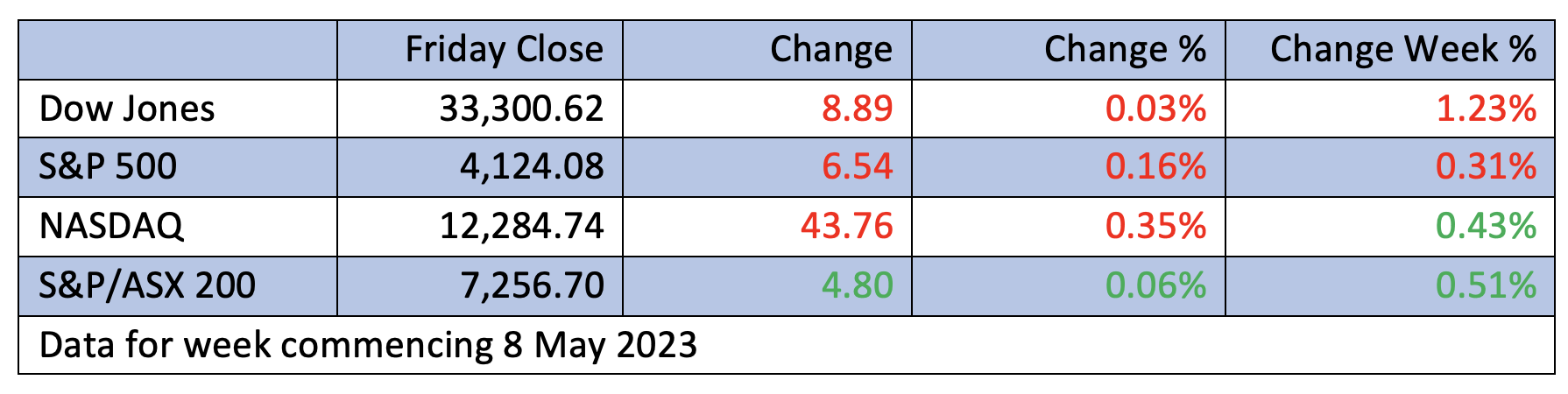

Wall Street ended in the red for the second week in a row, but let’s face it, this is May, a month when plenty of people sell. However, the data drops are improving, pushing the Fed closer to stopping its aggressive interest rate policy.

Against the market-appealing idea of no more rate rises are the headwinds of the US debt-ceiling drama set to play out in Washington, lingering US regional bank concerns and the fear that possibly the Fed has gone too hard, increasing the chances of a deeper-than-expected recession.

Overnight, a preliminary reading on the University of Michigan’s consumer sentiment index dropped to a six-month low of 57.7, which was a lot lower than the 63 consensus guess by economists polled in a Dow Jones survey. Even before this, the bond market was telling us that it expects, wait for it, four rate cuts by year’s end!

Of course, that could be wrong, but it does show you the diversity of views from informed players. And it followed a good week of data for inflation worriers, with inflation dropping to 4.9% in the US, which was lower than expectations. Then the PPI grew by a low 0.2% in April. This means business inflation was up 2.3% for the year to April compared to March’s 2.7%.

On top of that, weekly jobless claims jumped to 264,000, the highest reading since 30 October 2021, which led Quincy Krosby, chief global strategist at LPL Financial, to tell CNBC that “…this morning’s PPI release indicates that prices are inching lower, a significant indicator for a market concerned about an elevated trend in prices paid.”

He then added: “The higher-than-expected initial unemployment claims release similarly is market friendly as the resilient labor landscape, underpinning higher wages, is showing signs of easing.”

