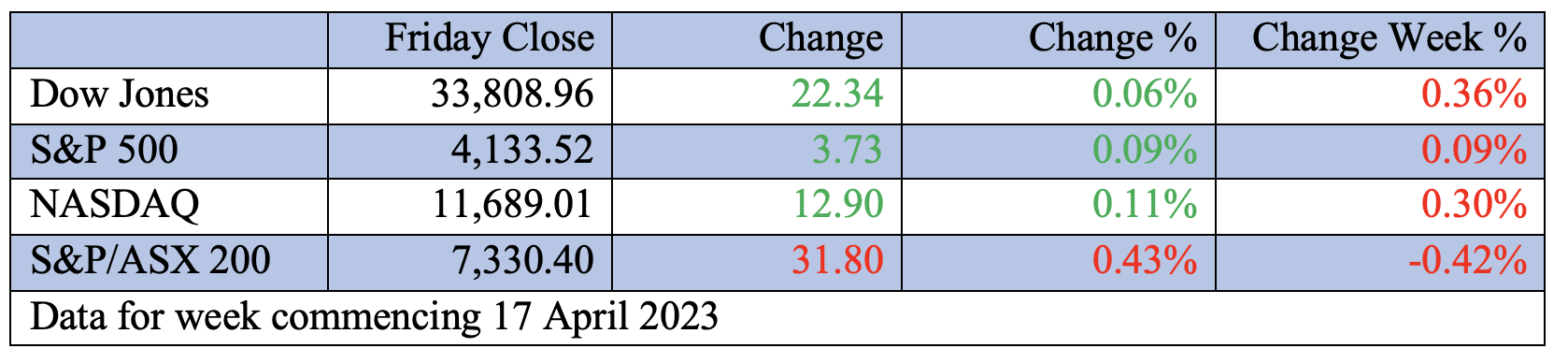

It has been a losing week for stocks and Wall Street only just defied this trend at the close on Friday. Part of the negativity is the uninspiring profit story coming out of US reporting season, but who really should be surprised about that, with the Fed turning the thumbscrews on the economy with its aggressive interest rate strategy?

However, year-to-date, the S&P 500 Index is up 8% and the Nasdaq is 16.15% higher, so why wouldn’t there be a breather for stock-buyers, given these questions out there:

- Is a recession coming and will it be mild or deeper than expected?

- Does the Fed have more rate rises coming in May and beyond? Fed speakers are not telling the market “Mission Complete” – yet.

- Until recently, the economic data wasn’t screaming that rate rises are working to kill inflation.

- Some bears point to a small group of companies leading the market as one reason to believe that the S&P 500 is poised for a pullback.

- Those big index gains look vulnerable to that old market maxim of “sell in May and go away, come back on St Leger’s Day”.

- Reporting season has been good for banks but other companies aren’t helping momentum upwards for stocks.

“There is a tug of war between those who are feeling optimistic that the Fed will soon be ending the rate tightening program because of softness that we’re seeing in the economy … with those who believe the Fed will be forced to raise rates longer because the economy is not in a sense, surrendering,” said Sam Stovall, chief investment strategist at CFRA Research on CNBC.

That looks like a pretty good way to put it. I interviewed Sam a few years back when I took my old TV show to Wall Street. He’s a smart analyst of market sentiment.

It’s interesting that the Dow is up in April by 1.5%, but the month is the best for the Dow and the fact that the tax deadline date of April 15 happens in the month has a lot to do with it. Many investors sell before the deadline and buy back after it. Of the past 25 years, the S&P 500 has traded positively in 76% of the five-day periods following the deadline. And 24% of the times when stocks fell after April 15 would’ve been linked to negative company reporting.

“So far, earnings season is off to an uneventful start, with many companies meeting already reduced earnings expectations and that helps to explain the lack of movement in the major stock indices over the past few days,” said Carol Schleif, chief investment officer at BMO Family Office, adding that she expects stocks to trade in a tight range for some time.

