Global stocks had the best month in three years and the smarties are jumping on board my past predictions that small cap companies are likely to have a good 2024. This is the knock-on effect of the better-than-expected inflation news in many of the economies of the world.

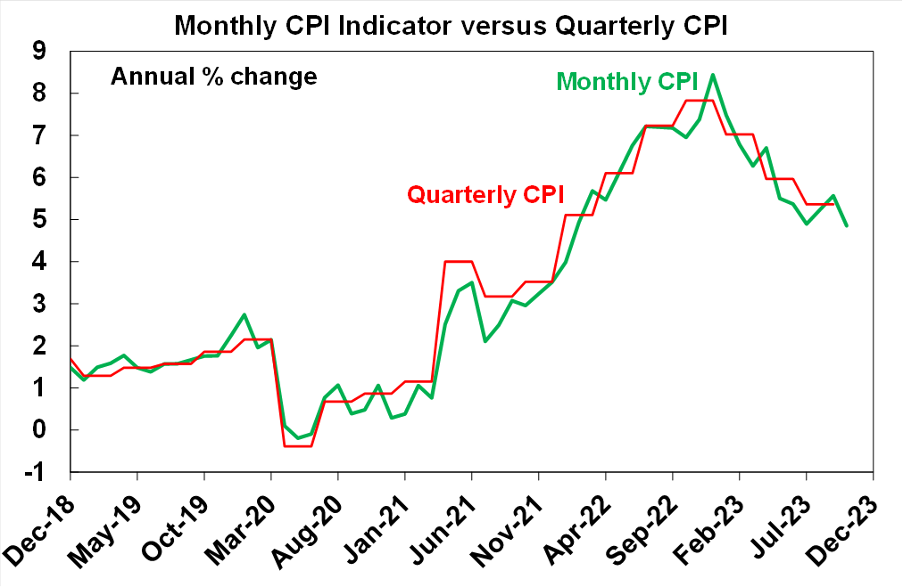

This week we saw our inflation news go positive, with the October number coming in at 4.9% for the year, based on monthly data, which was way down on the 5.6% we saw in September. Of course, this was the first leg up for good CPI data, but our market won’t be convinced that the RBA is done and dusted with rate rises until the December monthly reading is released on January 12. Then we’ll turn our market-anxious eyes to the December quarterly statistic on January 31.

If we get a CPI-trifecta of inflation-reduction readings, we’ll be ‘off to the races’ and our market will start responding like US markets have in past weeks. Since October 7, the S&P 500 index was up 10.7% and 19.4% year-to-date.

Compare that to our S&P/ASX 200 and you’ll see why I expect 2024 to be a great year for local stocks, provided we get the inflation improvement that this week’s data implied was possible.

Our index is up 4.4% since October 30, but year-to-date we’re only up 1.8%! Our market has had a lot of headwinds, including a China slowdown and a negative set against mining stocks (especially lithium players). Of course, 13 rate rises on top of slowly falling inflation didn’t help our stock market.

S&P/ASX 200

However, if future inflation data continues the positive story of the past week, then it could easily be catch-up time for local stocks, and particularly the growth and tech stocks that have struggled since rate rises started in May 2022.

This shows how local tech stocks copped it, but this Betashares ETF capturing Aussie tech companies has been on the comeback trail. At its peak, it was a $25.38 price that fell to $13.98. Now it’s at $19.27. That’s a good trend that will be helped if inflation falls and economists start talking about rate cuts.

For the Wall Street story overnight, and the November positivity continued, with all three key indexes in the green. Notably, while the S&P 500 and Nasdaq were up less than half-a-percent, the small cap Russell 2000 was 2.4% higher, as beaten-up companies are now becoming the flavour of the month.

The best bit of news is the downward trend of bond yields. Mona Mahajan, senior investment strategist at Edward Jones, summed up the money mood nicely with this on CNBC: “There’s a trifecta of drivers here. The first is the inflation. Second is the Fed seeming like it may be stepping to the sidelines, and then third is this cooling in the economy that is starting to unfold, but at a very gradual pace.”

I don’t like saying ‘I told you so’, but the reality is I did! It tells you that it’s time to invest now for future returns if you’ve been cautious waiting for more concrete signs around inflation.

To the local story, and the S&P 500 rose a measly 32.4 points (or 0.46%), with some momentum lost because the oil price fell as OPEC+ members disagreed on supply cuts. This didn’t help energy plays.

Meanwhile, you have to love the news that Australian Super is taking on the Pilbara Minerals short sellers by buying more PLS. It now has 5.1% of the company! Unfortunately, it didn’t help the stock price, though it’s early days. PLS was down 0.82% for the week to $3.61.

In contrast, shares in Paladin Energy jumped 6.2% to $1.04 on Friday, after losing around 5.5% on Thursday, with uranium embracing some real volatility. In case you missed it, PDN is up 54% over the past six months, with even Green politicians seemingly being more positive about this resources usefulness for saving the planet!

Meanwhile, Premier Investments impressed the market and rose 5.2% for the week to finish at $25.11. But not all retailers fared well, with Coles off 0.85% to $15.17. The company is now down 14.8% for the past six months and looks like it needs a game-changing strategy.

What I liked

- AMP’s take on stocks: “Our base case remains that global and Australian shares can trend upas easing inflation takes pressure off central banks and any recession is likely to be mild. But expect lots of bumps along the way.”

- That CPI number for October that told us annual inflation on a monthly basis went from 5.6% to 4.9%.

- Retail trade fell by 0.2% in October, following the solid 0.9% gain in September. The RBA would like less retail activity.

- Private sector credit growth moderated to 0.3% a month in October, as personal and business credit growth slowed. The RBA would like that.

- The total volume of capex rose by 0.6% a quarter in the third quarter of 2023 and the June quarter was also revised higher. While the RBA might prefer a softer number, I don’t want a recession, so this is a good number.

- This US growth story: “September quarter GDP growth was revised up to 5.2% annualised from 4.9%, reflecting stronger business investment but weaker consumer spending, but the Atlanta Fed’s GDP Now estimate of current quarter growth slowed to 1.8% annualised, which wasn’t helped by a widening trade deficit.”

What I didn’t like

- Dwelling prices rose by a decent 0.6% across the eight capital cities in November – the tenth consecutive monthly gain. Dwelling prices have now risen by 9.6% since their February trough, but growth is now moderating.

- Private sector credit growth moderated to 0.3% a month in October, as personal and business credit growth slowed. The RBA would prefer a less buoyant building sector.

- Chinese business conditions PMIs for November were soft. Recently announced stimulus measures are clearly yet to impact.

A good week for cautious stock players

The inflation number shows that we’re close to the top of the rate rising cycle. When we get there, stocks are bound to surge. Remember that. And importantly, be patient.

Switzer This Week

Switzer Investing TV

- Boom Doom Zoom: [1]Paul Rickard and Michael Wayne answers your questions on MP1, APX, PLS & more

- SwitzerTV: Paul Rickard talks to Peter Switzer and Adam Dawes [2]

Switzer Report

- Flight Centre & Serko worth considering at current levels [3]

- “HOT” stock: Ramelius Resources (RMS) [4]

- Questions of the Week [5]

- Here’s how to get ready for good investment returns next year [6]

- Is Xero too expensive? [7]

- HOT stock: Next DC (NXT) [8]

- 3 stocks below 75 cents [9]

- Buy, Hold, Sell — What the Brokers Say [10]

Switzer Daily

- How did 7-Eleven become worth $1.71 billion? [11]

- Can we now kiss interest rate rises goodbye? [12]

- Are baby boomers selfishly ripping off younger generations? [13]

- Ignore negativity and believe stocks will go higher in 2024 [14]

- Treasurer Chalmers gives up his influence over the RBA and interest rates [15]

- New Zealand has a new government – at last! [16]

The Week Ahead

Top Stocks — how they fared

Most Shorted Stocks

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before

Chart of the Week

Quote of the Week

With the passing of Warren Buffett’s investing buddy and mentor, Charlie Munger, it’s respectful and wise to look at one of his great investing recommendations: “

“I constantly see people rise in life who are not the smartest, sometimes not even the most diligent, but they are learning machines,” Munger said in a 2007 commencement address at the University of Southern California Law School.”

(I hope what we do here is part of your learning machine!)

Disclaimer

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.