Like many tech investors, I have been wrong about cloud accounting software provider Xero (XRO). I have been a backer of the company at much higher prices and as of Friday, it had shed 50.4% since the start of the year from $141.44 to S70.09.

Last week, it announced its results for the first half of FY23 (which ended on September 30). This saw its shares tumble to a low of $62.85, before rallying strongly on Friday in the wake of the record rebound on the NASDAQ following the US October CPI result.

Xero (XRO) – last 12 months

Source: nabtrade

Xero is not the worst performing tech stock on the ASX this year, not by any imagination, but amongst the large caps, it is near the bottom of the pack. Wisetech (WTC) is down 1.2%, Altium (ALU) has lost 19.9% while Computershare (CPU) is up in 2022.

So what has “gone wrong” with Xero and should you continue to back it?

“Gone wrong” is too harsh a description because the company has largely done as it suggested to the market. But the market’s pivot towards companies with earnings profitability and expanding free cash flow means that Xero has been left behind. Further, Xero’s growth hasn’t been as strong as the market was hoping for.

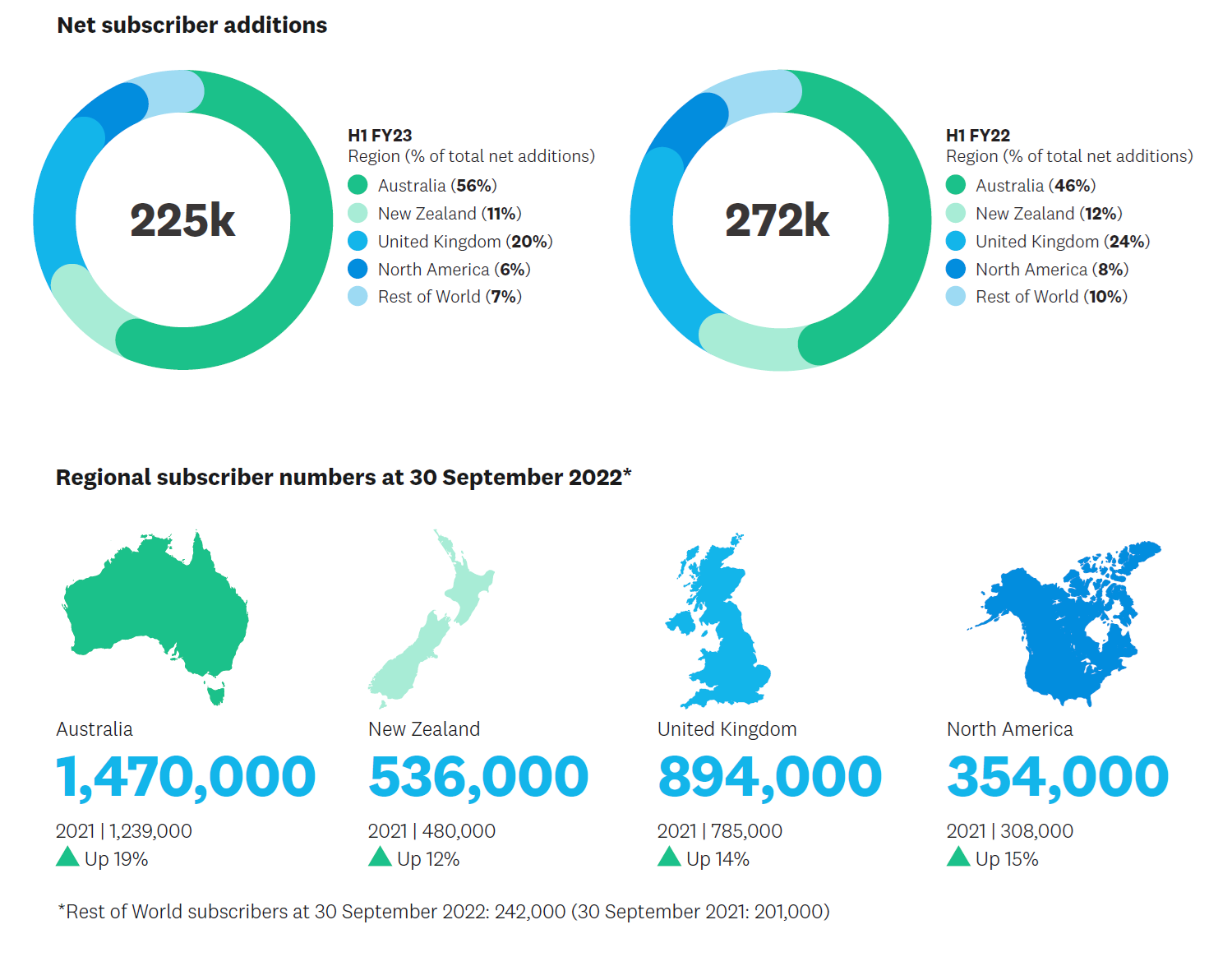

This is best shown in the following slide. Xero added a net 225,000 subscribers in the first half of FY23, down from 272,000 subscribers of the corresponding half of FY22. This took the total number of subscribers to 3.5 million. However, Australia/NZ accounted for 67% of the growth, up from 58%, and the USA/UK only yielded 26% of the growth. This is despite the market opportunity of USA/UK, massive spending by Xero, and the relative saturation of the Australasian market for Xero.

Xero said that the subdued economic outlook in the UK and timing of a VAT change impacted performance there.

To put the bet on international expansion into context, Xero earned 57% of its revenue in ANZ and 43% in the UK/USA/rest of the world. However, operating expenses were in the reverse proportion: 40% in ANZ and 60% in UK/USA/rest of the world.

CEO Steve Vamos is stepping down. His replacement is Silicon Valley and former Google Executive, Sukhinder Singh Cassidy. She will formally take over on 1 February and is expected to be based in Northern California.

There were several positives in the half year result, including key SaaS (software as a service) metrics. These included:

- Total lifetime value of customers increased by 30% from NZ$9.9bn to NZS13.0bn;

- Churn stayed very low at 0.91% (up very marginally from 0.88%);

- Average revenue per user (ARPU) increased by 13% from NZ$31.32 per month to NZ$35.30. In constant currency terms, the increase was 6%.

Financially, EBITDA increased by 11% from NZ$98m to NZ$109m, and free cash flow from NZ$6m to $NZ$15m. Operating expenses as a percentage of revenue rose marginally from 83.4% to 83.9%.

The lack of improvement in operating expenses was partly due to the resumption of Xerocon, Xero’s major marketing/business development conference for partners that hadn’t been held physically for 3 years. Looking ahead, Xero said that full year operating expenses should be at the lower end of a range of 80-85%. This implies that EBITDA and free cash flow generation in the second half should be higher than the first half.

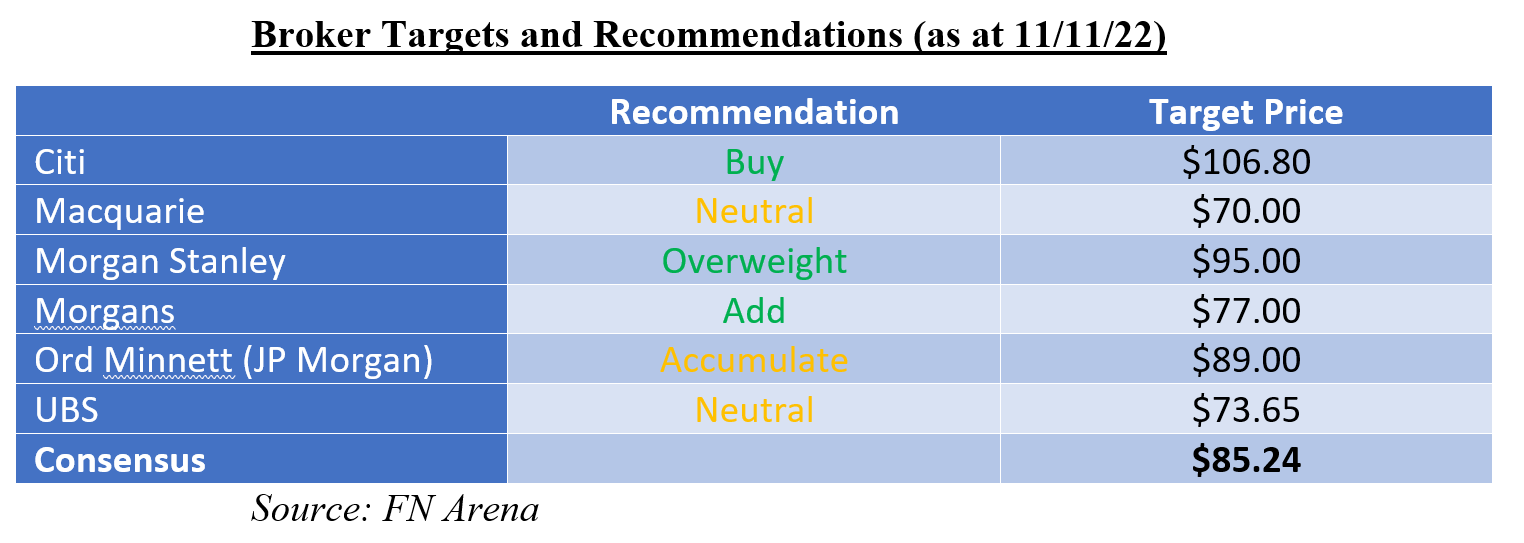

What do the brokers say

The brokers are largely positive on Xero. While target prices have been trending down, all of the major brokers have targets in excess of Xero’s current ASX price. According to FN Arena, the consensus target price is $85.24, 21.6% higher than Friday’s close of $70.09.

Most of the brokers felt that the first half result was largely in-line in regards to revenue, but a miss in terms of EBITDA (costs too high) and international subscriber growth. The increase in ARPU and “stickiness” of customers following price increases were positives.

Bottom line

At around a multiple of 9 times EV/Revenue (enterprise value to revenue), Xero is towards the higher end of the range. Profitable growth is the key to sustaining a high multiple, so Xero’s success in the US and UK markets, which are massively bigger, is critical.

Further, its dominance in the Australasian market means there is less opportunity locally. While increasing ARPU from a combination of prices increases and platform revenue is a real positive, with 60% of expenses going internationally, this is where it needs to improve performance.

I am not ready to walk away from Xero because it has been so successful in Australasia and the opportunity for cloud accounting software in the UK/USA is so big. A material improvement in share price will however only come when it can demonstrate improved traction offshore, and/or the market globally re-rates SaaS technology companies.

Long term investors should be patient. Potentially, look to use the recent share price weakness to add to holdings.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.