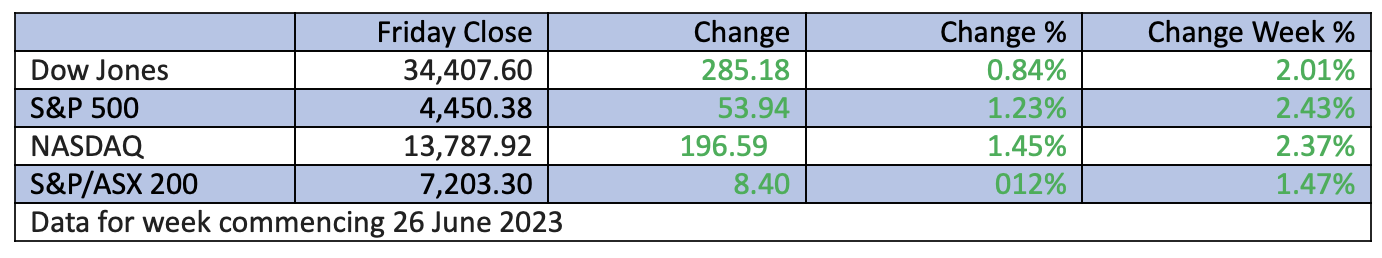

In case you’re wondering, early Saturday morning for me starts with a ‘crawl’ out of bed and the first thing I grab is my mobile phone. I quickly click on the markets’ app, and today for Wall St it was green on the screen! This generates an enthusiastic dash to my laptop and TV to see if the latest data drop justifies the current optimism for stocks, especially in the US. But it has been a help here, with our market up 1.47% for the week.

Friday’s close for Wall Street (which of course was the last trading day in June) saw all three closely-watched stock market indexes up strongly. Helping these rises was the Fed’s preferred inflation indicator — the PCE deflator.

PCE stands for Personal Consumption Expenditure and this price index rose only 0.3% for the month of May, as consumer spending dropped considerably. The headline inflation number was 3.8%, while the core PCE was 4.6%, but both were less than economists expected. They’d also be lower than what the Fed and its boss Jerome Powell have been thinking lately, given his remarks this week in Portugal, where he tipped more rate hikes ahead. At least for today, the market is betting the Fed is nearly done torturing the economy to kill inflation. “The spending splurge is likely nearing the end as consumers released most of the pent-up demand for spending,” said Jeffrey Roach, chief economist at LPL Financial.

Despite the good news, traders still think there’s an 87% chance of another rate rise in this month’s meeting of the Federal Market Open Committee (FMOC), which decides monetary policy in the US. I think the Fed and the RBA are in the danger zone. They might be underestimating when the big bang lag effect of their previous 10 rate rises for the US central bank, and the 12 that were doled out here, will really KO spending and possibly the economy.

While only time will tell, some of this stock market rebound is based on positive sentiment, helped by the belief that rate rises are at least nearly over and therefore pushes us closer to the first rate cut.

Art Cashin is CNBC’s legendary and longest-serving broker at the New York Stock Exchange (NYSE). He turned 82 in March and works for UBS on the floor of the NYSE. I’ve interviewed Art there twice in my Sky Business TV days. He warns that sentiment might be ahead of itself and says we’re seeing “financial fireworks” as the 4th of July celebrations loom, partly powered by “the fear of missing out (FOMO)”.

While Art’s not calling a big sell-off for the second half, he does observe that there are a few bumps in the road ahead, and you can’t rule out that one of these could be a landmine. He says the market surge in effect is being driven by what 19th century social psychologists Gabriel Tarde and Gustave Le Bon called “mob behavior”, where the mob thinks “the train is leaving the station” so they have to be on board.

Wisely, Art points out the important role of the Fed saying that “if rates go significantly higher, everything could change”.

This comes as US Barclay’s equity strategist Venu Krishna questioned the rise of the S&P 500 in a Friday note. The index has been largely driven by the “Magnificent Seven” stocks (Apple, Microsoft, Nvidia, Amazon, Meta, Tesla and Alphabet) and the AI boom.

Over the next six weeks, with US reporting season running from July 15 to August 31, we need to be careful. If earnings per share (EPS) are slugged by the 10 rate rises in a year, the S&P 500 could easily pull back.

However, if the EPS readings end up being better than expected (a bit like the recent run of economic data), then the positivity of US investors could be seen as being on the money. That said, the recent readings of the American Association of Individual Investors found optimism among individual investors towards stocks over the next six months dropped, however it was higher than the historic average for a fourth consecutive week.

That again puts the future focus for investors (like us) on the Fed and its fight with inflation. On that subject, I liked this from Jamie Cox, managing partner for Harris Financial Group, who told CNBC about the PCE reading: “This is excellent news on the inflation fight. If you don’t believe disinflation is happening, you aren’t paying attention. The Fed was right to pause and needs to hold firm at these levels to prevent overcorrecting and causing an unnecessary recession to fight a beast that is now under control.”

I hope the Fed is getting of the same mind!

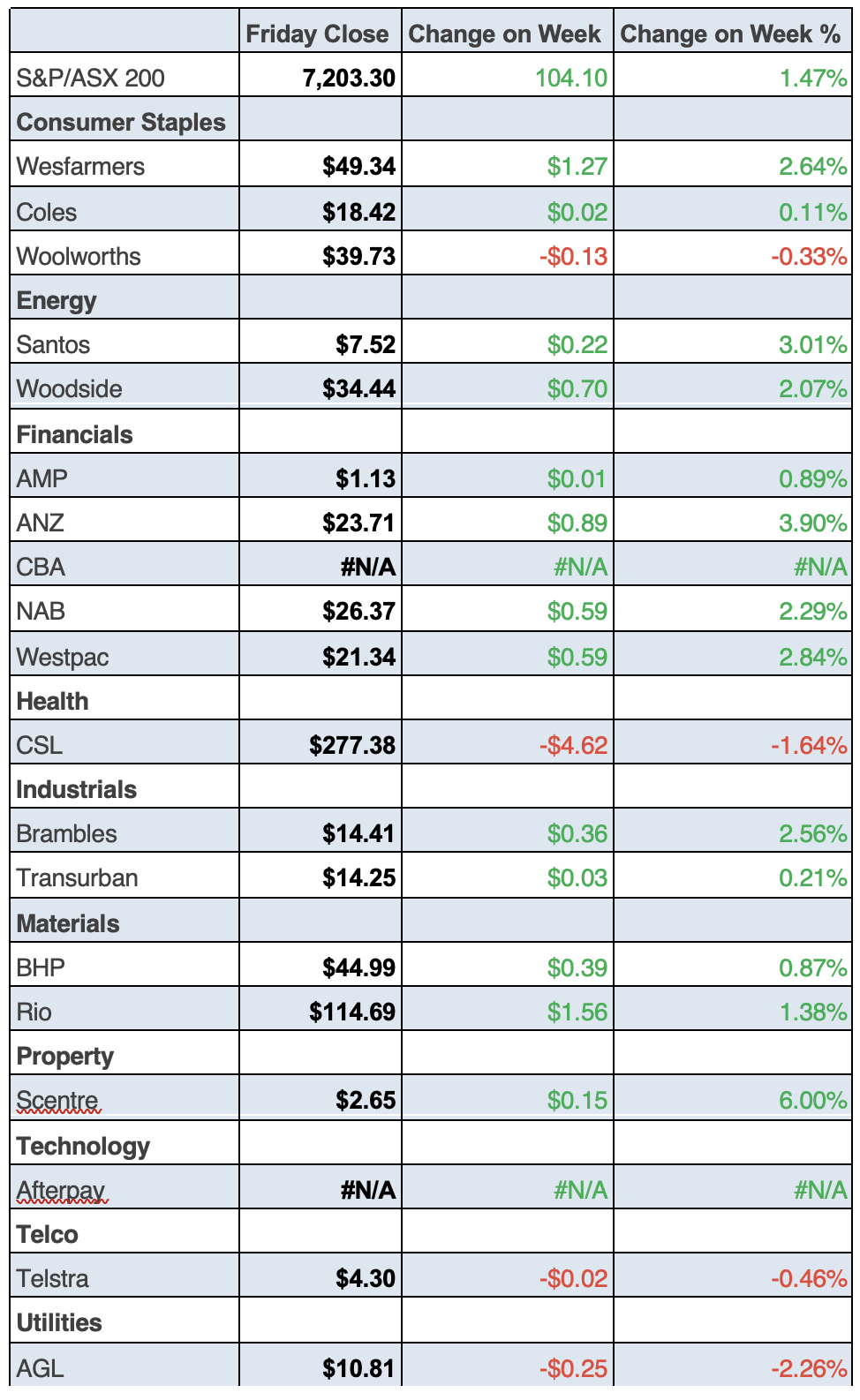

To the local story and the S&P/ASX 200 was up 104 points (or 1.47%) to 7203.30. That’s a 10.1% gain for the year but the year-to-date gain is only 3.7%, which makes me think the best of 2023 lies ahead of us.

