With the US stimulus package just about across the line, Wall Street has had back-to-back rises for the first time since February. And early monitoring of US stock market futures indicates the key indices will open higher on Thursday.

This raises two questions you might want to ask me.

First up, am I buying? And if not, why?

Personally I’m waiting but my wife has started buying the banks. Apart from liking them at the current low prices, she liked what she heard when I asked Chris Joye, on my Switzer Show podcast, about the strength of our banks, with some Australians worried about the possibility of a bail-in, where deposits at banks could be at risk. She also liked Paul’s (Rickard) article that he wrote on Switzer Daily [1].

Chris, who is the founder of Coolabah Capital, an AFR columnist and an adviser to the Morrison Government on many things monetary (as the bond market is his strength), insisted that our top four banks are rated as some of the soundest in the world! In his article, Paul added, if not the soundest.

The recent moves for the stock market should be tagged: “So far, so good.” To rid us of this bear market where our stock market has fallen 29% since our February 21 high of 7,139, we need four planks to the floor upon which an economic and stock market recovery will be built.

First, do central banks have supportive policies? Tick!

Second, are there fiscal stimulus packages? Tick!

Third, are banks coming to the rescue with loan repayment deferments and cheap loans? Tick!

Fourth, are there reducing rates of infection and death rates in Europe and the USA, in particular? No tick here, yet!

In Australia, we clearly care about our economy and death rates but so far we look like we’re doing well on an international comparison basis.

When Wall Street thinks the US has got over the worst of this health challenge, stocks will soar.

The former Fed boss, Ben Bernanke, a Great Depression expert, thinks this economic and stock market crisis is not like the 1930s Depression, comparing it more to a natural disaster, but he inferred strongly that the infection and death rate curves need to flatten.

“It is possible there’s going to be a very sharp, short, I hope short, recession in the next quarter because everything is shutting down of course,” he said on CNBC this morning.

And if the health readings are on the improve, he said “a fairly quick rebound” was on the cards.

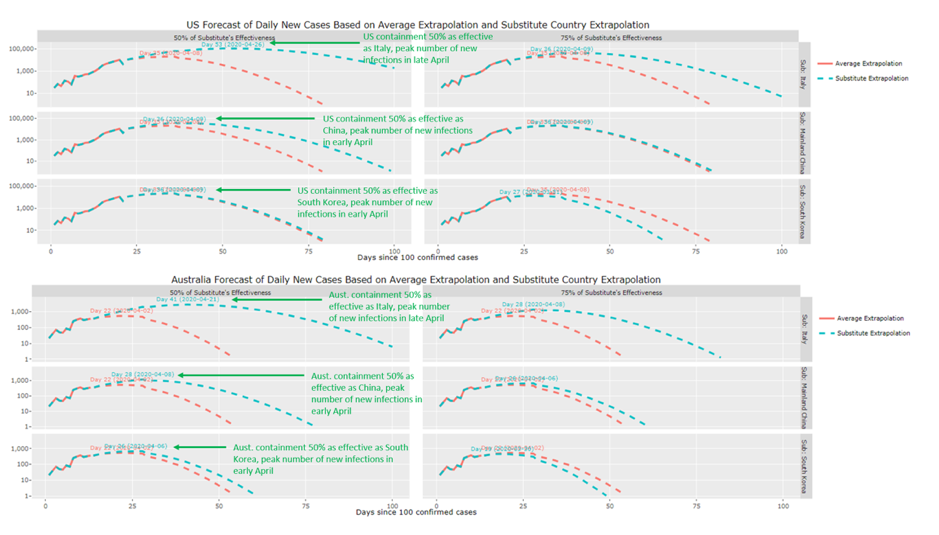

The importance of infection readings is such that Chris Joye has his money market team on constant watch of data on infection rates, as depicted on curves on curves on curves!

Below is what he sends me every day as he and his team pour over the data that will signal when the worst of this virus is behind us and it will be the most powerful signal that it’s time to buy.

Don’t worry if you don’t understand these charts but rest assured we are watching these the way a Labrador watches a sausage at a barbecue!

Italian signs are only possibly getting less scary but we’ll need a week before we’re convinced — but the Italian stock market rose 1.7% overnight and I hope this is an early sign of hope for the Italians.

Overnight my SWTZ fund manager, Shawn Burns, who isn’t easily excitable, emailed me the following: “I don’t often do this but I am excited. The US High Yield credit market appears to have turned, that is the first sign of recovery, in my opinion. That is, easier money for those most in need. Of course, I could be wrong, however, if these hold, I think we have seen the worst of it.”

This morning I was talking to my charts guy from my old Sky Business TV show — SWITZER — Lance Lai, who has been on a break from market speculation via squiggly lines. He’s not too confident about the Oz dollar and Wall Street, but he says the local market is looking slightly better. But we agreed, this time it’s different, because we need to understand the likely course of the Coronavirus.

The best news this week came from Chris Joye, who is speculating, based on his constant analysis of virus data, that good signs could be showing up in three weeks time. This lines up with the hopes of the Governor of New York, Andrew Cuomo, who thinks the apex of the infections will be in 21 days time.

If that’s right, people like Joye will be detecting this — and that’s when stocks will soar.

Let’s hope it happens according to this script or better still, even before.

For my part, I want to see a sustained trend up before I go headlong into stocks. And I don’t care if I miss the first 10% upside, because there is bound to be another 20% plus to follow.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.