A few weeks’ back, I posed the question “could Telstra get back to $5?” (see https://switzerreport.com.au/could-telstra-get-back-to-5/ [1]). I concluded:

“I don’t think Telstra is going to get back to $5. But I can see it going higher, just through the weight of money. As boring as Telstra is, its appeal as a relatively secure, tax effective income stream is attractive to investors. It is also less volatile than many other shares, and the downside risk is lower. From a business point of view, Telstra remains the market leader in telecommunications and is clearly in front when it comes to 5G. There also could be upside for shareholders if or when InfraCo is spun out, sold or demerged. At $4.40, Telstra yields 3.6%, which grossed up for franking credits takes the return to 5.2%. That’s about where I am targeting.”

Last Thursday, Telstra held an Investor Day to announce its strategy for the next 3 years. Imaginatively titled ‘T25’, it was headlined: “Telstra’s T25 strategy to deliver growth, exceptional customer experiences and continued network and tech leadership”.

T25 commences from 1 July 2022 and follows T22, the strategy Telstra embraced to deal with the material earnings headwind from the NBN. In CEO Andy Penn’s words: ‘if T22 was a strategy of necessity, T25 is a strategy for growth”.

To deliver growth, the strategy is built on four strategic pillars:

- An exceptional customer experience

- Leading network and technology solutions

- Sustained growth and value for shareholders

- Telstra as a top employer (the place staff want to work)

Putting the “marketing speak” to one side, this translates into the following commitments:

- Extending 5G network coverage to 95% of the population, with 80% of all mobile traffic to be on 5G by FY25;

- Expanding regional coverage with 100,000 sq km of new 4G and 5G coverage, closing 3G by FY24 and planning for 6G;

- Uplifting customer experience across all segments with a 25 point improvement in NPS (net promoter score);

- Grow the Telstra Plus rewards programme from 3.5m to 6.0m members, and expand it into a full sales and marketing channel;

- Expanding the ‘Telstra Purple’ service for enterprise customers. This is a 1,500 team of digital experts who provide a range of managed and consulting services;

- Greater access to mobile tower assets with 250 new towers and 700 additional tenancies;

- Building financial momentum by growing mobile services revenue, improving the profitability of Telstra fixed and turning around Enterprise

- Growing revenue from new markets – a target of $500m revenue from Telstra Health by FY25, becoming a ‘top 5’ retailer of energy; and

- Further cost reduction of $500m from FY23 to FY25 on top of the $2.7bn already committed under T22.

Financially, Telstra says the plan will:

- Deliver underlying EBITDA of $7.5–8bn in FY23 on top of the guidance for FY22 of $7.0-7.3bn, and continue to grow underlying EBITDA out to FY25 achieving a mid-single digit EBITDA CAGR (compound annual growth rate) for the whole period of T25;

- Improve underlying ROIC (return on invested capital) to around 8% by FY23, and grow it beyond; and

- Deliver a high-teens EPS (earnings per share) CAGR from FY21 to FY25.

For shareholders, this means that Telstra is “confident in maintaining a minimum 16 cents per share fully franked dividend, subject to no unexpected material events and the requirements of our capital management framework.”

To grow the dividend and maintain full franking, Telstra will need to grow underlying earnings. But because cash flow is higher than the accounting profit (capex is around $3bn while depreciation and amortisation is $4.5bn), excess cash will either go into future growth opportunities and/or be returned to shareholders.

Monetisation of the Telstra Infra-Co Fixed business remains on the agenda. Telstra says that in terms of income and EBITDAaL (EBITDA after leases), this is about six times larger than the Towers business (now known as Amplitel), where Telstra recently sold a 49% share on the very heady multiple of 28 times earnings.

What do the brokers say?

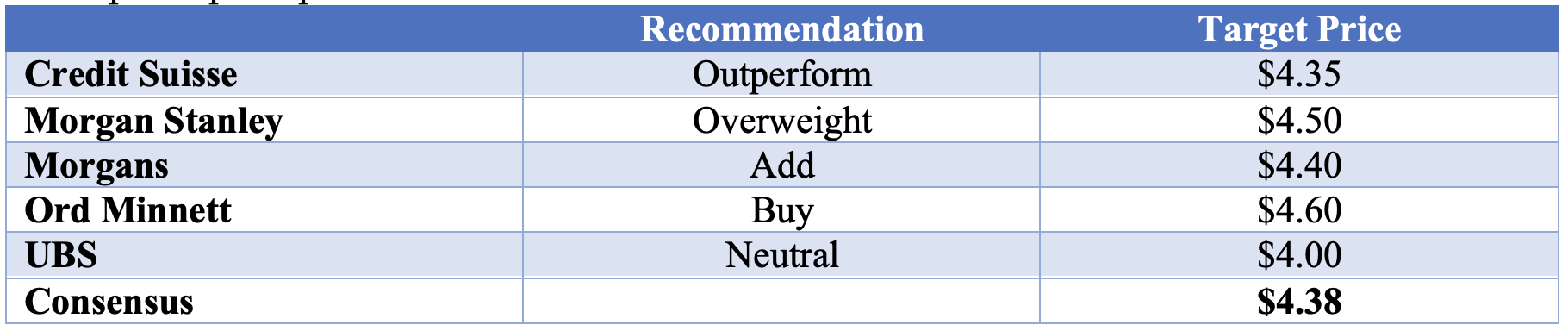

The major brokers largely welcomed Telstra’s renewed focus on growth, with the company’s FY25 financial targets broadly in line with expectations. Four of the major brokers increased their target price, with the consensus increasing from $4.22 to $4.38. Based on Friday’s closing price of $3.92, this implies upside potential of 11.7%.

Source: FNArena

Telstra – 9/16 to 9/21

Source: nabtrade

Source: nabtradeBottom line

The renewed focus on growth is a positive. Because downside risk is relatively low, Telstra can, and should, move higher. At $4.40, Telstra yields 3.6%, which grossed up for franking credits takes the return to 5.2%. That’s about where I am targeting.

Portfolio investors should stick with Telstra.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.