Regular readers know I’m backing a 10% rise in the stock market this financial year, as a minimum. To that I’d add at least 5% for dividends, but I’m hoping that the RBA doesn’t make it all too difficult by raising rates too high and thereby creating a recession. Mind you, a mild technical recession would be OK as it would speed up rate cuts, which would be another reason to buy stocks.

But what are the other reasons for market optimism?

For starters, there’s the rebound of the Dow Jones Industrial Average (DJIA), which has recorded strong gains 14 out of the last 15 trading days. If it had gone up on the 14th day on a trot, rather than missing one and then rising on the 15th, it would’ve equalled the historic run of 1897!

So, why is there this huge positivity for the 30 stocks in the DJIA? Well, this isn’t a tech-heavy index like the Nasdaq, which is up about 38% year to date, while the Dow is up only 7%. The techies in this most-quoted index are Apple, Intel, IBM and Alphabet.

The big tech companies have been favoured by the big market influencers, but now the Yanks are near the top of their rate rises, other companies will be chased (other tech and other good quality growth companies that have been hit by the negativity linked to big rate rises).

There is bound to be rotation out of defensive stocks into growth stocks that will power US share markets, and this will give our market a lift as well.

This recent Dow surge is linked to four big issues for investors:

- Inflation data in the US is looking good.

- Interest rate rises could be over, or nearly over.

- Company earnings are better than expected; and

- The fear of recession has been pushed back into 2024, or even later.

Also, out there waiting to happen is a China stimulus and a global surprise that inflation is likely to fall in other economies, as we’ve seen in the US and here.

Sure, our annual inflation reading is 6%, down from 7%, but the annualised number on the 0.8% rise in the June quarter of 3.2% augurs well for the rest of the year.

The stars are aligning. As long as economic data doesn’t stagger us with some surprise developments, then I expect a gradual uplift in stocks for the Dow, the S&P 500 and the S&P/ASX 200.

I’m asked if the Nasdaq could fall because of the big surges for the Magnificent 7 stocks (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla) but I argue there are 93 stocks in the top 100 Nasdaq list that will power that index higher.

But what about our S&P/ASX 200? There are a lot of growth and smaller cap companies that will be re-loved over the next 12 months as rate rises end. But because of the addiction to ETFs, many of our big cap market drivers will help our index go higher.

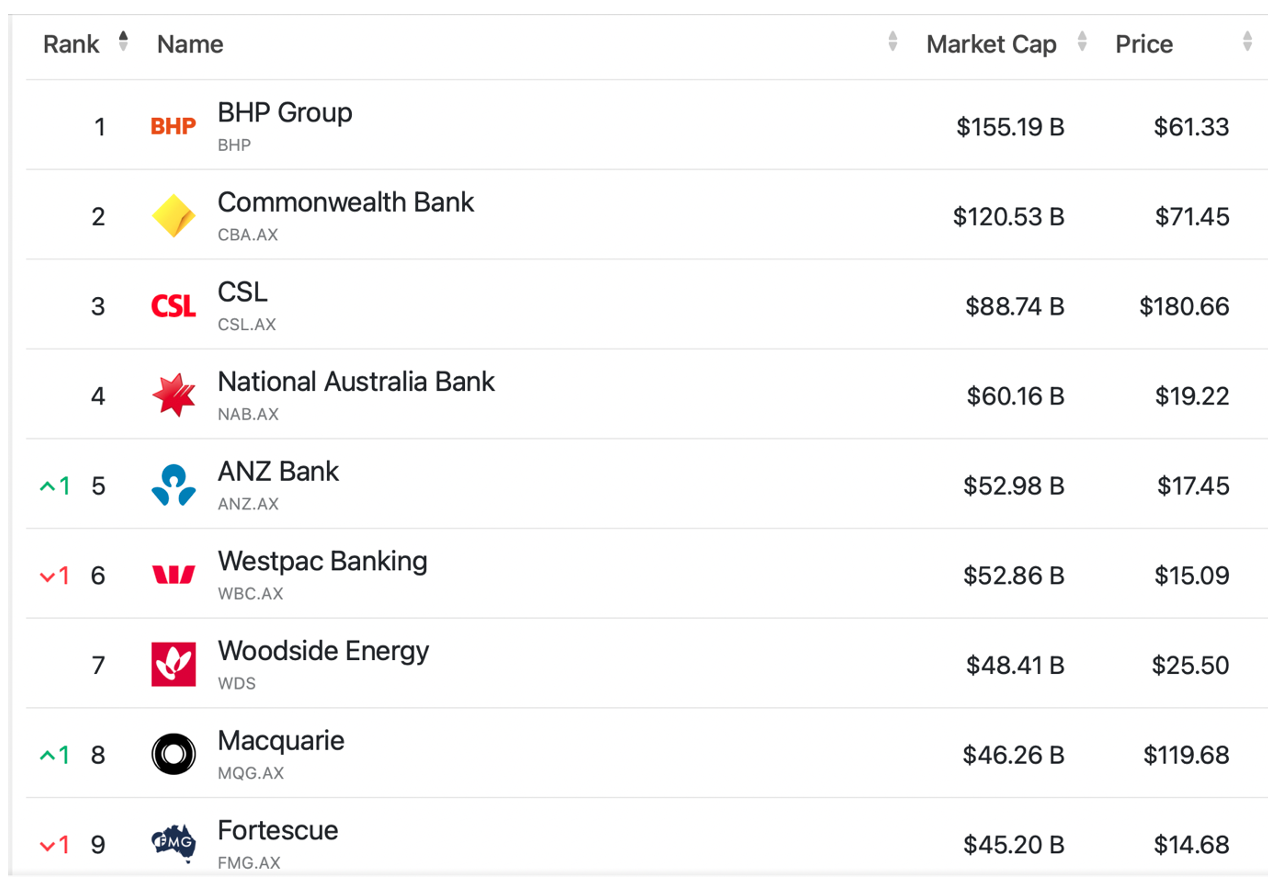

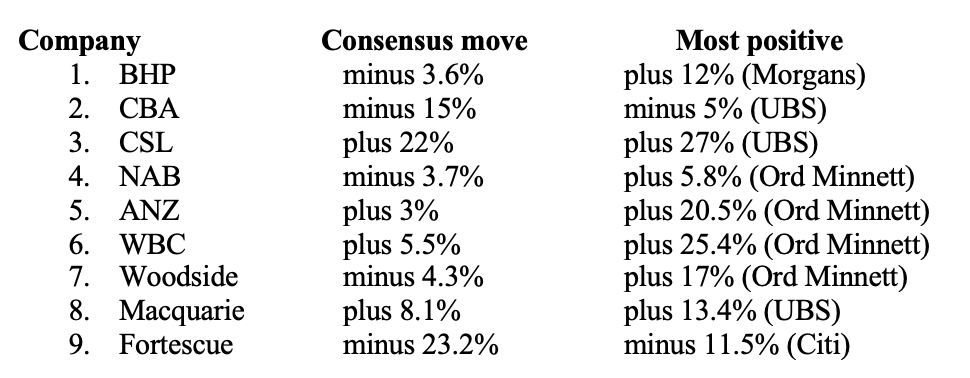

Here’s the list of our top nine companies by market weight, and what the analysts say about them also gives reason to believe our market can go higher.

On first blush, you might see that five of our biggest companies have negative price outlooks, if you can believe the analysts. But I believe the chasing of ETFs naturally creates demand for these top stocks, so many of these negative views could prove to be excessive and off the mark.

If China stimulates, our big miners could have a better 2024 than analysts are now tipping. And if we avoid a worrying recession and rates stop rising, then we could see many smaller companies lead the way for the S&P/ASX 200.

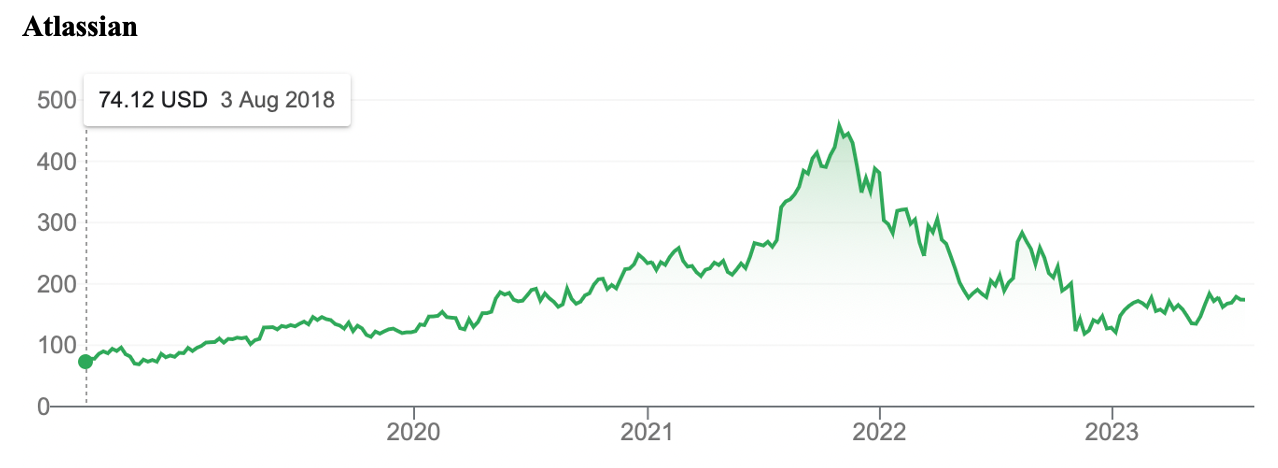

What we all should be waiting for is the Fed making it clear that no more rate rises are needed. Because when that happens, it will be like a starters gun in a race for investors to chase great companies that have seen their stock prices smashed since late 2021 and early 2022.

In the US, Atlassian is a case in point and is a company that will help the Nasdaq and S&P 500 go higher in the year ahead.

Locally, we’ll have a lot of companies that will be making comebacks over the next 12 months. That will be our main task identifying them over coming months before the ‘rate rises are over’ signal comes.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances