Following the lead of the USA, the Australian share market recorded its fourth consecutive month of gains in July. All sectors, with the exception of financials, finished in the “green”. Year to date, the market is up 7.2% and with dividends included, 9.0%.

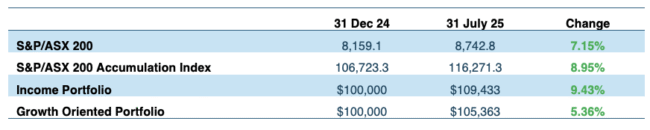

Our model portfolios finished higher in the month. Year to date, the income portfolio continues to outperform.

At the beginning of the year, we updated our portfolios for 2025. There are two model portfolios – an income oriented portfolio and a growth portfolio. The objectives, methodology, construction rules and underlying economic assumptions can be referenced here.

These are long-only model portfolios, and as such, they are assumed to be fully invested at all times. They are not “actively managed”, although adjustments are made from time to time.

In this article, we look at how they have performed so far in 2025. To do so, we will start by examining how the overall market has fared.

Resources and health rebound, financials lag

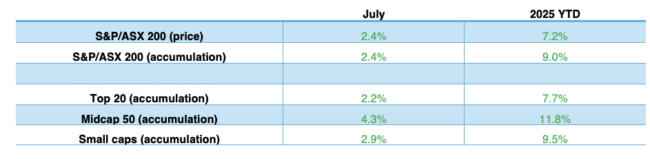

The tables below show the performances in July and calendar 2025 (year to date) of the components (large cap, mid cap, small cap etc.) and the industry sectors that make up the Australian share market.

Within the components (see table below), mid cap and small cap stocks are doing better than large cap stocks. The latter can be approximated by the ‘top 20’ index, which measures the performance of the 20 largest stocks by market capitalisation. This index was up 2.2% in July and 7.7% in calendar 2025, which is below the overall market’s performance of 2.4% in July and 9.0% for the year.

The Midcap 50 index, which tracks the performance of stocks ranked 51st to 100th by size of market capitalisation, was up 4.3% in July and 11.8% for the year.

Market Component Performance

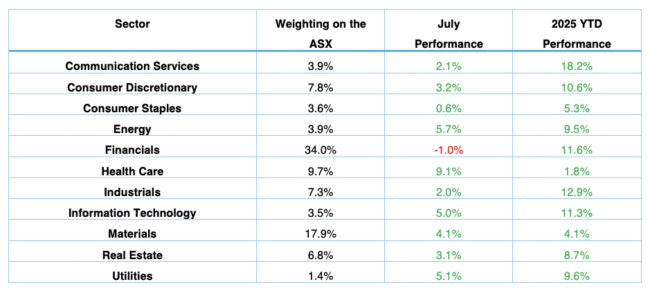

With the industry sectors (see table below), healthcare starred in July with a return of 9.1% as sector leaders CSL, Resmed and Cochlear recorded strong gains. Resources and energy stocks also posted strong gains, with the materials sector adding 4.1%.

The largest sector by market weight, financials, which makes up 34.0% of the overall S&P/ASX 200 index, lost 1% in July as Commonwealth Bank, Macquarie and NAB eased. Notwithstanding the fall in July, the sector continues to outperform the overall market in 2025 with a return of 11.6%.

Communications services, which includes Telstra, is the best performing sector in 2025 with a return of 18.2%.

Industry Sector Weighting and Performance

Portfolio performance in 2025

The income portfolio to 31 July has returned 9.43% and the growth-oriented portfolio has returned 5.36% (see tables at the end). Compared to the benchmark S&P/ASX 200 Accumulation Index (which adds back income from dividends), the income portfolio has outperformed by 0.48% and the growth portfolio has underperformed by 3.59%.

Income Portfolio

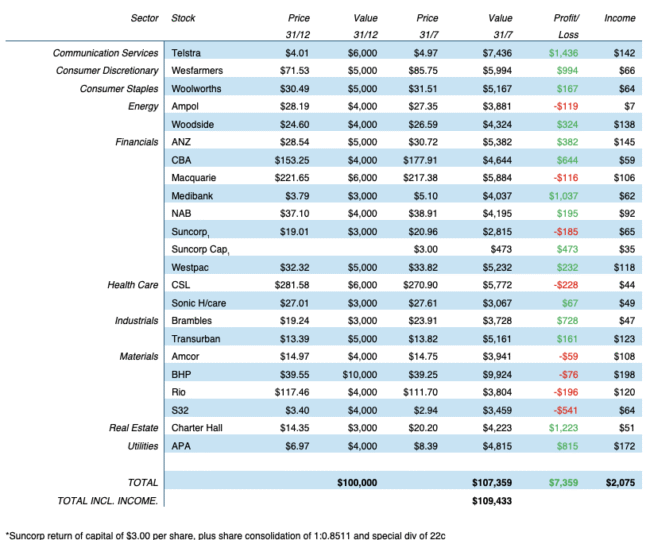

The objective of the income portfolio is to deliver tax advantaged income whilst broadly tracking the S&P/ASX 200.

The income portfolio was forecast to deliver an income return of 4.3% (based on its opening value at the start of the year), franked at 71.2%. After seven months, it has returned 2.08%, franked at 68.9%. The income return is marginally lower than expected due to big cuts in resource and energy company dividends.

The portfolio has a defensive orientation and a bias to yield style stocks. On a sector basis, the biases are fairly minor. It is overweight consumer services and utilities (in order to find income), and marginally underweight financials (particularly the major banks), given our view that Australian banks are expensive. It is underweight information technology (where there are very few medium yielding stocks). It is marginally overweight materials and energy.

In a bull market, we expect that the income portfolio will underperform relative to the broader market due to the underweight position in growth oriented sectors and the stock selections being more defensive, and conversely in a bear market, it should moderately outperform.

In the month of July, the portfolio returned 2.63% compared to the index’s 2.36%. A big lift in CSL and generally higher prices for resource and energy stocks offset falls in the price of Commonwealth Bank, NAB and Macquarie. Year to date, the income portfolio has outperformed the benchmark index by 0.48%.

No changes to the portfolio are proposed at this point in time.

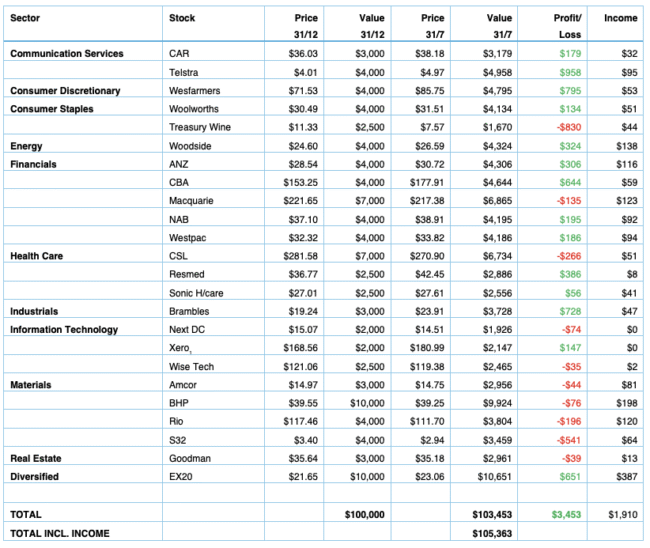

The income biased portfolio per $100,000 invested (using prices as at the close of business 31 July 2025) is as follows:

Growth Portfolio

The objective of the growth portfolio is to outperform the S&P/ASX 200 market over the medium term, whilst closely tracking the index.

The growth portfolio in 2025 is moderately overweight communication services, health care, materials and information technology. It is underweight financials (particularly the major banks), consumer discretionary, industrials, real estate and utilities.

A major inclusion is the Betashares Portfolio Diversifier (EX20), weighted at 10% ($10,000). This ETF invests on an index-weight basis in stocks outside the top 20, providing ready and diversified exposure to mid and small cap stocks.

In the month of July, the growth portfolio returned 2.89% compared to the index’s 2.36%. Strong performances in healthcare stocks CSL and Resmed, together with higher prices for energy and most resource stocks, offset falls in the banking sector. Treasury Wine Estates continued to head south, while Xero was flat following its major capital raising. Year to date, the portfolio has returned 5.36%, underperforming the benchmark index by -3.59%. An underweight position in Commonwealth Bank (relative to the index), plus overweight positions in healthcare and resources, are the main drags.

No changes are proposed to the portfolio at this point in time.

Our growth-oriented portfolio per $100,000 invested (using prices as at the close of business on 31 July 2025) is as follows:

Because the portfolio is always fully-invested, not able to participate in Xero equity raising at a max price of $176.00