As we make our way through August, the company earnings season reaches its crescendo. Over the next three weeks, I’ll produce a 3-part series casting our eye over the numerous reports to highlight some of those names that we believe have reported strongly and offer investors an attractive long-term proposition.

Markets enter the earnings season in an interesting position, having bounced off the yearly lows, raising the question as to whether the momentum can be continued from here.

Technical indicators

Looking at history and technical analysis signals can be effective in identifying major market reversals. One, in particular, is the 50% retracement level. As highlighted by CFRA Research, The S&P 500 Index flirted with that level of 4231 but ultimately closed above. In all bear markets since WWII, when the index has risen above that retracement level, it has been the start of the next bull market rather than a bear market rally that eventually fell to new lows.

Another key indicator to watch is the percentage of S&P 500 stocks trading above their 50-day moving averages. In more recent times, the 90% level has historically signalled the start of new bull markets coming off major lows such as 2009, 2011, 2018-2019, and 2020.

Fundamental landscape

Looking at the fundamental picture and the outlook appears less compelling. Current market estimates are for significantly lower EPS growth in FY23 and FY24, with more downgrades likely to follow. However, it does seem that lower earnings into the future have been at least partly factored into share prices.

At face value, the Australian share market looks on the cheaper side. The market’s average Price-Earnings (PE) ratio is in the 13’s, while the average dividend yield has risen to 5%. The long-term average PE in Australia is 14.9x. Excluding the two largest index sectors of banks and miners and the average PE in Australia quickly rises above 20x.

A reporting season highlight: REA

One business to report well in our view was REA Group (REA). With the strategy of “changing the way the world experiences property”, their most well-known brand in Australia is the widely used realestate.com.au which has been a dominant player in the space for many years and very much driven the success of the business. It is important to note that REA is becoming a far more diversified and wide-reaching company than many may be aware of.

While realestate.com.au is the number 1 residential property listing site in Australia, boasting 94 million monthly searches and by far the most successful brand for REA, that success has given management the ability to build a diversified portfolio of businesses, not only geographically with a presence in Australia, Asia and North America, but also with other property-related offerings, such as commercial real estate, share accommodation, mortgage broking, home loans and property portfolio management and analysis.

REA reached the $1 billion revenue mark for the first time and declared a record final dividend of 89 cents per share. Net profit climbed 25% to $408 million. Australia margins up 160bps to 67.1% when excluding the financial services write-down (pcp: 65.5%). After growing earnings by more than revenues, the “Positive Jaws” is expected to continue as REA guided mid to high single-digit cost growth in Australia, underpinning potentially >100-300bps of further margin expansion.

As highlighted by CEO Owen Wilson: “The relationship between house prices and listings, people assume they’re absolutely correlated and that’s not necessarily the case”. Residential buy listings growth was up 11% y-y (1H22: +17%; 2H22 +6%), which was better than expected.

REA has typically under-promised and over-delivered when commenting on the listings outlook. The group has indicated its assumptions are for low- to mid-single-digit declines in listings for FY23 as the property market continues to soften. With that in mind, price increases are already contracted from 1 July 2022 for +8% in FY22 and +6% in FY23. These were +6% and +5% respectively for rent listings.

We believe the business is in a position to weather the worst of any prolonged property downturn as the business has demonstrated during previous downturns, while also being encouraged by the large upside potential for international businesses in the far larger US and Asian markets. We feel the current price offers long-term investors the opportunity to pick a high-quality business well off its all-time share price highs, but nevertheless still growing revenues, earnings and margins at an impressive rate all while offering double-digit yield growth.

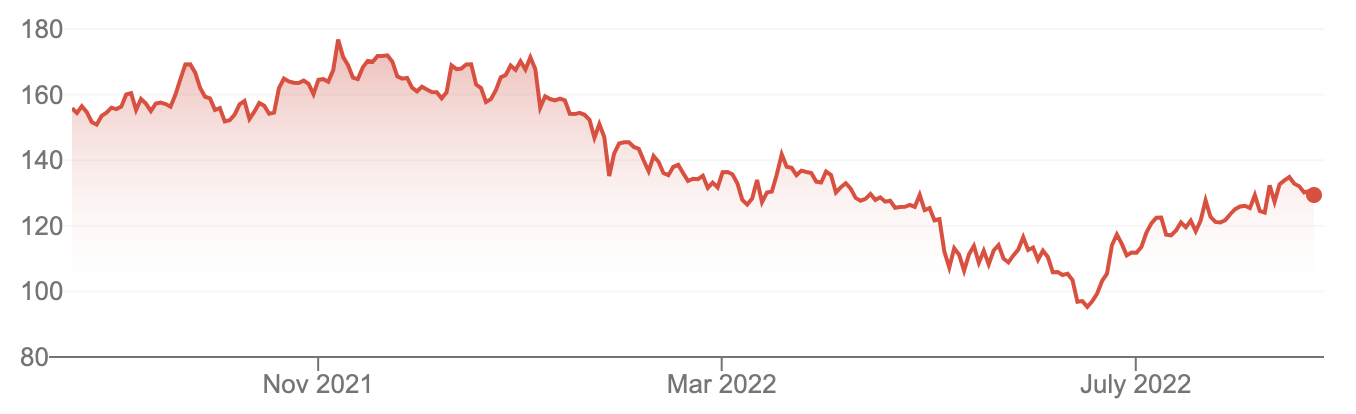

REA Group Limited (REA)

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.