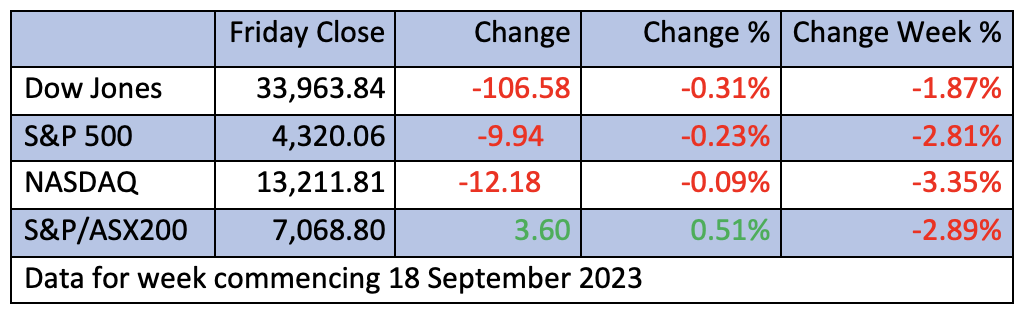

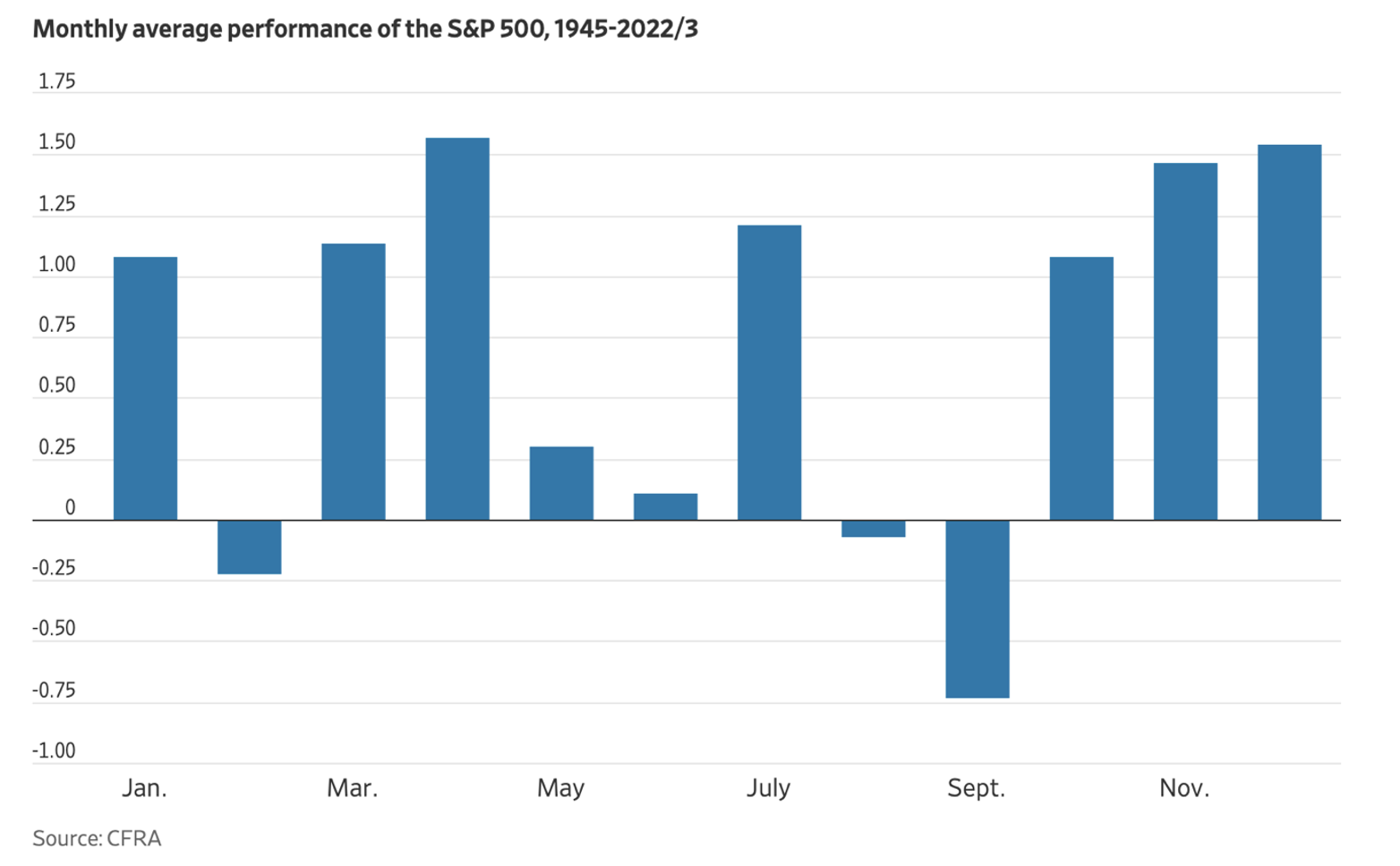

In case you have the jitters about stocks right now, well I must remind you that I did warn that September is historically the worst month for stocks. A Wall Street Journal story simply put it this way: “The ‘September effect’ means this month is the worst on average for the S&P 500.”

And here’s a chart to prove it.

Of course, there’s a range of different reasons for this bad September bad vibe for stocks but it does coincide with social events, such as the end of holidays in the northern hemisphere, but that explains little. “There is no clear reason for what is known as the September Effect, but it is typically a month without the type of news that can push stocks higher, such as major corporate earnings,” said Jay Hatfield, chief executive officer of Infrastructure Capital Advisors. “The basic theory is that good news almost always comes from the companies, and the bad news comes from random events.” He pointed to Fitch’s recent downgrade of the US credit rating as an example. (WSJ)

Right now, there’s a host of headwinds that explain nervousness on Wall Street and on markets such as ours.

AMP’s Shane Oliver has listed the challenges for stocks here in September and he argues that “the risk of a further correction in shares remains high”, with the main threats being:

- Many central banks are still leaning hawkish and warning of higher rates for longer.

- Sticky inflation.

- Rising bond yields pressuring share market valuations.

- The higher risk of recession.

- The rebound in oil prices.

- China’s economy still at risk.

- The very high risk of a US Government shutdown from 1 October.

- Continuing geopolitical tensions.

- The weak seasonal period for shares into next month.

But, like yours truly, this is how Shane concludes: “However, our 12-month view on shares remains positive as inflation is likely to continue to trend down taking pressure off central banks and any recession is likely to be mild.”

Like the CBA economics team, Shane thinks interest rate rises should be over, but it will depend on the economic data drop and the foresight of our Reserve Bank and other central banks. This week’s accelerated sell-off for stocks, where our market gave up nearly 3%, was triggered by the press conference of Fed chairman Jerome Powell, who wasn’t prepared to say his central bank had won the war on inflation and repeated the message that more hikes might be needed.

When you throw into the market mix the threat of a government shutdown over debt wrangling in Congress, an ongoing car workers’ strike and the Fed’s interest rate voting members indicating rates could rise further, you know why stocks are finding it hard to lift right now.

That said, every time the market had reason to believe that interest rate rises were over, stocks, and especially tech stocks, took off. So, it was no surprise that they copped it this week, but the present can often give clues about what’s likely to happen going forward, provided you look at the right indicators. That’s what I’ll look at in Monday’s Switzer Report.

Interestingly and not surprisingly, all big three stock market indexes (the Dow, the S&P 500 and the Nasdaq) ended Friday slightly in negative territory after being positive until the last half hour. That’s a reminder that every decent sell-off is a buying opportunity if you have a 12-month view and do your homework on the company or investment product you intend to buy.

I’m not convinced the worst of this current market negativity is over, but I suspect in October/November that the optimists could see some rewards, provided the data drops scream to the Fed: “Stop raising rates!”

Goldman Sach’s Scott Rubner has an interesting take on this troubled month, which is worth remembering: “We are in the middle of the worst seasonal equity period of the year right now for the market to close out Q3. Since 1928, the median SPX return for the last 10 out of 11 days in September is negative. In addition, Monday is a holiday and potential long weekend (lower volumes). This dynamic improves as we move into October…” Rubner added.

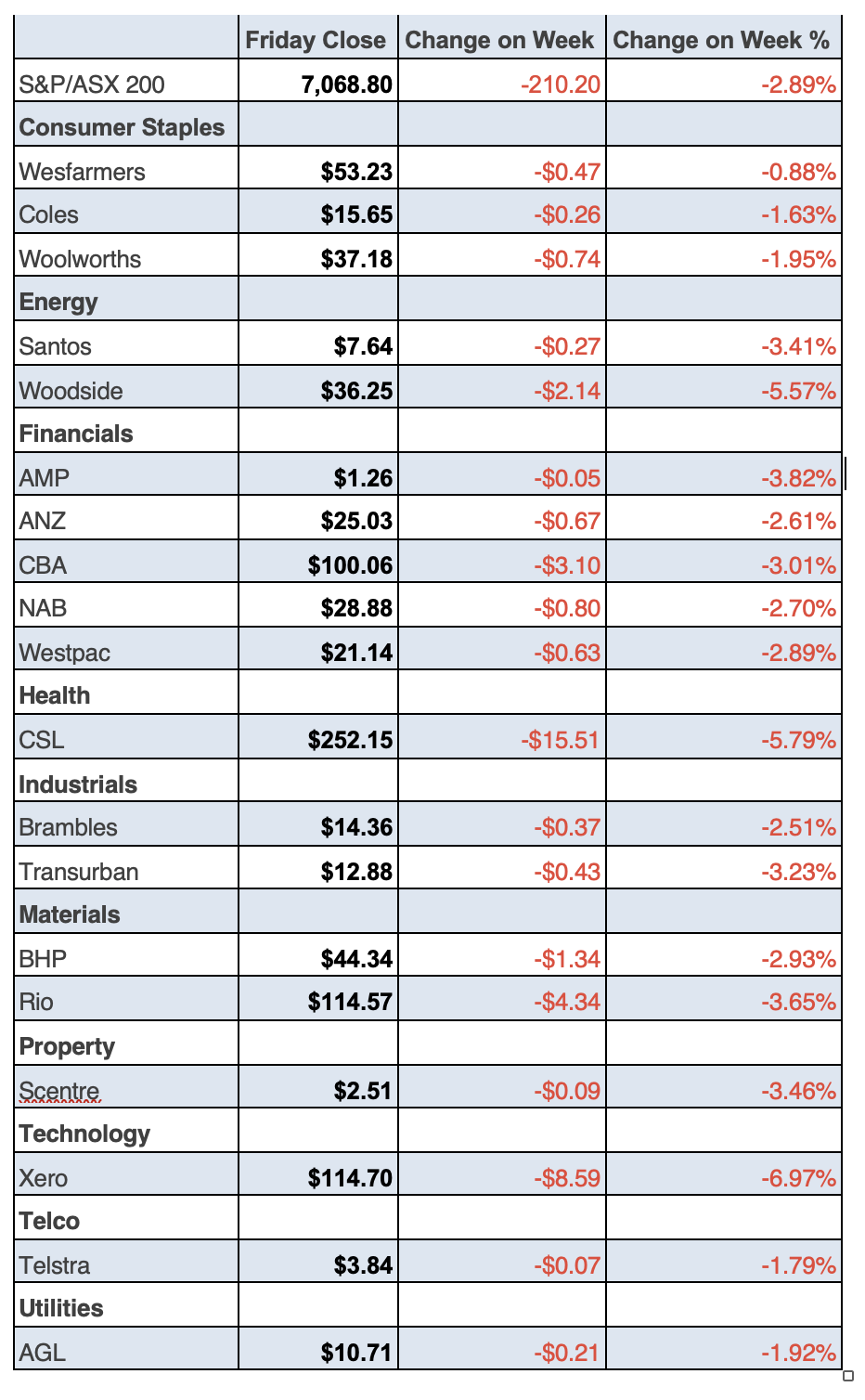

To the local story and the S&P/ASX 200 surprised by ending just in positive territory after a very negative start, but over the week it lost a big 210 points (or 2.89%). You can blame the bad vibes about possible future interest rate rises inferred by Fed boss Jerome Powell on Wednesday.

Tech was given a right old ‘bollocking’, but the threat of possible interest rate rises (that were increasingly seen as possibly done and dusted) spooked not only Wall Street and Times Square (where the Nasdaq hangs out) but also here in Australia.

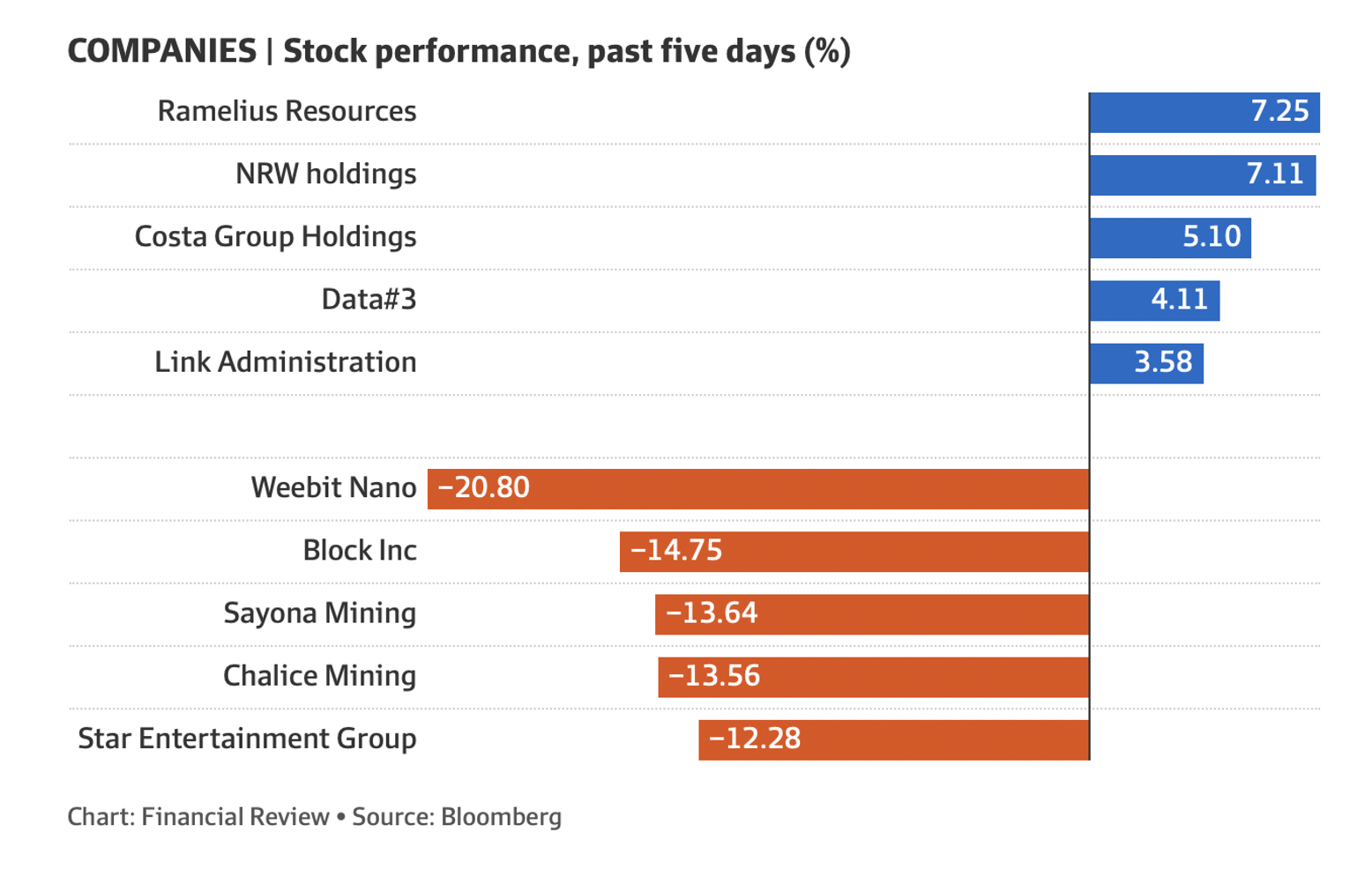

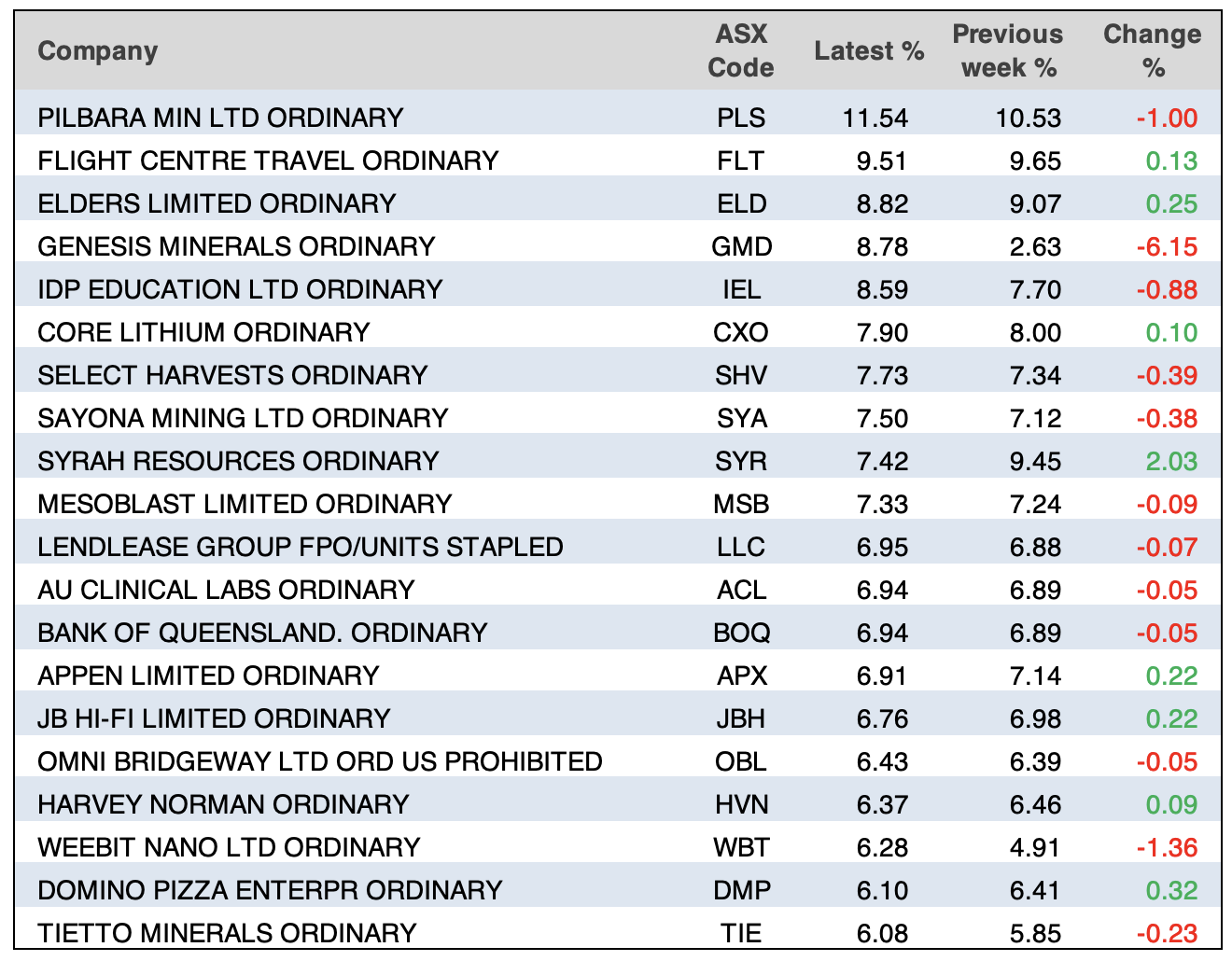

Here are the big winners and losers for the week, thanks to Bloomberg and the AFR.

Energy stocks went higher as Russia announced a ban on oil exports, which has to hurt the global supply of oil. Santos put on 0.66% on Friday, but its week-long loss of 3.05% shows what a tough week it has been for stock players. Costa Group gained over 5% for the week, following accepting a $3.20 cash-per-share offer from US buyout company Paine Schwartz Partners.

Meanwhile, Treasury Wine Estates got some good news, with the AFR’s Cecil Lefort reporting that “…E&P Capital estimated that a potential resolution on China tariffs on Australian wine, flagged in China’s Global Times, would be positive for the company. E&P set a price target of $12.93.” The company’s share price closed at $12.05 on Friday. (See ‘How the Top Stocks Fared’ table below for a summary of share prices moves this week.)

What I liked

- CBA’s take on the RBA Minutes from the September meeting: The message was the same; the RBA is still of the view that the economy is on the ‘narrow path’, despite some minor shifts to the risk profile; and “our base case remains the current cash rate of 4.1% is the peak in this cycle”.

- Australian business conditions PMIs for September rose again to the 50 growth/contraction level with a rise in services conditions. Cost pressures were flat, but output prices fell – both remain elevated but well down from their highs, which is good inflation news.

- The Australian budget confirmed to be back in surplus for 2022-23 – at $22.1 billion.

- State governments in Victoria and NSW are trying to kickstart a housing construction revival. The numbers look unachievable, but I like the intent.

- In the US, home building conditions fell in September, housing starts fell in August and existing home sales were weak, as the rebound in mortgage rates hit the sector, which is good for stopping another Fed rate rise.

- US manufacturing conditions weakened in the Philadelphia region and the US leading index fell again, which also helps stop the Fed from rate rises.

What I didn’t like

- The higher-for-longer interest rate signals from the Fed and some other central banks, which pushed bond yields higher and hurt stock prices.

- Metal and iron ore prices fell, which hopefully is only a temporary problem.

- Because of rising oil/petrol prices, AMP’s Shane Oliver has said: “Given these riskswe have decided to push out our expectation for the first rate cut from around March next year to around June.”

- The downtrend in inflation has seen a bit of a reversal in some countries in August(notably in Asia, the US and Canada), thanks particularly to higher fuel prices.

- A US Federal government shutdown is now a very high risk, so the Congress needs to pass a new budget or a continuing funding resolution by 1 October to avoid a shutdown.

- US jobless claims fell, which is one reason why the Fed might be worried about inflation.

Proof central bankers are guessing.

Stocks are on the slide because central bankers are erring on the side of caution, but this Fed president is honest enough to admit it. Check this out from CNBC:

“San Francisco Fed President Mary Daly noted that more data is still needed to determine whether the central bank needs to further tighten monetary policy.

“The thing that would be a problem is if we decided that we wanted to call it done we’d say we’re done, we say definitely one more, when we actually don’t know,” Daly said in an event. “Patience is a prudent strategy.”

I don’t fully understand her last long sentence but the gist of it is that we don’t know if rates are beating down inflation enough, so we’ll keep the frighteners on. When they admit we’ve seen the last of rate rises, stock prices will surge.

The Week in Review

Switzer TV

- Switzer Investing: SwitzerTV Monday 18th September 2023 [1]

- Boom Doom Zoom: 21st September 2023 [2]

Switzer Report

- Two China ETFs to consider [3]

- “HOT” stock: Woodside (WDS) [4]

- Questions of the Week [5]

- How likely is a 10% rise in stock prices in the year ahead? [6]

- Is the worst over for Qantas? [7]

- HOT stock: Next DC (NXT) [8]

- 3 gold stars [9]

- Buy, Hold, Sell — What the Brokers Say [10]

Switzer Daily

- Albo’s government is rolling in money — our money! [11]

- Dan Andrew’s tax slug set to infect other states [12]

- Little trouble, big China [13]

- How much do you need to invest? [14]

- ASIC to punish slack boards and directors with no cyber-attack protection [15]

- The 1967 & 1999 referendums are generally mis-described by [16]Malcolm Mackerras [17]

- Could British & Scottish PMs learn from Anthony Albanese? by [18]Malcolm Mackerras [17]

The Week Ahead

Top Stocks — how they fared.

Chart of the Week

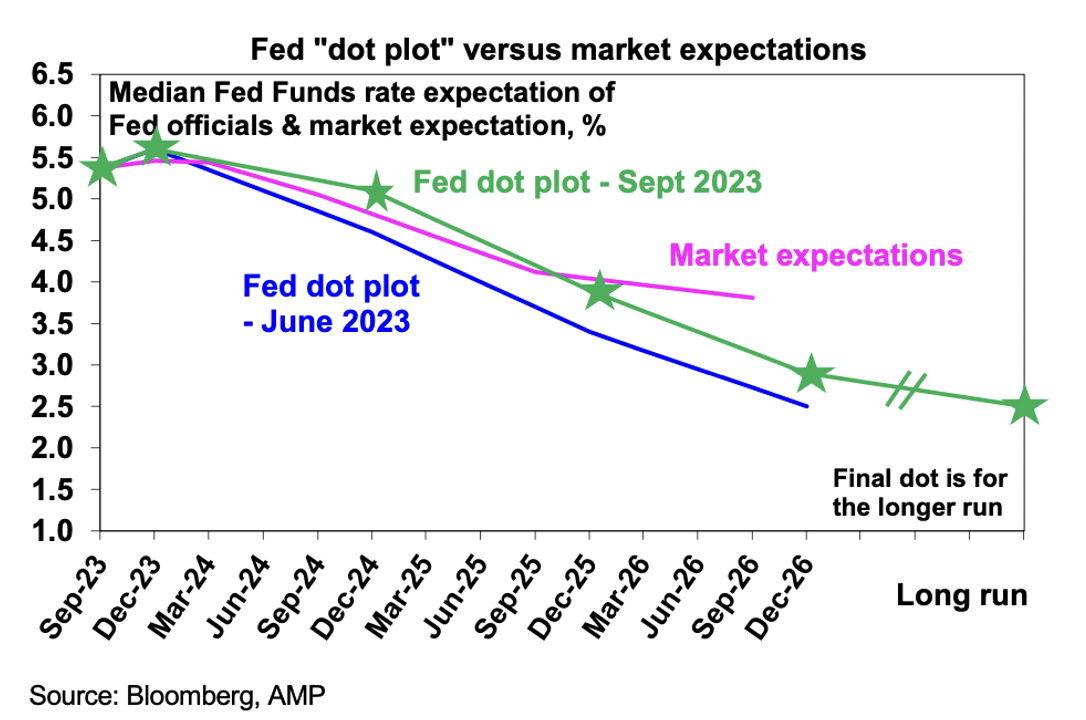

Read this from AMP’s Shane Oliver to better understand why stocks fell after the Fed chief’s comments after not raising interest rates this week: “The Fed left interest rates on hold but is still allowing for one more rate hike in its median “dot plot” of Fed officials interest rate expectations and raised its median “dot plot” expectations by 0.5% for each of the next two years on the back of upgraded growth and lower unemployment forecasts and despite still seeing inflation return to target by 2026. So, its expected pace of rate cuts over the next few years is substantially reduced. Our assessment is that the Fed’s growth forecasts are too optimistic and recession risk for next year remains high particularly as still rising bond yields will weigh even more on growth. But for now the “higher for longer” rates message is serving to push bond yields up even higher.”

Stocks Shorted

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before

Revelation of the Week

“ Fed Chair Jerome Powell said the central bank still needs to “see more progress” on inflation. Projections released in the Fed’s dot-plot, which indicates what members are expecting for the future, showed the central bank could hike rates to 5.6% by the end of 2023. The rate-setting Federal Open Market Committee also projected two rate cuts in 2024, which is two fewer than it forecast in June.” (Michelle Lun, CNBC)

Disclaimer

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.