It was a week that reminded us that stock markets are mostly about the profitability of listed companies, and Nvidia well and truly showed that. Better-than-expected quarterly earnings saw the company zoom past a valuation of a trillion dollars, which underlined the perceived importance of Artificial Intelligence (AI) and other technology that explains the relative competitive advantage of top market performers.

These sorts of companies/stocks are then huge drivers of market indexes, which is why the Nasdaq was up over 3% on Thursday, which in turn helped drive our market higher on Friday. And what I love is that the focus on inflation this week had to play second fiddle to the crucial matter of company performance. However, if prices don’t keep trending down, then the Fed and its intention for interest rates could be the fly in the ointment.

Mind you, you have to be aware that the US run up for stock market indexes has been huge and pullbacks have to be on the cards. But as I argued a couple of weeks ago, because the one-year view for stocks looks very positive, sell-offs will be a buying opportunity.

The pattern of our own S&P/ASX 200 index over the past month actually shows how buyers arrive after a sell-off to sustain the uptrend for stock prices.

This from Charlie Ripley, senior investment strategist at Allianz Investment Management in the US, looks rational: “The question from here is do investors shake that momentum? We’ve run up so far, so quickly. It might not make a lot of sense to chase that type of momentum”.

He then told CNBC that “Obviously, we haven’t seen quite the momentum as we have from technology stocks…I think that does pose some risks in terms of where the index goes ultimately, because clearly everything’s front-loaded into the technology shares.”

Yep, for a sustained rise of stocks to persist, other S&P 500 companies have to show better-than-expected earnings capability, so Block’s 17% spike in earnings was a nice sign that other businesses are showing promising signs.

AMP’s Shane Oliver put this US earnings season into statistical context revealing that after around 90% of US S&P 500 companies had reported December quarter profits, 76.5% came in better than expected, which is just above the norm of 76%. “Earnings growth for the quarter is running around +9.6% year-on-year, which is well up from consensus expectations for 4.3% growth at the start of the reporting season. Earnings growth has been driven by technology companies (+40%) and financials (+11%) with resources earnings down 21%.”

This is a great base for Wall Street to go higher and help our stock market. However, the drama of the data drops that tell us about future inflation and Fed’s expected moves on interest rates will reappear as important market drivers.

The Yanks get a swag of economic data next week, but the big market focus will be on the Fed’s preferred measure of inflation — the Personal Consumption Expenditure index or PCE. Economists expect a fall for the core PCE to 2.8%, so the actual reading potentially could be a big market mover.

To the local story and December half earnings season is now close to 80% complete, and as Dr Oliver noted “…it’s now looking rather average”.

We saw a good start, with well-known businesses but the level of companies beating earnings expectations fell over the last week, although it’s still fractionally better than average.

If you need a reason for our market’s OK rise while our US counterparts have been surging, it does get down to profits, and what AI might do for our companies isn’t creating the same positivity that’s helping Wall Street and, of course, the Nasdaq.

This one-year chart below of that index reinforces my point, where the index is up 38% over the past year. This was helped by not just AI but the expectation that the Fed has no more rate rises and will be a cutter sometime this year.

Locally, as we get closer to the end of reporting season, Oliver reports that “the consensus expectations remain for a 5% or so fall in profits this financial year with a big fall in energy sector profits on the back of lower oil, coal and gas prices and a small fall in financial sector profits but most other sectors seeing flat to up profits. The good news has been that cost control remains strong and corporate guidance has generally been OK.”

Over the week, the S&P/ASX 200 lost 14.7 points (or 0.19%), which shows how lacklustre reporting season has been to date. In contrast, there have been some inspirational performers, with Afterpay’s Block cutting costs and building better-than-expected revenue, driving a 16.5% surge in its share price.

Meanwhile, Aussie Broadband saw its share price jump 18.9% to $4.53 after a good profit report, and Brambles delivered a nice 21% jump in profits, but the share price only rose 9 cents to $15.27, but it’s up nearly 4% for the month and close to 12% this year, so the market got BXB right.

This week, this Report will sum up the big take-out messages from reporting season so far to see what company uptrends we should be backing for the year ahead and beyond.

What I liked

- Despite an uninspiring local reporting season, 42% of results have beaten consensus earnings expectations on the upside and 38% surprised on the downside. This is only just a bit better than the long-term average for both of around 41% but that’s still a positive sign.

- 54% of companies have lifted their dividends.

- Australian business conditions PMIs for February rose with strength in services and some experts think there could be a bit of Taylor Swift spending in these numbers.

- The RBA Minutes note the risk of inflation not returning to the Board’s target within a reasonable timeframe had eased. The moderation in inflation over preceding months had been slightly larger than the RBA previously expected.

- Global PMIs that survey businesses globally were on the soft side, which means rate rises have largely worked to slow economies and lower inflation, which helps central banks cut rates, which will help stock prices, provided no one gets serious about recession talk.

- The People’s Bank of China cut its 5-year prime lending rate by 0.25% to 3.95%.

What I didn’t like

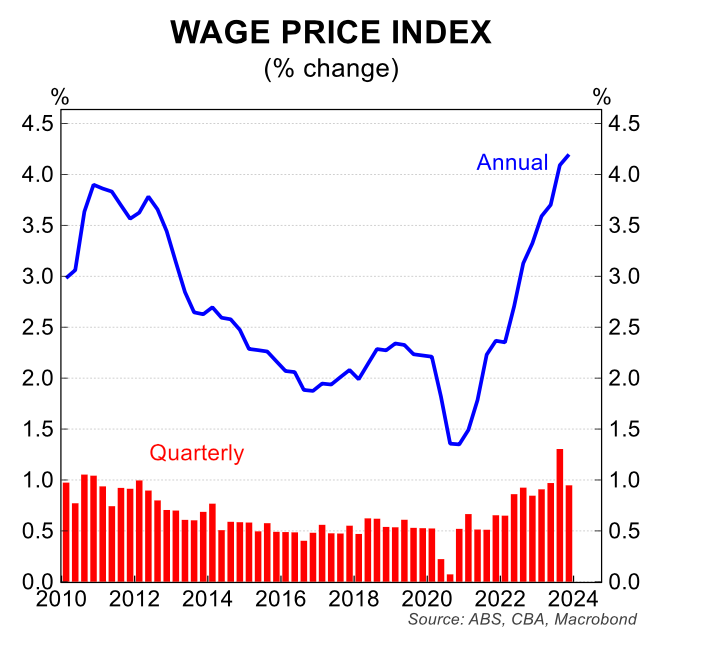

- Locally, annual wages growth in the December quarter was up 4.2%, which was the fastest pace since 2009, resulting in the first rise in real wages since 2021. This is good socially but could be an inflation threat if productivity doesn’t kick in to lower costs.

- The US leading index fell again, and the Fed needs to be careful about watching the wrong data.

- The AI boom in US stocks looks a little too positive, even for me!

This will help you keep the faith

The performance of our stock market year-to-date has been disappointing being up only 0.21% but I remain positive for 2024, with rate cuts bound to help. At least Wall Street’s lead is expected to be positive if we can believe the team at UBS in the US.

CNBC reported overnight that “UBS Global Wealth Management has lifted its end-of-year price target on the S&P 500 to 5,200 from 5,100 to reflect a more favourable environment despite recent mixed economic signals.

“We think the backdrop for US equities remains supportive, driven by healthy economic growth, moderating inflation, a Fed that’s pivoting to rate cuts, and a surge in AI investment,” the firm said in a note from the chief investment office on Thursday.

After a near 20% rise in the index since late October, pullbacks have to be on the cards, but the case for being a believer about higher stock prices looks entirely rational, especially locally where we haven’t shot the lights out stock pricewise. Our S&P/ASX 200 is up only 12.8% over that same time period.

Switzer This Week

Switzer Investing TV

- Boom Doom Zoom: [1]Peter Switzer and Michael Gable answers your questions on WES, HZR, EDV & more

- SwitzerTV Investing: [2]Mike Gable looks at the charts for Tyro, Zip, FMG, Pilbara Minerals & more. Dawes backs Tyro and meet the best property price predictor in the country!

Switzer Report

- Two thematic ETFs :Esports and video games [3]

- “HOT” stock: Reliance Worldwide (RWC) [4]

- Questions of the Week [5]

- What could China and Trump do to stocks in 2024? [6]

- The big ‘5’ report…where to from here? [7]

- HOT stock: GQG Partners Inc (GQG) [8]

- Two quality small caps [9]

- Buy, Hold, Sell — What the Brokers Say [10]

Switzer Daily

- Will Albo enshrine working from home into law? [11]

- Should we cheer wages outpacing inflation? [12]

- Virgin boss is flying the coop before it goes public [13]

- Son of James Packer shows enormous promise [14]

- Under the cost-of-living pump? Try these 25 cost cutting tips [15]

The Week Ahead

Top Stocks — how they fared

Most Shorted Stocks

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before

Quote of the Week

CBA economist, Belinda Allen on the wages spike: “Wage growth around 4% would be consistent with an inflation reading of 2.5% (mid-point of the 2-3% target band) if productivity was growing at a 1.5% or faster pace. So, for now, the waiting game continues. The monthly consumer price indicator is released next week and the national accounts (containing the latest productivity and economic growth estimates) in a fortnight from today.”

Chart of the Week

Disclaimer

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.