In case you missed it, despite Fed boss Jerome Powell implying there COULD be two more rate hikes, pundits and market players on Wall Street are debating if the Yanks have seen the last rate rise in this aggressive monetary tightening cycle. The AFR’s Tim Moore suggested that many think rate rises are over, but the Fed is afraid to let the cat out of the bag.

Meanwhile, the likes of Bank of America’s Michael Hartnett isn’t “…convinced [we’re] at the start of a shiny new bull market.” He’s been a bear for some time, and has got it wrong, but that doesn’t mean he’ll be wrong forever.

That said, he explained why he got it wrong in a recent note. Jeff Cox from CNBC summed it up this way: “Goldilocks” economic conditions taking hold, muted contagion from the March collapse of Silicon Valley Bank and other institutions, plus the ability of major artificial intelligence companies [1] to carry the market to powerful gains.”

In a nutshell, the Fed’s monetary tightening seems to be working on inflation and there’s no longer a belief that a recession in 2023 is inevitable. Some economists are now tipping it to be late 2024, and even those are more in the ‘mild’ recession camp.

Also, if the US economy starts to stall because of the rate rises, then rate cuts would ensue, which the stock market would love. Recall that the slides of the Nasdaq and the S&P 500 indexes into a bear market were driven by rising interest rates hitting growth/tech companies carrying debt. That means those companies punished in 2022 could get re-loved in 2023 and 2024.

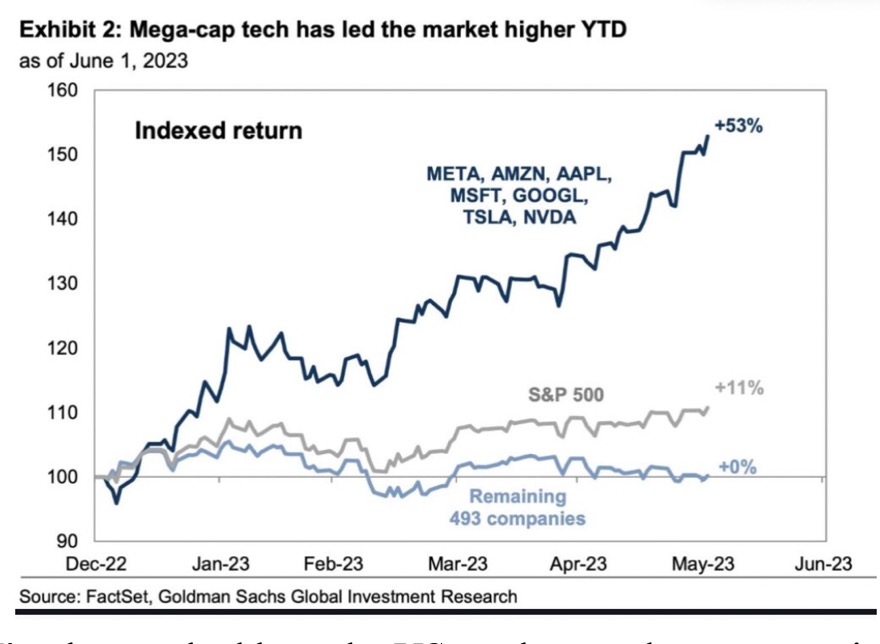

Of course, the Magnificent Seven (M7) tech companies (Apple, Meta, Tesla, Nvidia, Alphabet, Amazon and Microsoft) have returned 53% year-to-date, so they’re running with the bulls. This chart below not only shows the spectacular rebound of the M7 stocks but why I expect the overall US stock market to play catch up.

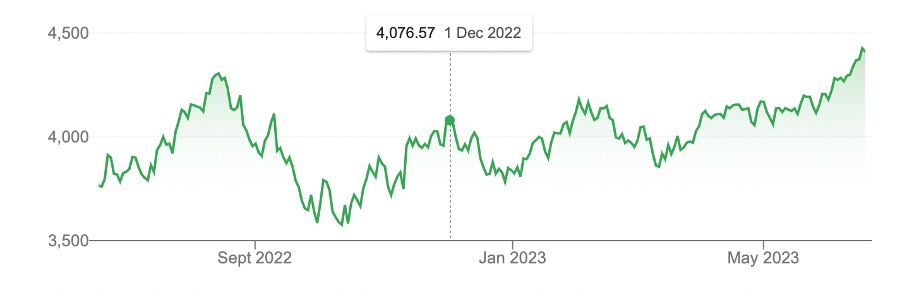

I’ve been asked this question: how can the US market keep on surging after such a big comeback after its 2022 lows? This one-year chart of the S&P 500 shows this bounce-back clearly.

I’m talking about a 23% plus rise over the year and around 15% year-to-date. In the first chart above showing the big rise of the M7 (which was created a few weeks ago), they were up 53%, while the S&P 500 was up 11% as the black and grey lines in that chart show. But now focus on the blue line in that chart, which looks at the S&P 500 minus the M7. See how the other 493 companies (as a group) in the Index are up, wait for it, 0%. So, this means that they’re not up at all!

This is why I like the prospects for the US stock market recovery over 2023 and 2024, especially if the US continues to see falling inflation and there’s a persistent belief that any recession in the future will be mild.

Hartnett says the big recovery of stocks could be held up by three headwinds. Here they are:

- The Fed “reintroduces fear” and projects it could raise its borrowing benchmark a full percentage point to 6%.

- An additional surge in Treasury yields; and

- The US unemployment rate climbs above 4%.

These are all possible but the most worrying would be the Fed U-turning on its expectations about rate rises, which is giving out the message that tightening is near the top.

Tom Lee at Fundstrat Global Advisors thinks the bull market started in October, which says there has been eight months of a rising trend.

My personal play is to increase my exposure to HNDQ, which gives me a hedged play on the top 100 Nasdaq stocks. I know the M7 have shot the lights out but the other 93 should also have upside over the next 12-18 months.

I like IHVV for exposure to the other 493 stocks in the S&P 500. Many of them have done well, but not as well as the M7 group.

I’m hedging because I think the $A will keep rising, as we’ve been seeing lately, whenever it looks like the Fed is done with rate rises.

Finally, as I expect our market to play follow the leader with Wall Street, I’m taking extra risk to magnify the upside by investing with GEAR from Beta Shares.

None of these are cautious plays. You should be aware of this if you play a similar game. But I do believe that even if there are recession fears locally, rate cuts will be expected in early 2024 and the market will like those expectations.

S&P/ASX 200

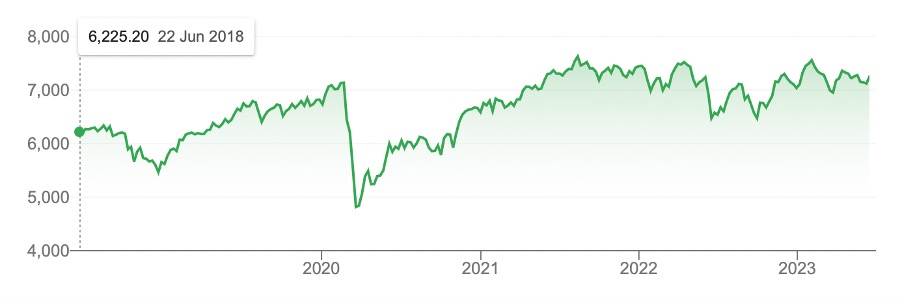

Also, while our market is 12.71% higher over the past year, we’re only 12 points higher than where we were at when the Coronavirus crashed the market! That tells me we have upside.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances