Here in Australia, bad economic news is still good for stock prices, but in the US where they’re on top of inflation, good economic news is actually good news. Hopefully in a few months’ time when inflation is down here, we’ll be able to greet good economic news with higher share prices.

Meanwhile, Goldilocks could be at work on Wall Street, with the Jobs Report telling a story that the market looks like it’s interpreting as the Fed might have engineered an elusive soft landing for the US economy, with inflation still looking like it’s on the slide.

Yep, in the US, good news is great for stocks, as we saw overnight.

Reinforcing this cautiously positive view on the US economy is the fact that all three most watched market indexes went up overnight after seeing the labour statistics. That said, while the numbers suggest the Fed looks like it doesn’t need any more rate hikes, those experts who were tipping rate cuts by March might have egg on their faces. The bottom line is that this report doesn’t hurt ‘the inflation is falling’ case and it puts the kibosh on those expecting the US could slip into recession any time soon.

That has to be good news for stocks — a growing US economy and falling inflation as a precursor to eventual rate cuts. As Goldilocks said: “Not too hot. Not too cold. Just right!”

Let’s look at the vital statistics from this November report:

- Unemployment fell from 3.9% in October to 3.7%.

- 199,000 jobs were created — a tick over the 190,000 expected by economists and 40,000 more than October.

- Average hourly earnings — a leading indicator of inflation — rose as expected.

These are all good reads for the US economy but there were more good tidings from the closely watched University of Michigan survey on inflation expectations, which dropped from 4.5% for the November number to 3.1% in December. That’s big and the stock market liked that as well.

Meanwhile, just when you might have thought all this news was too good to be true, along came a bounce in consumer optimism, with the index going up 8 points to 69.4. This was the best result since July. Recall from July 31 and October 27, the S&P 500 fell 10.5%, so this positive consumer survey couldn’t have come at a better time.

I like these observations from CNBC’s Mike Santoli, who has a CV that includes being a lead market writer for the Wall Street Journal. Santoli says the market thinks it sees “peak Fed” on rate rises. Then there’s “peak inflation” and “peak oil prices”, which is a great combination for stock players.

Importantly, he also pointed out that the S&P 500 was at 4,800 two years ago and is now only at 4,600, but the US economy is 15% bigger now than it was then.

None of what I saw overnight has rattled this 2024 optimist for playing stocks. It’s more a matter of selecting the best investments to capitalise on these positive economic and market developments, such as the recent fall in bond yields.

To the local story and shares rebounded from early losses on Friday, underpinned by a sharp rally in Santos and a welcome strength in iron ore prices.

The S&P/ASX 200 was up 0.3% (or 21.6) points higher to 7194.90 on Friday. Better still, for the week we were up 121 points (or 1.7%). That’s two weeks of rises in a row.

Economic data gave the local players a whiff of hope that maybe the RBA won’t raise rates again. This has been a green light for gains on Wall Street and we’re probably seeing what might lay ahead if the data, especially CPI readings in January, confirms that the RBA’s assault on inflation is working.

Big news this week was a potential merger of Woodside and Santos, with the latter seen as the target. That’s why its share price spiked 6.1% to $7.25 on Friday. Woodside lost 0.5% to end at $29.81. Also helping the market was a rise in iron ore prices, which meant Fortescue rose 1% to $25.75, BHP put on 0.6% to $47.74, while Rio added 0.8% to $128.89.

And at long last lithium miners won a few friends, with Sayona surging 12%, while Allkem rose 4.3%, Pilbara Minerals was up 3.6%, while Liontown Resources gained 4.1%.

For Ramsay Healthcare followers, the Australian Foreign Investment Review Board approved the sale of its 50-50 Asian joint venture to Columbia Asia Healthcare. The stock rose 0.5% to $48.53. Interestingly the AFR reported that “Washington H Soul Pattinson, which has lobbed a $3 billion takeover bid for fund manager Perpetual, retreated 0.5% after posting a negative return of 0.4% in its first quarter ending in October. Their shares rose 1.38% to $25.70.

The AFR also reported that Sigma Healthcare had extended its trading halt pending the release of an announcement regarding a material transaction. The shares went into a halt on Wednesday as it emerged that Chemist Warehouse planned to take control of Sigma Healthcare in a reverse listing [1].

What I liked

- The RBA Board today left the cash rate on hold at 4.35%, which was a smart move given the slowdown data we saw this week.

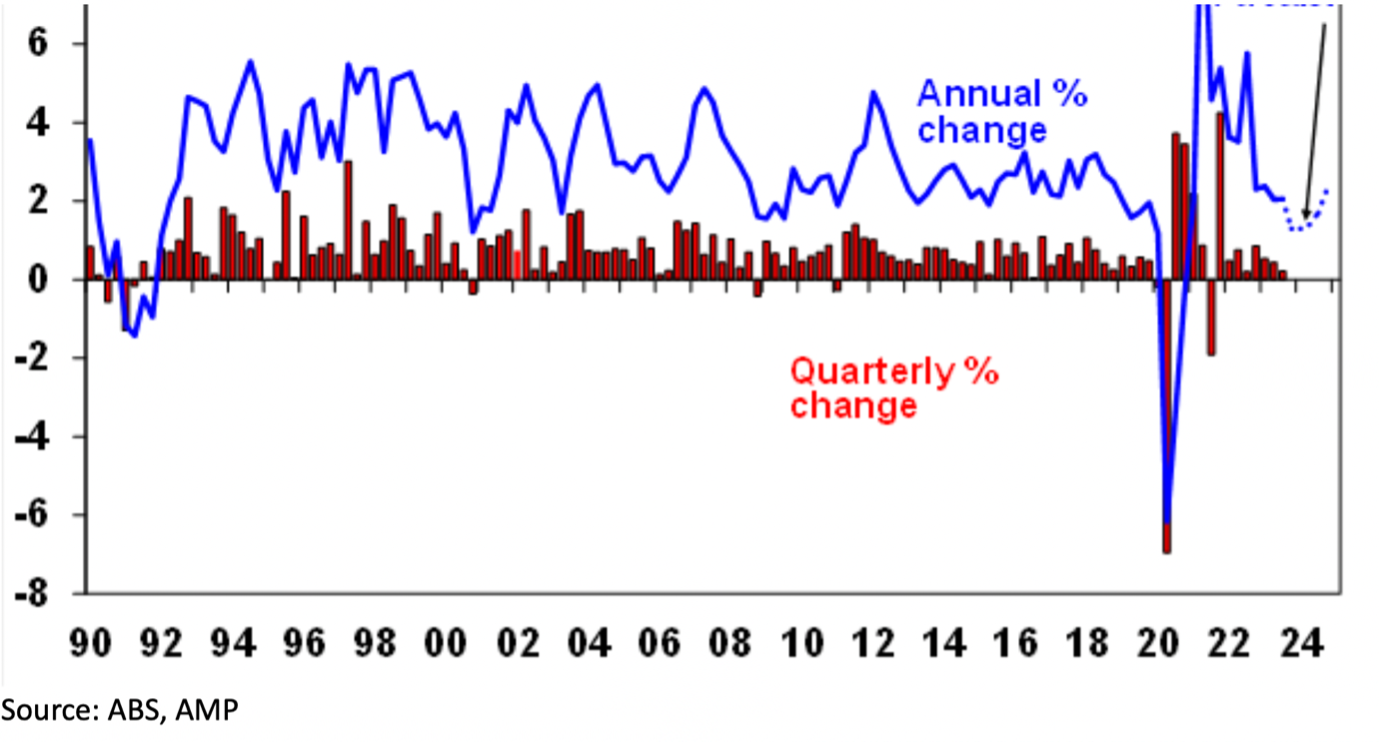

- Real GDP rose by a weak 0.2% in the third quarter of 2023 to be up 2.1% on year ago levels. Hopefully, slow growth news will stop the RBA raising rates.

- Household consumption was flat in the quarter, which is more slowdown news.

- Public spending was once again strong, business investment was robust, and inventories made a solid contribution to growth. This could help stop the slowdown becoming a recession.

- Real household disposable income fell by a large 1.7% in the third quarter to be down by a big 5.6% over the year. Another sign that the RBA’s rate rises are working.

- US data this week was supportive of the Fed not raising rates. This from AMP’s Shane Oliver sums it up neatly: “US economic data was mixed consistent with a slowing in growth this quarter and a continuing easing in the labour market. The services conditions ISM rose slightly in November and remains OK. Against this labour market indicators were mostly weak. Continuing jobless claims fell but the ADP survey of private employment growth slowed in November and job openings fell sharply. All of which suggests that while the US labour market remains tight, it’s easing. Falling job openings will reduce wages pressure even if unemployment still remains low. All of which is another pointer to easing inflation pressures.

What I didn’t like

- The current account tipped into deficit in the third quarter, printing at A$158 million, the first deficit since the third quarter of 2022.

- The terms of trade fell by 2.6% in the quarter.

- Company profits fell by 0.9% in the quarter (after inventory adjustment).

A US recession & stock prices

Before these good job numbers were released, JPMorgan has revealed that it thinks a US recession in the first half of 2024 was a 25% chance. For the second half, it’s priced at 45% and 60% in the first half of 2025. Recessions are inevitable but the fact the Yanks could have a solid first half, which could easily roll into the second half, makes me think my call that 2024 should be good for stocks is looking pretty good.

Switzer This Week

Switzer Investing TV

- Boom Doom Zoom: Peter Switzer and Paul Rickard answers your questions on NAB, BOQ, PPT & more [2]

- SwitzerTV: Peter Switzer talks to Jun Bei Liu [3]

Switzer Report

- Two favoured ETFs – one local, one global – for small-cap exposure [4]

- “HOT” stock: Wisetech (WTC) [5]

- Questions of the Week [6]

- Would Charlie Munger approve of GEAR? [7]

- Portfolios rebound following market rally in November [8]

- HOT stock: S32 [9]

- 3 stocks under $1 [10]

- Buy, Hold, Sell — What the Brokers Say [11]

Switzer Daily

- Here are my predictions for 2024 and what Aussies need to do [12]

- The case for ‘no more rate rises’ is building [13]

- Should you buy bitcoin now? [14]

- Here’s how to get ready for good investment returns next year [15]

- Should you have high hopes for your stocks and super? [16]

The Week Ahead

Top Stocks — how they fared

Most Shorted Stocks

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before

Chart of the Week

The September Quarter economic growth came in at 0.2% rather than 0.5% predicted by economists. This would have made the RBA happy and could spell an end to rate rises, which would be good for stocks for 2024.

Revelation of the Week

CBA economist Gareth Aird noted the following after looking at the National Accounts which showed a slowing economy: “Consumption has barely grown for four successive quarters, the worst stretch since the global financial crisis, despite households increasingly drawing on savings amassed during pandemic lockdowns.”

After the data this week, he also revealed:” Money markets reacted by paring back the chance of a further hike, slashing the probability of another RBA hike from 44% to just 10%. And futures now imply the chance of a rate cut as early as August at 51%, compared with zero on Tuesday.”

Disclaimer

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.