For my prediction that 2024 will be a good year for stocks to be correct, a number of important drivers will have to power along the key indexes that define our stock market. Clearly, a positive lead-in from Wall Street will be important, as it nearly always is, but the big companies that dominate our market indexes will need to do some heavy lifting.

Barring something crazy such as a new world war emanating out of the Middle East, I’m on board with this headline from CNBC, which I revealed in Saturday’s Switzer Report: ‘Bubble may be far from bursting’: Capital Economics says S&P 500 could hit 6,500 by end of next year.”

And here was the supporting quote: “The bubble in the S&P 500 that is forming now resembles the bubble that formed in the second half of the 1990s in many aspects, not least the way in which it is an attempt to capture the future benefits of a transformative technology,” said John Higgins, chief markets economist at Capital Economics in a note to clients on February 12 this year titled “This bubble may be far from bursting.”

All this is believable, with interest rates bound to be cut some time this year, while the fact that 7 to 10 big tech companies have driven the S&P 500 up in 2023, it makes sense that the other 490 stocks in the index will help share prices spike higher over 2024.

So, let’s bank the US as a positive for stocks this year. But what about other potential tailwinds or headwinds?

As a potential US President by November, Donald Trump isn’t likely to bring the surge he created in 2016. But on the other hand, he could be a plus for a lot of US listed companies.

I’d argue that Trump could hurt and help individual companies as he wields his tax and trade policy powers as the new US President. However, this from Morningstar in late 2023 shows the great influencers of stock prices aren’t too over-concerned about his comeback.

“The possible re-election of Donald Trump is as important to markets and geopolitics as any interest rate decision in 2024,” wrote Ollie Smith. “But you could be forgiven for thinking asset managers’ outlook documents for next year are somewhat light on the matter.”

He went on: “In the various asset management publications we surveyed, Trump analysis runs to a total of hundreds of words – versus the many thousands devoted to inflation and monetary policy.

Nor did any one document mention the immediate and obvious impact of a Trump re-election on environmental policy — an arena asset managers have found themselves in for the last few years under the guise of ESG investing.”

However, Smith did add “This is not to say the ramifications of another Trump term haven’t been acknowledged at all. The success of U.S. equity investors during Trump’s first term will humble anyone who thinks another one wouldn’t result in more stock market fireworks. But commentators still urge huge caution about the negative consequences”.

That said, only two weeks ago, a Goldman Sachs team said, “the 2024 U.S. election has the potential to be a major market event, boosting the dollar and bond yields,” though that could have more ramifications for stocks in 2025.

And what about China?

Tribeca Alpha Plus Fund portfolio manager Jun Bei Liu has argued on my TV show a number of times that she thinks the Chinese economy will surprise on the higher-than-expected side when it comes to economic growth. It’s part of why she still likes A2Milk and why she thinks iron ore and lithium will be beneficiaries of a stronger growing China.

I’ve argued before that I’d be a big China investor if Beijing wasn’t run by Xi Jinping. I can’t allocate my hard-earned investment money to stocks that can fall out of favour because Beijing comes up with an anti-entrepreneur policy, as Alibaba’s Jack Ma had to endure three years ago.

Criticizing Xi didn’t work out for him and wired.co.uk last year told us he has returned, not as a businessman but as a teacher! He certainly seems to have been taught a lesson or two.

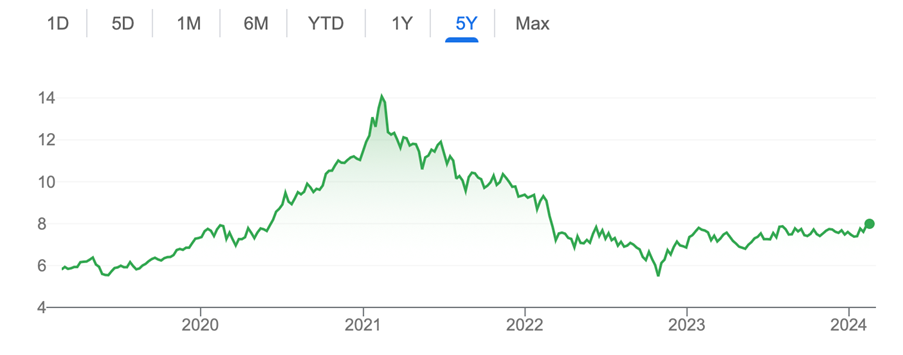

In the past, I’ve invested in ETFs such as ASIA, which is Betashares’ Asia Technology Tigers ETF play, which of course is dominated by China-based companies. The graph below shows you how smart I felt about my ASIA play until early 2021 and those Chinese tech firms were not dealing with an interest rate caning then, but more the stick of Xi!

Betashares Asia Technology Tigers ETF (ASIA)

This makes me wary of playing the likes of ASIA again. But what about something like Fidelity’s Asian fund?

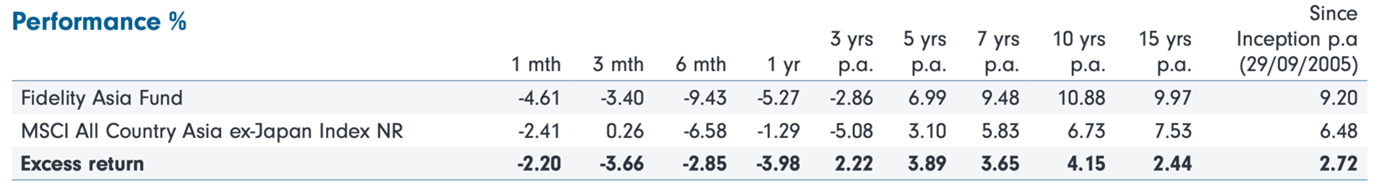

While this has had a good long-term track record, for the past three years (the three years Jack Ma would love to forget), it has struggled.

On a three-year basis, an investor would be down 2.86% pa, but this is better than the MSCI-benchmark, which was off 5.08% pa.

Of course, on the law of averages, you might guess it’s time for a rebound for Asian plays, which are heavily driven by China’s growth and policies. But does the new age Xi confound the law of averages?

Playing any Asian fund is a punt and has to be seen as a speculative play. On the other hand, a US fund based on an index for that country’s best companies is more a core investment.

Personally, I suspect Jun Bei Liu’s mail on China will prove to be reliable over the course of 2024 and into 2025, so I’d rather make money via local stocks that will benefit from the rebounding of the world’s second biggest economy.

In case you didn’t know, as marketindex.com.au recently reported: “China is the world’s largest consumer of lithium minerals, but it’s also a major supplier of both raw and refined lithium products, much of the latter which is used by its massive electric battery manufacturing industry.”

And in a story by Carl Capolingua, the interesting headline was “Latest data on China lithium: Demand increasing, supply falling.”

Research by Macquarie concluded the following:

1. Current lithium prices are now “pressuring both marginal players and cost leaders”.

2. In the near term, Macquarie believes behaviour by refiners and battery component/manufacturers, in the period immediately after Chinese New year, will be “will be the key drivers for lithium prices”.

3. In particular, they’ll be watching the data for electric vehicle (EV) sales and battery production plans very closely.

This analyst likes Pilbara Minerals (PLS), Arcadium (LTM) and Patriot Battery Metals (PMT).

I’ll be watching the economic growth figures coming out of China and the Beijing policies to stimulate activity.

The latest Nikkei.com forecast says that “…the economists’ average prediction for growth in 2024 is 4.6%, 0.1 point higher than in the last forecast in September, with a range of between 4.4% and 5%.”

But economists could be too negative, given reports from Standard Chartered, which tells us that “China’s new economy is “booming” and is sporting double digit growth rates.

This is the year of the dragon for China, which historically has been associated with good fortune!

If Beijing takes its lead from Bruce Lee’s famous film “Enter the Dragon”, then we could see some big bazooka plays that could put growth onto a higher uptrend. And if that happens, it could be good for lithium plays and our big iron ore miners.

Right now, the analysts are on board with lithium speculations and so Arcadium (LTM) has 67% consensus upside, while PMT has 145% upside if the future follows Macquarie’s script!

The iron ore plays aren’t promising upside, but BHP, Rio and Fortescue have a habit of proving their doubters wrong and Beijing could be critical to where their share prices go. I’m not buying the big miners now but if the market wants to take them down a peg or two, I’ll be a buyer.

On the other hand, last week’s action for lithium and nickel miners makes me more inclined to ‘punt’ on these minerals of our hi-tech future.

I might not be a big fan of Xi and Beijing, but I do wish them the best when it comes to their economy.

For my prediction that 2024 will be a good year for stocks to be correct, a number of important drivers will have to power along the key indexes that define our stock market. Clearly, a positive lead-in from Wall Street will be important, as it nearly always is, but the big companies that dominate our market indexes will need to do some heavy lifting.

Barring something crazy, such as a new world war emanating out of the Middle East, I’m on board with this from

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice.