Wisetech (WTC) is a $22 billion company that provides software solutions to the logistics industry.

“Being a cloud based logistics software as a service company, the share price did incredibly well after COVID when interest rates went to zero,” Michael said.

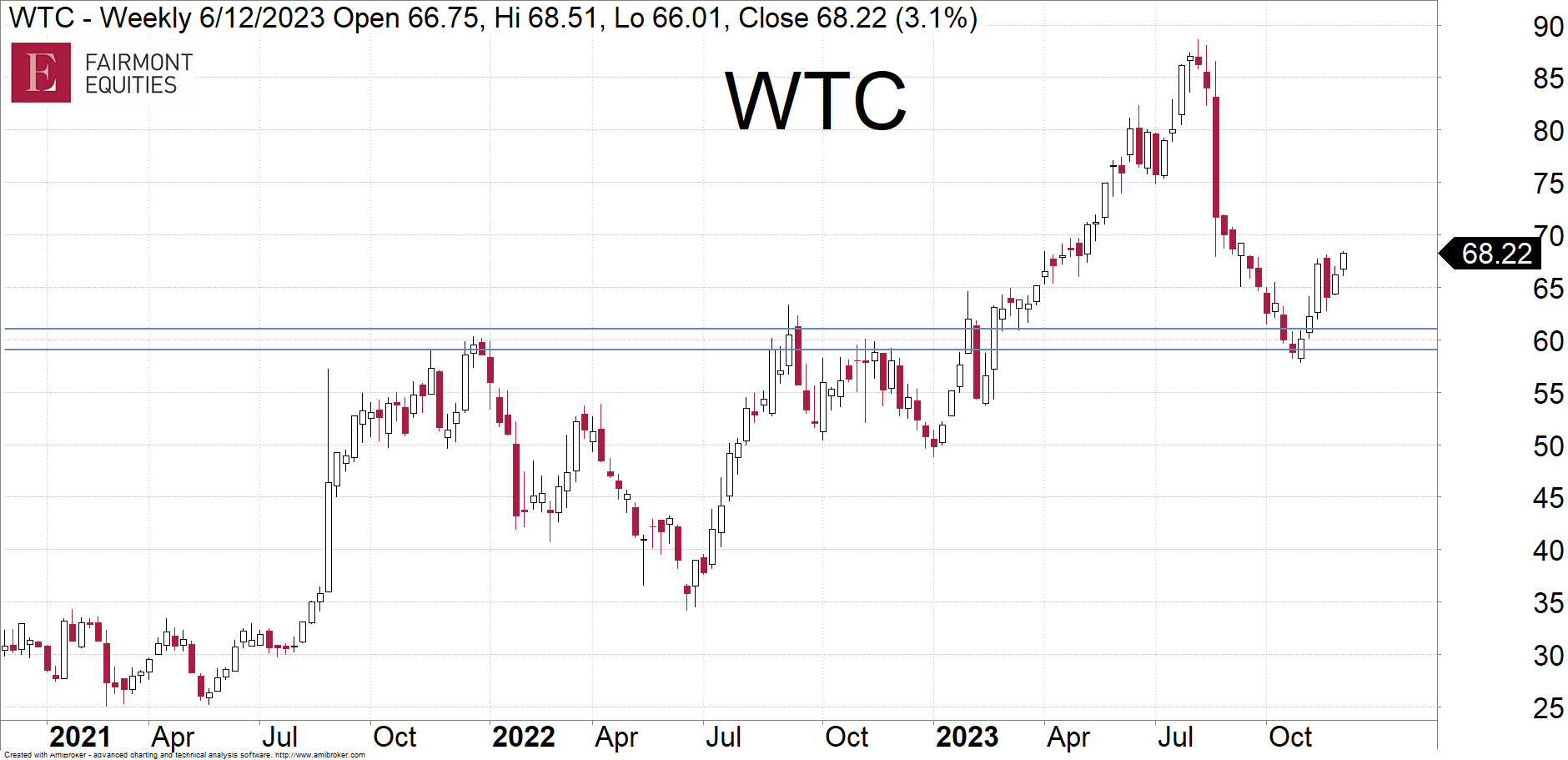

“However, despite rising interest rates, the share price has managed to climb higher since the share market peaked in 2021.

“They continue to roll out their software to new customers and the churn rate is very low. “When earnings didn’t quite match lofty expectations in August, the share price fell back. “However, that weakness now appears to be over.

“The decline in WTC over the past few months has seen it come back towards major support near $60.

“It has bounced well off this support level, and we now look to have a low in place.

“Since that October low, it has also made some higher highs and lows, which is a good sign of buying support.

“I expect a recovery from here over the next few months,” Michael said.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.