Infrastructure has been one of the best-performing assets in recent times. Notwithstanding the carnage on world equity markets, infrastructure is showing a positive return in 2022. That’s not a bad outcome for an asset that is traditionally less volatile (and less risky) than shares.

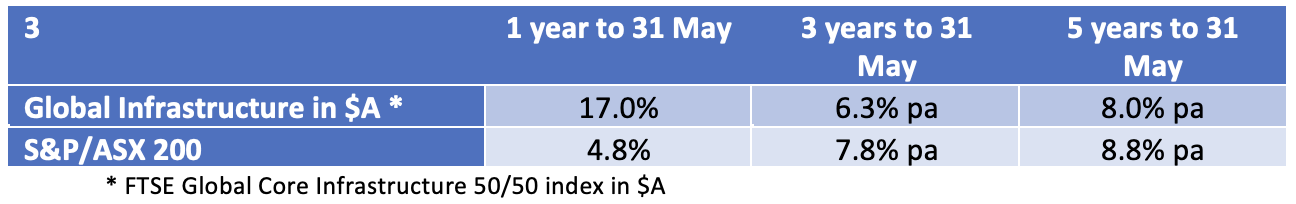

The table below compares the return of global infrastructure (in Australian dollars) to the Aussie sharemarket, the latter measured through the S&P/ASX 200 accumulation index. Over the last 12 months, infrastructure wins hands down – over 5 years, shares have done marginally better.

Strong, lower risk-adjusted returns are one of the reasons that infrastructure investments are particularly attractive to super funds. Typically, infrastructure assets have predictable long-term earnings which are often inflation-protected, with limited or very limited exposure to the business cycle. This suits super funds with their very long-term liabilities, mainly in the form of inflation-linked pension payments.

So, it is no surprise to see our super funds buying up infrastructure companies. In the last 12 months, three of the major ASX-listed infrastructure companies have disappeared (or look likely to disappear).

Spark Infrastructure, which owns energy infrastructure assets in Victoria, South Australia and NSW, was taken over in a $5.2bn transaction by a consortium comprising KKR and two Canadian pension funds. Then in February came the $23.6bn takeover of Sydney Airport by a consortium of Australian super funds and Global Infrastructure Partners. Earlier this month, IFM Global Infrastructure (which provides investment services to Australian industry super funds), announced that it had acquired a 15% interest in Atlas Arteria (ALX) and was seeking to conduct due diligence in order to consider making a bid. Atlas is the former Macquarie Group vehicle that owns toll roads in Europe and the US.

While they are diminishing, there are still infrastructure companies listed on the ASX. If electricity generators are included the list expands, but given the volatility of wholesale electricity prices, they don’t really meet the test for an ‘infrastructure asset’. Here are the main players:

- Transurban (TCL) – toll road operator in Sydney, Melbourne, Brisbane and the US – market cap of about $42.8bn;

- APA – gas pipeline owner, also owner and operator of renewable power and electricity transmission assets – market cap of about $13.2bn;

- Auckland International Airport (AIA) – market cap of about $9.6bn.

- Infratil (IFT) – infrastructure investor (energy, airports, digital and social infrastructure), plus healthcare – market cap $4.9bn; and

- Duxton Water (D2O) – owner of water leases- market cap $0.2bn.

Global infrastructure funds

Rather than investing in specific companies, investors can also consider infrastructure funds.

Two types of funds are listed on the ASX – actively managed funds investing in global infrastructure securities, and passively managed funds that track a global index and invest in the underlying infrastructure securities. The main advantage of these funds is that they invest in infrastructure companies from across all the sectors (energy, airports, rail, water, communications, toll roads) and from multiple geographies (typically the US, Canada, Western Europe, Japan, Korea and Australia). The main disadvantage is the management fee, and that they don’t specialise in an industry or company.

On the active side, the two main funds are the Magellan Infrastructure Fund (MICH) and Argo Global Listed Infrastructure Fund (ALI). The Magellan fund is essentially a feeder for the main (unlisted) Magellan Infrastructure Fund, which invests in toll roads, integrated power, energy infrastructure, water utilities and rail companies in developed countries. The fund is currency-hedged and has a management fee of 1.05% plus a 10% performance fee on outperformance above the benchmark.

To the end of May, MICH had returned 11.2% for the 12 months. For the five years, the return was 6.1% pa, outperforming its currency hedged benchmark of 5.4% pa.

Argo Global Listed Infrastructure Limited (ALI) is a listed investment company that invests in global-listed infrastructure securities. Although from the Argo stable (the manager of Argo Investments Limited (ARG), investment management has been “sub-contracted” to Cohen & Steers, a US infrastructure asset manager.

ALI is not currency hedged. The management fee is higher at 1.20%, but there is no performance fee. Against its unhedged benchmark, ALI returned 17.2% in the year to May and 9.6% for the five years, outperforming its benchmark by 0.2% and 1.2% pa respectively.

As a listed investment company, ALI can potentially trade on the ASX at a discount or premium to its NTA (net tangible asset value). The last published NTA was $2.33 (as of Friday 17 June) – it is currently trading at about $2.30.

There are also two passively managed exchange traded funds. Vanguard’s Global Infrastructure Index ETF (VBLD) tracks the FTSE Developed Core Infrastructure Index, which comprises about 136 infrastructure companies across multiple sectors in developed economies. The ETF is not currency-hedged and incurs a management fee of 0.47%.

VanEck’s FTSE Global Infrastructure (Hedged) ETF, which trades under the ASX ticker of IFRA, tracks a very similar index, the FTSE Developed Core Infrastructure 50/50 Index. It is akin to the index that VBLD tracks but has different weighting as it has a cap of 50% on utilities, 30% on transportation and 20% on other sectors. Individual company weights are further limited to 5%. It is currency-hedged with a management fee of 0.52% pa.

On track record, my preference is Argo Global Listed infrastructure, particularly if it is trading at an interesting discount to NTA. However, the primary call is how much exposure do you want to have in global infrastructure, should that exposure be currency or not currency-hedged, and then active or passive management.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.