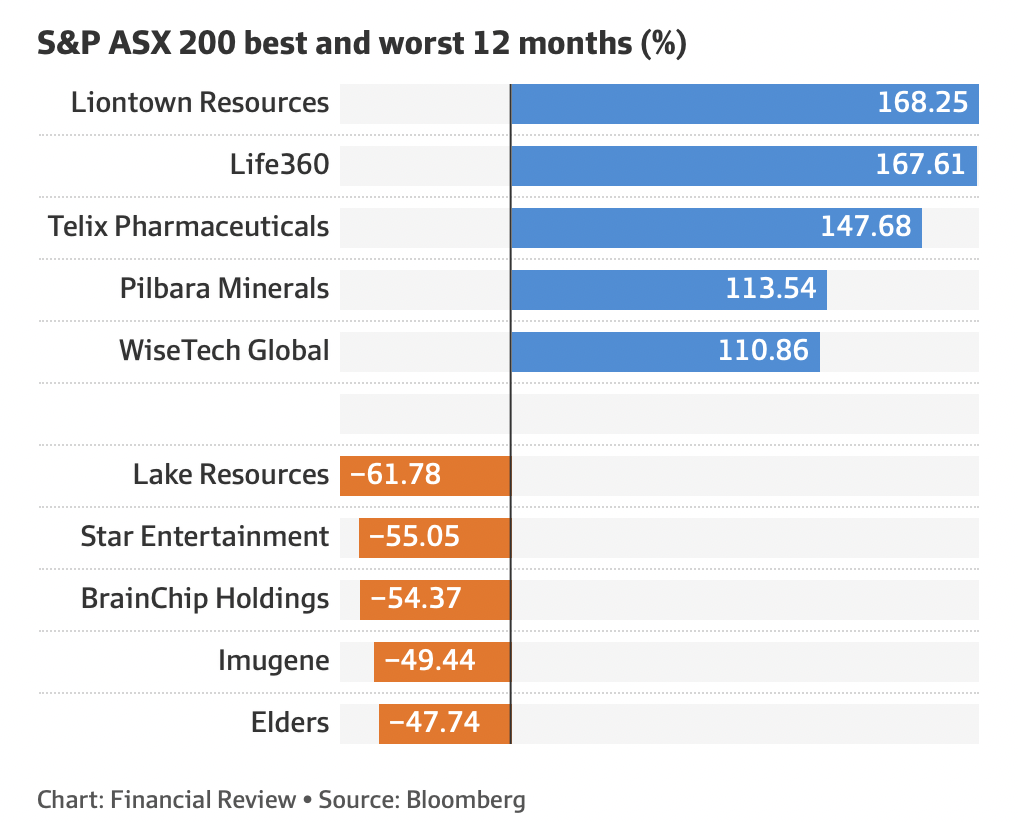

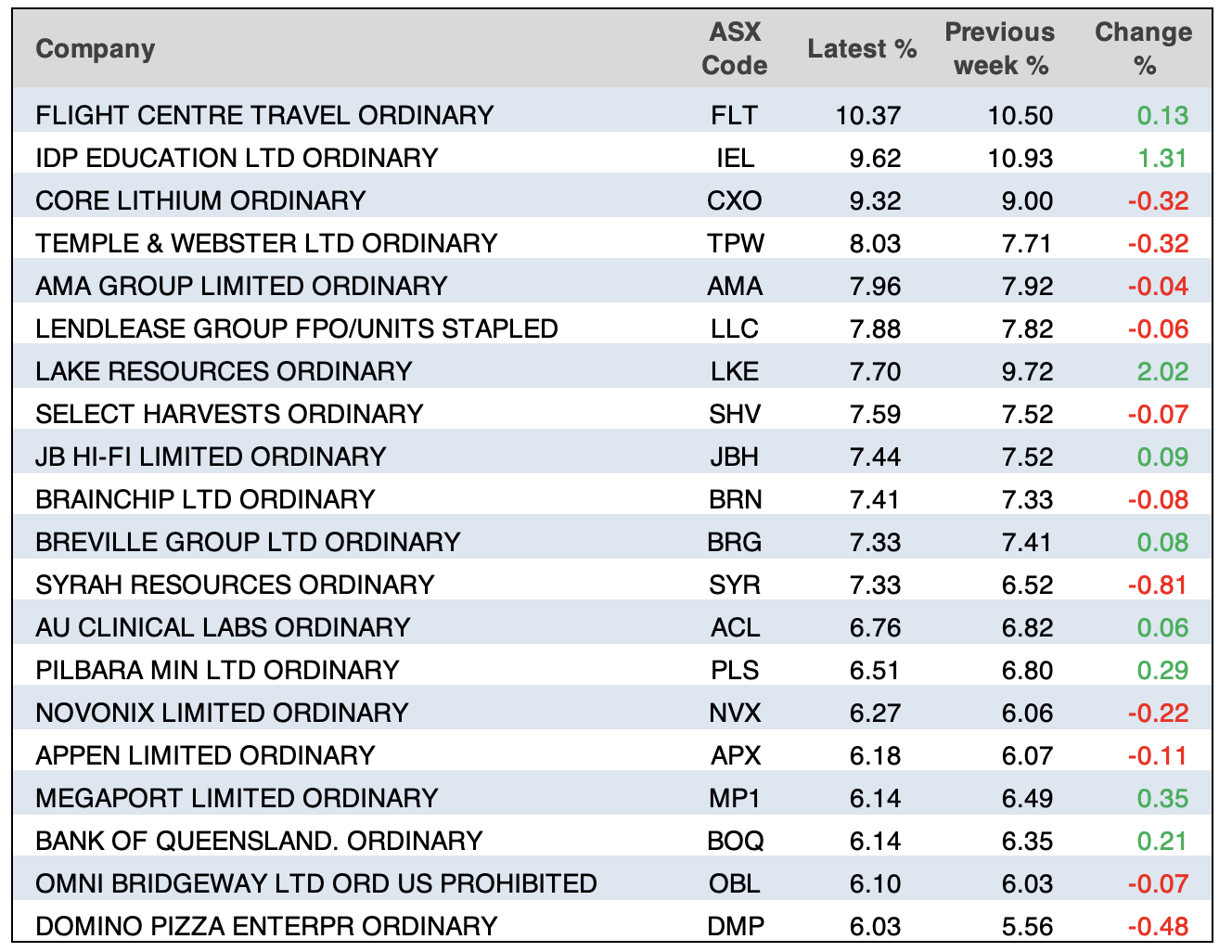

Here are the big winners and losers for the year. Remember this are financial year figures:

An interesting take on the market for the year comes from Morningstar’s head of equity research Peter Warnes, who told the AFR that “…banks and material stocks, which account for about 50 per cent of the ASX 200, have traded sideways – they haven’t gone ballistic.” By the way, the financial sector finished up 7.8% for the year, with materials up 14.9%. BHP (which accounts for almost 11% of the ASX) rose 9.1%.

