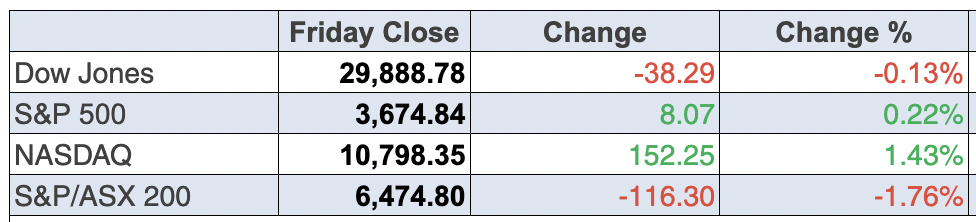

It’s 10pm in Milan and I’m about to retire to bed. The Dow closed down a mere 0.13% but the S&P 500 was 0.22% higher and the smashed Nasdaq crawled 1.43% up on the day. That’s nice to see but I can’t see this sell-off ending until we get some unambiguous good news, which I’m not seeing yet.

I can’t blame anyone for asking: “What the ‘F’ is going on with stock markets?”

The answer is simple! The ‘F’ stands for fear. And it’s the fear that central banks will screw up rate rises and cause a recession.

But remember this: this isn’t fact, it’s speculation. However, markets are driven by speculation in the first instance but eventually, they have to face reality. And that’s when it’s often concluded that a big buyer surge was based on excessively positive expectations. Right now, it’s the reverse of this.

Either way for the long-term player, there’s value in the beaten-up stocks and one day in the future, you’ll be glad you became a buyer. As I said last week, Professor Jeremy Siegel of the Wharton School at the University of Pennsylvania advised us: “We’ve had bigger shocks in the past … There may be another 5%, who knows, there may be another 10%, but that means for me, moving forward, that just raises the return on the market looking forward,” Siegel said on CNBC’s ‘Squawk Box’. “Hold in there. If you’ve got cash, begin to employ it. You won’t be sorry a year from now.”

I’m writing this from Milan, Italy and European markets ended in positive territory. And before the close, the Yanks are doing their best to keep it positive but, in reality, there’s no one really trying to keep it positive or negative.

The indices we reference only show that sellers outnumber buyers in terms of weight of money or vice versa. And one day in the future, that will actually happen. For now, the value-hunters who have a longer-term view are bottom-fishing, but no one knows when the overall market sentiment changes.

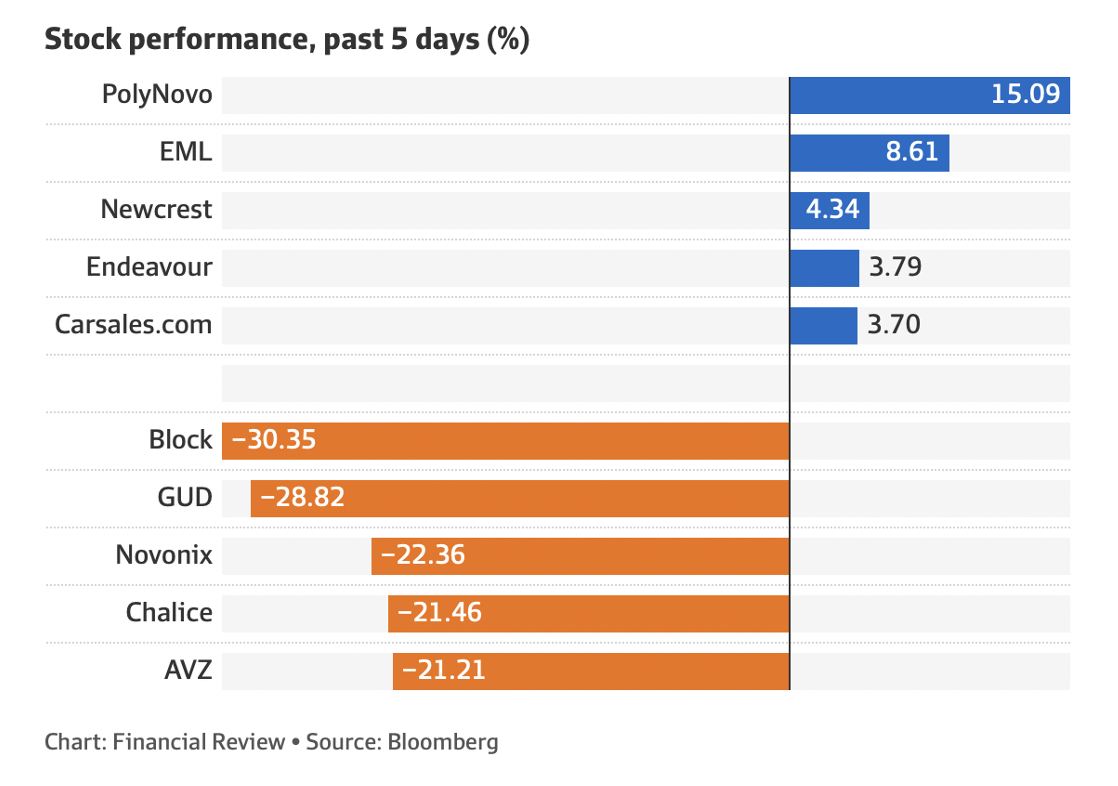

I noted on Friday as our top 200 index lost 116 points (or 1.76%), Tyro rose 0.6%, EML 9.43%, ELO 2.26%, A2M 4.24%, Altium 0.27% and MFG (poor old Magellan) went up 1.79%.

These moves against the tide are actions by those who simply are punting on an eventual change in sentiment, which I’ve previously said would more than likely happen around September/October.

All we know right now are these things:

- The S&P 500 is in a bear market, with the index down over 20%.

- The S&P/ASX 200 is in correction mode, off 14.69% year-to-date.

- Cryptocurrencies are in a bear market and, along with tech stocks, are being smashed.

- Along with investor confidence, consumer and business confidence is falling.

- A great stock such as Macquarie is down 24% and that’s a buying opportunity.

Meanwhile, the causes of this sell-off (i.e., the potential interest rate rises ahead and the likelihood of a recession) are all speculative guesses. The AFR’s US journalist Matthew Cranston gave us this: “After the biggest rate rise in 28 years, Federal Reserve chairman Jerome Powell went to great lengths to convey what Nobel Prize-winning economist Paul Samuelson said almost 60 years ago about predicting recessions,” he wrote. “Samuelson quipped that US share-market sell-offs had correctly predicted nine of the last five American recessions.”

The reality is the Fed is trying for a soft landing for the US economy and I think it’s an even-money bet that might or might not succeed. But all this fear created by the US and our local central bank is what was wanted to slow down inflation.

If the media goes over the top and ramps up the scare factor, they could do us a favour because then central banks could give us fewer rate rises!

