The question for this week has to be whether we can trust this market rebound. My answer would be that it’s not the time to go mad believing in this rally, with the banking clouds still hanging around, although they are less black.

I’d also add that if I’m right in ‘guessing’ (note I used the word ‘guessing’) that the banking challenges will bring central bank rear-guard reactions, then maybe the history of April as a month for stocks could be a reason to risk going longer with your exposure to the share market.

Before sharing that history with you, I noted that CNBC pointed to the fact that: “Seven S&P500 stocks reached all-time highs but a greater number reached 52-week highs.” Many were tech-like in nature, such as Boston Scientific, GE Healthcare Technologies, Stryker in medical technology, Oracle, software player Ansys and Motorola Solutions.

This tells me the re-loving of tech is starting, with profitable businesses in particular getting attention from the market. Adding to my story that I’ve been predicting for some time, is the fact that the S&P 500 was up 7.03% for the first quarter and the tech-heavy Nasdaq boomed 16.77%!

That said, it remains 23% down from its peak in 2021, but this three months for the index was the best quarter since 2020. Meanwhile, the Dow ended the period with a smaller 0.38% increase because it includes banks, which have been under a cloud, and it includes fewer tech companies. This didn’t help this most-watched gauge of market optimism and pessimism.

On that point, April is the best month for the Dow. The Stock Trader’s Almanac says “April has historically been the top month for returns in the 30-stock Dow Industrials, with average gains of 1.9% going all the way back to 1950. Meantime, April has historically been the second-best month for the S&P 500 and the fourth best for the Nasdaq. And it’s the second best for the Russell 1000 and third best for the Russell 3000.” (CNBC)

This could augur well for the smaller tech and growth companies that have been ignored or smashed since November 2021. However, this recent March rally, (helped along by falling inflation in the US, which continued Friday, with the core Personal Consumption Expenditure index coming in less than expected), needs to see this trend continue.

Next Friday’s jobs report will be an important data drop for the market and we need to see no more bank crisis headlines. The latter would reintroduce anxiety and then kill off the rising optimism, albeit from low levels.

The next hurdle will be the old market cliché of “sell in May and go away, come back on St Leger’s Day” which is around mid-September. It worked last year with the rebound starting in early October.

But does it always work? Could 2023 be a year when it doesn’t work? This is what IG.com says: “’Sell in May and go away’ is a trading strategy which recommends investors close their positions in May and walk away from the markets until October.”

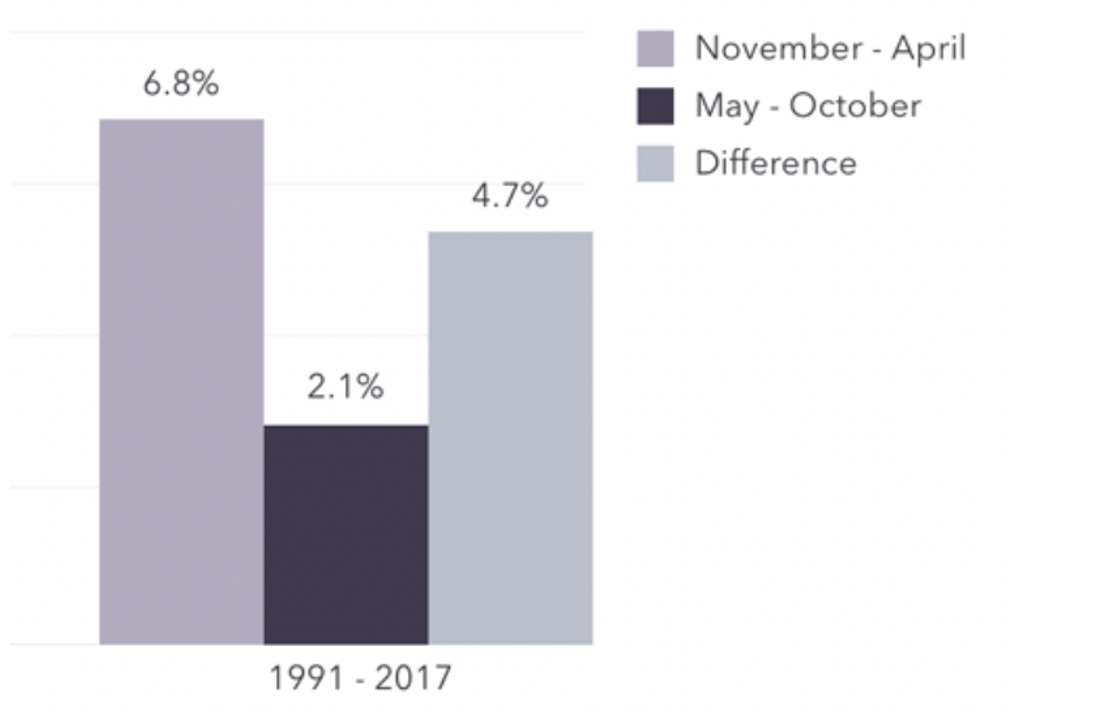

This chart shows what happens on average.

Getting out in April and coming back in October works, but you could miss out in some years. “Any investment strategy that you can summarize in a rhyme is probably a bad strategy,” said Jonathan Golub, chief U.S. equity strategist at Credit Suisse to CNBC a couple of years ago. He said on average the market’s performance does follow the pattern of weakness between May and October, but it’s not a reason to get out of stocks.

Even though November to April is better for stocks than May to October, Carter Worth, who is chief market technician at Cornerstone Macro, agrees that generally investors would not be well served to get out of the market in May and stay out through October.

Worth talked to CNBC’s Patti Domm and this is what was revealed: “For all years going back to 1896, the Dow’s average return was 5.2% in November to April, and 2.1% in May through October, according to Worth’s analysis. The average performance for all years was 7.3%. The six-month period of November to April has offered higher returns than the six-month period of May to October, 1896 to 2020,” he said. “But the best strategy by far, as all will know, is to keep capital exposed to the market year in and year out.”

Here is the strongest reason to grin and bear the May to October period: “Worth calculated that $1 million invested in the market in November-through-April periods going back to 1896 by investors who then went to cash from May to October would have returned $164.4 million,” Domm tells us. “Investors who stayed in all year would have a return of $672.6 million on that original $1 million.”

I’m staying. And I’m hoping there’s no more banking problems and that inflation keeps falling.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances