With the Ukraine war dragging on, and no news giving us hope that a timely end to hostilities is near at hand, investors face the proverbial Dirty Harry-like question that goes: Do you have the guts (either now or soon) to gamble that it’s time to pull the trigger on buying beaten-up stocks or even simply go long an index ETF?

Most of my investing life I’ve avoided buying stocks or markets on the slide, driven by the old maxim/advice — “don’t catch a falling knife.” Wisdom has taught me to wait for a stock price to bottom and maybe rise 5% or so before getting on board, rather than getting in too early. That said, if we’re near the bottom of the market sell-off because of the Ukraine war, then a small fall that gives way to a big bounceback might be a risk worth taking for some investors.

Have stock declines bottomed?

Significantly, Bank of America on Friday speculated that stock declines related to the war could have bottomed. “The S&P 500′s -12% decline from its peak suggests much of the froth has been taken out,” said Savita Subramanian, equity and quant strategist at Bank of America Securities. “Stocks are largely pricing in the geopolitical shock, where the S&P 500 fell 9% from peak-to-trough since Russia-Ukraine headlines in early Feb, similar to a typical 7-8% fall in prior macro/geopolitical events.” (CNBC)

On Saturday in this Report, I referred to the big call merchant Tom Lee of Fundstrat Global Advisors, who sees the S&P 500 at 5200 by year’s end. This Index finished at 4200. So even if we do our numbers on 5000, if Tom’s prediction is on the money, he’s seeing a 19% rebound!

So what next?

If the US stock market can achieve this, it has to be good news for our stock market that already looks poised to have a better year than Wall Street. Our market’s reliance on resources, financials and energy was always going to be good for our index-oriented ETFs, after we have languished behind the more diversified S&P 500, with its heavy exposure to great tech companies that most of us use daily. Who doesn’t use an Apple, Microsoft or Google product or service, or use the likes of Facebook, Netflix and Amazon? These stocks drove the S&P 500 up 38% from its pre-pandemic highs, before the sell-off that started on 4 January. We were only up 4% before the sell-off, when inflation got US experts talking about lots of interest rate rises from the Fed, starting in March.

I expect the Fed will raise the official rate by 25 basis points this week.

However, when war fears dissipate along with virus concerns, cyclical and value stocks are likely to lead share markets higher, which should help our market.

Since the 4 January sell-off, the S&P500 Index is down 10%, while our S&P/ASX 200 is down only 6%. This is a sign that not only will we fall less with sell-offs, but we’re likely to rise more quickly when markets decide it’s time to stop worrying about the war.

Of course, inflation and interest rate concerns will take centre stage once the war is over, but even in this kind of setting, I expect our market to have less rate-rising concerns compared to the Yanks, which should help local stocks.

The S&P500 Index has relatively more tech stocks in it than the ASX 200, and while I think they will stage a comeback later in the year, that negative rising interest rates/tech story will undoubtedly get another run if inflation remains stubbornly high and the Fed gives a few months of rate rises.

Here’s where I stand…

I’m in the “inflation is transitory” camp but this war will make the transition period longer than I (and many people) expected. Timing the stock market is historically proven to be very risky. Academic work shows that decisions to be out of the market for whatever reasons (usually fear) mean that market-timers often miss the big rebound days, after being exposed to huge sell-offs that sparked the decision to “get out” or go excessively defensive.

One of the best plays for anyone who believes my analysis and can bear being a little bit wrong short term in order to be very right long term could do worse than simply buying the likes of the ETFs such as IOZ, STW, A200 or VAS. These give you exposure to our top 200 companies and a dividend of about 4% plus franking credits.

If you want to play the same sort of game but with more dividends, then SWTZ or Vanguard’s VHY are options to ride up a rising stock market down the track.

For the thrill-seekers…

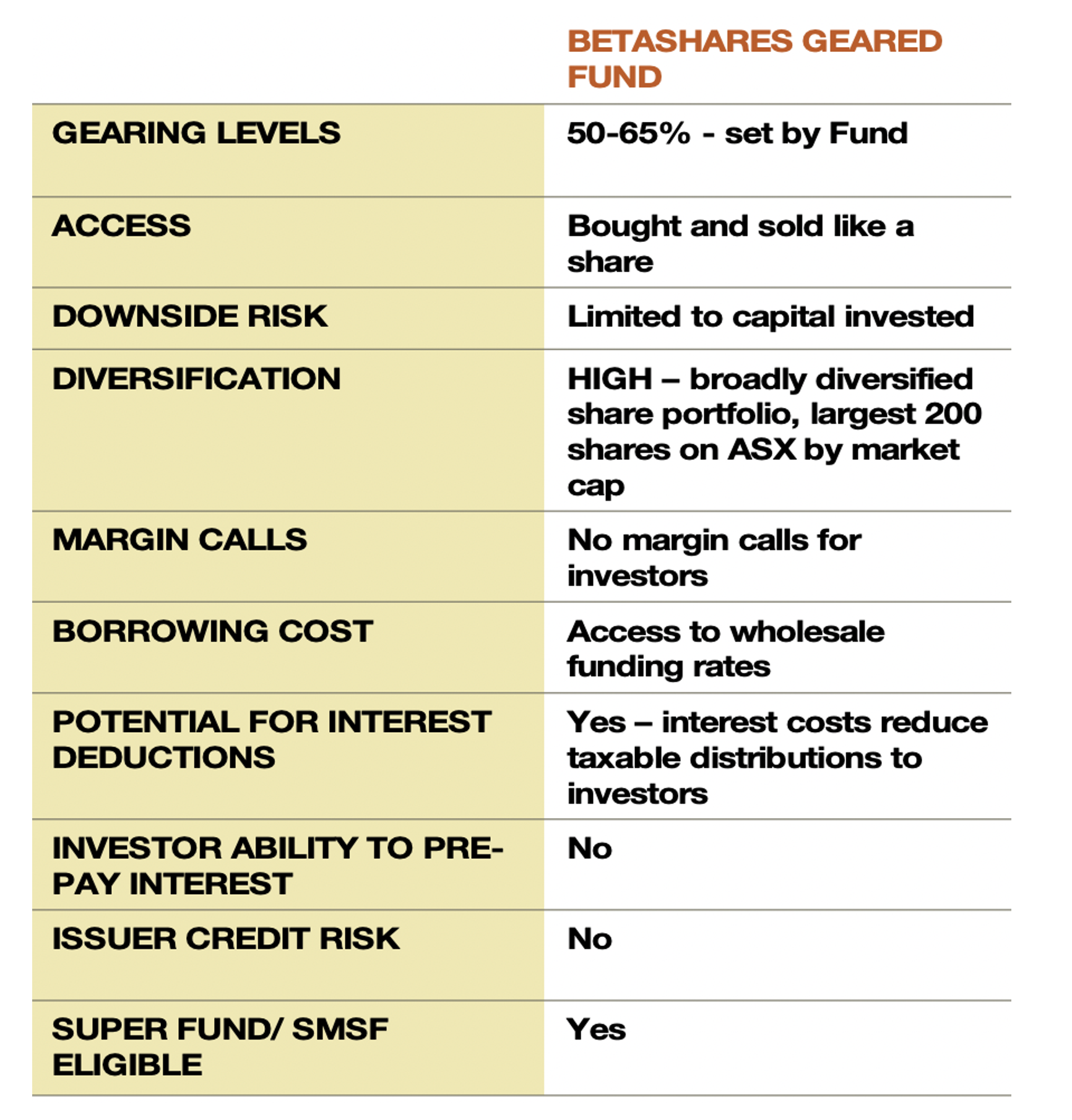

If you’re a thrill-seeker, you could ramp up the potential return by investing/speculating in BetaShares’ listed product called GEAR.

This is a simple explanation of GEAR: “The BetaShares Geared Australian Equity Fund (Hedge Fund) is a registered managed fund (i.e. unit trust) that trades on the ASX. GEAR will implement the investment strategy by combining funds received from investors with borrowed funds, and invest the proceeds in a broadly diversified share portfolio.”

A word of warning

The appeal of something like this is that if the market rebounds, you’ll get a magnification effect. But the worry is if the market falls, you will get this magnification effect in the wrong direction!

The gain or loss can be close to 3 times higher than investing without gearing but you have to be aware of the risks you’re taking. The only less worrying aspect of GEAR is that there are no margin calls, which you can stay in as long as you can tolerate the losses or live with the wins!

If you’re willing to take the punt on GEAR, it might be wise to wait for some solid indications that peace is a chance in Ukraine. And I wouldn’t be in GEAR for too long after 2022, because rising interest rates are bound to add to volatility over 2023 and 2024.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.