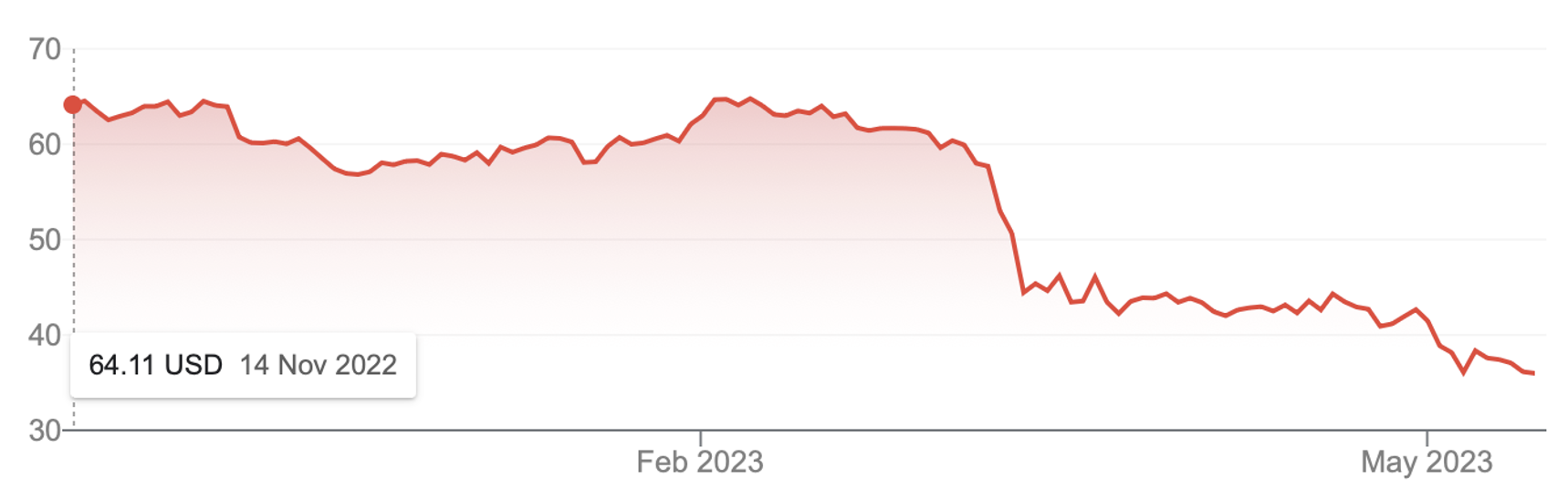

As I argued, the data drops look positive for believing the Fed is close to the top of its rate-rising cycle, but let’s look at the headwinds, starting with bank concerns. This chart of the US regional banks ETF — KRE — shows how these concerns are still live.

SPDR S&P Regional Banking ETF (KRE)

That’s a six-month fall of 43%. In the past month, the drop has been 16.4%. This week the loss was 8.3%, showing that concerns persist. The overnight negativity was partly blamed on the question marks over US regional banks.

Meanwhile, as news.com.au explained: “The [US] nation is running out of cash – fast – and tense negotiations are currently underway in Congress regarding the US debt ceiling, which currently sits at $US31.4 trillion ($A46.8 trillion). Democrats want it to be raised immediately, while Republicans are pushing for a range of conditions such as spending cuts to be met before agreeing to lift the self-imposed borrowing cap.”

If politicians don’t reach an agreement and the US Government defaults on its bond payments, stocks will hurtle lower, just like in 2013. Comerica Bank’s chief economist Bill Adams put it all into context for us market players. He cited the National Federation of Independent Business’s Small Business Optimism Index, which fell to a 10-year low in April. “Not coincidentally, the last time small business sentiment was this weak was when the federal government went over the fiscal cliff in early 2013.”

He then put a bond default into context. “Bonds issued by the Treasury are a basic building block of the American financial system. Nobody can predict what happens if those blocks all crack at the same time,” Adams said. “In Washington’s past fiscal games of chicken, sentiment recovered within a few months of the crises ending. On the other hand, if the government defaults, it won’t be pretty.” (CNBC)

That’s a decent headwind, which when mixed in with “sell in May and go away” historical actions, underlines the importance of this debt ceiling debate. On the flipside, if a debt agreement is reached and the Fed gives up on rate rises soon, it sets us up for that stock market rebound I’ve often talked about.

And if the above optimistic option shows up and this is added to the latest US reporting season, which shows that for the 91% of S&P500 companies that have reported first quarter earnings, some 77% have delivered a positive earnings surprise! This is above the long-run average and better than the December quarter earnings season, which shows a recovery in earnings at a time when all the headwindsprevailed, on top of a slowing economy.

The next quarter earnings are likely to be lower but if the debt ceiling problem is overcome and the Fed pulls up stumps on rate rises, stock market players will cheer.

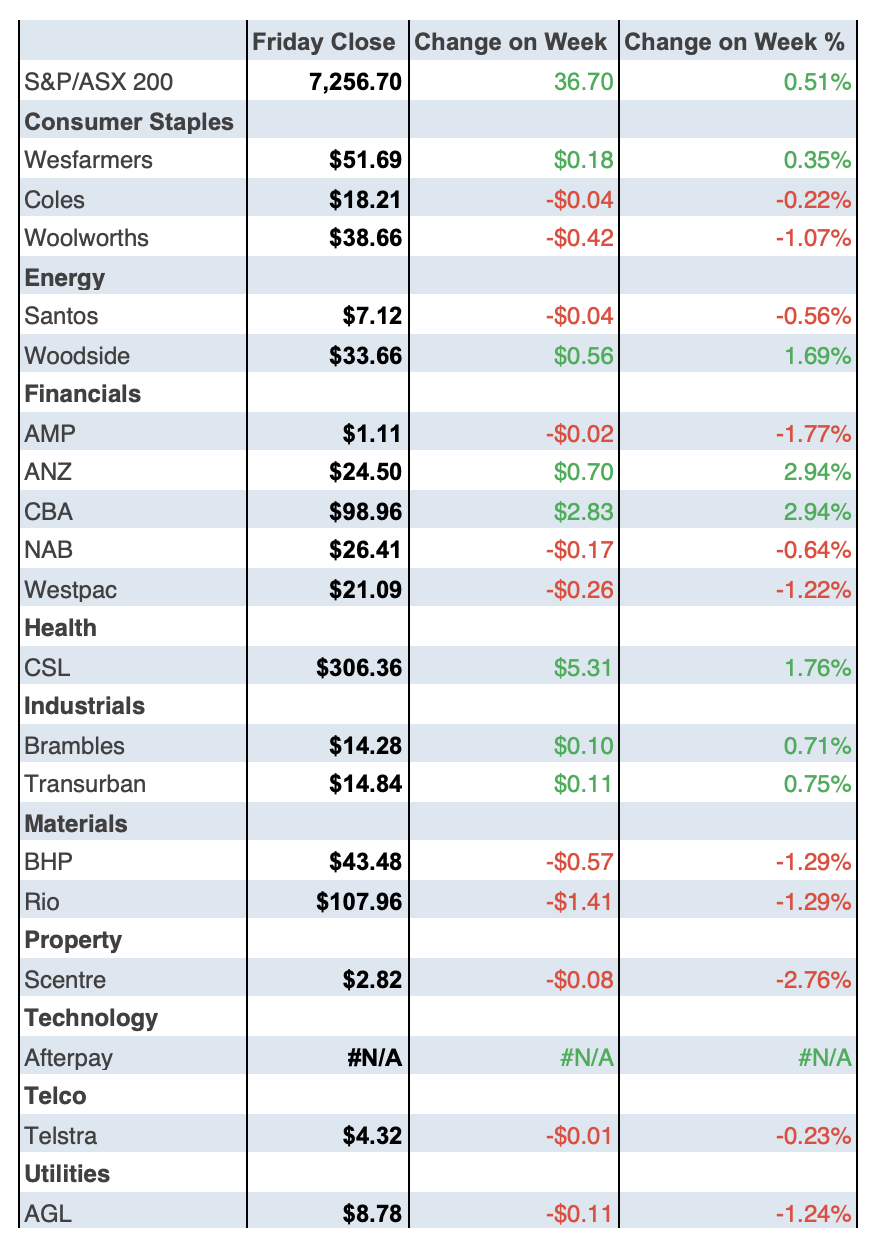

To the local story and the S&P/ASX 200 put on 0.51% for the five days trading, to end the week at 7256.70. It’s now up 4.47% year-to-date.

Miners didn’t help, as the AFR’s Cecile LeFort explained: “Mining giants extended losses as iron ore prices fell on worries that China’s post-pandemic economic recovery was losing steam. BHP Group fell 1.2 per cent to $43.48, and Rio Tinto slipped 1 per cent to $107.96, followed by Fortescue Metals Group down 0.6 per cent to $20.10.”

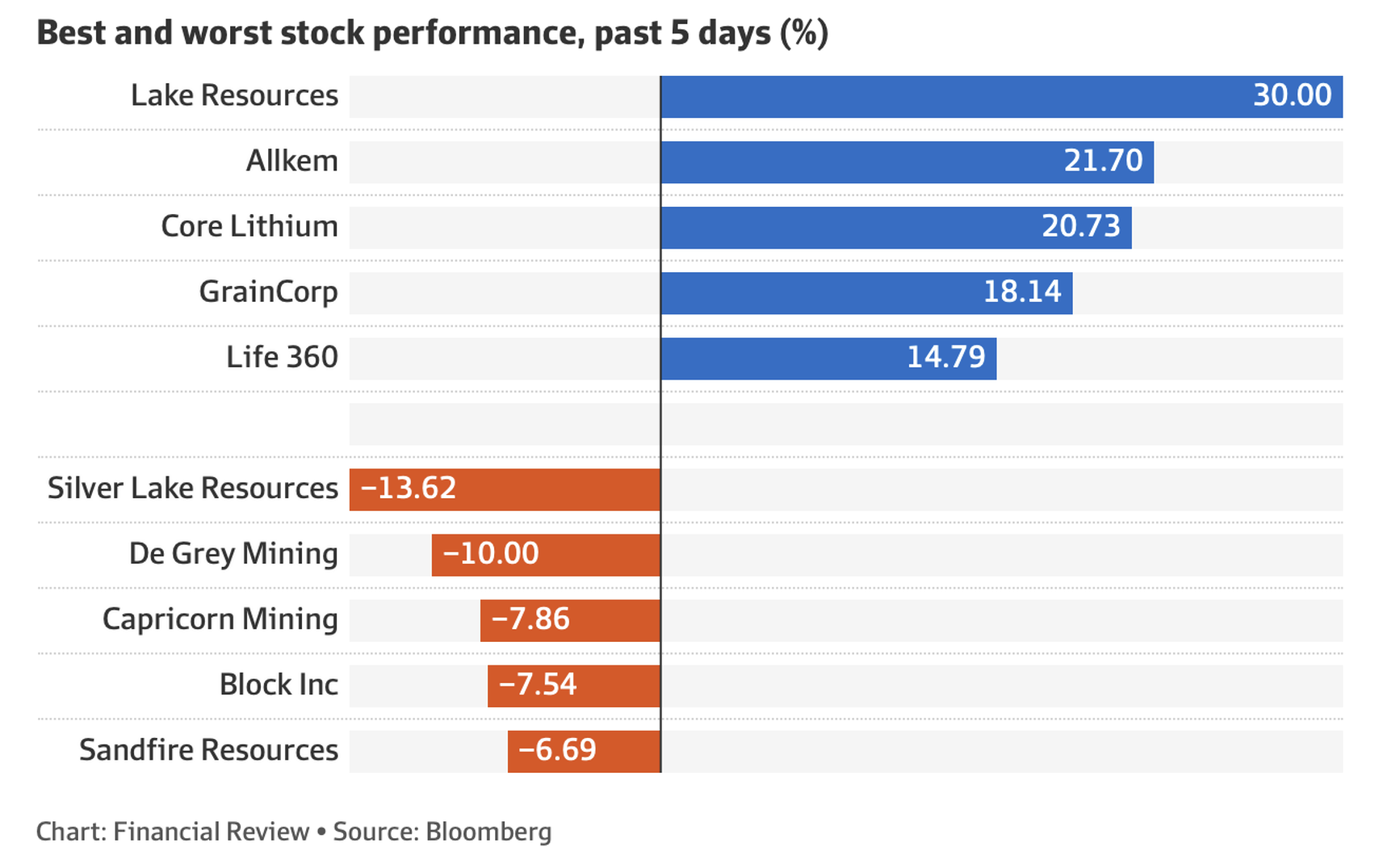

Lithium stocks got a boost when US company Livent and Allkem revealed their $15.7 billion merger.

