One of my favourite stocks has been Transurban (TCL). Not because I like paying road tolls – but rather because it has a fantastic business model. Essentially a monopoly provider, it wins because motorists usually don’t have a realistic option with alternative roads and have to pay the tolls, and further, those tolls go up every quarter by at least the rate of inflation. With a little bit of traffic growth, revenue is “guaranteed” to increase each year by mid to high single digit.

It is a defensive stock with low volatility. It really only faces three risks – construction risk on new projects, it gets the traffic forecasting on new projects horribly wrong (as occurred with other developers on Sydney’s Cross City Tunnel and Brisbane’s Clem7 Tunnel – both of which Transurban now owns) or over the medium term, higher interest rates (because it is highly leveraged).

While these risks can be material, they are also well telegraphed. In the main, Transurban’s construction record (notwithstanding that it has had a few issues with the West Gate Tunnel in Melbourne) has proven to be pretty reliable and so it is considered to be a low risk stock.

That was before the Covid 19 pandemic, which changed everything with (previously unimagined) lockdowns. But Transurban survived and as workers returned to the office, traffic volumes picked up. As the charts below show, Transurban has returned to trading in a tight range (1 year and 10 year charts below).

Transurban (TCL) – last 12 months

Source: nabtrade

Transurban (TCL) – last 10 years

Last Thursday, Transurban reported its first half result. Let’s take a closer look at this and what the broker analysts have to say, to see if there is any value in Transurban.

Transurban’s first half

Transurban reported proportional toll revenue of $1,763m for the first half, which was up 6.3% on 1H23. Proportional EBITDA grew by 7.5% to $1,331m, thanks to tight control of costs which only rose by 1.7%. (Reportings are “proportional” because on some motorways, Transurban owns less than 100% – for example, Sydney’s M7).

Free cash flow, which is the key driver for the distribution paid to unitholders, rose by 18.6% to $1,003m driven by higher EBITDA and broadly stable net finance costs.

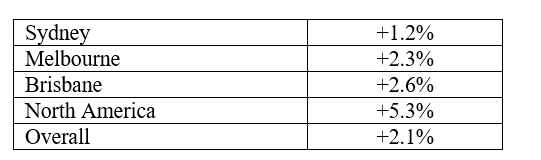

While these numbers were broadly in line with the analysts’ forecasts, the growth in traffic (average daily traffic trips) disappointed a touch at 2.1%. All markets were higher, but the largest market, Sydney, recorded an increase of only 1.2% due in part to construction impacts on toll roads.

Growth in average daily trips: 1H24 vs 1H23

Showing the impact of lockdowns and changed working arrangements, and despite population growth, some motorways haven’t yet recovered from Covid-19. For example, traffic on Melbourne’s CityLink in the December quarter of 2023 was 5.5% lower than December 2019, and Sydney’s Lane Cove Tunnel was 10.2% lower. On the other hand, Brisbane’s Logan Motorway was up 16.2% and Sydney’s M7 was up 2.6%.

On the development pipeline, the West Gate Tunnel project continues in Melbourne with major tunnel milestones achieved. Transurban expects the project to complete in late 2025. In Sydney, construction of the M7-M12 interchange and M7 widening has commenced, and the Rozelle interchange (which opened last November) is being modified to ease congestion on adjacent local roads. In North America, there is an extension to the motorway in the Greater Washington area. Overall, Transurban forecasts capex of $0.6bn in 2H24 (same as 1H24), and then tailing down to a total of $0.8bn in FY25 and $0.4bn in FY26.

Group debt rose from $24.0bn at 30 June 23 to $24.4bn at 31 Dec 23. It has an average weighted maturity of 6.8 years and is 94.6% hedged. Upcoming maturities in FY25 and FY26 amount to 15.6% of the total debt. While this will result in higher interest costs when it is refinanced, the overall impact should be containable. On a liquidity front, Transurban is well covered with a current excess of $2.6bn over and above the $2.0bn committed on projects for FY24 to FY26.

The company has guided to a total distribution of 62c per unit for FY24, up 7% on the 58.0c paid for FY23.

What do the brokers say?

The major brokers are largely supportive of the stock. Overall, the first half result was seen as “in-line”, with a little disappointment that the distribution guidance wasn’t a tad higher. Of the five major brokers who have posted research updates following the announcement, 2 have “buy” recommendations and 3 have “hold” recommendations.

The consensus target price is $13.78, about 5.7% higher than Friday’s closing ASX price of $12.94. As shown in the table below, the range is from a low of $12.32 from Morgans up to a high of $15.60 from Citi (source: FN Arena).

Brokers forecast the expected distribution of 62c for FY24 to rise to almost 65c in FY25.

What’s the bottom line?

On a prospective distribution of 62 cents and priced just under $13, Transurban is yielding a prospective 4.8%. This is largely unfranked, so the distribution is best described as “interesting” rather than “compelling”.

But the stock is seen as “super defensive” and due to the scarcity of infrastructure stocks, particularly ASX listed vehicles, Transurban carries a premium as it is the biggest and one of the few available. Institutions won’t be ready sellers.

Further, some brokers see more upside in the traffic volumes as roadworks complete. Macquarie’s observation is interesting: “A traffic surge will emerge as roadworks complete driving momentum from FY26 through to FY29, which drives strong earnings and cashflow growth”.

If bond yields fall quickly, Transurban might also get a push along. However, as it didn’t really bare the cost of rising bond yields on the way up (because such a small proportion of the debt had to be refinanced), it won’t really be a huge winner as yields fall. Overall, it is still likely to be paying more in interest expense.

Bottom line, I think Transurban is reasonable value now around current levels. Certainly, in a market selldown that took it back to $12.40, I’d be a buyer.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.