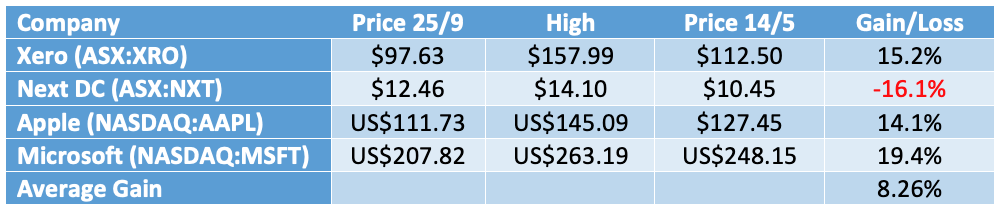

Last September, I nominated my “4 top tech stocks to buy in a dip” (see https://switzerreport.com.au/4-top-tech-stocks-to-buy-in-a-dip/ [1]). Two were local, two were offshore. Let’s see what has happened:

Leaving aside any currency issues, over the period that is an average gain of 8.2%. Interesting, though not outstanding. But it does come after a material dip in technology stocks caused by the inevitable rotation to “value” stocks and fears about inflation, and in the case of Xero, a fall last week of 16% following its full year profit report.

Xero (XRO) – 5/20 to 5/21

Here’s why I continue to like Xero and think it should be a core stock in your portfolio. (In fact I like the others as well – in the case of NextDC, I think the market it might have just got ahead of itself).

Xero -stickiness, growth, and high margin

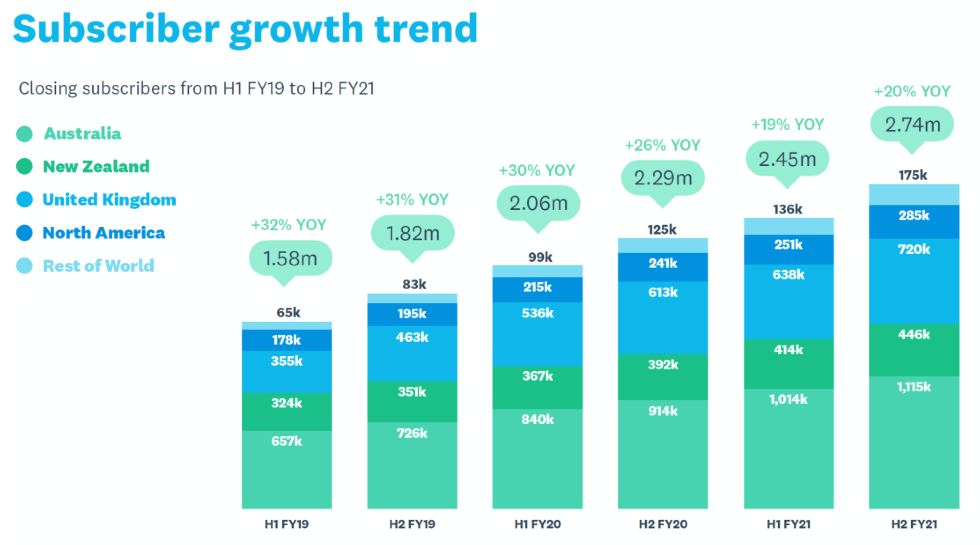

A New Zealand company by origin, Xero (XRO) is the leader in cloud accounting software in Australasia. Talk to any small business owner or their accountant, the chances are that they will sing the praises of Xero. It went to the cloud first and left established competitors, including MYOB and global player Intuit (QuickBooks), in its wake. With 1,115,000 subscribers in Australia (up 22% on the previous year), it is the largest player.

It has been expanding offshore, with 720,000 subscribers in the UK and 285,000 in North America. Overall, it grew net subscribers in FY21 by 456,000 to 2.74m.

One of the things that I really like about Xero are that its core product, accounting software, is incredibly sticky – typically accountants (and their clients) do not like change and churn is relatively low. Its monthly churn (in terms of recurring revenue) is 1.01%, and this fell in FY21 from 1.13% in FY20.

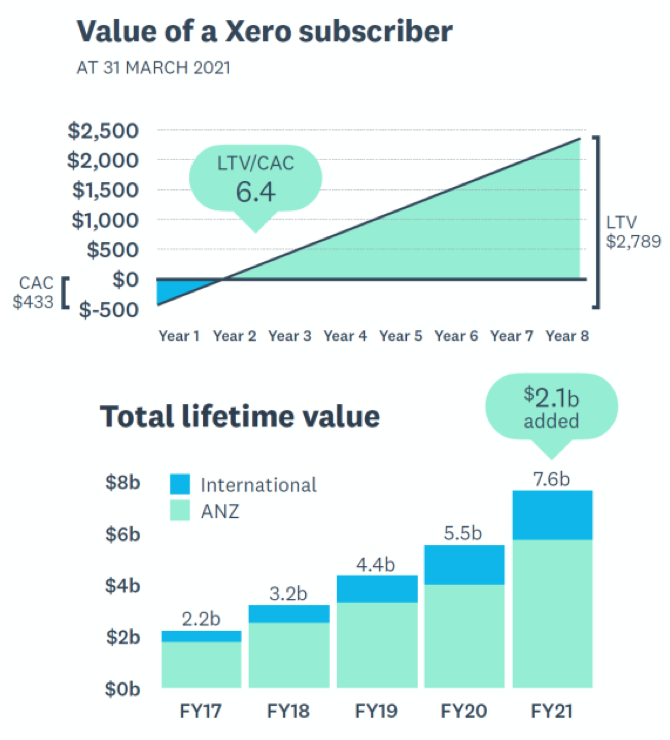

As a growth story, Xero says that its cost of acquisition (which is the marketing and sales expenses) averages out at NZ$433 per customer. Based on an average revenue per user per month (ARPU) of NZ$29.30 (this was down 2% in FY21), payback occurs after just 15 months. Combined with the churn rate, this gives a lifetime value (LTV) of NZ$2,789 per customer and a LTV/CAC ratio of 6.4 times. For a SaaS (software as a service business), these are key metrics. (For the Australasian business, the ratio is even higher at 13.2 times).

Being cloud based, the Xero business is very scalable. More remarkably, a high proportion of accounting software in English speaking markets outside Australasia doesn’t yet sit in the cloud. This is one of the main opportunities for Xero in the UK and USA.

The Xero strategy is to drive cloud accounting, grow a small business platform around this, and build for global scale and innovation. Currently, 91% of revenue is derived from core accounting, with 7% coming from platform services. The latter includes revenue from adjacent products including document subscriptions, add on modules for payroll, projects and expenses, and payments from partners under revenue-share agreements.

To support the expansion of the platform business and drive cloud accounting, Xero has completed three acquisitions in the last 12 months. Planday, a workforce management platform for employers and employees that operates in the UK, USA, France, Germany and Nordic countries (this is Xero’s most significant acquisition); Waddle, an invoice lending platform leveraging customers’ accounting data that operates in Australia; and Tickstar, technology that provides access to established e-invoicing capability.

Financially, Xero’s operating revenue rose by 18% in FY21 to NZ$848m. EBITDA rose by 39% to NZ$191m. The balance sheet was sound, with net cash on hand of NZ$256m at 31 March and free cash flow of almost NZ$57m for the year.

But the EBITDA outcome was considered a “miss” with some analysts, who had been expecting around NZ$250m. Expenses, particularly product design and development, were up materially. Xero also flagged that it was continuing to invest heavily in the business, saying that it expected total operating expenses as a percentage of operating revenue for FY22 to be consistent with the levels seen in the second half of FY21 and the pre-pandemic levels. This implies EBITDA for FY22 to be broadly flat with FY21.

What do the brokers say?

The major brokers are positive on the company’s outlook, given structural tailwinds and a record of strong management execution. However, they fall into two camps in terms of valuation. Morgan Stanley and Credit Suisse are the bulls (also Goldman Sachs with a target price of $151.00), while UBS and Ord Minnett are the bears. UBS says that its “sell’ recommendation relates to its view that the stock is trading “above a level that represents a fair risk/re-ward trade-off’.

According to FN Arena, the consensus target price is $116.83, about 3.8% higher than Friday’s close of $112.50. The following table shows the individual broker targets and recommendations.

My view

On an EV/Gross Profit (enterprise value/gross profit) multiple, Xero is trading on a prospective FY22 multiple of circa 18.8 times. And even for a company growing revenue at circa 20% pa, this would be considered high.

But by Australian tech standards, Xero is quite unique with very sticky customers, high margin and scalable platform. By its record of innovation and delivery, it is arguably the best ASX listed tech company. It is also a market leader in its field.

That makes it a ‘buy” for me when others want to sell it. I will go with the consensus of the brokers and say that it is reasonable value right now. That doesn’t mean it won’t head further south if the rotation out of tech stocks continues. However, portfolio holders should be rewarded in the long term. If you don’t own Xero, I would be looking at it for your core portfolio. If you aren’t ready for this, then put it on your watch list.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.