What I liked

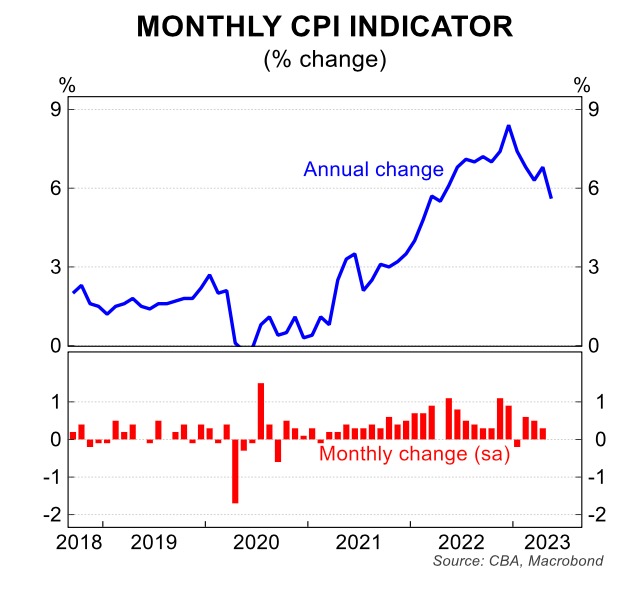

- Australia’s monthly CPI Indicator fell to 5.6% year-on-year in May.

- Shane Oliver’s take on our inflation. “The downtrend in the monthly Inflation Indicator provides some confidence that Australia’s inflation profile is following that of Canada (where inflation has fallen to 3.4% year-on-year).”

- Comments from the Treasurer that the Budget surplus for 2022-23 will be significantly higher ($19 billion) than the $4.2 billion projected in May. Compared to a deficit of $99 billion projected in December 2021, this is good news for those fearing a local recession.

- Job vacancies fell 2% over the three months to May, making their fourth consecutive quarterly decline, which is a plus for falling inflation.

- Credit growth slowed a bit in May reflecting slower growth in business credit and a slight slowing in housing credit growth going to investors. These are more pluses for the fight against inflation.

- That PCE deflator reading that says US inflation is falling nicely.

- Anyone fearing a US recession should note this week’s data that showed consumer confidence, durable goods orders, home prices and new home sales all rising by more than expected.

- In the US, the March quarter GDP growth was revised up to 2% annualised from 1.3%, reflecting stronger consumer services and net exports.

What I didn’t like

- Australian retail sales rose a stronger-than-expected 0.7% in May. While this could make the RBA raise the cash rate next week, the ABS notes that the retail rise looks like it’s due to an earlier-than-normal end of financial year discounting. This has to be good for inflation.

- Central bank leaders continued to warn of more rate hikes aheadat the ECB’s forum in Sintra, Portugal during the week.

- Consistent with the fall back in Eurozone business conditions, PMIs and economic confidence fell in June, as did the German IFO business climate index.

- Chinese business conditions PMIs slowed a bit further in Junewith thecomposite falling to 52.3 as services slowed, albeit to a still solid level. Manufacturing remains soft though, with the PMIs suggesting that China’s recovery may be continuing to disappoint.

The S&P 500 surge is broadening

On Friday, CNBC told us: “Almost 40% of S&P 500′s new 52-week highs on Friday are industrial stocks”. This is a good sign that companies other than technical businesses are now joining the market recovery. The breakdown of the sectors that had companies making new one-year highs were financials (18%), technology (15%), health care (13%), consumer discretionary (7%), materials (6%) and staples (2%). We’re bound to see similar trends here as well, as we do play follow the leader when it comes to stocks.

The Week in Review

Switzer TV

- Switzer Investing Should you sell these disappointing stocks before June 30? [1]

- Boom Doom Zoom: JUNE 29 2023 [2]

Switzer Report

- Powerful predictions for positivity on stocks [3]

- 3 global healthcare funds [4]

- “HOT” stock: Charter Hall (CHC) [5]

- Questions of the Week [6]

- HOT stock: Mineral Resources Ltd (MIN) [7]

- Is ASX a buy? [8]

- 3 ‘excellent’ micro-caps [9]

- Buy, Hold, Sell — What the Brokers Say [10]

Switzer Daily

- Read this – there are financial changes ahead! [11]

- Inflation drops and the RBA should stop rate rises [12]

- Yes, we have a bigger Budget Surplus! But is a recession looming? [13]

- Should Dr Phil go? Could a dark horse get up and take his job? [14]

- Why has a $300 million PwC business relationship been sold for $1? [15]

Top Stocks — how they fared.

Chart of the Week

Inflation is falling with the annual rate now at 5.6% after the annual rate in May was 6.8%.

When the mortgage cliff kicks in inflation will tumble but Tuesday’s rates decision will show if the RBA agrees.

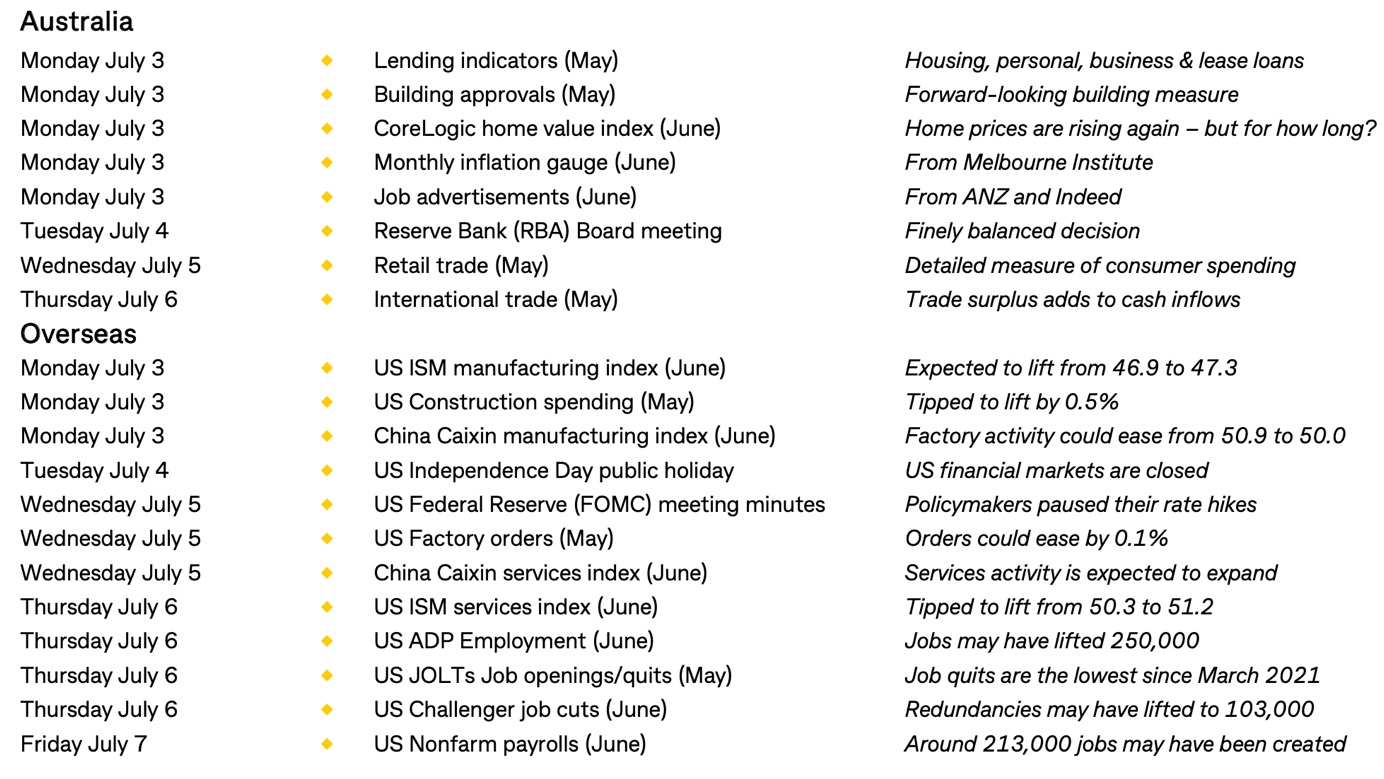

The Week Ahead

Stocks Shorted

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before

Quote of the Week

I’ve talked about central bank bosses acting like a Mafia carel when it comes to their inflation-fighting narratives, and this is what Jerome Powell said on a panel with other central bank leaders: “We believe there’s more restriction coming…What’s really driving it … is a very strong labor market.”

( History has shown that these guys overtighten and over-loosen and it could be that they are a long way from the real world!)

Disclaimer

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.