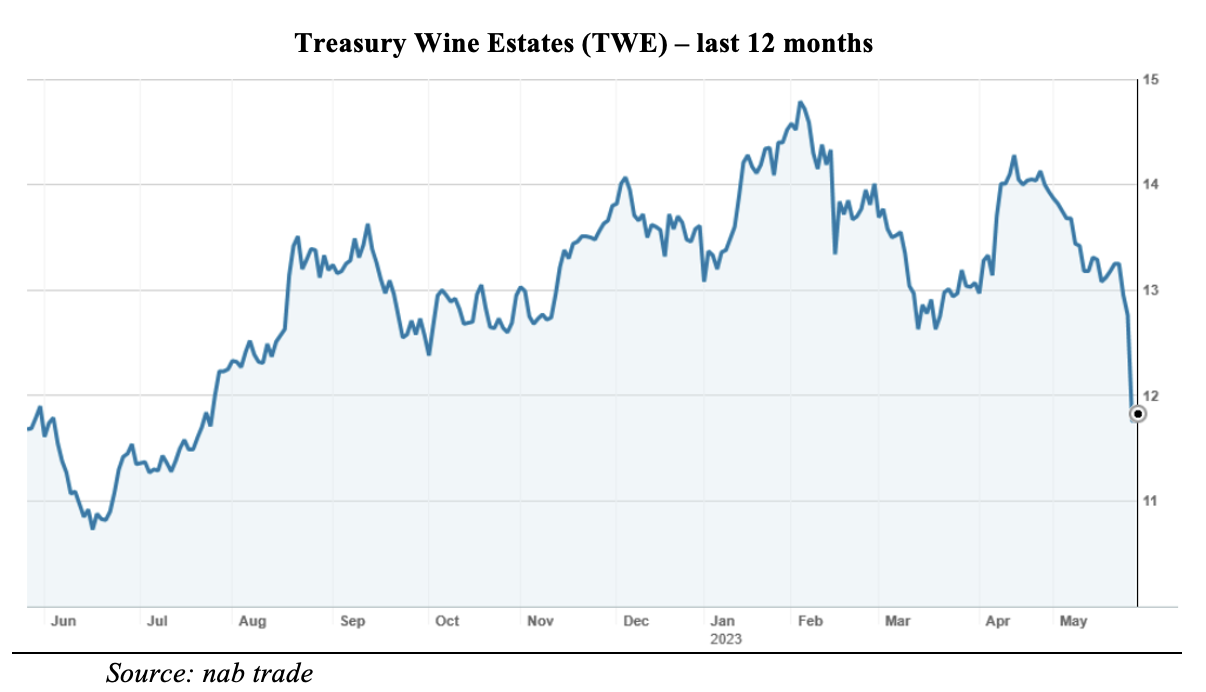

Last week’s sharp sell-off in Treasury Wine Estates (TWE) provides investors with an opportunity to buy into a business with robust growth prospects, best in class brands, tailwinds and a strong track record of executing in adverse circumstances.

The sell-off came in response to a trading update from Treasury Wines last Thursday. They marginally downgraded estimates for FY23 net sales and earnings, citing challenging conditions for entry-level premium wine in the United States. They also announced a range of initiatives to take out cost and improve margins in the Treasury Premium Brands portfolio.

Treasury Wines consists of three operating divisions: Penfolds, which generates just over 50% of earnings and operates on a margin of almost 45%; Treasury Americas, which produces and distributes wines in the USA including Penfolds and other Australian wines; and Treasury Premium brands, which produces and sells Treasury’s other premium and commercial brands in Australia, the UK and other markets. The latter includes brands such as Wynns, Pepperjack, Squealing Pig and 19 Crimes.

Whereas Penfolds is very profitable, the other two divisions are less so: Treasury Americas operates on a margin of around 23% and contributes around 35% of earnings, while Treasury Premium Brands operates on a margin of 12% and contributes only 13% of earnings.

Treasury has a strategy to “premiumise” its portfolio and currently generates 85% of its sales revenue from the “premium” and “luxury” categories. It defines “luxury” as wine that sells for more than $30 a bottle, and “premium” as bottles that sell for between $10 and $30. The balance of sales (approximately 15%) comes from the “commercial” tier (under $10 a bottle).

It says that global category growth is expected to be led by the premium and luxury segments, with CAGRS (compound annual growth rates) from 2021 to 2026 forecast to be 2.8% and 4.7% respectively. Premiumisation is being driven by the emergence of the ‘drink better’ trend and by younger customers who desire premium tastes and exclusive experiences. Penfolds is adjusting its portfolio accordingly.

The United States is the biggest market for these categories (28% share), with the top 10 markets representing 76% of global consumption. Interestingly, China’s share is not much bigger than Australia’s at around 5%.

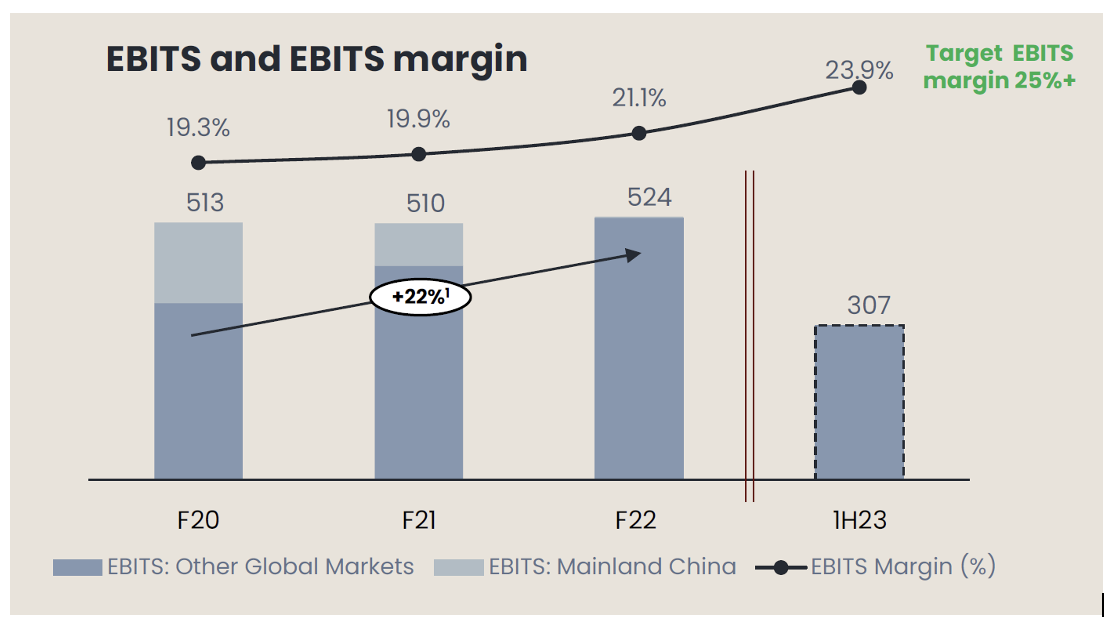

In 2020, China banned the export of Australian wine. While this hurt Treasury initially, it responded by accessing other markets, and in 2023, is set to deliver EBITS (earnings before interest, taxes, material items and an agricultural adjustment) of $580 to $590m, up approximately 11% to 13% on FY22. As the chart below shows, this will be around 14% higher than FY20, but with no contribution coming from sales from mainland China. (Mainland China earnings are shown in light grey, other global markets in dark grey).

For FY23, Treasury is expecting net sales to decline by 2% to 3% compared to FY22, with declines in Treasury Americas and Treasury Premium Brands to be partly offset by growth for Penfolds; an increase in overall margin from 21.1% to 23.5%; and an increase in earnings of 11% to 13% ($580m to $590m).

Category consumption trends for entry-level premium wine in the USA remain challenging and have deteriorated in recent months, impacting sales of the 19 Crimes portfolio of wines. In response, Treasury plans to reduce fixed costs and increase focus on priority brands, undertake a review of the commercial wine supply chain in Australia and explore divestiture or rationalisation of selected assets.

Over the medium term, Treasury is targeting sustainable top-line growth and high-single digit average earnings growth. With further “premiumisation” of the sales mix, an overall EBITS margin of over 25%, increasing ROCE (return on capital employed, 10.7% for FY22) and cash conversion of 90% or higher.

For the period 1 July 2020 to 28 February 2023, Treasury delivered total shareholder returns of 39% compared to the ASX200 of 22% and a group of ‘wine peers’ of 26%.

What do the brokers say

The major brokers remain supportive of TWE, although most cut their target price following the trading update. The new consensus target price (according to FN Arena) is $13.23, about 12.4% higher than Friday’s ASX close of $11.77. As the following table shows, the range is a low of $11.50 from Ord Minnett through to a high of $14.70 from Morgan Stanley.

Commenting on the trading update, Macquarie said: “Treasury Wine has announced a review of its premium brands. Management will restructure and adjust its operating model as volumes decline. Macquarie notes demand in the US for entry-level premium wine has continued to deteriorate and 19 Crimes in particular has underperformed expectations.

The broker reduces forecasts for FY23 and FY24 by -4.5% and -6.1%, respectively. Target is lowered to $13.90 from $14.90. Despite the deteriorating operating conditions, Macquarie remains bullish on the near-term prospects in China and retains an Outperform rating.”

Based on an ASX price of $11.77, the major brokers have TWE trading on a multiple of 24.4x forecast FY23 earnings and 21.2x forecast FY24 earnings. They forecast a full year dividend of 33.5c, putting TWE on a prospective dividend yield of 2.8% (fully franked).

Bottom line

I think there is value in Treasury in the ‘11s’. They have shown that they can execute in adverse circumstances following the loss of the China market and their “premiumisation” strategy appears sound. They are a leader, and with world class brands, they will attract investor and broker support. Buy.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.