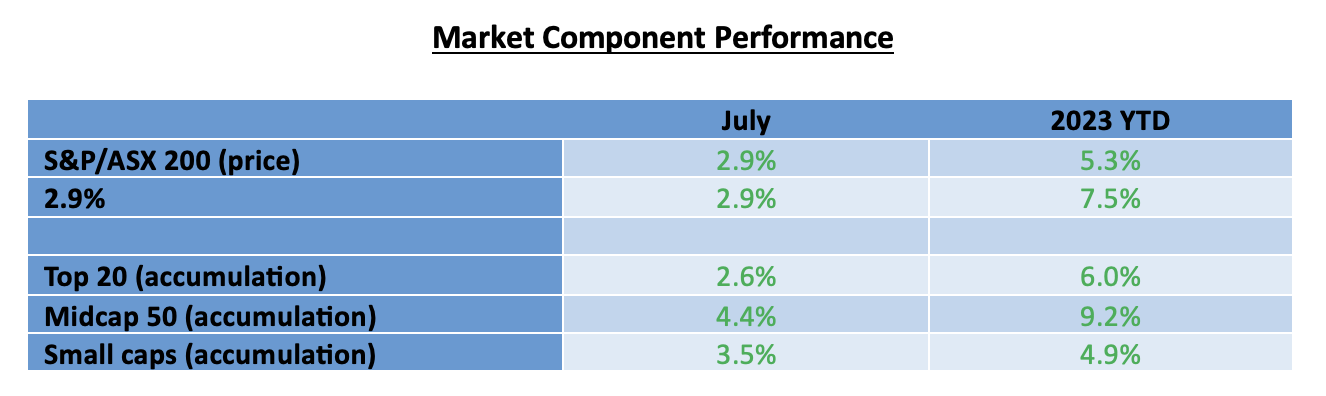

Following the strong lead from the USA, the Australian sharemarket posted a positive return of 2.9% for July as it neared a 12 month high. In the first seven months of calendar 2023, the benchmark index is up by 5.3% or 7.5% when dividends are included.

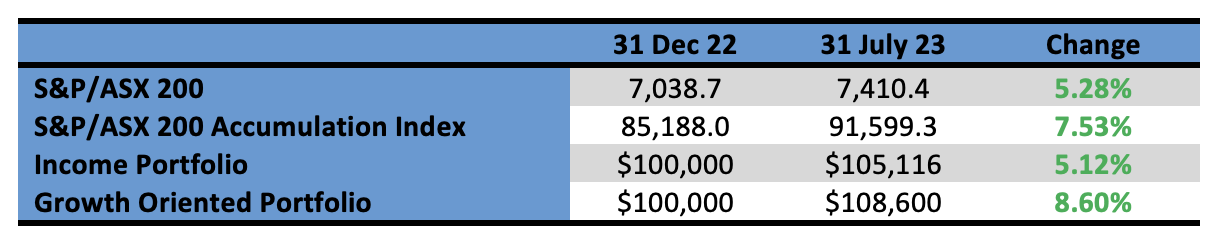

Our model portfolios have also delivered positive returns. The growth portfolio continues to outperform the benchmark index, while the income portfolio, with an overweight position in financial stocks and no exposure to technology stocks, is moderately lagging the benchmark.

There are two model portfolios – an income oriented portfolio and a growth portfolio.

The objectives, methodology, construction rules and underlying economic assumptions can be referenced here: (see: https://switzerreport.com.au/our-portfolios-for-2023/

These are long-only model portfolios, and as such, they are assumed to be fully invested at all times. They are not “actively managed”, although adjustments are made from time to time.

In this article, we look at how they have performed so far in 2023. To do so, we will start by examining how the overall market has fared.

Midcaps, technology and energy stocks lead the market

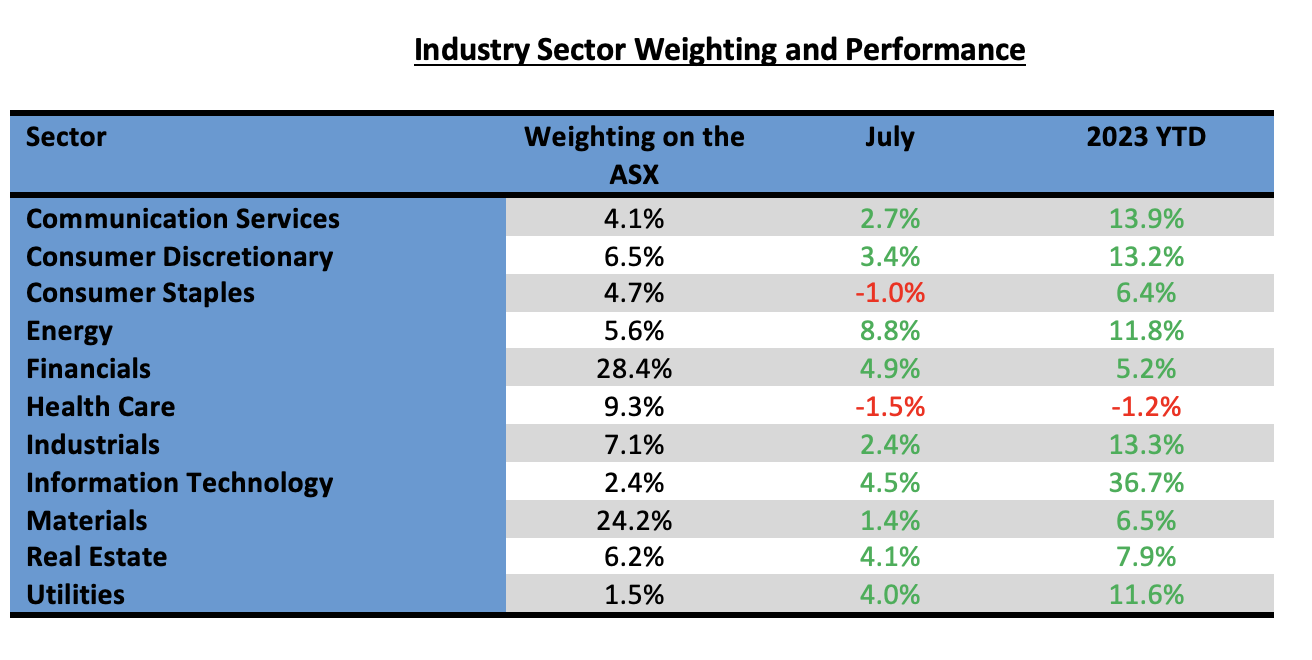

The tables below show the performances in July and for the calendar year of the components and industry sectors that make up the Australian share market.

In July, the midcaps and small caps outperformed the broader market, with the top 20 stocks lagging. The midcap 50 index, which tracks the performance of stocks ranked 51st to 100th by market capitalization size, returned 4.4% in July to outpace the broader market by 1.5%.

With the industry sectors, information technology is the standout sector. Following on the lead from the USA, the sector has posted a gain of 36.7% in 2023 due to the performances of industry leaders such as WiseTech, NextDC and Xero.

The largest sector, financials, enjoyed a strong rebound in July. Making up 28.4% by weighting of the broader S&P/ASX 200 index, the sector added 4.9% and is now up 5.2% for the calendar year. The second largest sector, materials, which includes the big miners such as BHP and Rio, posted a return in July of 1.4%.

Energy was the biggest winner in the month as the price of oil rose back over US$80 per barrel. The sector added 8.8% and is up 11.8% for the year.

The healthcare sector was one of two sectors to lose ground in July (largely due to the performance of CSL), losing 1.5%. It is also the only sector in the red for 2023.

Portfolio Performance in 2023

The income portfolio to 31 July has returned 5.12% and the growth oriented portfolio has returned 8.60% (see tables at the end). Compared to the benchmark S&P/ASX 200 Accumulation Index (which adds back income from dividends), the income portfolio has underperformed by 2.41% and the growth portfolio has outperformed by 1.07%.