Healthcare is winning friends with CSL up 2.12% for the week to $306.36 and Ramsay 1.62% higher to $60.99. Meanwhile Resmed gained 2.54% to $35.18.

Here are the big winners and losers for the week:

What liked

- The Budget was expansionary but I agree with Bill Evans that it won’t affect the RBA’s rate rises. Data has to show that 11 rate rises are beating down inflation and I think it will very soon.

- The Budget forecast that inflation will be 3.25% next year, which says expect rate cuts, is all good news for stocks.

- No recession tipped in the Budget, with GDP growth at 1.5% next financial year and then 2.25% in 2024-25.

- Unemployment peaks at 4.5% in 2024-25 — I hope that’s right!

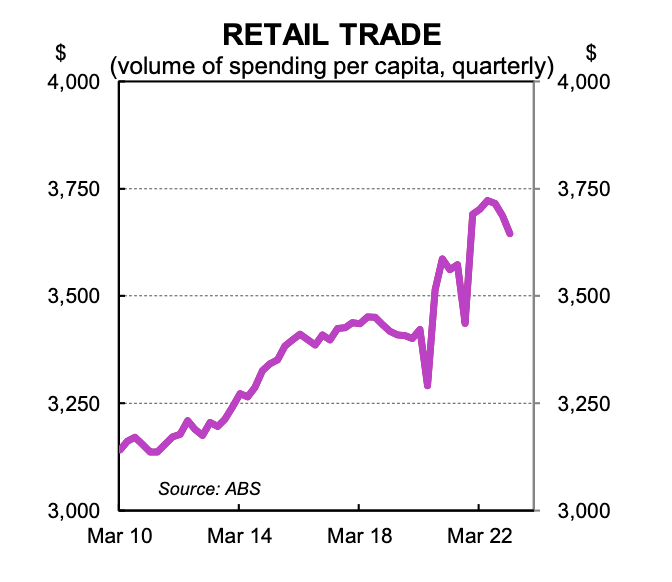

- Retail trade volumes fell by 0.6% in the March quarter 2023. This is a measured fall that will help bring down inflation.

- US CPI came in at 0.4% for April taking the annual inflation reading to 4.9%.

- AMP’s Diana Mousina says: “US producer prices are in a firm downswing, with prices up by only 0.2% over the month or 2.3% over the year, well down from its high of 11.7% in early 2022, which should filter through into consumer prices in coming months.”

- Financial markets are pricing in around four interest rate cuts from the Fed by January next year, which would be great for stocks.

What I didn’t like

- The super cap of $3 million after which tax on earnings over this level goes from 15% to 30%. And it’s not indexed!

- US debt ceiling talk, with J.P.Morgan’s CEO Jamie Dimon predicting market chaos if US sovereign debt is downgraded because politicians can’t fix the debt problem.

- The US April Senior Loan Officers surveyshowed some further deterioration in lending standards, especially for commercial real estate and commercial and industrial loans (see the chart below) compared to January.

- The UK’s Bank of England met this weekand hiked interest rates by 0.25%, as expected, taking interest rates to 4.5%. These guys could be over-tightening.

Is the Budget inflationary?

Some economists and Government critics suggest the Budget will add to inflation. It could, but it also could end up being a buffer for when the past 11 interest rate rises and the mortgage cliff comes to haunt local consumers with home loans. I agree with Westpac’s Bill Evans who wrote this in the AFR this week: “In contrast, Westpac assesses that in the May budget the government is underestimating the likely weakness of the real economy in the key 2023-24 fiscal year. We expect that consumption growth will slow to only 0.7 per cent, with GDP growth at a sluggish 0.9 per cent. That compares with the government’s forecast of 1.5 per cent growth in consumption and GDP.”

The Week in Review

Switzer Investing TV

- Top fund manager likes Xero, CSL, Ramsay, Sonic, Rio and Macquarie but cuts Medibank. Find out why! [1]

- Boom Doom Zoom: 11th May 2023 [2]

The Report:

- Skies start to brighten for NZ airline-related stocks [3]

- “HOT” stock – BHP [4]

- “HOT” stock – Macquarie Bank (MQG) [5]

- It’s sell in May time! What am I dumping? [6]

- Macquarie delivers – again! [7]

- 4 interesting mining contractors [8]

- Buy, Hold, Sell — What the Brokers Say [9]

Switzer Daily

-

Rate rises force desperate Aussies to rifle their super [10]

-

If times are so bad, where has the Budget Surplus come from? [13]

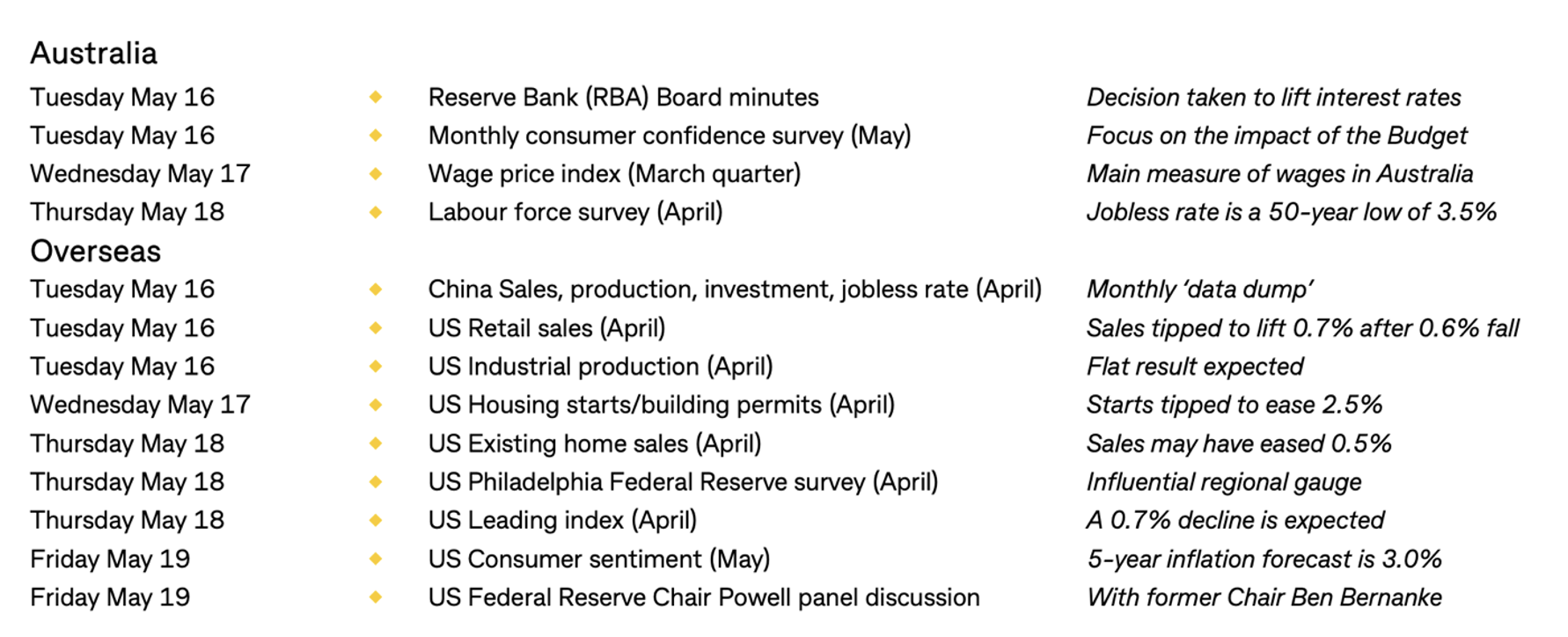

The week ahead

Top Stocks – how they fared

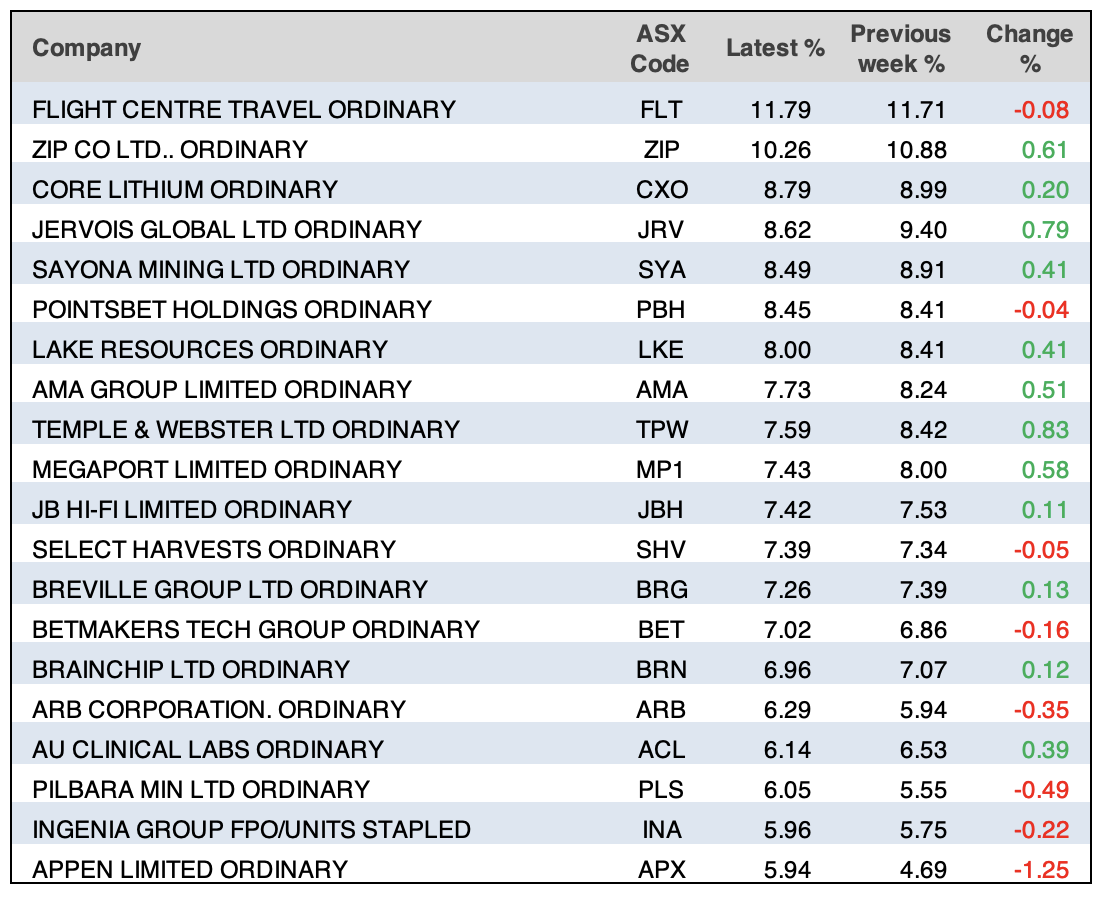

Stocks shorted

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Quote of the week

Buffett’s mate, Charlie Munger said this: “We’re interested in owning a wonderful business forever. … We do learn a lot as we go along. … We’re learning all the time how consumers behave. I’m not going to be able to learn the technical aspects of businesses. It’d be nice if I knew it, but it isn’t essential. … We’ve got a business at Apple … I don’t understand the phone at all, but I do understand consumer behavior. … We’re learning all the time, from all of our businesses. … We don’t get smarter over time, we … get a little wiser, though, following it over time.”

Chart of the week

“The [retail] slowdown has intensified in late 2022 and now into 2023. With another rate hike delivered at the May RBA Board meeting, and large cohorts of fixed rate debt due to rollover from April, demand will only weaken further from here. The slowdown in demand though, in conjunction with dissipating global supply chain disruptions will help slow growth in retail prices further and contribute to inflation moving back towards the RBA’s target band.” (CBA Economics team.)

Disclaimer

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.