Market participants who closely follow the headlines will be forgiven for thinking the last two months have been a non-stop barrage of negative news, with no shortage of reasons to panic. The actual outcome – major indices again trading within sight of all-time highs – seems somewhat incongruous, given all the doom and gloom of August. What has changed? In short: sentiment. After seeing a substantial collapse in bond yields in August, some recent data has pointed to the US economy being more resilient than expected. While the trade war is having an impact, it would seem the fundamentals – for now – still favour an expansion of the current economic cycle. As a result, bond yields have rebounded sharply in September, and equities have moved higher, although a different set of names have lead this rally.

To state my case clearly, I fundamentally believe that a combination of disinflationary advances in technology, ageing global demographics and increasingly insular trade policy will anchor interest rates at historically low levels; growth simply is not robust enough to withstand the impact of significantly higher interest rates on a sustainable basis. In September alone, 16 central banks have cut cash rates, with the ECB even going as far as reintroducing QE. Under this scenario of uneven global growth, low inflation and ultra-low interest rates, I strongly believe that companies that can organically grow their revenues and profits will outperform. As such, I believe the investment case for high-quality, industry-leading and structurally growing companies remains intact.

This month we have seen an equity market rotation from “growth” to “value” and “defensives” to “cyclicals”. Given the reversal in bond yields, it’s not surprising but I do not see the fundamental macroeconomic catalyst for it to be sustained. Fiscal stimulus could support a measure of reflation but I think investing on whether the political stars align to allow this to happen amounts to near-term speculation and is not a sustainable way to generate long-term outperformance.

I go back to my first principles: I want to own businesses with sustainable earnings growth, good governance and efficient capital allocation, which I believe will allow it to compound in value over time. There can always be periods of time when certain factors underperform but I don’t think trying to chase the flavour of the month to capture a shift in market sentiment is an exercise likely to bear fruit.

I strongly believe that companies that can organically grow their revenues and profits will outperform. As such, I believe the investment case for high-quality, industry-leading and structurally growing companies remains intact.

Inside this rotation I have been opportunistically deploying capital in existing and new global investments at what we believe are attractive entry points with a clear margin of safety. I’ve also started to look for some ASX-listed high quality ideas that have pulled back in this rotation.

Goodman Group (GMG) has been an Australian excellent example of all the attributes I describe above. Similarly, its share price has just pulled back around -16% from its recent peak, despite a full-year result that beat analyst expectations and led to consensus earnings upgrades.

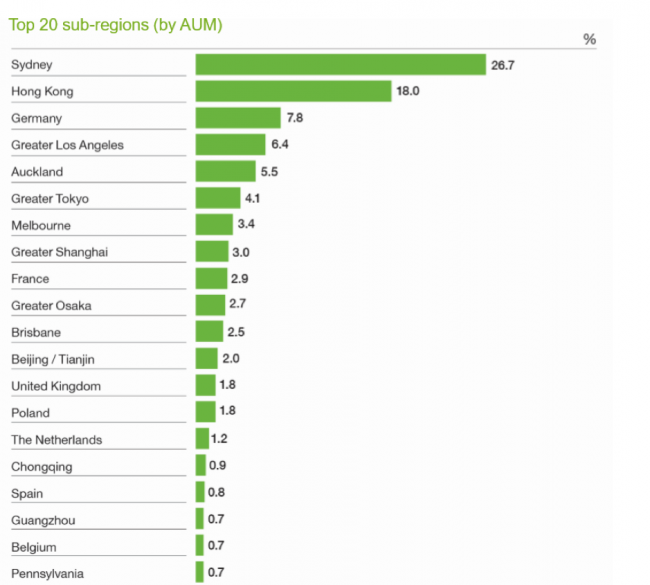

In the very short-term, three factors have worked against GMG. The first is the rotation from “growth & momentum” stocks, of which GMG is clearly one. The second is GMG has 18% of its assets under management in Hong Kong. The third is GMG is imminently to be removed from an influential global REIT Index.

The second point is the more important as passive funds selling GMG ahead of this index removal have exacerbated the share price downside, in my opinion. That is why I now believe there’s a margin of safety in GMG and I think it’s worth looking at.

For the record, GMG will be removed from the FTSE NAREIT Index on the close of trade this Friday the 20th of September. GMG, which is 1% of this index, no longer meets the requirements to be part of this index. Brokers estimate up to 50 million GMG shares in total will be sold by passive index trackers by Friday afternoon.

GMG is an integrated industrial property group. The group has operations in Australia, New Zealand, UK, Asia and Europe. Goodman’s activities included property investment, funds management, property development and property services. The groups property portfolio includes business parks, industrial estates, office parks and warehouse/distribution centres.

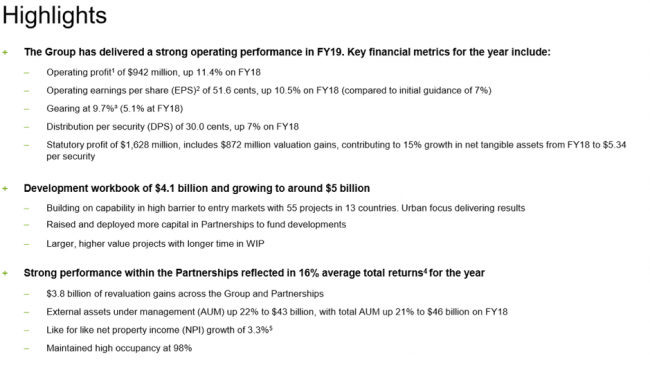

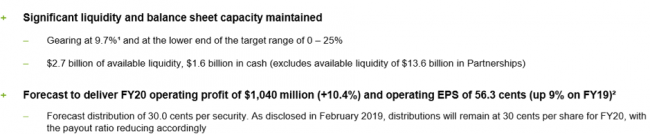

Let’s start by looking at the recently released FY19 results, which were very solid.

GMG’s strategy remains clear and logical.

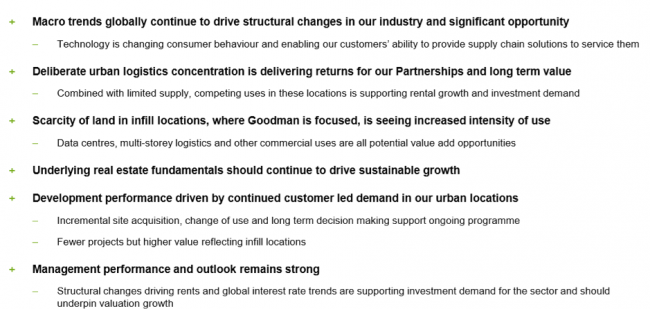

GMG’s TOP 20 customers are a who’s who of the leaders of the online retail and distribution world. This is a tremendous TOP 20 customer list.

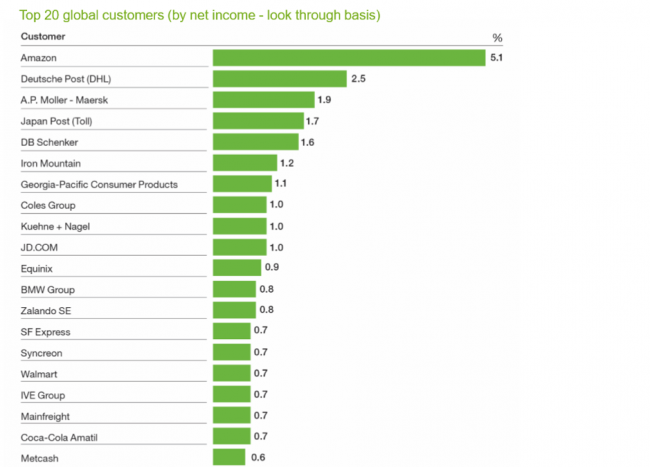

Geographic exposure by assets under management is tabled below. No doubt the 18% of assets in Hong Kong is currently weighing on sentiment.

I think we are well aware of the three short-term factors driving the -16% fall in GMG shares. However, I believe they are all short-term factors of which one will certainly disappear this Friday afternoon (Index change). I also believe that the factor rotation from growth stocks will prove short-term. The Hong Kong sentiment factor is less predictable but manageable unless we see PLA Tanks on the streets of HK. That would lead to the market putting a very low value on 18% of GMG’s asset base.

GMG is not a traditional REIT and not priced like one. It is priced like a structural industrial growth stock leveraged to the structural growth thematic of just-in-time inventory management for online retailers. This is really a play on technology and disruption without having to pay a tech multiple, but having the valuation support of hard assets and low gearing (9%).

In a recent UBS survey, over 50% of respondents expect to increase space requirements. 72% expect to use increased warehouse automation. This will add value to the underlying GMG real estate and lends itself to further cap rate compression at the asset level (valuation uplift).

GMG trades on around 21x forward earnings that will grow by around +10%pa. This dividend yield is around 2.3%. It’s not a bargain, but it shouldn’t be a bargain due to its excellent positioning and strong management execution. However, great businesses are rarely cheap and I think considering GMG into this pullback is sensible.

On the technical, the stock has pulled back to and held the 200-day moving average twice. I tend to believe that’s encouraging.

At the analyst level, there are 3 buy, 2 hold, and 3 sell recommendations. The median 12 month price target is $14.96. That is also encouraging, as it suggests analysts are not universally bullish on GMG.

GMG has all the attributes I seek in looking for a stock that will compound over time. That’s why I am looking at it in this rotation from growth stocks.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.