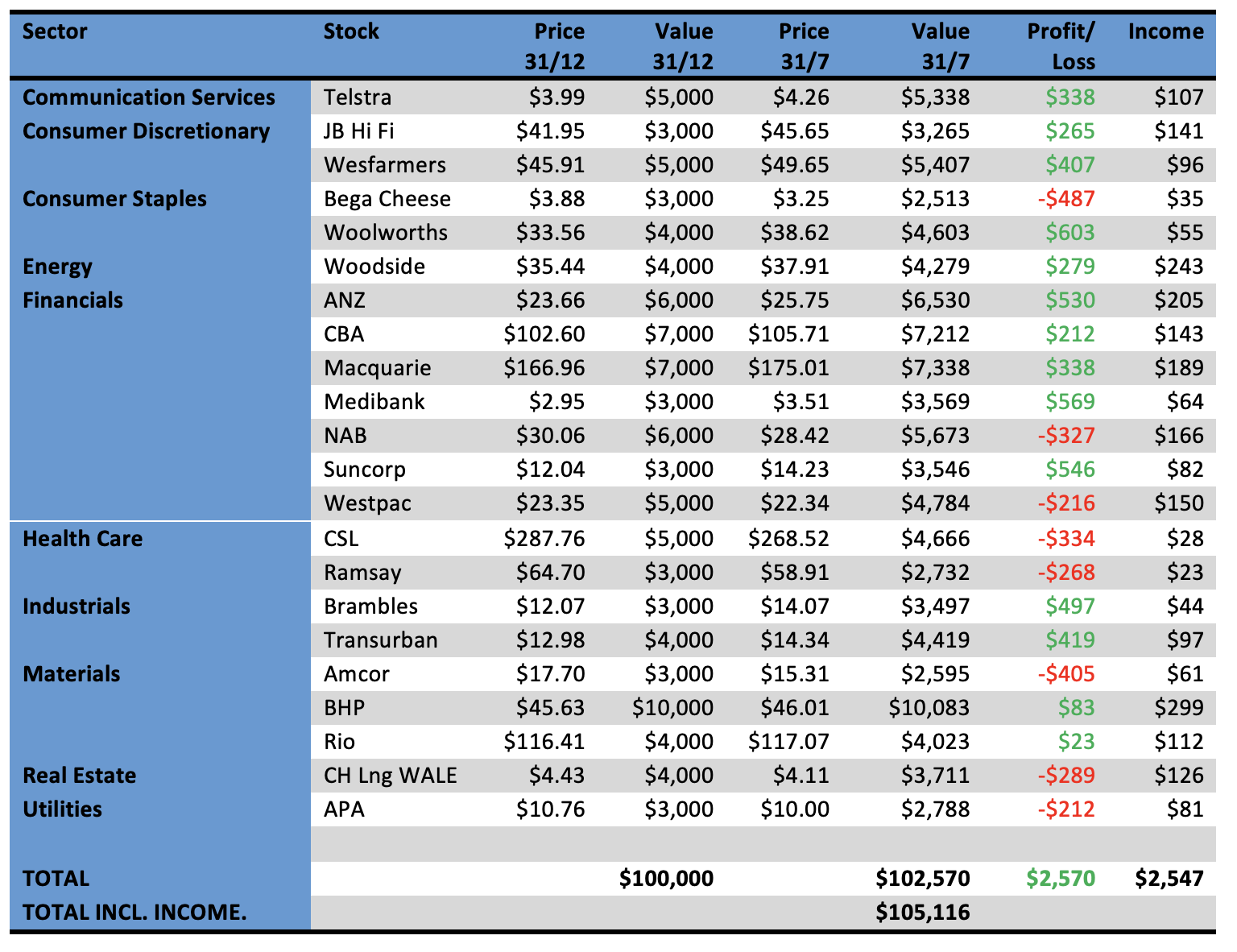

Income Portfolio

The objective of the income portfolio is to deliver tax advantaged income whilst broadly tracking the S&P/ASX 200.

The income portfolio is forecast to deliver an income return of 5.0% (based on its opening value at the start of the year), franked to 80.3%. With dividends declared during the February reporting season marginally better than forecast, it is on track to meet this. Year to date (seven months to end July), the income return is 2.55% franked to 79.1%.

In the month of July, the income portfolio returned 2.67%. This underperformed compared to the benchmark index by approximately 0.21%. For the year, it has returned 5.12%, which is 2.41% behind the index.

The portfolio is moderately overweight financial stocks and underweight the more growth oriented sectors such as information technology and health care. In a strong bull market, the income portfolio will typically lag the market, and in a bear market, it is likely to outperform.

No changes to the portfolio are proposed at this point in time. Bega Cheese is on the radar, although our sense of this is that most of the damage has been done and it is now too late to sell.

The income biased portfolio per $100,000 invested (using prices as at the close of business on 31 July 2023) is as follows:

Growth Portfolio

The objective of the growth portfolio is to outperform the S&P/ASX 200 market over the medium term, whilst closely tracking the index.

In July, the growth portfolio returned 2.59%, underperforming the benchmark index by 0.29%. This was largely due to the performance (negative) of CSL and Macquarie. Year to date, it has returned 8.60%, outperforming the benchmark by 1.07%. (Note: performance does not include potential participation in NextDC 1:8 non renounceable entitlement issue at $10.80 per share).

The portfolio is moderately overweight financials, health care and information technology. It is moderately underweight industrials, real estate and utilities. Overall, the sector biases are not strong.

No changes are proposed to the portfolio at this point in time.

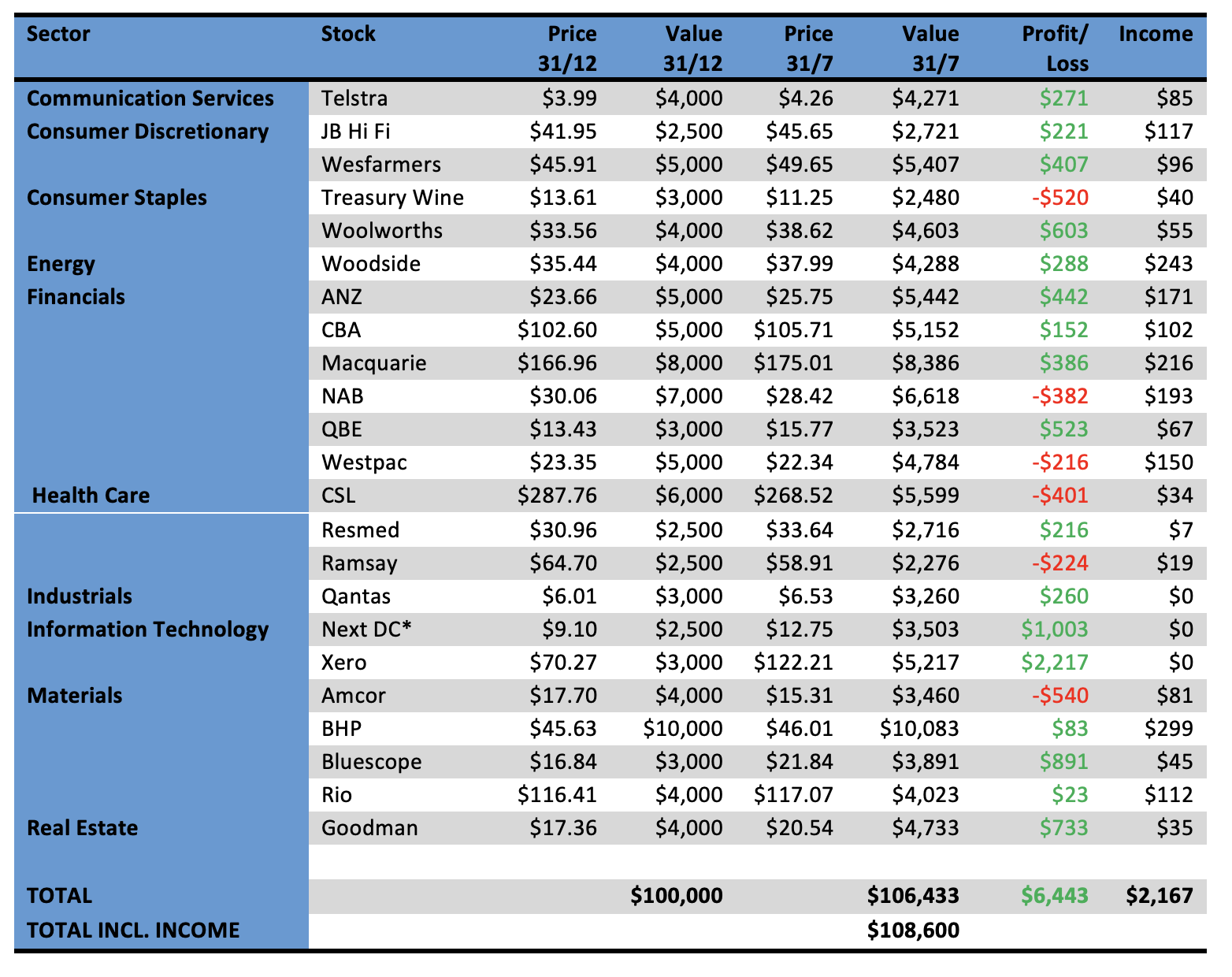

Our growth oriented portfolio per $100,000 invested (using prices as at the close of business on 31 July 2023) is as follows:

* Performance does not include participation in 1:8 non-renounceable issue at $10.80 per share

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.