Right now, tech stocks are being trashed here and overseas and you can blame the expectation that US interest rates will rise in March and we could see our first rate rise as early as November. This is making the US bond market anticipate higher rates, and this has pushed up the all-important 10-year bond yield rate.

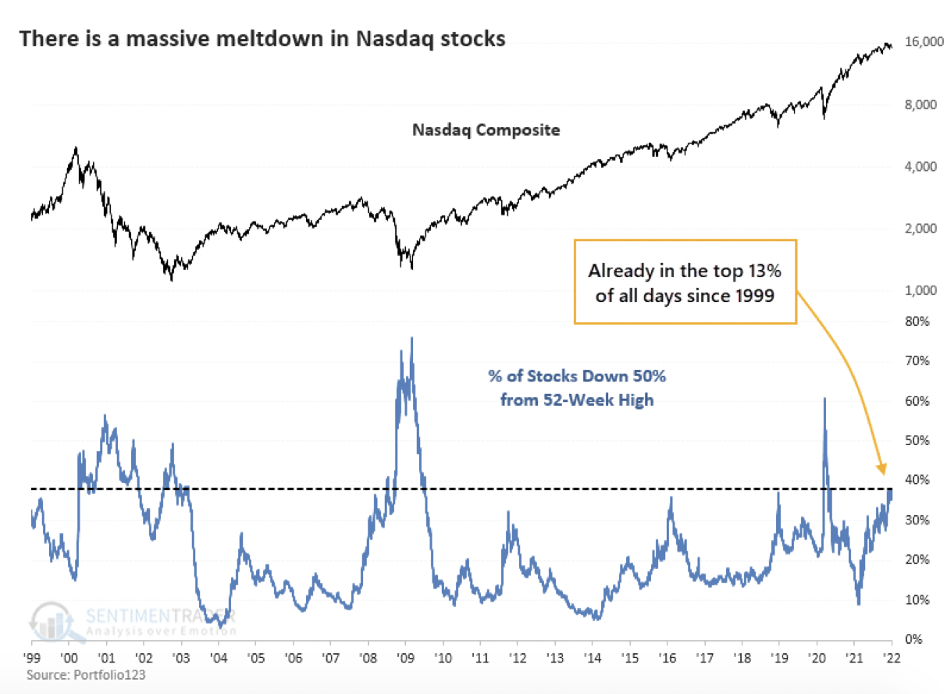

The rout of tech stocks is so significant that Percy Allen pointed out on the weekend that, unbelievably, “almost 40% of NASDAQ stocks have fallen 50% since their peak in the last year!”

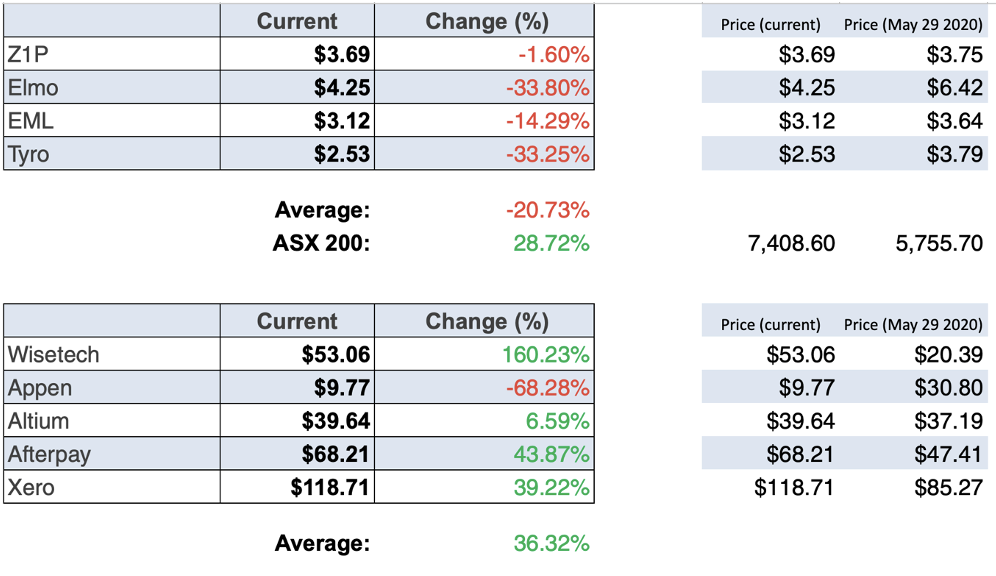

This hasn’t surprised me because my ZEET stocks have copped a drubbing recently after performing better than the famous WAAAX stocks and the ASX 200 Index for over a year, after I first signalled them out on 29 May 2020.

It has been a shocker lately, with Z1P and Tyro copping the backlash from the set against tech and payments companies, as well as the implications of the lockdowns and restrictions because of the Delta and then the Omicron variants.

EML had a battle with the central bank of Ireland and Elmo Software seems to be impressing everyone else bar the influencers that control stock prices.

In last week’s Boom Doom Zoom show I was asked about ELO and ZIP and if I still supported them. Currently I am, and I’ll give them one more year, and here’s why.

First, I think some time in 2022, after we get used to interest rate rises in the US, there will be a rotation into tech stocks because they are the future. Are you seriously prepared to argue that in a world of a hybrid workplace model that businesses like Zoom, Microsoft and Apple aren’t going to do well?

Do you really believe BNPL businesses will become old hat?

Second, I’m a great believer in being patient with good businesses that fall out of favour as a group. The words of Warren Buffett always come back to me: to be “greedy when others are fearful”.

Third, the expert analysts surveyed by FNArena are on a unity ticket with me and my ZEET stocks. This is their latest consensus call:

Stock Upside Biggest + Call

Z1P 82.6% 157% (Ord Minnett)

ELO 80.6% 83% (Morgan Stanley)

EML 29.1% 41% (UBS)

TYR 63.1% 86% ( Morgan Stanley)

In none of these stocks were the analysts sellers. It’s clear they believe over time their share prices will improve.

If there is one thing I’ve learnt about stock markets it is that rotations happen and it’s when companies have been oversold. The fact that almost 40% of Nasdaq stocks have fallen 50% since their peaks makes me think one day there will be a turnaround in sentiment. Looking at the analysts’ views on my ZEET stocks says I’m not alone in being a believer in tech and payments companies.

The core of my investments are quality dividend-paying companies, and my tech plays are purely designed to get some alpha. So I’m happy to remain solid to my ZEET stocks but I do want to see some turnarounds before the year is up.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.