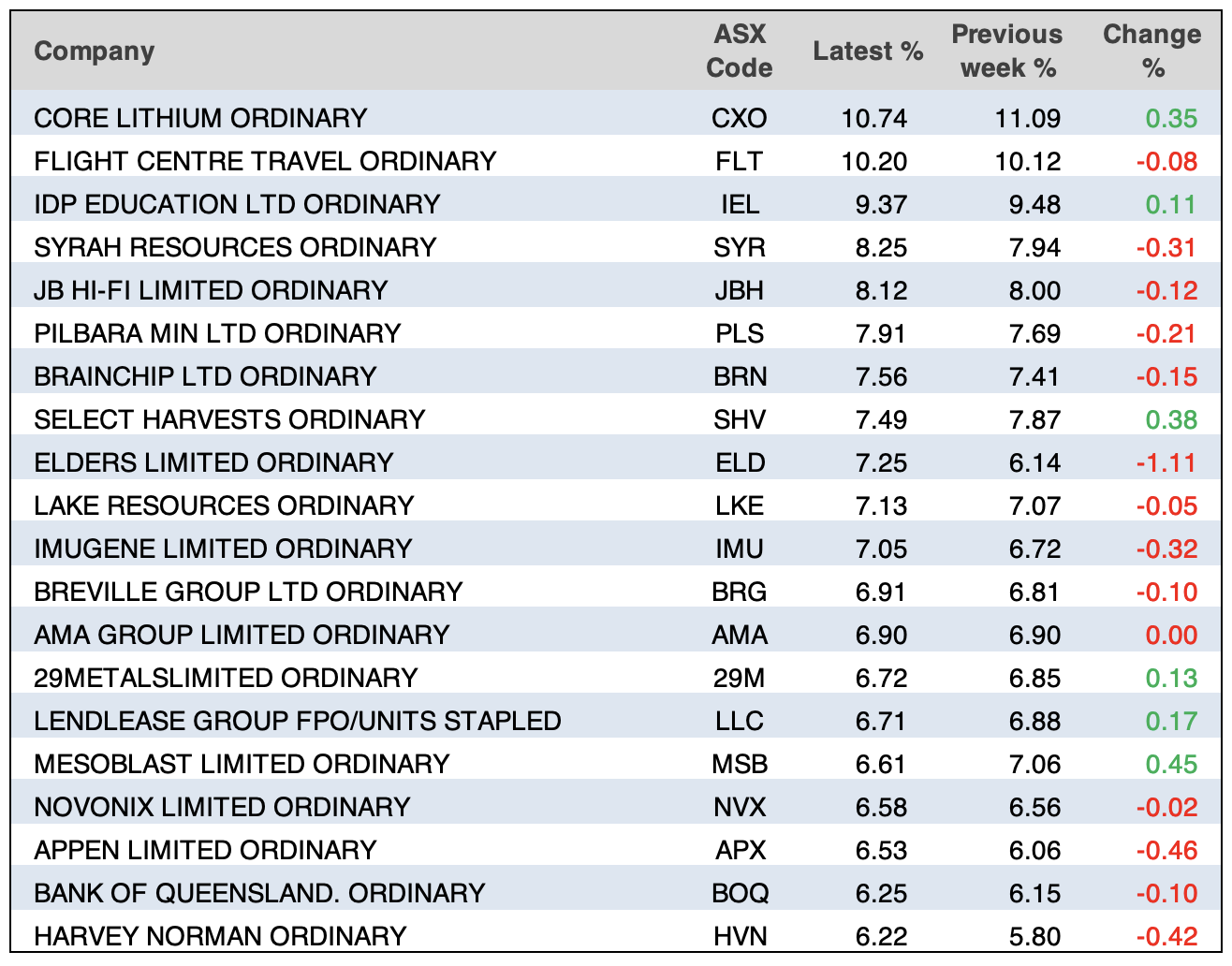

Top Stocks — how they fared.

Chart of the Week

Economic damage from 12 Interest rate rises is starting to show with unemployment rising.

Stocks Shorted

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before

Quote of the Week

With short-term worries driven by China woes, take this in from AMP’s Shane Oliver: “The next 12 months are likely to see a further easing in inflation pressures and central banks moving to get off the brakes. This should make for reasonable share market returns, provided any recession is mild.”

Disclaimer

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.