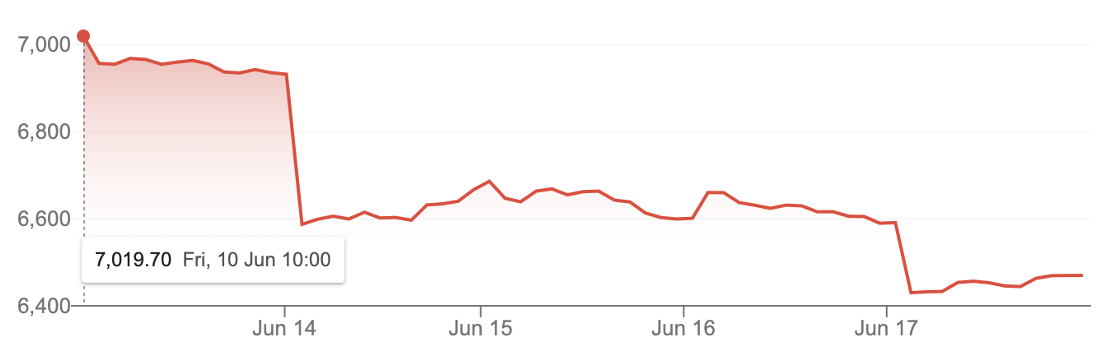

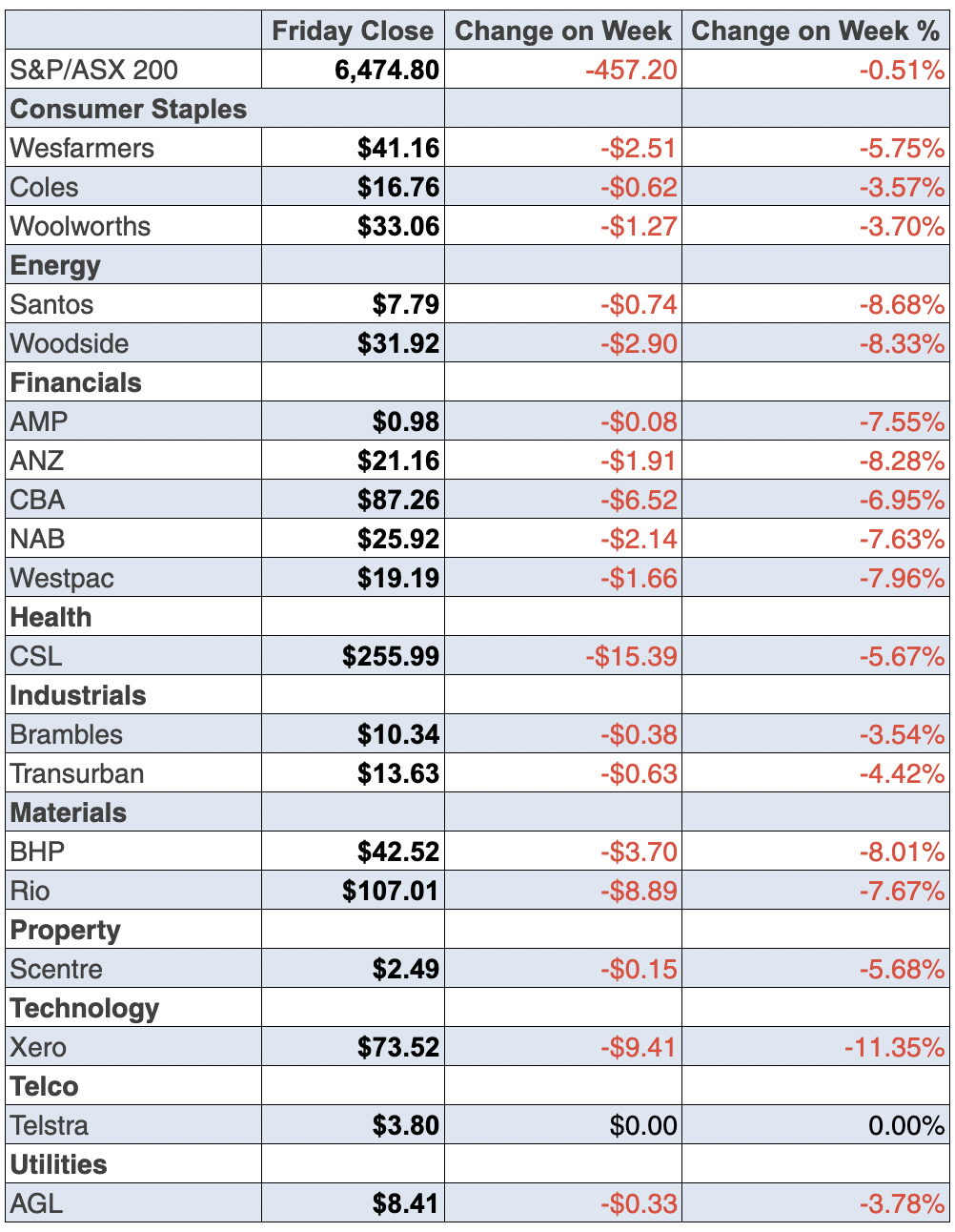

To the local story and the S&P/ASX 200 lost 6.6% for the week and 18 months of gains have now been kissed goodbye.

This is the bad news in pictures:

S&P/ASX 200

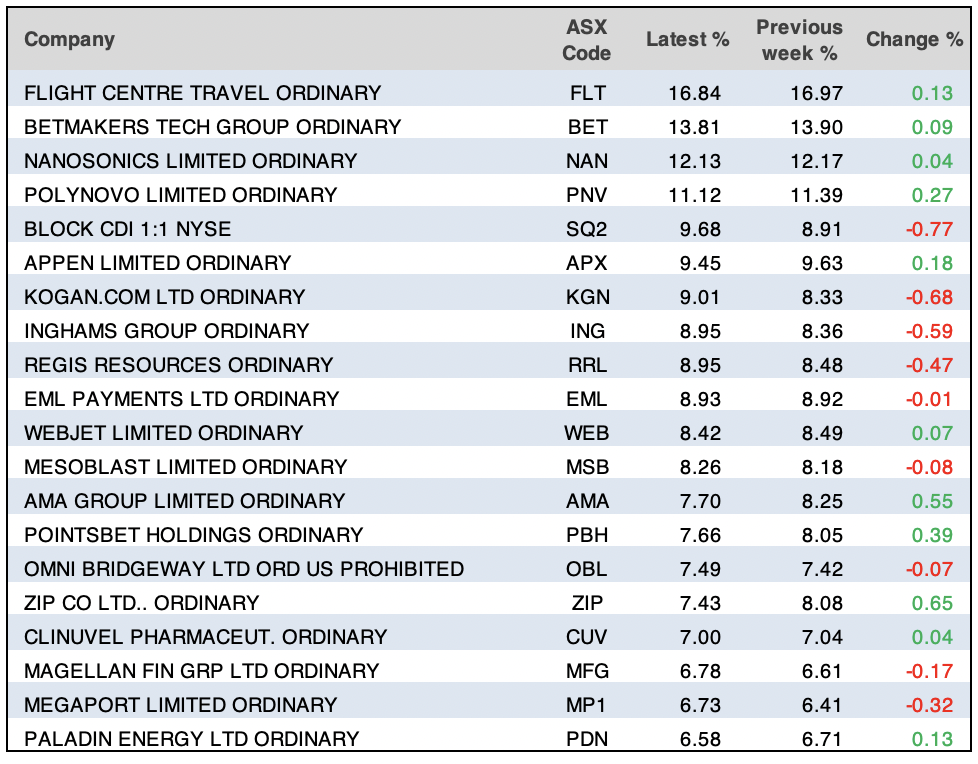

In bad weeks, I always like to see who the contrarians liked, so here are the winners and losers from Bloomberg and the AFR.

Block is copping it as the consensus is that buy now pay later businesses are under the pump. It’s going to be interesting to see how that plays out.

The dumping of Xero (down 5.74% to $73.52) underlines how crazy this sell-off is and screams “buy me” for the long-term investor who only wants to hold quality businesses.

One interesting story that’s a sign of the time was underlined by the AFR’s Cecil Lefort. This is what was reported: “The index’s biggest laggard was designer, manufacturer, and distributor of automotive products GUD Holdings down 19.6 per cent to $7.3 after downgrading its guidance due to supply chain disruptions.”

Hold that thought. GUD has supply chain problems, which are a sign of the times but eventually supply won’t be a problem.

The analysts surveyed by FNArena predict a 72.6% upside, with five out of five expert company watchers liking the business. And Macquarie is the most positive, with a 119.28% call on the company!

Think about that.

What I liked

- A positive sign from CommSec about normalcy returning: “In May, provisionally there were 651,060 overseas arrivals to Australia – the most since Covid-19 international border restrictions were imposed in March 2020. And there were 663,970 overseas departures from Australia last month – the most in over two years. “

- The Federal Reserve chair, Jerome Powell, expressed optimism for a soft landing for the economy. Gotta hope he’s right!

- The Fed’s voting members think US economic growth, as measured by GDP, is now forecast to expand by 1.7% in 2022.

- Employment rose by 60,600 in May with full-time jobs up by 69,400, but part-time jobs were down by 8,700. Total employment hit a record high of 13.51 million in May. (I know a strong jobs market might push the RBA to make too many rate rises but it will also fight those predictions of recession.)

- Unemployment rose from a 48-year low of 3.86% in April (lowest since August 1974) to 3.9% in May in response to a record participation rate. People looking for a job is a good sign for the economy.

- After an unscheduled meeting, the European Central Bank said it would skew reinvestments of maturing debt to help more indebted eurozone members and would devise a new instrument to stop the fragmentation of the bloc’s bond market. (Christine Lagarde isn’t a dope and her response to the stock market sell-off shows that.)

What I didn’t like

- The Westpac-Melbourne Institute Index of Consumer Sentiment fell by 4.5% in June to a 22-month low of 86.4 points, down 19.5% on a year ago.

- The National Australia Bank (NAB) business confidence index fell from 10.1 points in April to 6 points in May (long-run average: 5.4 points). And the business conditions index eased from 18.6 points in April to 16.2 points in May (long-run average: 5.9 points).

- The weekly ANZ-Roy Morgan consumer confidence index fell by 7.6% to 80.4 (long-run average since 1990 is 112.4). Sentiment is at the lowest level since early April 2020.

- The US Federal Reserve increased its target range for the Federal Funds rate by 75 basis points (three-quarters of a per cent) to 1.5%-1.75%, the biggest rate hike since November 1994. I might eventually like this big hike if it scares US consumers enough to bring down inflation quicker than expected and that will be good for stocks. That said, this week’s slide in stocks is linked to the big rate rise possibly causing a US recession.

- The producer price index (PPI) rose by 0.8% in May to be up by 10.8% on the year (survey: +10.9%) — that has to change ASAP!

- According to the “dot plot” of individual Fed members’ projections, the benchmark interest rate is expected to end the 2022 calendar year at 3.4%, an upward revision of 1.5 percentage points from the March 2022 estimate. That’s too much of a rise. Thankfully these guys have a bad history of predicting rate movements!

- In US economic data, housing starts fell by 14.4% in May to a 1.549 million annualised rate (survey: 1.69 million). Building permits dipped 7% in May to a 1.695 million annualised rate (survey: 1.78 million). The Philadelphia Fed manufacturing index fell from 2.6 points to -3.3 points in June (survey: 5 points).

- This US data are all showing the US economy is being challenged: retail sales fell by 0.3% in May (survey: 0.2%). Import prices lifted 0.6% in May (survey: 1.1%) with export prices 2.8% higher (survey: 1.3%). Business inventories rose by 1.2% in April (survey: 1.2%). The NAHB housing market index eased from 69 to 67 in June (survey: 67). The Empire State manufacturing index rose from -11.6 to -1.2 in June (survey: 3). MBA mortgage applications rose by 6.6% in the past week. (By the way, nothing in this data says a bad recession is coming, which, of course, I like.)

What central banks want

European share markets dropped to their lowest level in 16 months on Thursday on inflation and growth concerns. In the above likes and dislikes, I’d usually unashamedly say that I didn’t like a fall in business and consumer confidence but now the RBA and other central banks need to see slowing economic data. So bad news is kind of good news as it will reduce the number and size of future interest rate rises. Economics isn’t just a dismal science, it can, at times, seem irrational, but it’s my job to explain these screwy though important takes on the economy.

The week in review:

- With the public holiday last Monday, we just had Thursday’s edition of the Switzer Report this week, and in his feature article, [1] Tony Featherstone goes through 3 defensive small-cap stocks that look attractive at current prices and meet his criteria for buying.

- In our “HOT” stock column, Michael Gable, Managing Director of Fairmont Equities [2], explains why he thinks Graincorp (GNC) is a stock worth considering. [3]

- In Buy, Hold, Sell – What the Brokers Say, there were 2 upgrades and 3 [4]downgrades from the 7 stockbrokers monitored by FNArena so far this week.

- In Questions of the Week, [5] Paul (Rickard) answers subscribers’ queries about crystalizing a capital loss on a share and any rule about how long you need to wait before buying them back?; Why has Appen had such a miserable run? Why has Grange Resources trebled in price over the last 12 months? With the spouse tax offset, who gets the tax offset – the spouse or the person making the super contribution?

- And with only a couple weeks to go before the end of the financial year, Paul urges you to figure out whether you could benefit from some or all of his 7 tax tips. [6]

Our videos of the week:

- What are the lasting symptoms that come with long COVID? | The Check Up [7]

- With the RBA Governor saying that inflation could hit 7%, is this still a “buy the dip” market? [8]

- Michael Gable on whether CBA & FMG are potential buys + should you buy off the plan? | Switzer Investing (Thursday) [9]

- Boom! Doom! Zoom! | 16 June 2022 [10]

Top Stocks – how they fared:

The Week Ahead:

Australia

Tuesday June 21 – Reserve Bank Board minutes (June 7)

Tuesday June 21 – Review of the Yield Target

Tuesday June 21 – Speech by Reserve Bank Governor

Wednesday June 22 – Detailed skilled vacancies (May)

Thursday June 23 – Finance & wealth (March quarter)

Thursday June 23 – Purchasing manager surveys (June)

Thursday June 23 – Detailed labour force (May)

Thursday June 23 – Business conditions and sentiments (June)

Friday June 24 – Reserve Bank Governor on panel

Overseas

Monday June 20 – China Loan Prime Rates

Tuesday June 21 – US Existing home sales (May)

Tuesday June 21 – US National activity index (May)

Wednesday June 22 – US MBA mortgage applications

Wednesday June 22 – Testimony by US Federal Reserve Chair

Thursday June 23 – US purchasing manager surveys (June)

Thursday June 23 – US Current account (March quarter)

Thursday June 23 – US Kansas City Fed manufacturing index (June)

Friday June 24 – US consumer sentiment (June)

Friday June 24 – US new home sales (May)

Friday June 24 – China Current account (March quarter)

Food for thought: “You don’t get rich by what you earn. You get rich by what you don’t spend.” – (Henry Ford)

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before. NOTE: No data released from ASIC for week commencing Tuesday 14 June 2022. The above table has been compiled from the most recent data released by ASIC on Friday 10 June 2022.

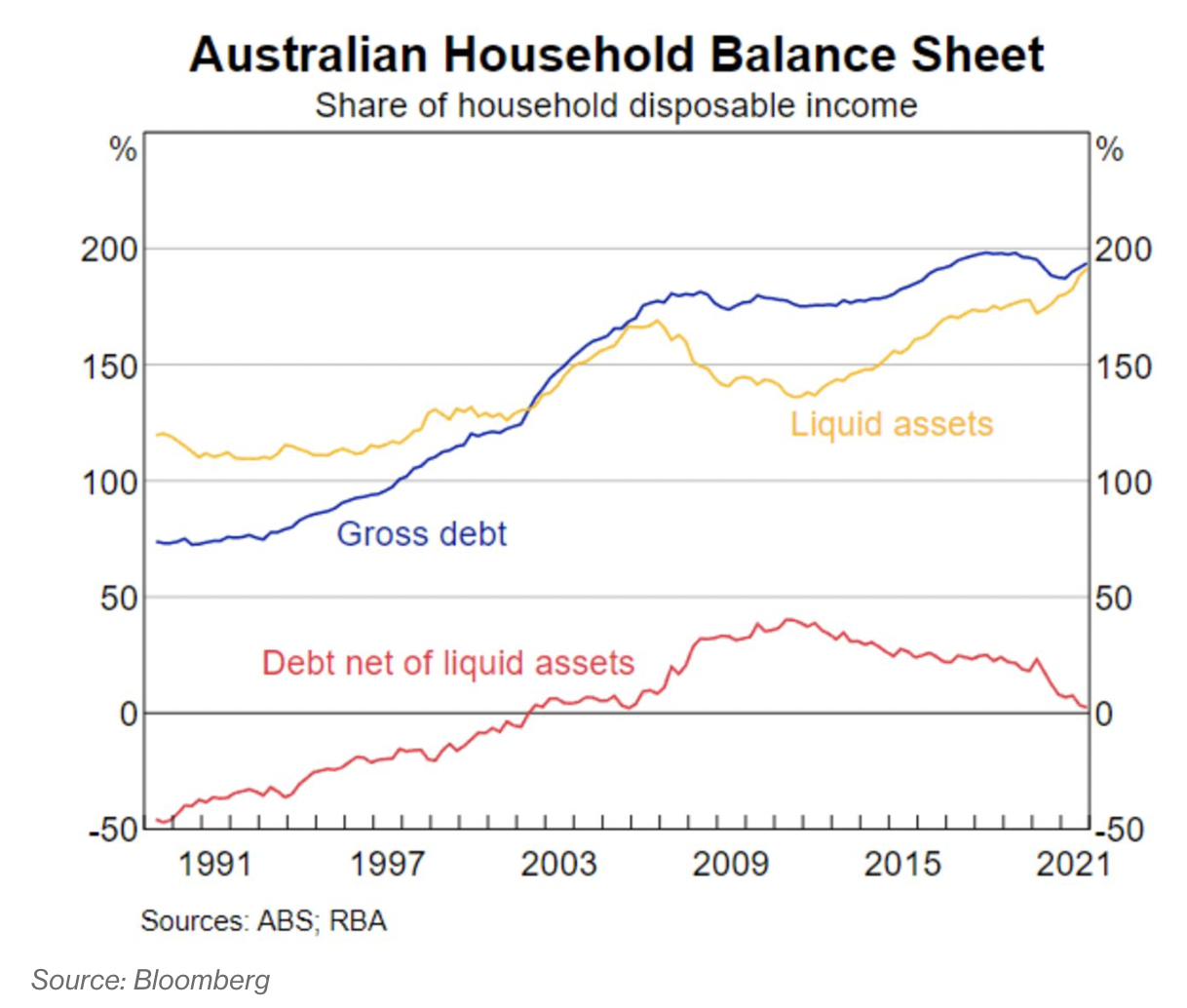

Chart of the week:

Although you wouldn’t think it possible with the state of the market, our chart of the week shares some positive data for Aussie homeowners despite rising rates and their increased mortgage debt.

“Australians have built up strong liquidity buffers in recent years, reducing the threat to financial stability from a sharp rise in household debt, according to a Reserve Bank research paper,” Bloomberg reports.

“The value of household liquid assets now almost matches the value of gross household debt, RBA economist Lydia Wang said in the paper [11] released Thursday. The stock of household liquid assets relative to incomes has also increased to 190%, similar to the aggregate household debt-to-income ratio, she added.”

Top 5 most clicked:

- Top 7 tax tips for 2022 [12] – Paul Rickard

- 3 defensive small-caps for the plunging market [13] – Tony Featherstone

- Questions of the Week [14] – Paul Rickard

- Buy, Hold, Sell – What the Brokers Say [15] – Rudi Filapek-Vandyck

- “HOT” stock: Graincorp (GNC) [16] – Maureen Jordan

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.