Despite US stock markets and our market index hitting all-time highs, I can’t get out of my head this fact from J.P. Morgan that from 1972 Wall Street has rallied in five of the eight election years with market gains of 12-26%! And it took whopping recessions in 2000 and 2008 for the S&P 500 to produce negative returns!

OK, that’s great for believing that this year should be good for stocks, especially when interest rates start falling later in the year. Also, few economists are seriously predicting a US recession is on the horizon.

Even China is starting to show some better economic recovery signs. However, the Yanks have really partied up on stocks, with the S&P 500 racking up the best first-quarter returns since 2019 i.e. 10.2%, which was clearly before the world was hit by the Coronavirus.

The 30 stock Dow index put on 5.6% for the quarter, while the Nasdaq was up 9.1%. This better showing by the S&P 500 is indicating that my prediction that other stocks would play catch-up this year on the big tech higher achievers of last year (the so-called Magnificent Seven) is starting to happen.

Invesco in the US has an S&P 500 Equal Weighted ETF (RSP) which has been outperforming both the S&P 500 index and the Nasdaq, which is a sign that the other companies in the index, rather than the big seven tech players, are now being looked at by fund managers and pro-investors.

I expect this to be a theme for 2024. And it’s likely to work in 2025, as interest rates fall, and growth-oriented small and mid-cap companies gain popularity. That will be a part of our job to help you get on to these stocks before they go too high.

However, after big gains, we have to be ready for pullbacks, which for the right companies will mean this would be a buying opportunity.

This week, CNBC surveyed investors at its Delivering Alpha Conference, and 61% of respondents expected a market pullback in the near term. But that’s not a convincing result. That said, given the fact that July to August is often problematic for stocks in an election year, the sell-off scenario sometime this year doesn’t look far-fetched.

Interestingly, CNBC also reported that investment group Piper Sandler sees a rising risk of recession in the US, which is a minority view. Despite that, they think stocks will go higher! “We believe stocks will rally on rising recession risks (i.e., softer macro data) — certainly an unusual take!” the investment firm wrote. “We remain constructive with the view that lower rates from softer macro data will set up stocks for another leg higher in the coming quarters.”

So, even if an unexpected recession threatens, the rate cuts would be bigger, and the stock market would love that.

At home, the AFR reported a warning from Perpetual’s head of investment strategy, Matthew Sherwood. He looked at Australian shares topping 7900 points for the first time ever on Thursday, as gold, iron ore and lithium miners advanced amid a rebound in resource prices and suggested that the rising market couldn’t last.

Sherwood isn’t alone holding a negative view on our market, with Citi reckoning our market the most stretched in three years and is “the most at risk of a pullback should investors go negative”. That said, I suspect both Perpetual and Citi are being too negative on China, which, as I’ve said, is starting to show some economic promise.

I can see a pullback for profit-taking reasons, but I’ll be surprised if there’s a dramatic sell-off because I calculate that the tailwinds for stocks outweigh the headwinds this year.

To the local story and the S&P/ASX 200 index finished the week with a nice 77.3 points rise, to be up 1.48% for the week, finishing at a record high of 7896.90.

The table lower in this Report shows how some of our big name stocks performed this week. But for today, I’d like to show what the marketindex.com.au website has produced for a snapshot of some of the big performers over the past month.

Many of these are the smaller cap companies that could be surprise packets in coming months. What you can see is REITs are gaining friends, with Centuria’s COF up 16.1%, Cromwell’s CMW rising 11.5% and Arena’s ARF spiking 11.8%.

What I liked

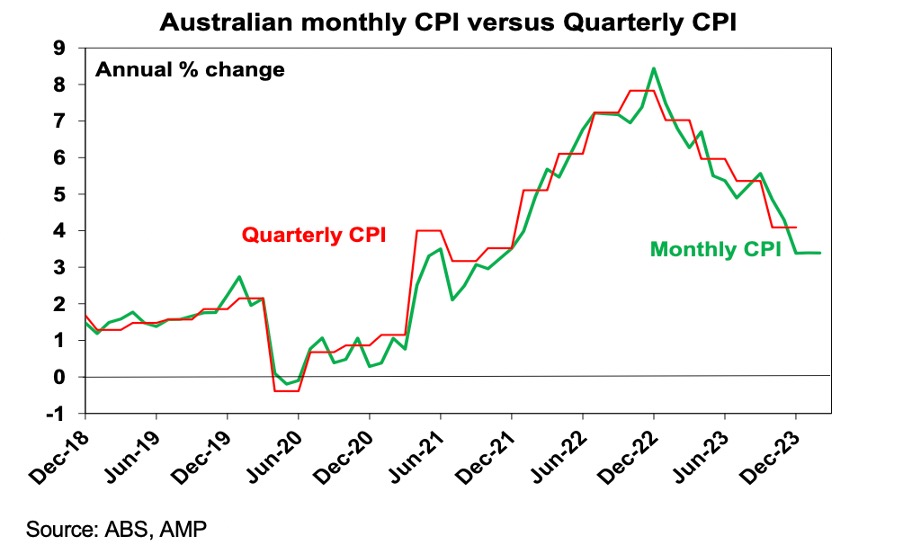

- The local monthly CPI reading, with the annual number of 3.4% less than economists expected.

- Though helped by the Taylor Swift effect, retail sales remain very weak, rising less than expected in February and were are up just 1.6% year-on-year. This might convince the RBA to think about a rate cut in June, as AMP’s Shane Oliver predicts.

- China’s combined industrial profit [1]for January and February climbed 10.2% year-on-year, according to data from the country’s statistics bureau.

- European Central Bank officials sounding dovish and the Swedish central bank flagging possible rate cuts in May or June.

- Durable goods orders in the US rose strongly in February.

- Eurozone economic confidence rose in March helped by gains in business and consumer sentiment but remains softish.

What I didn’t like

- The news unions want a 5% rise in the minimum wage, which won’t help the goal to get inflation into the 2-3% band. This isn’t great for interest rate cut hopes.

- Local consumer confidence fell again, and the RBA should be seeing a weakening economic picture evolving.

- The labour market is continuing to cool – job vacancies fell for the seventh quarter in a row in February — and that’s another negative I hope the RBA is seeing.

I’m banking on new ‘nice guy’ China

It really looks like Xi Jinping is trying to win friends ahead of a possible President Donald Trump. Lifting the wine tariff is just one action intended to remind Australia not to be too cosy with Mr Trump if he wins the White House and resumes his anti-China stance.

Happily, China (and for us as a dependent economy) is seeing some better economic data. I liked this from Damien Boey, an equity strategist at Barrenjoey Capital Partners, who told the AFR that “…the stocks on the resources side had climbed on Thursday because of increased confidence that China, Australia’s biggest buyer of iron ore, was ‘stabilising the ship’.

“This is a better-than-expected outcome for many investors bearish about China.”

This news makes me comfortable with my positive outlook for stocks this year.

Switzer This Week

Switzer Investing TV

- Boom Doom Zoom: [2]Paul Rickard and Michael Gable answer your questions on FMG, STO, DRR & more

- SwitzerTV Investing: [3]What are the best mid-cap stocks according to Jun Bei Liu and Raymond Chan?

Switzer Report

- Long-term opportunity in clean-energy stocks amid market gloom [4]

- “HOT” stock: Fortescue (FMG) [5]

- Questions of the Week [6]

- Does sell in May and go away work in a US presidential year? [7]

- Is Woolworths a buy, yet? [8]

- HOT stock: S32 [9]

- Two listed fund managers in the doldrums but another one’s flying high. [10]

- Buy, Hold, Sell — What the Brokers Say [11]

Switzer Daily

- I’m a bank cheerleader but purely for money reasons [12]

- CBA boss wants a higher GST but no politician supports his call [13]

- Should you be positive about stocks and your super this year? [14]

- Labor gunning for Coles and Woolies. Watch their share prices fall! [15]

- Queensland Libs do well – disaster elsewhere – by Malcolm Mackerras [16]

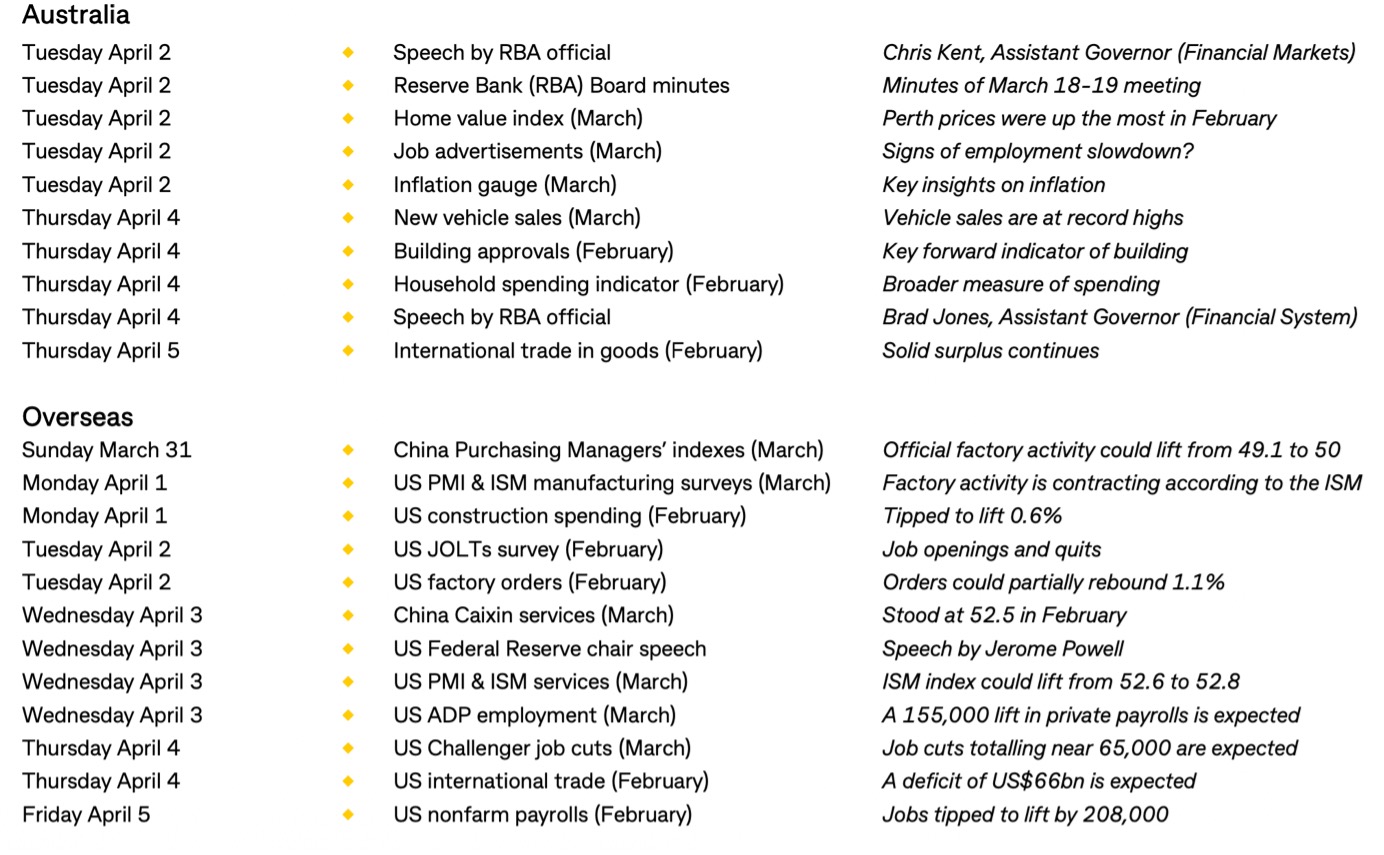

The Week Ahead

Top Stocks — how they fared

Most Shorted Stocks

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before

Quote of the Week

Shane Oliver, AMP Chief Economist: “Australian inflation is continuing to surprise on the downside and is tracking below RBA forecasts. For the fifth month in a row monthly CPI inflation came in weaker than expected in February, with a monthly rise of just 0.2%mom and annual inflation unchanged at 3.4%yoy. Our Australian Pipeline Inflation Indicator continues to point to a further fall ahead and in the September quarter we see inflation falling to just below 3%, 12 months ahead of the RBA’s forecasts.”

Chart of the Week

Disclaimer

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.