As of Friday morning, FactSet reported that 76% of S&P 500 companies reporting earnings so far have beaten analyst EPS estimates, which isn’t bad.This is why the next couple of weeks of reporting will be important, and so will the May 2-3 meeting of the Fed’s interest rate committee, with the consensus still tipping a rise.

“US Federal Reserve officials remain set to raise interest rates at their May 2-3 meeting but key data between now and then, particularly a survey of bank lending officers, may shape how they weight the risks facing the U.S. economy and whether they decide to pause further increases,” Reuters reported overnight.

Data-watching will determine the Fed’s play but the latest jobs report, where available positions dropped below 10 million for the first time in nearly two years and inflation came in at 5%, all point to the fact that the peak in rates must be close. That will be a plus for stocks but there are others that are explaining why it has been a good start to the year. Tom Lees of Fundstrat Global Advisors, who’s a bigger bull than me, says the market is beginning to ‘feel like a bull market’ as the percentage of up days has hit the highest level in 17 months. In his regular note to investors, he pointed to the fact that stocks were up 65% of the last 20 trading sessions, marking the highest percent since November 2021.

And he thinks this trend will continue for a few more weeks, undoubtedly helped by those who have used the tax deadline to sell and then buy. But Lees is not alone in liking stocks, with CNBC this week telling us that investors poured money into money market funds during the March bank concerns that led to a chase for safe-haven instruments. “For the month, the asset class pulled in $363 billion, the third highest ever in Morningstar data that goes back to 1993,” Jeff Cox reported. “The surge was bested only by the early days of the Covid crisis. The move pushed the total assets for the group to $5.2 trillion by the end of the month, according to the Investment Company Institute. Looking to snap up oversold bank stocks, investors pushed $1.2 billion into the $3 trillion SPDR S&P Regional Banking [1] ETF.”

In contrast to this positivity for that specific investing sector, US equity funds saw outflows of $16.5 billion, which was the fifth straight month of negative flows! Once again, this is another sign of the tussle between sellers and buyers (or bears and bulls), but it will be economic data, company profits and, more importantly, what the Fed does, that will determine where stocks head.

One thing’s for certain, if the Fed stops raising rates after May because inflation-related data says it’s time to do so, then if there are no dramatic recession concerns, stocks will be heading a lot higher.

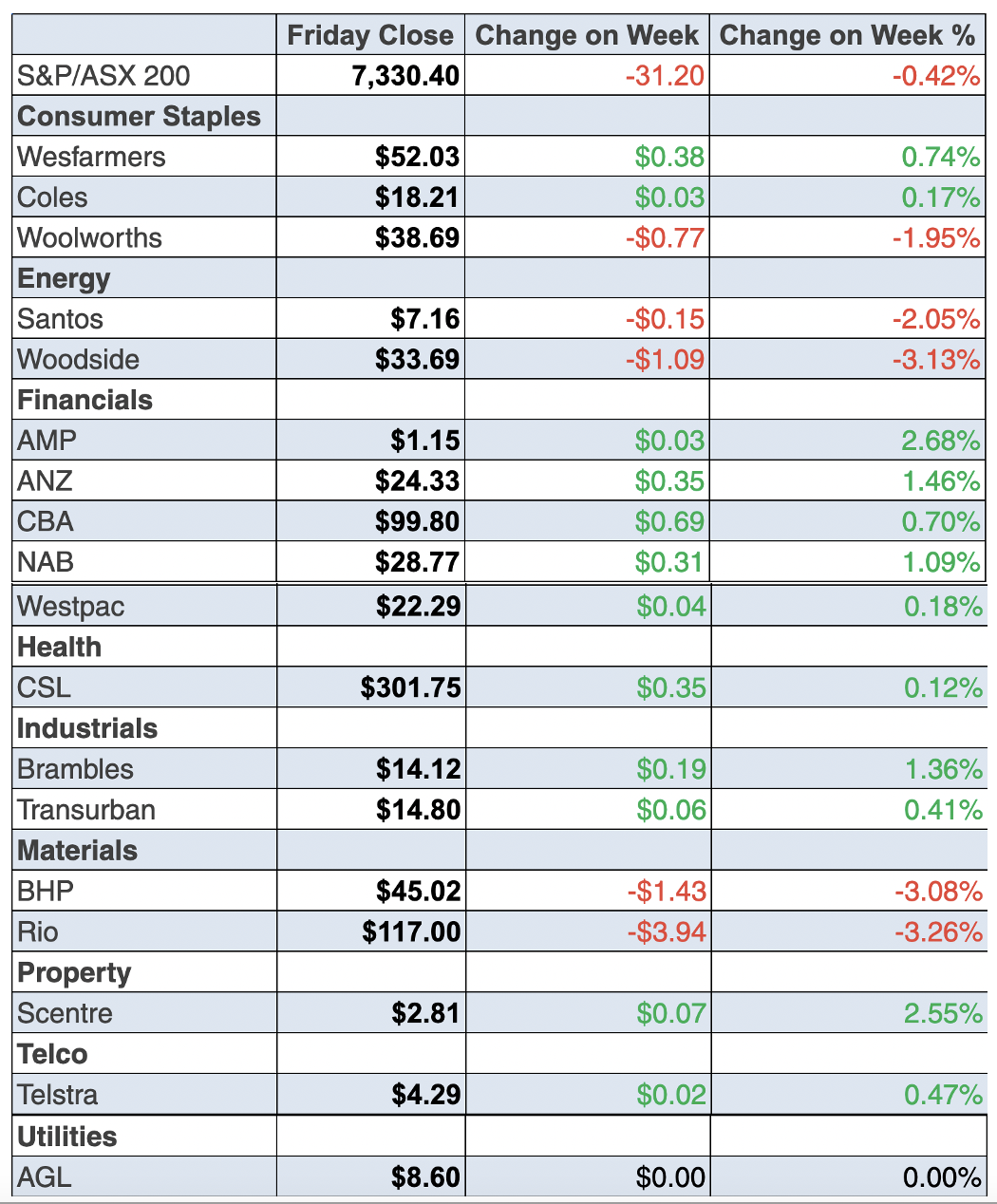

To the local story and the S&P/ASX 200 lost 0.4% (or 31.8 points) on Friday to close at 7330.4, losing 0.42% over the past five trading days. The big negative was recession fears linked with news that stocks of iron ore were piling high, which took iron ore futures down in China and Singapore. This hit our big miners and sent Rio Tinto 2.8% lower to $117. Fortescue Metals tumbled 4.2% to $21.49. Champion Iron eased 2.7%, while BHP Group lost 2.5% for the week to $45.02.

On Friday, Lynas had a good one, climbing 4.75%% to $6.84 on rising sales. And gold players did well. The AFR said “St Barbara climbed 5.4 per cent to 58.5 cents, Silver Lake Resources rallied 2.1 per cent to $1.245 and Northern Star advanced 0.9 per cent to $13.75. West African Resources rose 1 per cent to $1.015. But Newcrest Mining dipped 0.4 per cent to $28.90.”

What I liked

- The Treasurer’s plans to fix the RBA’s interest rate decision process. The future press conferences after a rates decision will be a big plus for RBA accountability.

- The AFR reports: “Bond traders gave a 35 per cent chance the Reserve Bank will lift the cash rate to 3.85 per cent on May 2.” This is only a small chance of a rise.

- The CBA on the rates decision next month: “Our base case sees the RBA deliver one final 25bp rate hike at the May Board meeting, but at this stage it looks a line ball call.”

- NAB on the US banking crisis: “It is clear from the banks [reporting] so far that fears of a banking crisis have receded, and instead the focus is turning to what extent banks tighten up lending standards”.

- Chinese activity data showed GDP rebounded more quickly than expected.Q1 GDP growth was 2.2% vs an expected 2%.

- The US service sector’s purchasing managers’ index (PMI) hit a high not seen for 12 months, according to data released by S&P Global on Friday. The PMI climbed to 53.7 in April from 52.6 in the previous month. This is good for hosing down recession concerns but it might not be good for inflation.

- The Philly Fed Manufacturing Index fell more than expected to minus 31.3 versus the expected minus 19.3 and minus 23.2 previously, which should help the Fed stop raising interest rates.

- Bank of America’s CEO, Brian Moynihan, said he sees only a slight recession hitting because the consumers remain in solid shape: “Everything points to a relatively mild recession given the amount of stimulus that was paid to people and the money they have left over”.

What I didn’t like

- Too much Fed speaking on rate rises: NAB says “Speakers reiterated the case for a 25bp move in May and pushed back on the pricing of cuts.” The Fed’s Mester (a non-voter) noted: “I anticipate that monetary policy will need to move somewhat further into restrictive territory this year, with the Fed funds rate moving above 5% and the real Fed funds rate staying in positive territory for some time”.

- UK inflation was a shocker. Headline CPI only fell from 10.3% to 10.1% against 9.8% expected. The core measure was unchanged at 6.2% against expectations for a fall to 6%.

- UK’s employment growth was strong at 169,000 versus 50,000 expected, while the unemployment rate ticked up one tenth higher to 3.8%, which all points to another rate rise coming soon.

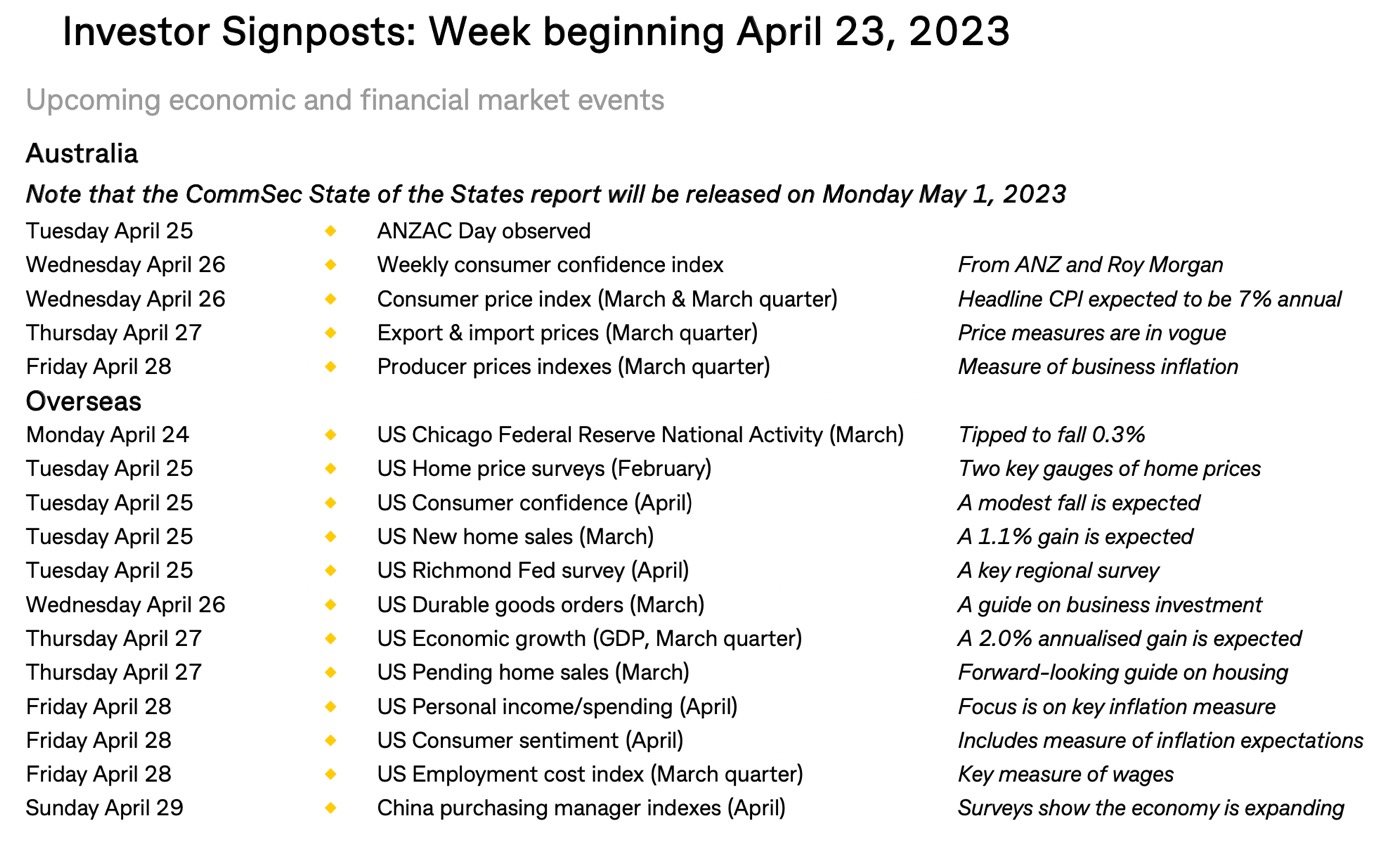

My big watch for the week

Wednesday brings important inflation data for the quarter and the month of March and I’m hoping we keep seeing a downward trend. If we don’t, it could be bad for borrowers, the future growth of the economy, then stock prices and Dr Lowe’s re-employment prospects as his contract expires in September. He needs a win and so do borrowers!

Keep watching the numbers

Data remains the main game in town for stocks and given what we’ve seen in the past three weeks, I remain positive that 2023, will be a good one for stocks but there will be some heart-pumping moments. US company reporting will have the heart racing in coming weeks, so watch this space!

Switzer this week

- A better RBA and interest rate setting process is coming to an economy near you! [2]

- Silence of the lambs: should RBA board members have told Dr Phil Lowe that his call on rates was wrong? [3]

- Coming soon: Dr No starring Treasurer Jim Chalmers [4]

- When investing, be careful of what Budgets and Governments can do! [5]

- Are rate rises over? [6]

Switzer TV

- Paul Rickard is joined by Adam Dawes and Marcus Bogdan. [7]

- Boom Doom Zoom | 20th April 2023 [8]

Switzer Report

- Two under-the-radar healthcare services microcaps [9]

- “HOT” stock – Lynas Rare Earths (LYC) [10]

- 3 yield-plus-capital growth stocks [11]

- Questions of the Week [12]

Top stocks and how they fared

The week ahead

Shorted Stocks

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

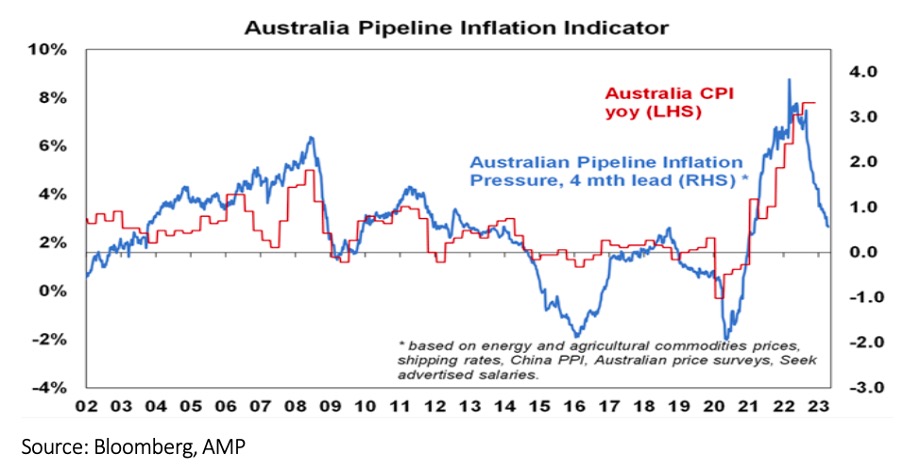

Chart of the Week

With both March monthly and quarterly CPI numbers are out on Wednesday and these will be crucial to what happens to interest rates next month. This Pipeline Inflation Indicator chart for Australia from Shane Oliver shows the official inflation stats are way behind the Pipeline readings.

Quote of the week

US fund manager at Ark Invest, Cathie Wood, said Tesla [13] could hit $2,000 in five years on the back of a robotaxi boom. “It is one of the most important investment opportunities of our lifetimes.”

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.