This is a work-in-progress exercise where I’m looking for stocks that reported last week and the AFR’s Chanticleer featured them asking “What we learnt from…”.

The duo of James Thomson and Anthony Macdonald, who play Chanticleer nowadays, analysed these companies. But I want to see what the analysts surveyed by FNArena are saying about these businesses.

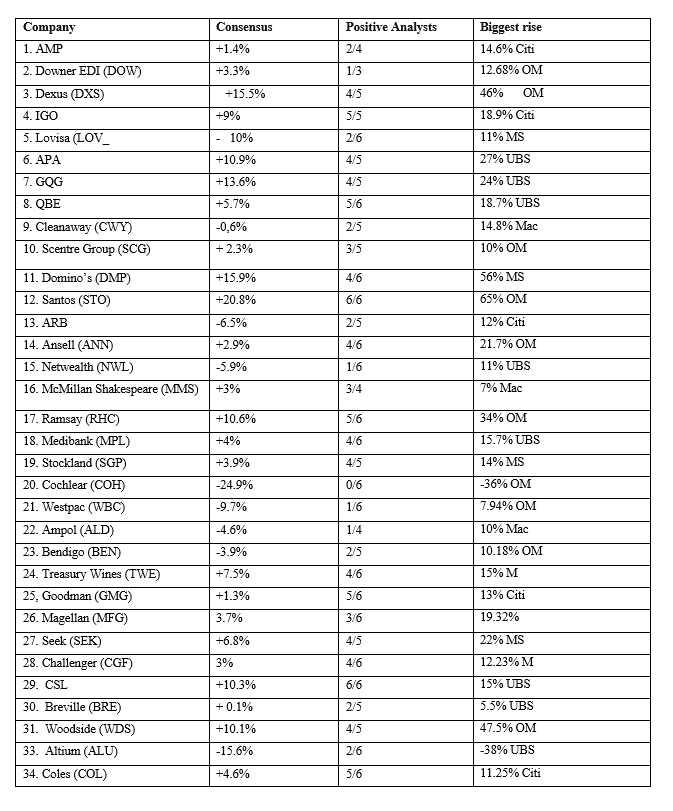

Let me show you the companies they reviewed. I found the expected consensus rise or fall, how many analysts like the company, the most positive view on the business and which analyst held that big thumbs up for the stock.

Here are 9 stocks that look to be in the BUY zone

So, according to the analysts, what recently reported companies look to be in the buy zone?

I want companies that only, at worst, one analyst rejects. I want to see a big supporter or two.

Here’s my short-list:

1. Dexus (DXS) with a consensus rise of 15.5%, four out of five analysts are on board and Ord Minnett (OM) sees a 46% rise!

2. APA ‘s consensus rise is 10.9%, four out of five like the stock and UBS sees a 27% rise ahead.

3. GQG’s tipped rise is 13.6%, four out of five like the stock and UBS predicts a 24% rise.

4. Santos (STO) looks a winner, with a consensus rise 20.8%, six out of six are supporters and OM tips a 65% rise!

5. Ramsay (RHC) surprised me with a 10.6% rise expected, five out of six were believers and OM saw a 34% rise.

6. Seek (SEK) snuck in with a 6.8% consensus rise, four out five supporters and Morgan Stanley tipping a 22% rise.

7. IGO has a 9% consensus rise, five out of five like the company and Citi tips an 18.9% rise.

8. CSL has a 10.3% expected rise, with six out of six analysts liking the stock and UBS tipping a 15% jump in the year ahead.

9. Domino’s is given a wild card start in my select group of analysts-loved companies because the consensus rise is 15.9%, and while only four out of six analysts like the stock, Morgan Stanley tips a 56% rise.

On Thursday, I’ll make an appearance in this Report to tell you what Tribeca’s Jun Bei Liu and the AFR have to say about these nine companies that analysts have a crush on.

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice.