It was always going to be a big night where only a hard-to-achieve Goldilocks result was going to be the best outcome for Wall Street from the June jobs report. The number had to be low or cool enough to hose down inflation fears but warm enough to say “don’t worry about a serious recession”.

The expectation was for 250,000 jobs created in June but the result was 372,000, which certainly makes those confidently telling us that the US is already in recession tone down their certainty. And the fact that the US unemployment rate was unchanged at 3.6%, which was the same as in the previous three months, has many asking “what recession?”.

By the way, this unemployment rate remains the best jobless number since February 2020, after which the Coronavirus smashed job creation. However, it’s now making those wanting the Fed to go hard on inflation to be more insistent that the next official interest rate rise should be 0.75% at the FOMC meeting scheduled for July 27-28.

Here’s one reaction to the jobs report from Michael Schumacher, head of macro strategy at Wells Fargo: “The overall picture is pretty strong job growth, and I’d say quite good earnings growth. That just makes the case for 75 basis points this month almost air tight.” (CNBC)

Incidentally, it will be a big week for our market with that Fed decision coinciding with our June quarter Consumer Price Index reading. A Goldilocks number here saying the inflation threat isn’t as bad as we’ve been led to believe it would be, could be good for restraining the Reserve Bank on rate rises at its August 2 meeting.

Interestingly, the ‘all-knowing’ bond market, which has been peeling back its yields because it was a big recession worrier, sent yields/interest rates up on the employment story, but, with an hour to go before the closing bell, stock prices were up, though not convincingly so.

This tells me that the 372,000 jobs result has some potential sellers of stocks thinking that it might be suggesting it was close to a Goldilocks number, so they’re not keen to be big share dumpers.

In the more negative corner are the predictions of the Atlanta Federal Reserve’s GDPNow tracker, which predicts the June quarter will be a 1.2% contraction following the actual contraction of economic activity of 1.6% in the March quarter. This tracker continually updates its prediction and this better-than-expected employment statistic actually reduced its predicted June quarter contraction from 1.9% to 1.2%, which is a nice sign.

Remember, the best outcome for the US economy and its impact on stocks is a Goldilocks one, where inflation falls but a recession is avoided. “Overall, the jobs data support our view that talk of the economy being in recession right now is fanciful, while the wages numbers suggest inflation pressure is easing”, Ian Shepherdson, chief economist for Pantheon Macroeconomics told CNBC. He argues that “the recession story was over-priced” by markets and the Fed is still likely to keep raising interest rates.

The next big watch for US economic data and therefore stocks is next Wednesday, which hit our market on Thursday, with the Yanks getting their June CPI reading. Keep your fingers crossed that it’s better than the last one of 8.6% — go Goldilocks!

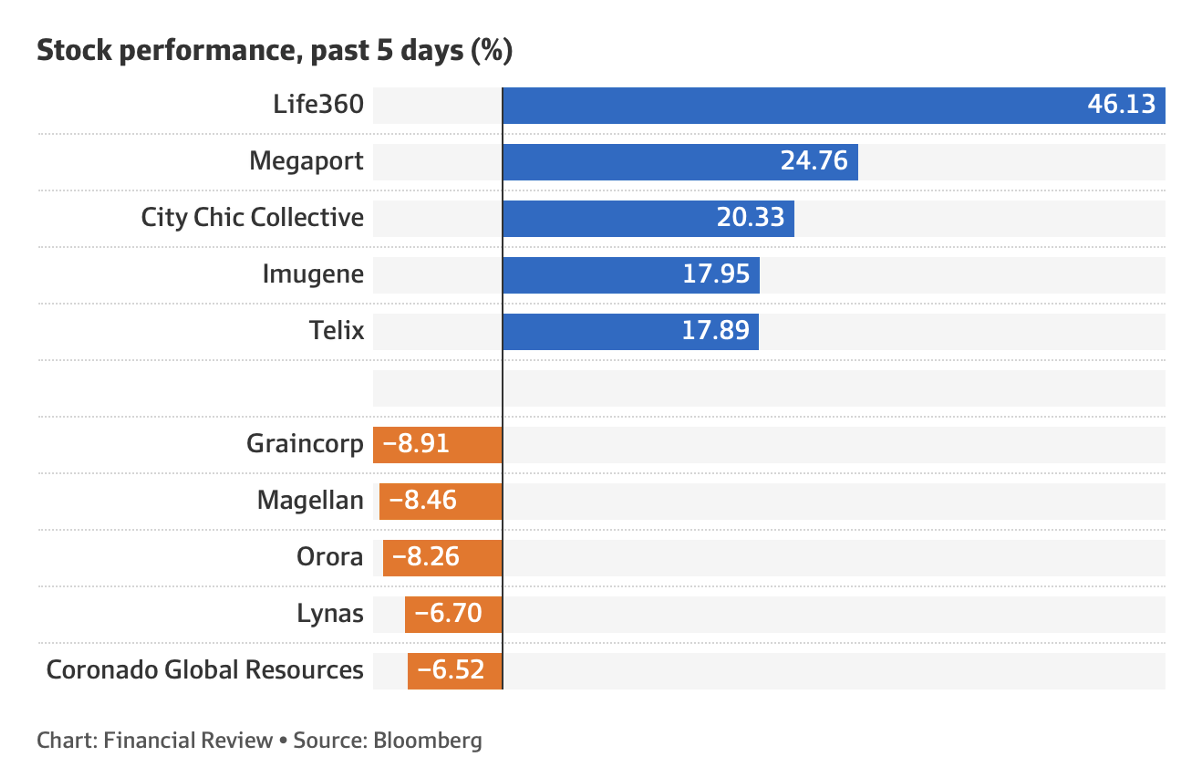

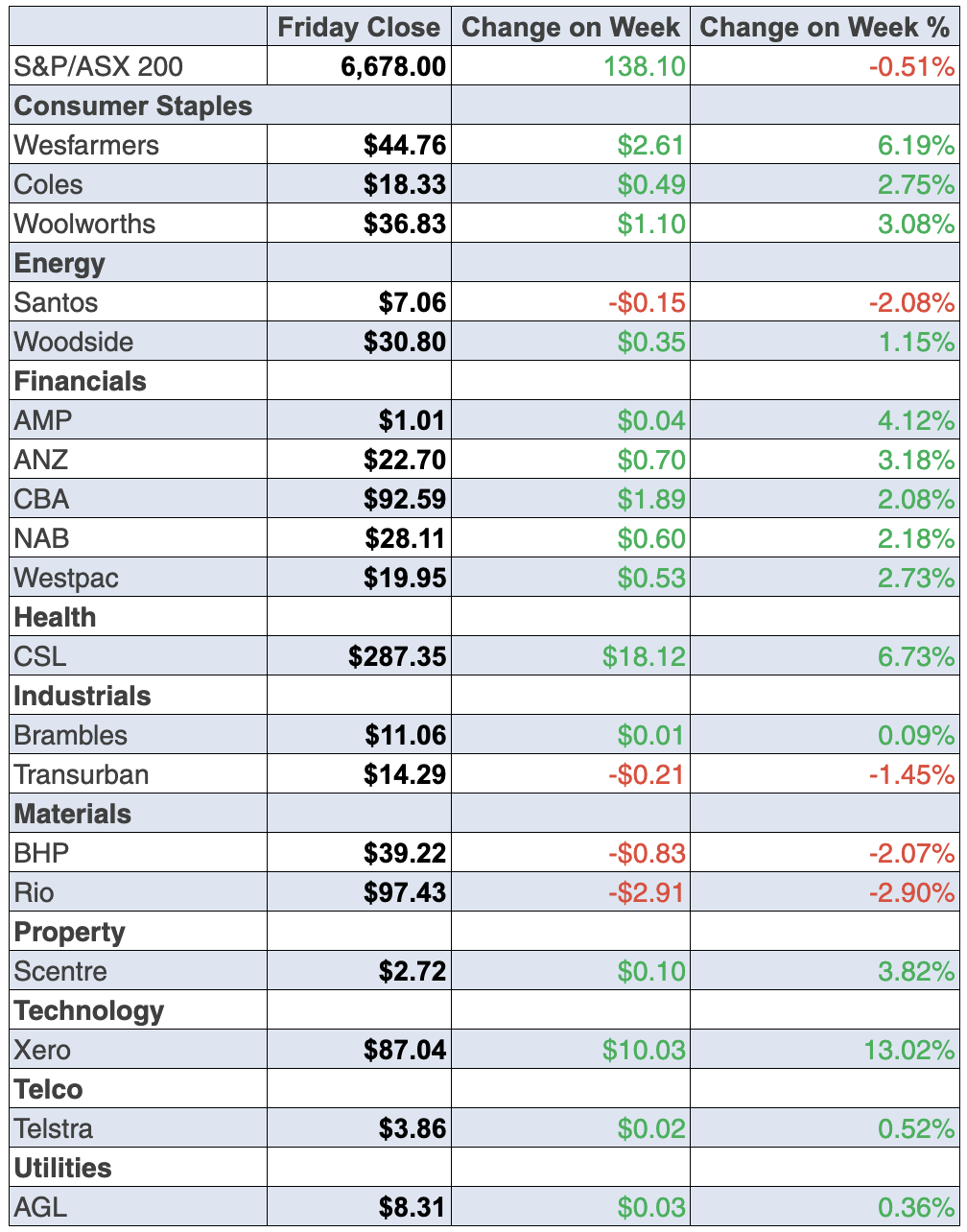

To the local story and the rebound in commodity prices on Friday helped the market register a 2.1% rise for the week, leaving the S&P/ASX 200 Index at 6678. What I liked most, however, was the takeaway message that if the interest rate rises expected prove to be over-the-top (as I’ve been predicting), then tech/growth stocks will take off from the ridiculously low levels that market influencers have been taking them to this year. Here are the big winners and losers for the week:

You might be wondering how come mining stocks rose on the same day as tech continued to sneak higher (see Megaport’s rise). Well, you can thank China! The AFR explained it on Friday: “Energy stocks jumped 2.1 per cent and materials 1.2 per cent following reports that China was considering a 1.5 trillion yuan ($327 billion) bond sale [1], with the cash expected to be used for infrastructure spending to stimulate growth. Mineral Resources added 4.6 per cent to $46.88, Beach Energy climbed 4.3 per cent to $1.71, and Pilbara Minerals rose 6.8 per cent to $2.35.”

Disappointment of the week was Magellan. The company copped a 3% hit after it told us that investors took $5.2 billion out of its fund management business in the June quarter. However, it still manages $61.3 billion. Clearly, fewer funds under management mean less revenue but I’m betting the actual fund managers look smarter by year’s end and that could be the basis of a turnaround in attitude to this once great fund management business.

What I liked

- The Melbourne Institute monthly headline inflation gauge rose by 0.3% in June after rising 1.1% in May. The annual rate fell from 4.8% to 4.7%. I hope this indicator is reliable because we want inflation to slow down.

- The Nasdaq rising over 4% for the week.

- In May, nominal business turnover lifted in 11 of the 13 selected industries, according to the Australian Bureau of Statistics (ABS). Turnover rose in all sectors over the year.

- The ABS says the seasonally adjusted balance on goods and services surplus increased by $2,717 million to a record $15,965 million in May. Australia has posted 53 successive monthly trade surpluses. In the year to May, the trade surplus was a record $136 billion.

- National payroll jobs rose by 3% over the year to June 11 and total wages lifted by 5.8%.

- According to the Federal Chamber of Automotive Industries (FCAI), new vehicle sales totalled 99,974 units in June, down 9.7% on a year ago. Slower sales are good for lowering inflation.

- The S&P Global Australia Services Purchasing Managers’ Index (PMI) eased from 53.2 in May to 52.6 in June. Readings above 50 denote an expansion in activity.

- According to ANZ and Roy Morgan, consumer confidence fell 1.2% in the past week, which is another plus for reducing inflationary pressure. This is why I’ve put this on my ‘what I like’ list.

- The ISM services index fell from 55.9 to 55.3 in June (survey 54.3). The S&P Global services index fell from 53.4 to 52.7 in June (survey 51.6). These numbers say things are slowing down but they’re not going down too fast.

What I didn’t like

- In June, ANZ job ads rose by 1.4% to stand 18.4% higher on the year. Of course, I like job creation because it reinforces my view that we will avoid a recession but we still need to see numbers that say inflation is likely to be on the slide.

Reality could bite but…

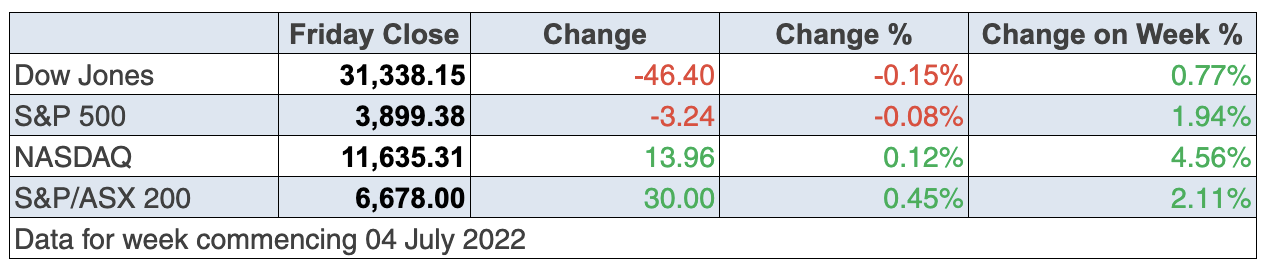

The final washup for stocks overnight was that the Dow was down a small 46 points (or 0.15%), while the S&P 500 gave up only 3.24 points, and the Nasdaq was up 0.12%. The best conclusion I can make about stocks going forward is that the jobs report was an OK number and we want more of them, but one bad one and reality could bite to take stocks down again over the next couple of months.

That said, I’m seeing economic data sneaking in the right direction, which supports my call that we should see a nice rebound in stocks by the December quarter. Of course, the quarter starts in October, though September’s revelations could easily help positivity towards the market. Have faith and be patient!

The week in review:

- While science may tell a different story, history says when it comes to stock markets, what goes down, goes up again. So, my main takeaway [2] in the Switzer Report this week was to keep your head when all about you are losing theirs, and if you can, buy more quality stocks.

- After what Paul (Rickard) rightly describes as one of the toughest half years in recent memory, our model portfolios are doing better than the market, in relative terms outperforming, though they’re still down. Paul looked at how our model portfolios (income and growth) have performed so far this year. [3] Later in the week, Paul said he doesn’t expect a recession in Australia and thinks it’s unlikely in the US. By the end of the year, he expects share prices to be higher [4].

- Australia’s listed property trust sector has had a wretched year as rising interest rates crush investor sentiment but Tony Featherstone says that opportunities are emerging within some niche trusts and ARENA & Rural Funds Group are worth a look. [5]

- Natural gas has long been touted as the “transition” fuel for economies reliant on coal, that can fill the gap as the world transitions to renewable energy. James Dunn says the ASX has a cohort of gas stocks situated around the globe exploring for gas, signing deals to participate in other companies’ wells, developing projects, and working to sign offtake deals to sell their gas once it starts to flow, showcasing three of these companies. [6]

- In Buy, Hold, Sell — Brokers Say, there were 7 upgrades and 17 [7]downgrades in the first edition and 5 upgrades and 2 downgrades [8] in the second edition.

- In our “HOT” stock column, Michael Gable, Managing Director of Fairmont Equities [9], explains why he thinks it’s worth keeping your eye on ResMed (RMD). [10]

- And finally, in Questions of the Week, [11] Paul (Rickard) answers subscribers’ queries about whether you should take up the entitlements in the Carsales.com issue; Is it better to invest in the Vanguard ETF or through a managed fund? Are there any US tax consequences when you sell Apple shares? What metrics do you use to evaluate investing in an unlisted property fund?

Our videos of the week:

- Do dairy products really increase cancer risk? | The Check Up [12]

- Are Macquarie, Magellan & ResMed ripe for buying? Chris Joye on why bond funds will make a comeback! | Switzer Investing (Monday) [13]

- How this buyers agent bought 18 properties! + Is it time to buy a crypto ETF?! | Switzer Investing (Thursday) [14]

- Boom! Doom! Zoom! | 7 July 2022 [15]

Top Stocks – how they fared:

The Week Ahead:

Australia

Tuesday July 12 – CBA Household Spending Intentions (June)

Tuesday July 12 – NAB business survey (June)

Tuesday July 12 – Monthly household spending indicator (May)

Tuesday July 12 – Overseas arrivals and departures (May)

Tuesday July 12 – Weekly consumer confidence index (July 10)

Tuesday July 12 – Monthly consumer confidence index (July)

Wednesday July 13 – Dwelling starts (March quarter)

Thursday July 14 – Labour force (June)

Overseas

Tuesday July 12 – US consumer inflation expectations (June)

Tuesday July 12 – US NFIB small business optimism index (June)

Wednesday July 13 – China international trade (June)

Wednesday July 13 – US consumer price index (June)

Wednesday July 13 – US Federal Reserve Beige Book

Thursday July 14 – US producer price index (June)

Friday July 15 – China economic (GDP) growth (June quarter)

Friday July 15 – US retail sales (June)

Friday July 15 – US import and export prices (June)

Friday July 15 – US empire state manufacturing index (July)

Friday July 15 – US industrial production (June)

Friday July 15 – US University of Michigan consumer sentiment (July)

Food for thought: “Before you speak, listen. Before you write, think. Before you spend, earn. Before you invest, investigate. Before you criticize, wait. Before you pray, forgive. Before you quit, try. Before you retire, save. Before you die, give.”

— William A. Ward

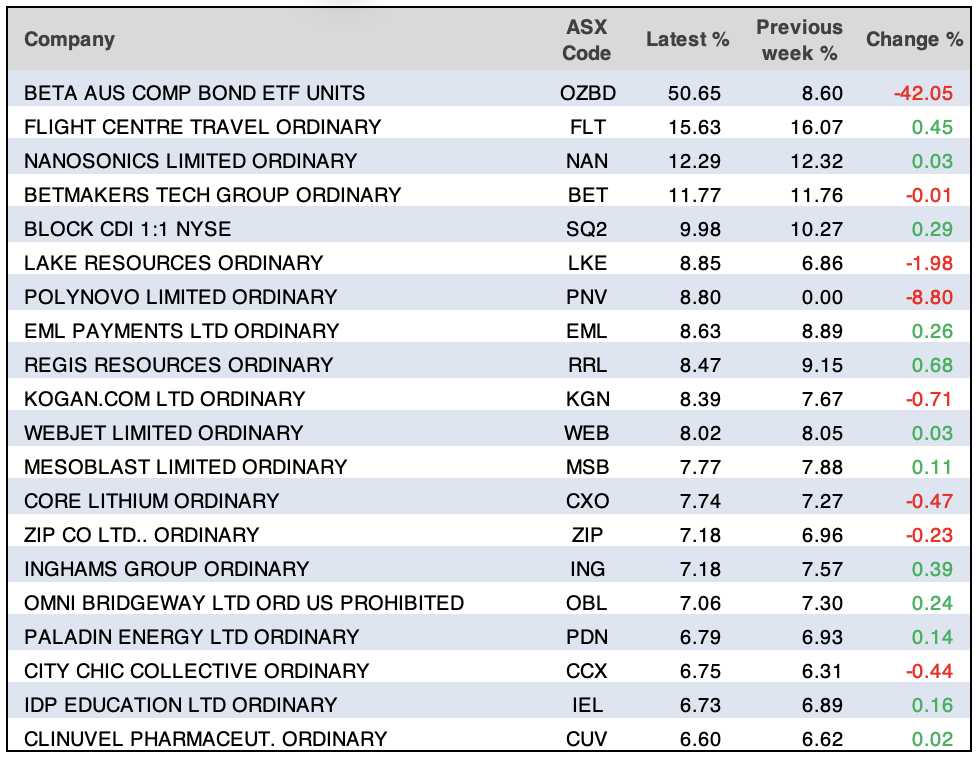

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Chart of the week:

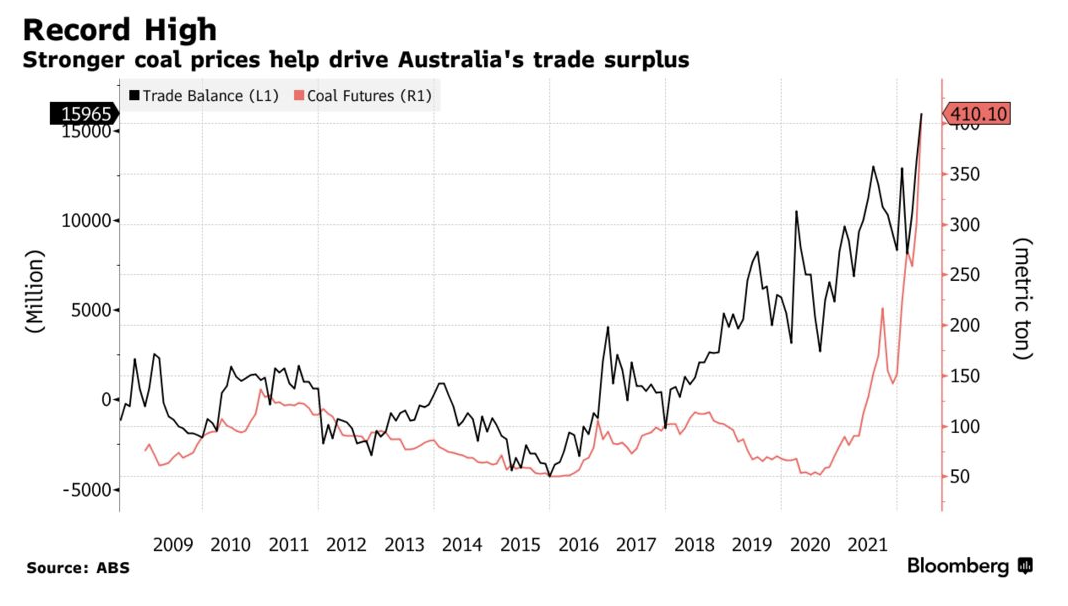

We take to Bloomberg for our chart of the week to see some positive news regarding Australia’s trade surplus, which reached a record high in May thanks primarily to strong prices in coal and a surge in imports to signify solid domestic demand.

“The surplus widened to A$15.97 billion … easily surpassing economists’ forecast of A$10.8 billion, Australian Bureau of Statistics data showed [16] on Thursday. Exports jumped 9.5%, while imports climbed 5.8%,” Bloomberg reports.

“Australia’s economy has posted monthly trade windfalls for almost four and a half years, underpinned by sales of iron ore and coal, mainly to China. Australia is also a key exporter of LNG, prices for which had surged, along with commodities like wheat amid fears of supply disruption from the ongoing war in Ukraine.”

Top 5 most clicked:

- Keep your head when all about you are losing theirs, and if you can, buy more quality stocks [17] – Peter Switzer

- Portfolios outperform, but still down in a tough year [18] – Paul Rickard

- 3 exciting gas plays [19] – James Dunn

- Buy, Hold, Sell – What the Brokers Say [20] – Rudi Filapek-Vandyck

- June was a shocker – what’s in store for July? [21] – Paul Rickard

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.