It might surprise some investors to learn that the Australian sharemarket enjoyed a positive return in the March quarter. In price terms, it was only 0.7%, but when dividends are included, it jumps to 2.2%. That’s an annualized return of almost 10%!

The Aussie market continues to outperform the US and most other advanced economy share markets. Despite putting on 3.6% in March, the US market (as measured by the benchmark S&P 500 index) is down 5.0% in 2022, meaning that the Aussie market outperformed by 5.7% in the first quarter.

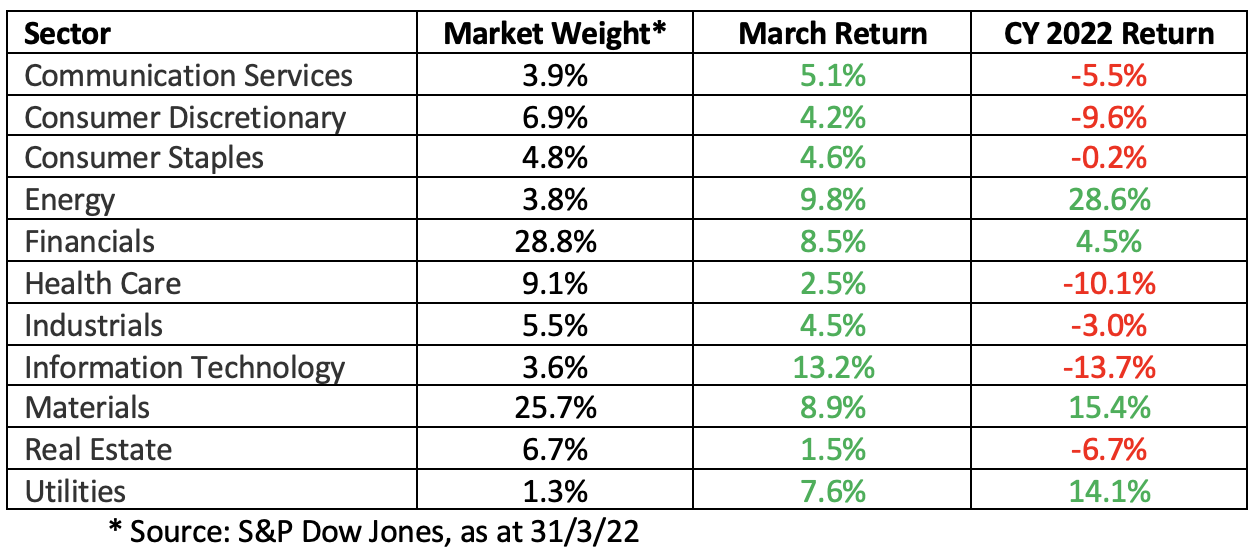

So where is the relative “outperformance” coming from?

Three sectors stand out. Energy is obviously no surprise, with oil and LNG majors (Woodside and Santos) trading higher as the oil price rises. The sector returned another 9.8% in March and is up 28.6% in 2022.

The second-largest sector, materials, is also driving the market. Weighing in at 25.7% of the total market capitalization, the sector added 8.9% in March. Base metals and iron ore remain firmly bid as global economic growth expands. The unification of BHP and a higher gold price have also provided support.

The largest sector, financials, has also been a winner. Better than expected profit results in February, the prospect of higher interest rates, and relative “safety” have led to significant investor support and the sector has returned 4.5% in 2022.

On the negative side, the information technology sector continues to wallow. Although it bounced by 13.2% in March, it has lost 13.7% this calendar year. Healthcare, which is also considered to be a “high growth” and “high multiple” sector, is also struggling. The third-largest sector by market capitalisation, it is down 10.1% this year. Consumer discretionary isn’t doing much better, having given up 9.6%.

Shareholders whose portfolio comprises ‘top 20’ stocks should be feeling pretty comfortable about the market because this part of the market is going well, returning 5.1% in the quarter. Mid and small cap stocks aren’t faring as well. The small ordinaries index, which tracks companies ranked 101st to 300th by market capitalization, has shed 4.2%

But can the market go higher in April and for the rest of 2022?

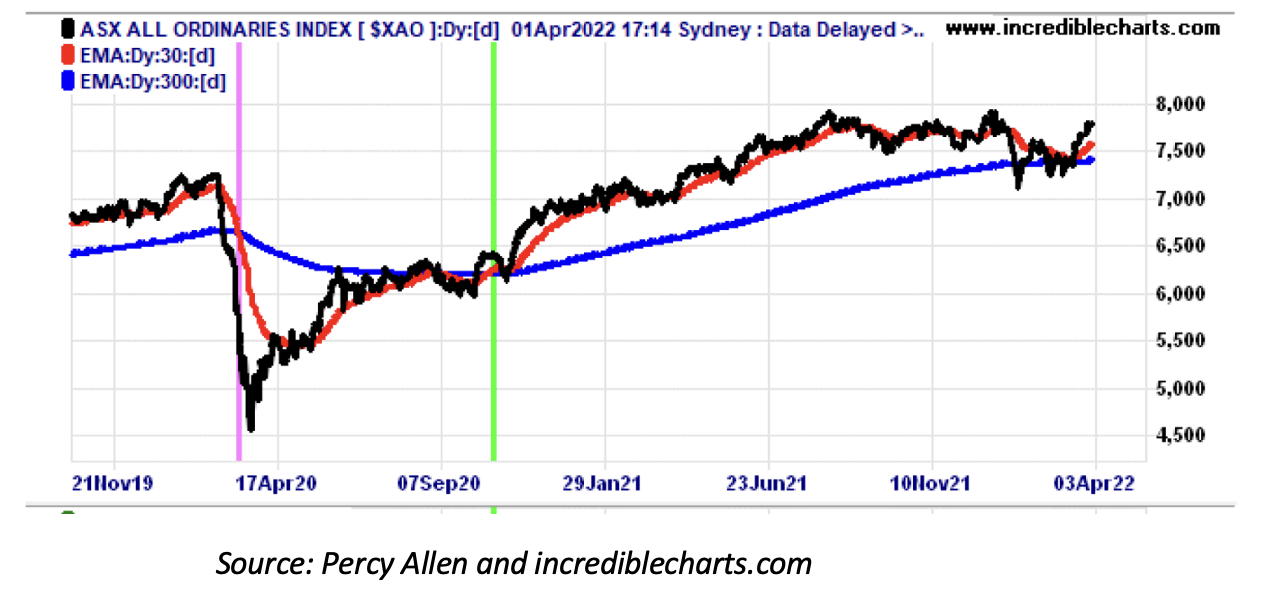

Firstly, it is important to note that the long term bullish trends (both in the US and Australia) are still in place. Percy Allen’s chart below shows that for the Australian All Ordinaries Index (shown in black), the 30 day moving average (shown in red) is above the 300 day moving average (shown in blue). It was challenged in February, but the bull trend has held.

With Ukraine, the market is hoping that “common sense” will prevail. If Putin goes crazy and conflict spreads to other states in Europe, all bets are off. But assuming it is contained, investor eyes will turn back to interest rates, inflation and yield curve inversion.

The US Federal Reserve doesn’t meet in April, but at its next meeting on 3 – 4 May, the market is expecting it to increase the US Fed funds rate by 0.5%. Monthly inflation numbers, Fed Reserve Minutes, speeches and statements by Fed Governors and Bank Presidents, as well as discussion about an inverted bond curve and whether it is really warning of a recession, will keep US investors on edge.

Company earnings season will kick off in the US mid-month and run through to the middle of May. In aggregate, expectations for the 1st quarter of 2022 are fairly constrained – average growth in earnings per share of about 4.7%. As company earnings ultimately drive share prices, the tone of these earnings reports will take over from interest rates and inflation in setting market direction. Comments about cost pressures and supply chain disruptions will be closely watched.

Historically, April is the best month of the year for the US stock market. According to CNBC, the benchmark S&P 500 has been higher 70% of the time and has gained an average of 1.7% in all Aprils since World War II. In the last 19 years, the US S&P 500 has finished in the black in April on 18 occasions.

In Australia, the Federal election in May will be in focus. Typically, the market goes quiet ahead of elections due to the uncertainty. Consumers defer major spending commitments, and companies put off decisions about major projects and investments until the political situation is clearer. And with many pundits expecting a change of Government, this is going to be even more the case because the ALP is taking a “low target” approach with respect to policy.

Offsetting nervousness around the election are two powerful forces – the economy is booming and jobs are plentiful – and investors are awash with cash following the dividend payment season of March/April.

Barring a calamity with Ukraine, I expect the markets to tick higher in April and for the rest of 2022. If earnings season is strong in the US, this might be the month it outperforms as the Australian market catches its breath ahead of the poll in May. In an environment of strong global economic growth and interest rates moving higher, resource stocks and financials will continue to drive our market.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.