Two questions I’ve received from supporters of the Switzer Report have inspired this piece today. The first was this: what should I do with a $200,000 windfall? And the second was: what five stocks or investments do I like right now?

Of course, as the questioners’ appetite for risk with this money is crucial in the decisions I’d make, let me lay down the criteria that ultimately drove my recommendations.

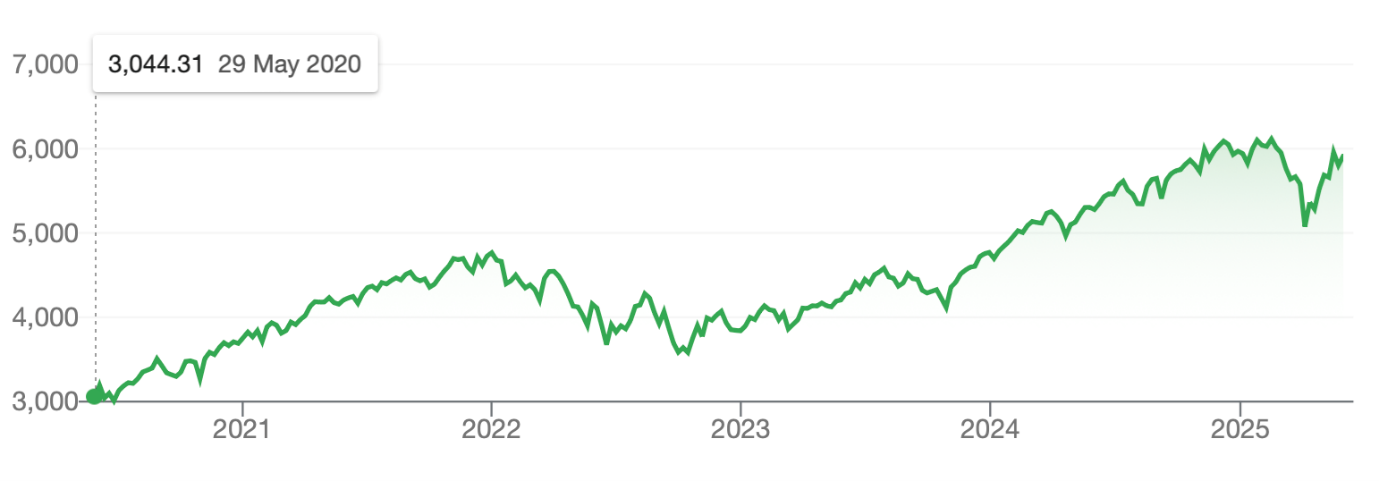

First, these will be investments I think will do well over the next year. Second, the arrival of Donald Trump and his US-centric policies could work against the pluses out there for stocks, such as AI and falling interest rates. Third, I suspect 2026 might be a time to get a little more defensive because Trump and the rises we’ve seen in this stock market cycle have been quite significant. This chart below of the S&P 500 graphically makes the point. It shows this best gauge of the overall US stock market is up 65% since 14 October 2022 and 136% since 3 April 2020.

S&P 500

For the record, since 1929 and 2023, the average bull market lasted around 1,011 days but the Bespoke Investment Group says that three of the last 10 have gone on for 2,000 days plus.

How many days have we had since the low of the Coronavirus crash in March 2020? Try around 1,885! That’s one reason why I might want to get a little more defensive next year. Of course, while artificial intelligence (AI), better-than-expected trade deals, lower interest rates and lower US taxes linked to President Trump’s “big, beautiful bill” could all help extend this bull market, as you can see, we need a lot to go right to ensure this bull market keeps on keeping on.

Provided Trump doesn’t go silly with tariffs, I’ve said before that AI and other positives could make this bull market a very long one but I’m still happy to play one year at a time.

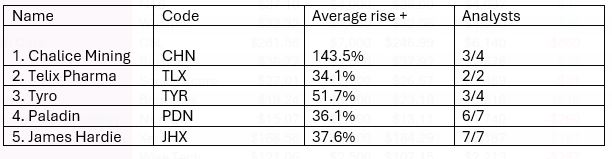

So, I want at least five stocks/investments that could be rewarding over the next year. If I was buying for myself or recommending for a longer-term investor, I’d be happy with these companies that the analysts really like.

These are decent plays that might need more than a year to live up to the expectations of the analysts.

The famous five

Now to the five investments that look appealing.

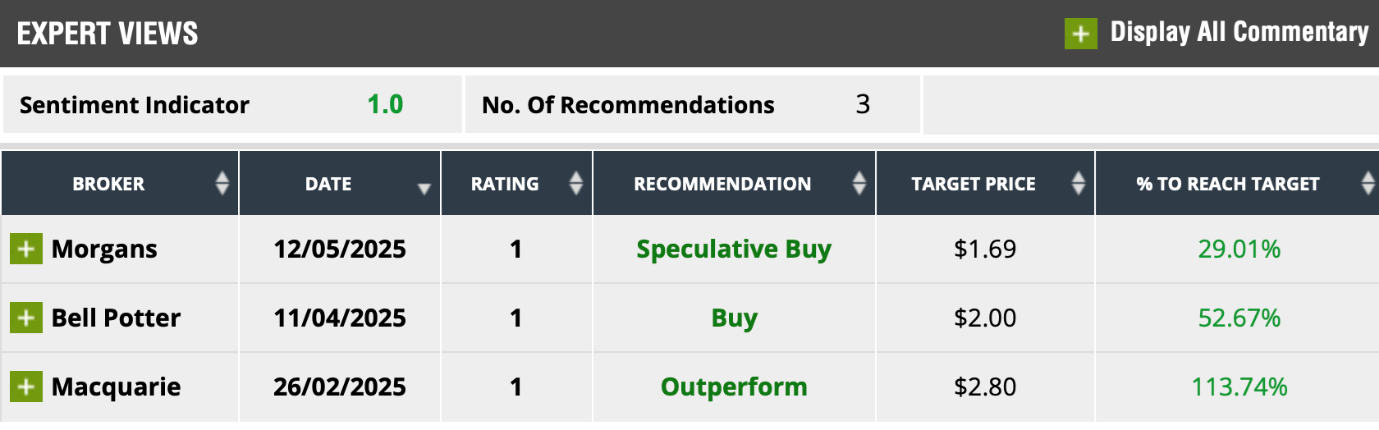

- Polynovo (PNV),

The first is Polynovo (PNV) that has an expected rise of 65.1%. Three out of three expert company watchers think the price is heading up. As you can see, the Macquarie analyst is very positive with a 113.47% call. This is my riskiest suggestion but it’s nice to have a throw at the stumps occasionally.

- CSL

Let’s stick to the health sector. I can’t believe CSL won’t eventually make a monkey out of market doubters.

CSL

Sure, while there can be reasons to explain today’s share price of $246.99, I’m investing for tomorrow and I like the consensus rise tipped by the analysts of 32.6%.

More than that, I like the table above that shows seven out of seven analysts are on my side and I’m especially happy with Macquarie’s 45.88% forecasted rise.

- BHP – the BIG Australian

Sticking to quality, I’m sticking with my BHP call. Once again, the experts are with me, with six out of six analysts surveyed by FNArena giving the company the thumbs up.

BHP

I’m not buying arguably the world’s best miner for big returns in a year but over the next few years. I always like quality companies that are going through market rejection, which isn’t likely to be a long-term problem.

For the overall Australian market, I still like EX20 to capture the rotation out of the big cap stocks that have performed brilliantly but will sell off as interest rates fall. This Betashares ETF contains the stocks 21 to 200 in the S&P/ASX 200 and over the past month is up 4.76%, which I think is a sign of things to come.

EX20

- WCMQ

My final selection are two overseas funds with a good record. The first is the ETF, WCMQ, which has really performed well with its special focus of companies that have growing moats or competitive advantage.

This performance table basically shows that these guys have a good approach to investing. It’s a good financial practice to have a decent exposure to overseas markets.

It’s 10-year and inceptions returns of 15.48% and 14.16%, as well as last year’s number of 22.72% is pretty impressive. (A company I have an interest in — Associate Global Partners brought these guys to the Aussie market with WCMQ and WQG and I’m glad they did!)

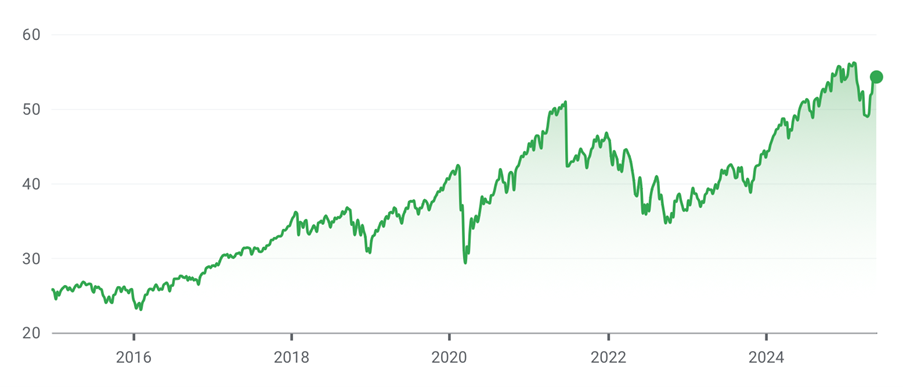

- IHVV

If you want a more varied approach to overseas or US investing, you could mix up the likes of WCMQ with IHVV from iShares, which gives you the S&P 500 index, hedged, for 10 basis points. The chart below shows what a good investment IHVV has been since 30 December 2014, rising 111.34%.

iShares S&P 500 (AUD Hedged) ETF (IHVV)

All up, while this one-year investing plan looks nicely diversified and potentially could generate nice returns, we do have to hope that Donald Trump doesn’t spook financial markets over the next few months with his tariff negotiations.