In Thursday’s Boom! Doom! Zoom! show, Paul Rickard brought up the bad ADP jobs report, which indicated that the US economy could be in trouble creating employment opportunities in the private sector. I made the point to Paul that Omicron could be the issue but I also said that the ADP report can sometimes be at odds with what the US Bureau of Labour Statistics pumps out each month.

Well, bingo, it happened on cue. Instead of losing 301,000 jobs as the ADP numbers showed, 467,000 were created! The ADP economists and stats analysts need to relook at their model! Also, revisions to November and December results tell us there was a whopping 709,000 unreported jobs that were found when the statistician put a line under these months!

Back to January, and economists also disagreed with the ADP team and expected 150,000 jobs but this shows how surprisingly strong January was, or how hopeless their Labour Statistician is.

Unsurprisingly, this has led to the bond market pushing yields and also future expectations of interest rate rises from the Fed upwards. The 10-year Treasury bond yield went over 1.9% from 1.83% on Thursday and puts the spotlight back onto US inflation and expected interest rate rises in the next year and it looks like the market’s expectations of five rises have gone to seven! (This is what Chris Joye said to me in yesterday’s interview that I did with him for Monday night’s TV show. Typically, he was very confident about his view and I questioned it but I might not have if I’d seen these job numbers! Chris is more negative on stocks than me this year, which makes for an interesting interview.)

“Diane Swonk, chief economist at Grant Thornton, said the very hot wage gains make the jobs report an inflation story, and market focus now swings to the consumer price index next Thursday,” CNBC’s Patti Domm reports. “She expects CPI to rise to 7.2% from December’s already sizzling 7% headline number.”

By the way, some market guessing is suggesting the Fed’s first rise could be 0.5%. If that happens, the stock market would have to come up with more guts than it has shown in recent times when inflation and rate rise talk hots up.

Surprisingly, as I write this at 5.26 am, the Nasdaq (the home of tech stocks) is up 241 points (or 1.76%) and I have to ask: how does that happen?

The logical conclusion process is this: jobs are surging and so is the economy, and that must mean inflation will be strong so the Fed will have to raise rates more and faster, so tech stocks should be sold off. So where does this rise come from? And can we trust this rebound/rally we’ve seen this week?

Interestingly, there are those out there who think the numbers still only say five rate rises are coming in the US but the seven hikes do look more believable and the bond market agrees.

But why are tech stocks rising?

Hang on, maybe the Labour stats could be dodgy because of seasonal factors and the threat to worker numbers because of Omicron. “They [employers] didn’t let holiday hires go,” Diane Swonk said. “They kept them on in a tight labor market to keep stores and restaurants open,” she said.

“She has noted the Bureau of Labor Statistics has had a difficult time measuring the job market since the pandemic,” Domm reported. “There have been massive revisions, initially missing job losses, and then later recording job gains too slowly.”

Even before the craziness of the expectations of more interest rate rises than were expected from the Fed not sinking tech share prices, the behaviour of tech stock prices was screwy. So what’s going on? (I’ll look at this on Monday and review it if I should stick to liking my ZEET stocks.)

“None of this makes sense,” said Bernstein’s Mark Shmulik. “But there’s money to be made on this rollercoaster.”

One view that is consistent with my argument (about the overreaction in this tech sell-off) is what if the economy is really strong so the gains from economic growth for company earnings trump the rise in the cost of borrowing?

Lately, tech companies such as Microsoft, Apple and Amazon that make a profit were again winning friends on Wall Street, but now those smaller tech companies such as Snap and Pinterest reporting well have gained buyer support.

Well, that’s the view today, but I wouldn’t be surprised if this all changes next week. That said, I want to be a buyer of sell-offs and some tech stocks will get my money, though I know we’ll have to wait some time for a good payday — but that’s what the patient long-term investor does.

Of course, if the growth story is offsetting the “rates to rise more than expected” fear, then we better hope these job numbers aren’t too exaggerated. Economic data watching in coming months will determine company earnings expectations and then what happens to stock prices for the rest of 2022.

That said, I like this from UBS chief investment officer Mark Haefele: “Overall, the earnings outlook is still solid, with the global tech sector on track for earnings growth of around 15%. In our base case, we expect valuations to stabilize and robust mid-teens earnings growth rates to be reflected in share prices over the next 12 months.” (CNBC)

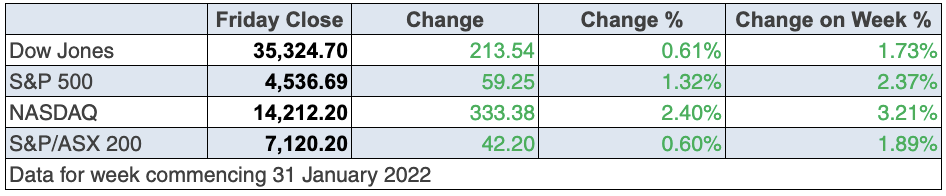

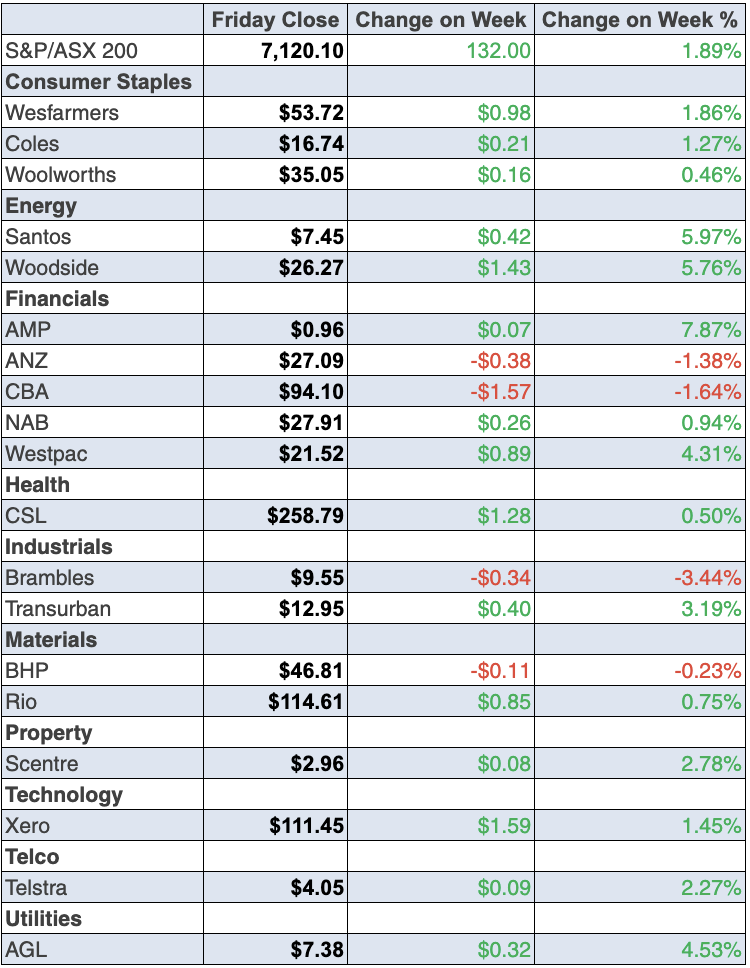

To the local story and our market gained 132 points (or 1.9%) for the week, which makes me feel glad I argued the sell off was an over-smashing affair. We were helped by better-than-expected earnings from many US tech stocks and the signs that the RBA boss, Dr Phil Lowe, isn’t mad keen to raise interest rates as fast and as early as many of our banking economists think.

Ironically, some banks had a good week. Westpac put on 5.44% to $21.52, NAB added 1.68% to $27.91 but CBA lost 0.96% to $94.10, while ANZ gave up 0.84% to $27.09. Meanwhile, Macquarie had a nice 5% rise to $192.34 but remember this was a $215 stock in January before all these “rates-tech-related” sell-offs kicked in.

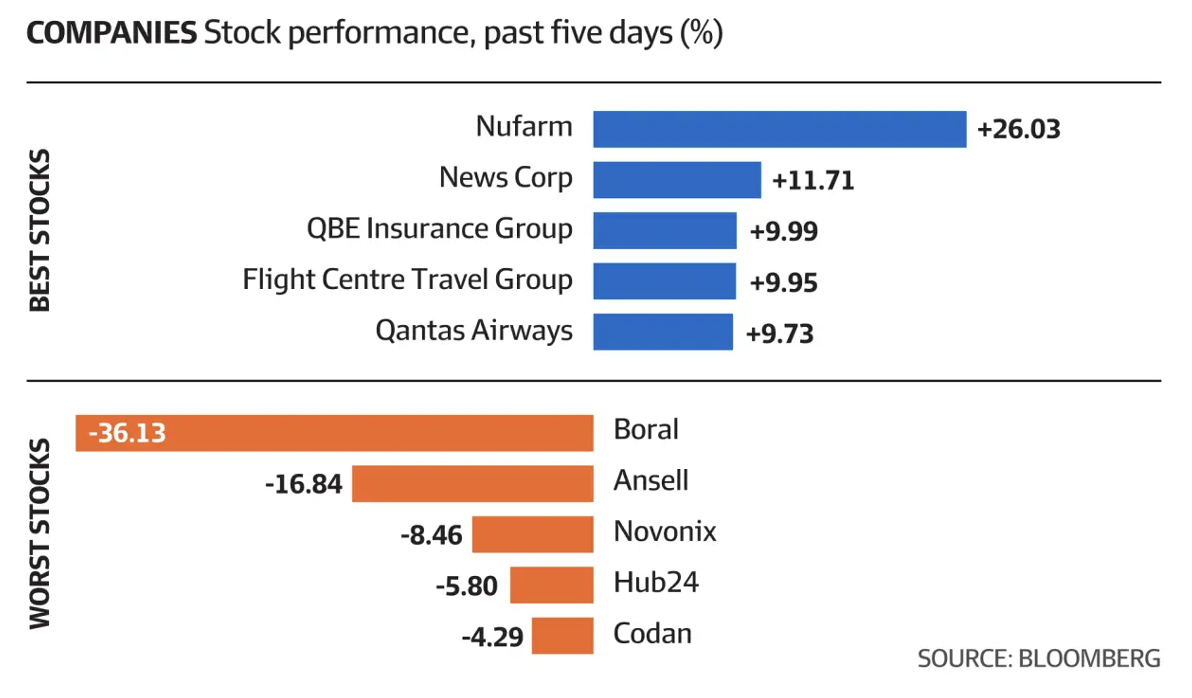

Here are the standout big winners and losers for the week:

News Corp gained on good earnings news and Julia Lee’s pick of Nufarm a few months ago has been on the money — good weather and a big demand for commodities is paying off for this company.

Energy continues to do well and we have been tipping this for some time. Woodside gained 6.06% to $26.27 for the week, Santos was up 6% to $7.45 and Origin Energy went up 6.5% to $5.90.

Why Xero only put on 0.51% to $111.45 over the week, when US quality stocks were rising, remains a market mystery but maybe the hotting up reporting season will explain it or show just how crazy our attitude to quality tech stocks is here in Oz.

What I liked

- The RBA was sensible leaving the target rate for the cash rate at 0.1%. The RBA announced that it would stop purchasing government securities from February 10 and indicated that it’s in no rush to lift rates: “The Board is prepared to be patient as it monitors how the various factors affecting inflation in Australia evolve.”

- Dwelling approvals rose by 8.2% in December (the biggest lift in 9 months) to 17,698 units. But approvals are down 7.5% on a year ago. Townhouse approvals (as a share of total annual building approvals) hit 7½ year highs of 20.2% in December.

- The December number for retail was bad (see below) but the annual number was great — “retail trade was up by 4.8 per cent on a year ago to $31.9 billion, the second-highest level on record. In 2021, retail trade grew by 5.3%, above the 20-year average of 4.8%.” (CommSec)

- The trade surplus fell by $1.4bn to $8.36bn in December. Australia has posted 48 successive monthly trade surpluses. Imports rose by 5% in the month to be up 21.7% on the year – the biggest annual rise in 13 years. Car imports in December were the second-highest on record. It was a fall but it’s still a surplus and the import rise is a good sign for economic growth going forward.

- In a good sign for the UK economy’s prospects, the Bank of England Monetary Policy Committee voted to lift its key Bank Rate to 0.5% from 0.25% — the first back-to-back increase since 2004. Notably, four of the nine members actually voted to lift rates by 50 basis points or half a per cent. This contrasts with Europe, where the European Central Bank (ECB) has kept monetary policy settings unchanged. But ECB head Christine Lagarde chose not to repeat her past comment that in the face of higher inflation rates, a 2022 rate hike was unlikely,

- According to Refinitiv, fourth-quarter profits for companies listed on the STOXX 600 are expected to rise 55% from a year earlier.

- The ISM manufacturing purchasing managers’ index (PMI) in the US fell from 58.8 to 57.6 in January (survey: 57.5) but any number over 50 means expansion, which is good, considering Omicron is causing problems.

- The ISM services gauge in the US fell from 62.3 to 59.9 in January (source: 59.5).

- The JOLTs series of job openings in the US rose from 10.775 million to 10.925 million in December (survey: 10.3 million).

What I didn’t like

- Retail trade fell by 4.4% in December after rising 13.6% in the three previous months.

- New vehicle sales totalled 75,863 units in January, down 4.8% on a year ago.

- The IHS Markit Services PMI fell by 8.5 points (the most in 6 months) to a 4-month low of 46.6 in January. Readings under 50 denote a contraction in activity.

- The AiGroup and Housing Industry Association (HIA) Performance of Construction index (PCI) fell by 11.1 points (the most in 20 months) to 45.9 in December/January, indicating a contraction in activity.

- The ADP survey in the US found that private sector payrolls fell by 301,000 in January (survey: 207,000)

I’m excited

Reporting season goes onto steroids this week and I can’t wait to see what some key companies have to say. I’m keen to see the show-and-tells of CBA, Suncorp, Megaport and a range of others. I suspect actual numbers will be good because Omicron problems didn’t kick in until December but it will be the outlook statements that will have the biggest influence on share prices. Earnings should be the maker or breaker for this rebound in stocks.

The week in review:

- This week in the Switzer Report, I consider whether CSL is currently a stock worth buying, [1] especially in the context of a long-term investor.

- Paul Rickard tackles the question of whether term deposit rates are set to rise this year, [2] and more importantly, when exactly this could occur. After listening to the RBA this week, he thinks it “might come as early as June (after the election), and then only from 0.1% pa to 0.25% pa, followed by another increase later in the year”. Paul also discusses whether the performance in the stock market over January flags bad times ahead in 2022. [3]

- James Dunn goes bargain hunting after equities took their recent dive, and uncovers 3 stocks that have been oversold [4] during the latest correction.

- As students have been constrained dramatically over the last two years in their schooling and learning environments, Tony Featherstone is confident this will increase the demand for online learning education companies and tutoring services. He gives us his two picks [5] that are poised to do well in this sector.

- For our “Hot” stocks this week, Managing Director at Fairmont Equities, Michael Gable points to [6] Aristocrat Leisure (ALL) as a stock that is seeing a little downside and hence should be placed on investors’ watchlists.

- This week in Buy, Hold, Sell – What the Brokers Say, there were an equal number (fifteen) of upgrades and downgrades [7] in the first edition, with 14 upgrades and 7 downgrades in the second edition. [8]

- And finally in Questions of the Week, [9] Paul answers your questions on personal and SMSF bank accounts both being covered by the Government Guarantee, whether property trusts will be hit if interest rates go up, if bond fund prices will recover, and the tender discount for the Westpac off-market share buyback.

Our videos of the week:

- Looking at ‘The End of Alzheimer’s,’ by Dale Bredesen | The Check Up [10]

- Is the sell-off over and is it time to buy? + Xero, Seek, CSL, Lynas, Allkem, the banks and more [11]

- Boom! Doom! Zoom! | Thursday 3 February [12]

- 2 stocks that reported well this week + what stocks is Marcus Bogdan adding to his income fund? [13]

Top Stocks – how they fared:

Note: As of 19 January 2022, Afterpay (APT) ceased trading on the ASX under Listing Rule 17.2 following its acquisition from NYSE-listed Block (formerly Square). Afterpay shareholders were afforded the opportunity to elect to receive the scheme consideration of 0.375 shares in Block for every 1 share in Afterpay as either direct shares in ‘SQ’ listed on the NYSE, or as ASX-listed Chess Depositary Interests (CDIs) trading under the ticker ‘SQ2’. As such, APT will be replaced by Xero (XRO) in our ‘Top Stocks’ segment for the technology sector moving forward.

The Week Ahead:

Australia

Monday February 7 – Retail trade (Dec quarter)

Monday February 7 – Job advertisements (Jan)

Tuesday February 8 – Weekly consumer confidence (Feb 6)

Tuesday February 8 – CBA Household spending intentions (Jan)

Tuesday February 8 – NAB Business survey (Jan)

Wednesday February 9 – Consumer sentiment (Feb)

Thursday February 10 – Weekly payrolls jobs & wages (Jan 15)

Thursday February 10 – Business turnover (Dec)

Overseas

Monday February 7 – China purchasing managers’ index (Jan)

Monday February 7 – US Consumer credit (Dec)

Tuesday February 8 – US NFIB Business optimism Jan)

Tuesday February 8 – US Trade balance (Dec)

Tuesday February 8 – US Economic optimism (Feb)

Thursday February 10 – China Money & credit indicators (Jan)

Thursday February 10 – US Consumer prices (Jan)

Friday February 11 – US Consumer sentiment (Feb)

Food for thought: “Courage taught me no matter how bad a crisis gets … any sound investment will eventually pay off.” — Carlos Slim Helu

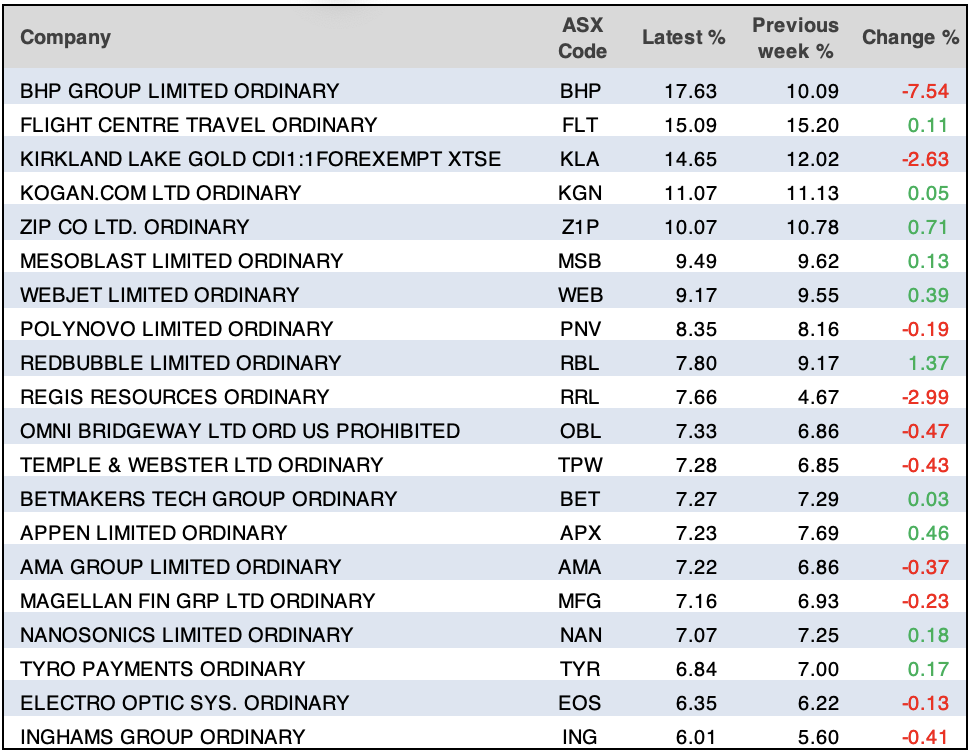

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before. NOTE: No data released from ASIC for week commencing Monday 31 January 2022. As such, the above table has been compiled from the most recent data released by ASIC on Friday 28 January 2022.

Chart of the week:

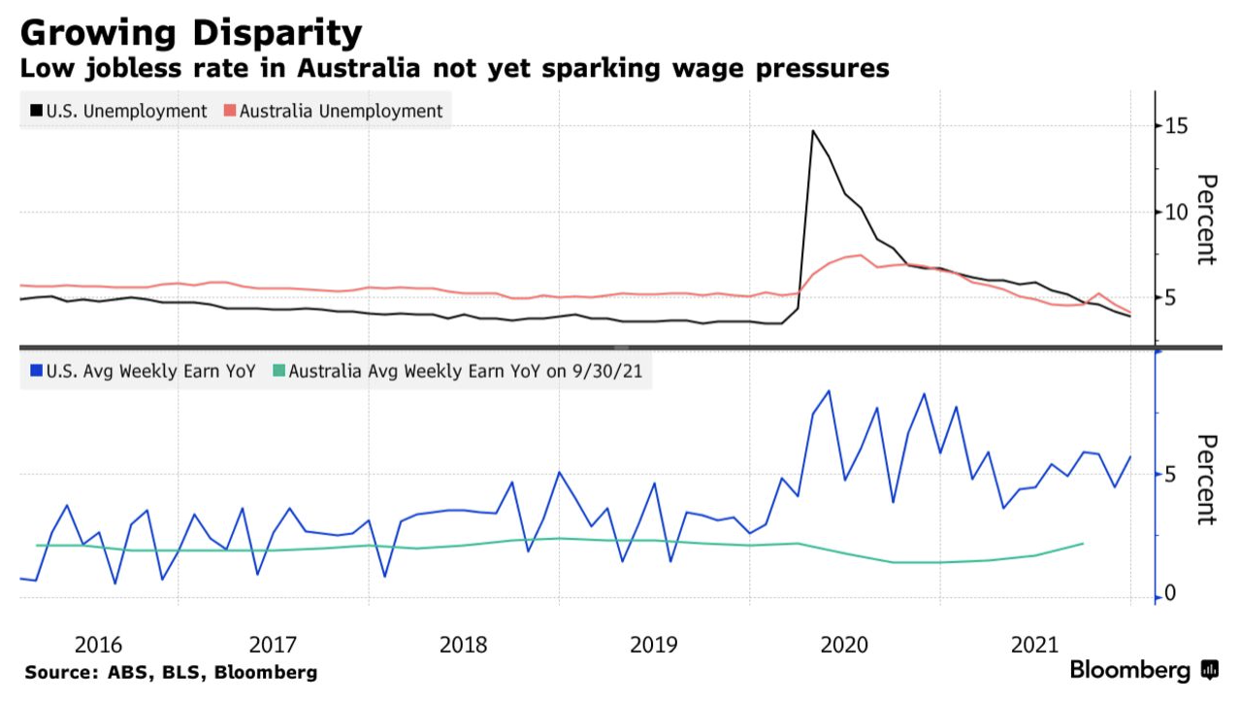

Our chart of the week is one of many datapoints that explains Reserve Bank of Australia governor, Philip Lowe’s more dovish stance on inflation. “The RBA’s stance contrasts with a Federal Reserve gearing up for hikes to try to rein in 7% inflation and a Reserve Bank of New Zealand that’s set to tighten further as it confronts the fastest price gains since 1990,” Bloomberg reports. It goes on to explain key influential factors, namely that Australia’s inflation started out slower. Further, unemployment at 4.2% has also failed to unleash stronger pay demands, an anomaly Lowe blames on “substantial inertia” in the pay setting process. This prevents wages from responding rapidly to changed economic circumstances.

Top 5 most clicked:

- Is CSL a stock worth buying? [1] – Peter Switzer

- 3 oversold bargains [4] – James Dunn

- Are term deposit rates set to rise, and if so, when? [2] – Paul Rickard

- Buy, Hold, Sell – What the Brokers Say [7] – Rudi Filapek-Vandyck

- Does the “January effect” signal bad times for the stock market? [3] – Paul Rickard

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.