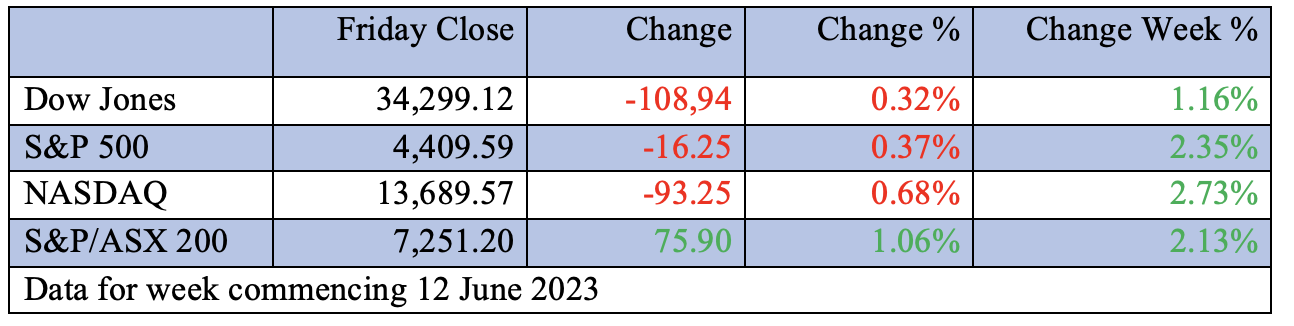

It’s been another positive week for stocks in the US and here, with the US Federal Reserve helping stock prices through a pause on its aggressive interest rate rise policy and leaving a message that they could be done with monetary tightening. While this expectation is at odds with what Fed boss Jerome Powell said, the course of economic data drops is helping bulls believe that rate hikes could be over, or at least near the top.

To be clear, Powell indicated two more rises were on the cards this year. However, if economists and experienced market participants know if the economic numbers say ‘no more hikes’ are necessary, then the Fed will keep pausing on rate rises, which could mean the tightening process will be over.

You’ll recall that ‘rate rises near the top’ has been a beating-of-the-drum call that I’ve been making since late last year. And the recent flow of economic readings is helping market players believe that buying stocks now makes perfect sense. For example, the US Consumer Price Index (CPI) rose by 4% year-on-year in May, making it the lowest level since March 2021. Also, from the University of Michigan Survey of Consumers, one-year inflation expectations fell to 3.3% from 4.2% in May.

Meanwhile, initial jobless claims rose to 262,000 in the past week, maintaining the same pace from the previous week, but this was above expectations of 245,000 and suggests that the labour market is slowing under the weight of the aggressive rate hikes to date.

Another tailwind, especially helping tech stocks, has been the enthusiasm for the prospects of companies that will gain from artificial intelligence (AI). “Wall Street remains upbeat that the AI wave won’t be going away any time soon and that investors will prefer US stocks as we see diverging central bank policies worldwide,” senior market analyst at Oanda, Ed Moya, told CNBC. “This stock market rally seems a bit overextended but too much money remains on the sidelines, which means if the AI trade remains intact, this winning streak for the S&P 500 can continue…”.

Also helping positivity for stocks are the new expectations that the US recession isn’t likely to occur until later in 2024, which was once seen as more likely to show up this year. China gave us another positive uplift with announcements of monetary stimulus via interest rate cuts this week. This helped lift commodities, with copper, iron ore, nickel and steel up over the week, and this lifted the Australian dollar to just under 69 US cents.

Importantly, this move higher for stocks is a global phenomenon, with Japanese shares at levels not seen since 1989. European stocks rose overnight, despite the ECB raising rates by 0.25% and Bank President Christine Lagarde not softening on her anti-inflation stance saying: “We are not thinking about pausing.”

While this current optimism is welcomed, I wouldn’t be surprised to see some profit-taking over the next few months, and so does the AMP economics team.

“The next 12 months are likely to see easing inflation pressures and central banks moving to get off the brakes,” wrote economist Diana Mousina. “This along with improved valuations should make for reasonable share market returns, but the next few months are likely to be rough given high recession and earnings risks, uncertainty around US banks, the potential of unexpected rate rises and poor seasonality out to around September/October. This is likely to impact both global and Australian shares.”

If share prices do pullback, possibly because central banks play ‘too hard ball’ on rates compared to what markets are thinking right now, I’ll call this a buying opportunity, though I don’t think that would surprise many of you.

To the local story and despite that jobs report that saw unemployment fall from 3.7% to 3.6% (that raised expectations that the RBA will keep raising rates, thereby risking creating a recession), the S&P/ASX 200 went up a solid 2.1% and racked up five up-days on a trot. Clearly, we can thank Wall Street’s positivity for that tailwind for stock prices.

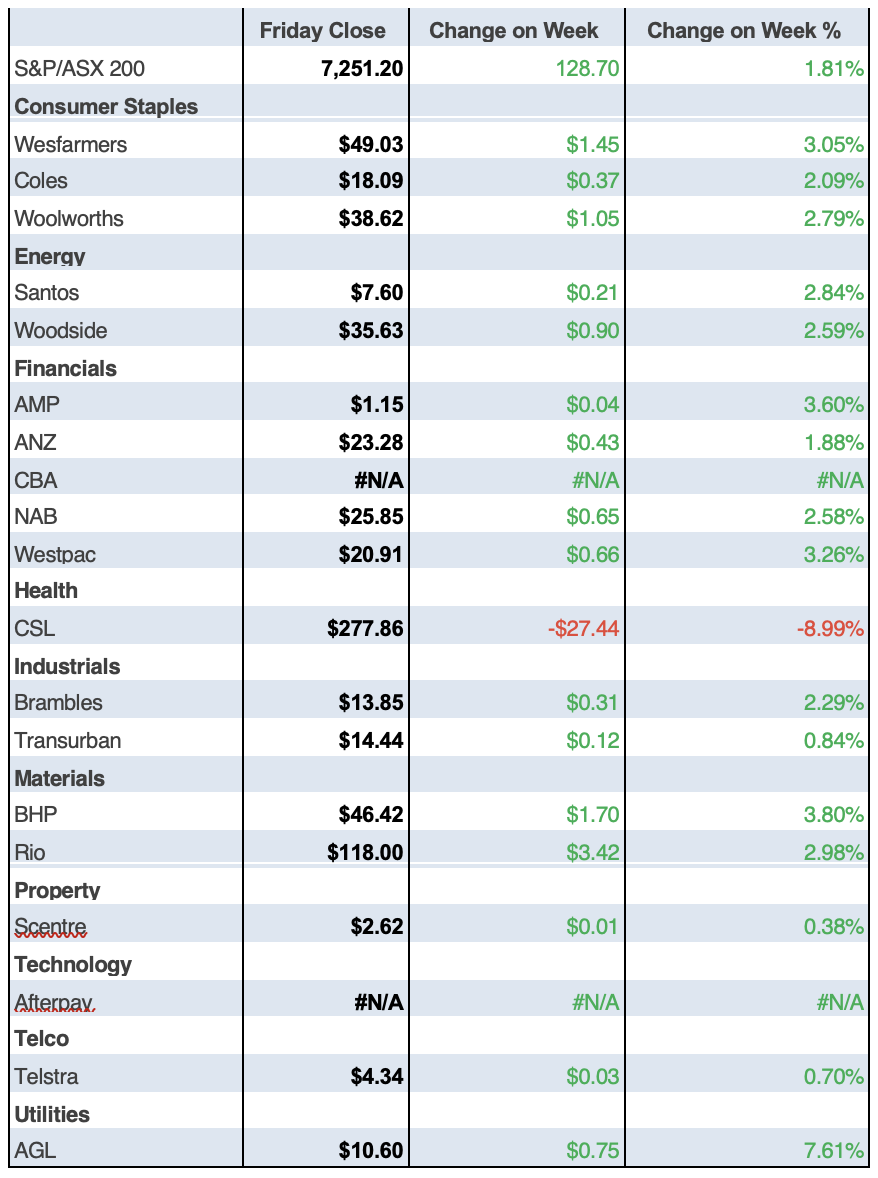

A big help was AGL’s surprisingly positive profit outlook, which saw its share price spike 9.73% on Friday and 7.4% for the week to finish at $10.60.

“The energy sector jumped 3.5 per cent after crude oil approached $US71 a barrel overnight on optimism of strengthening demand in China,” the AFR reported on Friday. “Woodside Energy gained 3.5 per cent to $35.63, Santos rose 4.1 per cent to $7.60 and Whitehaven Coal was 8.3 per cent higher to $6.94.”

The China rate cut news helped the miners, with BHP up 4.1% for the week to $46.42, while Rio added 3.1% to $118 and the big reactor — Fortescue — spiking 9% to $22.51.

Allkem shares rose 1.8% to $15.88 but its gain was dwarfed by Liontown’s 14.55% increase to $3.15. For the year, Liontown is up a whopping 205%!

Tech also had a good week, thanks to the favourable winds blowing out of Wall Street, which is tech-obsessed right now. Xero was up 9.5% to $116.72, with Citi noting that its recent price rises to customers will be a big plus for revenue per user numbers. That reliable tech company Wisetech put on 7.14% this week, Next DC put on 5.47% and Megaport gained 4.76%.

Big disappointment of the week was CSL, which dropped 9% for the week to $277.86, but brokers remain believers in what is seen as Australia’s premier, global company. The price drop followed the company lowering profit guidance and citing currency issues affecting their bottom line.

What I liked

- The US Consumer Price Index (CPI) increased by 0.1% over the month of May, to be 4% higher through the year. This was the smallest annual increase since March 2021. The outcome represents a deceleration from the 0.4% monthly, and 4.9% annual, increase recorded in April.

- Local consumer sentiment was broadly unchanged at 79.2 points but it’s at an historically low level consistent with major economic dislocations. I hope the RBA recognises this!

- Business confidence fell by 4 points to minus 4 to be now well below the long-term average, which is another economic development the RBA shouldn’t ignore (only bad news will stop the RBA from raising rates, which is why I’m forced to like this news!).

- The rise in the Aussie dollar, as it says that smarties see a better global economy that helps our currency rise.

- The US Fed rate pause — good sense has prevailed, even if it’s only temporary.

- The University of Michigan Survey of Consumersrevealed confidence was up to 63.9 from May’s 59.2 and was higher than the economists’ guesses of 60.2. This reinforces the view that the US could dodge a 2023 recession.

- US retail sales data for Maywas up by 0.3%, while the consensus was looking for a decline.

What I didn’t like

- Those local job numbers, with unemployment falling from 3.7% to 3.6%. This will make the RBA think more rate rises are needed.

- This from AMP economist Diana Mousina: “We think the risk of an Australian recession is very high, at 50% in the next 12 months.”

- The Kiwi economy went into recession, which is no surprise as the central bank there has been more aggressive than Dr Phil and the RBA. Their RBNZ has hiked by 5.25% while our RBA has hiked by 4%.

- As expected, the European Central Bank (ECB) raised rates by 25 basis points, and it delivered hawkish commentary. They worry me that central banks are playing a moronic same game!

- USretail salessurprised to the upside, painting a somewhat mixed picture. Retail sales were 0.3% higher in May, following a 0.4% gain in April.

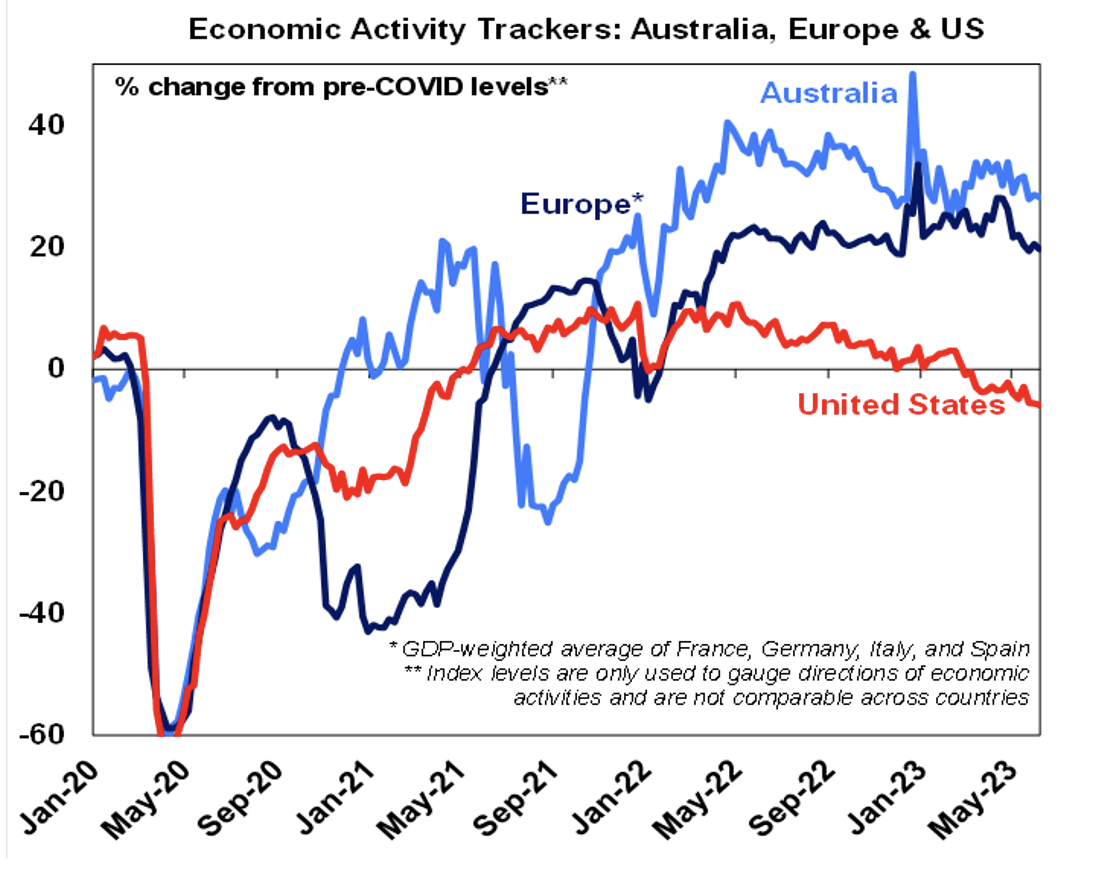

Is economic data telling the RBA to ease up?

This chart below says ‘Yes!’ Have a look at the blue line for Australia’s economic activity and you’ll see it’s falling. The red US line has fallen more and it’s why the Yanks are seeing inflation at 4%. Our time will soon come. I hope Dr Phil believes that too!

The Week in Review

Switzer TV

- Switzer Investing Peter talks with the co-founder of Zip, can its share price rebound? [1]

- Boom Doom Zoom: JUNE 8 2023 [2]

- Switzer Investing: Why does Shaw & Partners think ZIP will rise over 240%? [3]

- Boom! Doom! Zoom! | 15th June 2023 [4]

- No new Switzer Investing thanks to King Charles’ birthday on Monday this week, so here’s last week’s with Zip’s COO, Peter Gray [1]

Switzer Report

- Two office A-REITs to consider [5]

-

Read these 5 ‘super’ actions to take before the end of the financial year! [8]

Switzer Daily

-

Is recession talk or the rise of Artificial Intelligence making workers take refuge in the office? [11]

-

Hollywood darling Jennifer Coolidge & the NSW Government lit up my life! [12]

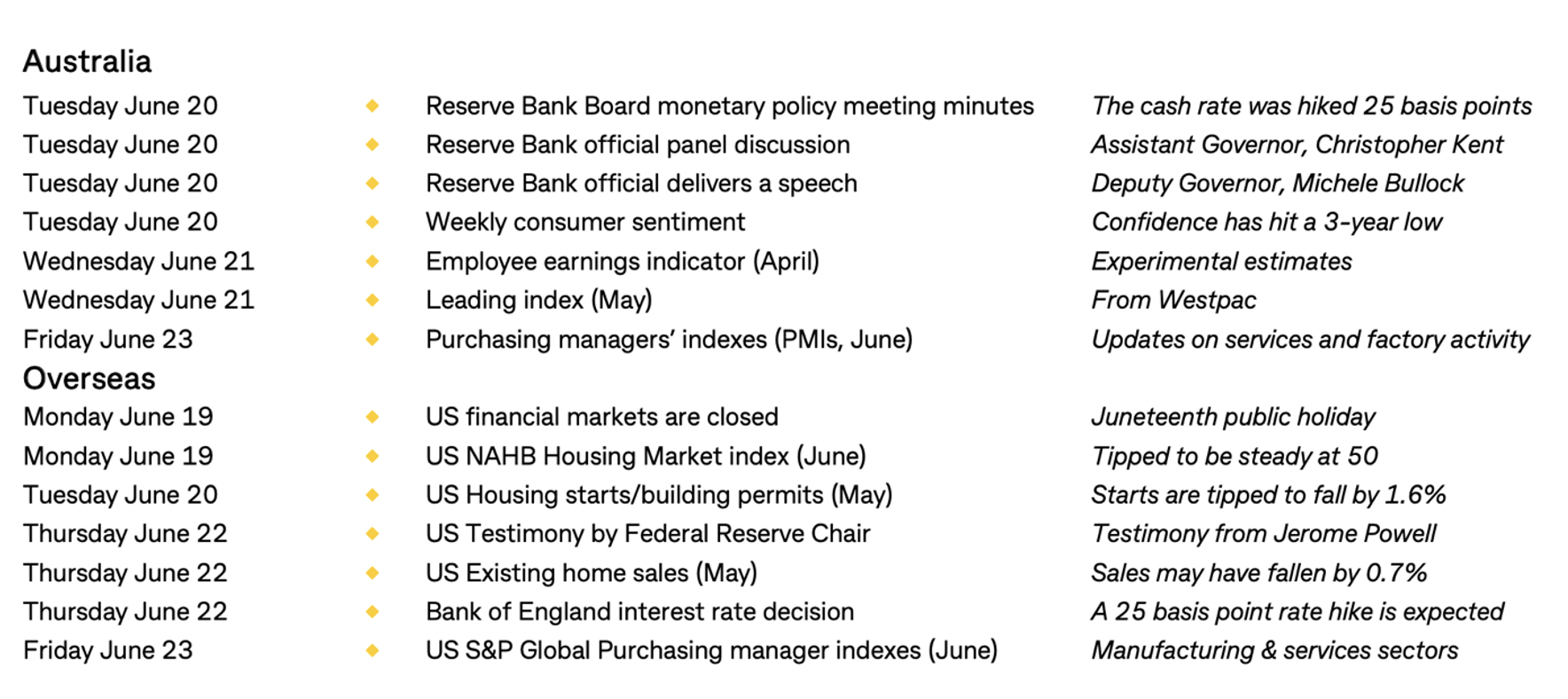

The Week Ahead

Top Stocks — how they fared.

Chart of the Week

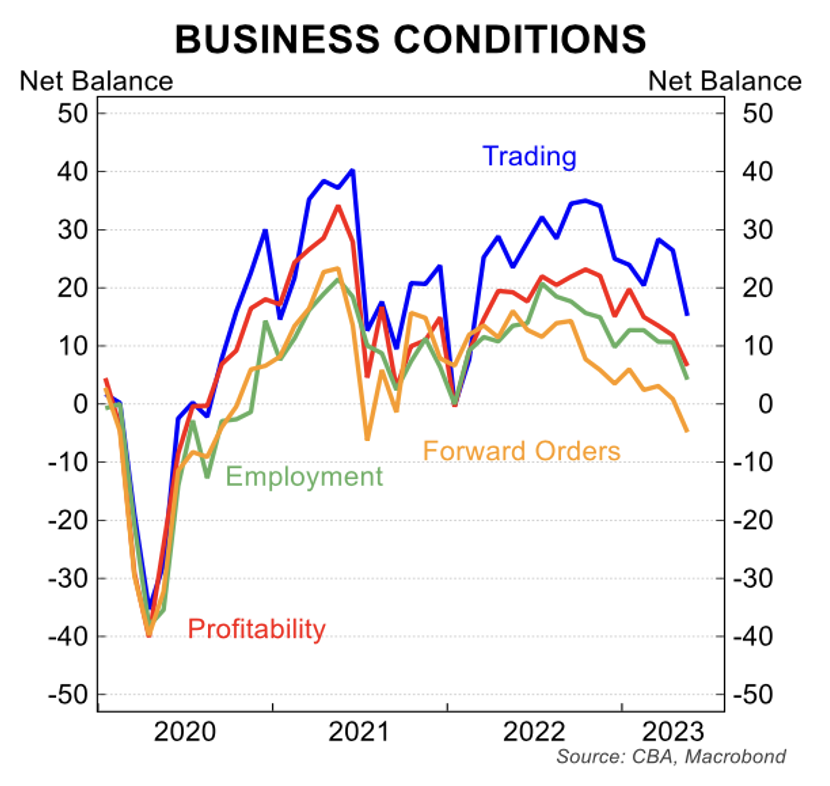

The CBA take on NAB’s Business Conditions reading: “All of the sub-components of the business conditions index fell by a similar magnitude. Trading (down 7pts to 14), profitability (down 5pts to 7) and employment (down 6pts to 4) all registered solid declines. Forward orders, which typically leads other activity components fell 6pts to -4 in the month. This indicates that conditions are likely to continue to soften this year. NAB also noted forward orders were particularly weak in the consumer exposed sectors of retail and wholesale trade.” (I hope the RBA looks at this before raising interest rates again.)

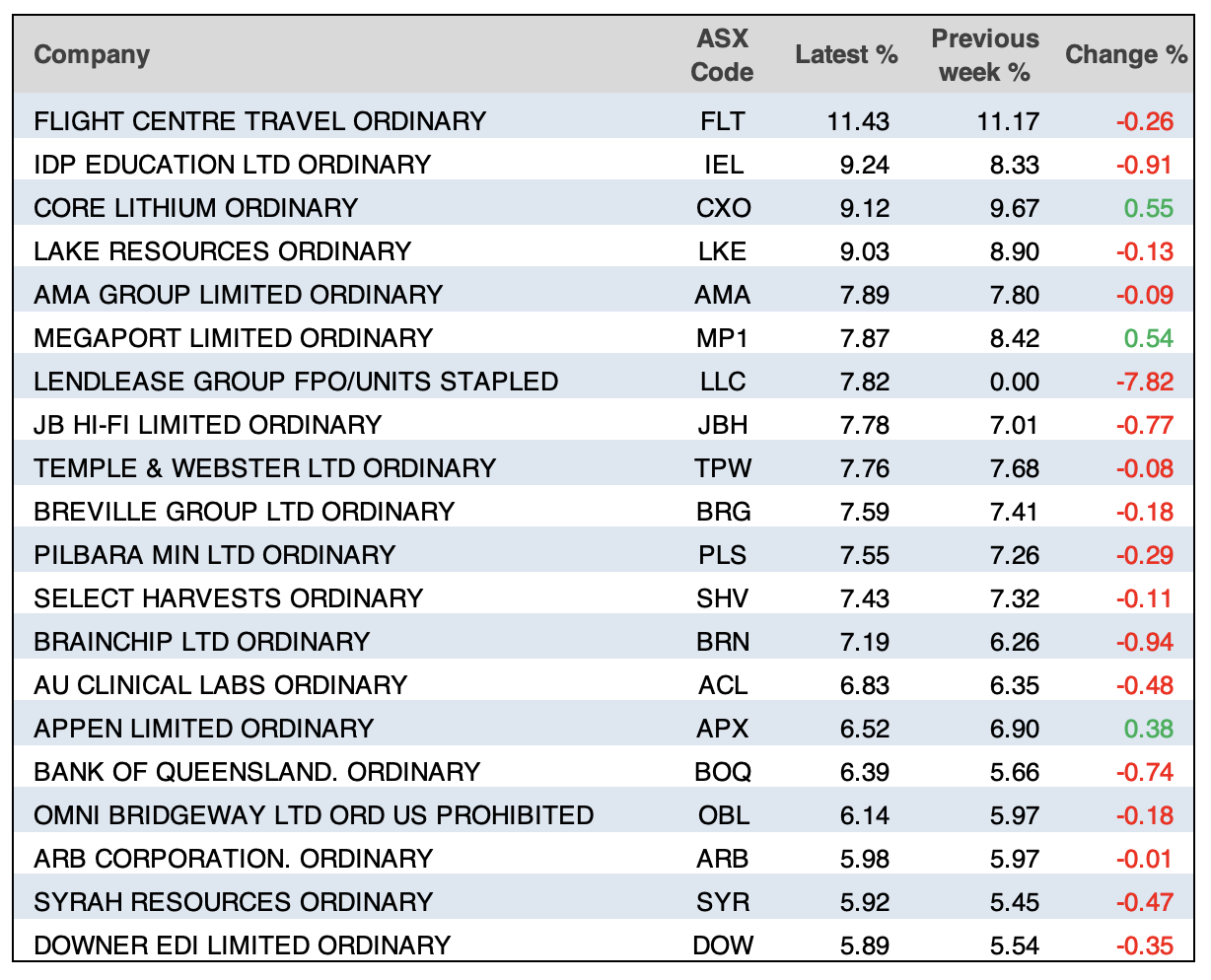

Stocks Shorted

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before

Quote of the Week

While the drop in unemployment made some predict the RBA will increase rates again in July, here’s CBA’s Head of Australian Economics, Gareth Aird on the subject: “The message we take from the data is the labour market is loosening, but not via the traditional mechanism of an increase in the unemployment rate. Rather it is loosening via more workers looking for extra hours. In time the unemployment rate will lift given below-trend economic growth. But it is simply just taking more time than would be expected given the slowdown in the economy.”

Disclaimer

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.