The ability to bring forward your entitlement to make non-concessional contributions has been in place since 1 July 2007. Previously, this could be done up until the year in which you turned 65. Legislation has now been passed to move the age from the year in which you turn 65 to 67 years of age as at 1 July 2021.

The idea of the bring forward provisions is to help individuals that may want to put extra funds into superannuation, but are limited by the restrictive nature of contribution caps. Subject to satisfying the eligibility requirements it helps individuals who may want to make a larger one-off contribution.

What are the bring forward provisions?

Effectively you can bring forward your non-concessional contributions caps from future years and use them earlier. The most that can be contributed is three times the non-concessional contributions cap over a 3-year period, either in one contribution or over multiple contributions.

The provisions are triggered if you exceed the standard non-concessional contributions cap and are eligible to bring forward the caps (and have not already triggered the provisions in the prior 2 financial years). The cap that is brought forward is based on the cap at the time you trigger the provisions to apply so any subsequent indexation to the caps will not apply over that set period.

How does the Total Superannuation Balance affect the bring forward amount and timing?

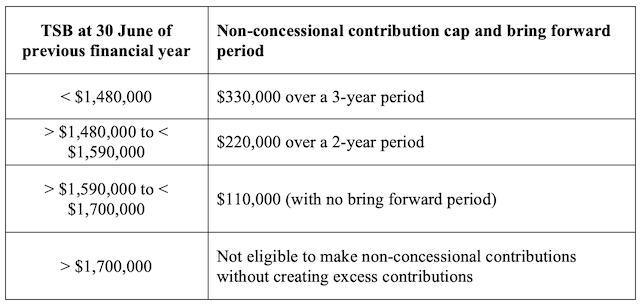

To be eligible to use the bring forward provisions you need to look at your Total Superannuation Balance (TSB) at 30 June of the financial year prior to when you want to make a contribution in excess of the non-concessional contributions cap.

How does the age of the member affect it?

If you were under 67 years of age at 1 July of a financial year, you are eligible to use the bring forward provisions, subject to your total superannuation balance.

If you were aged 67 to 74 years of age at 1 July of a financial year, you will not be eligible to trigger the bring forward provisions and will be subject to the ordinary non-concessional contributions cap of $110,000 (eligibility also still subject to TSB requirements and work test).

If you were aged 75 you will not be able to make non-concessional contributions (unless received on or before 28 days after the end of the month in which you turn 75 years old – also subject to TSB requirements and work test).

How does the work test fit in?

The work test requires you to undertake at least 40 hours of gainful employment within a period of 30 consecutive days. To be considered gainful employment you must provide a service and be remunerated for doing so (voluntary unpaid work does not count).

If the bring forward provisions have been triggered and you subsequently turn 67 years of age and are still going to make a further final contribution under the arrangement after turning 67, you must meet the work test before making the final contribution.

Work test exemption

Alternatively, a work test exemption allows members to make contributions post age 67 without meeting the work test. The exemption allows a member over age 67 but under age 75 to contribute to super in the year following their retirement, subject to your Total Superannuation Balance being less than $300,000. It is important to note that the work test must be satisfied in the financial year prior to the year in which the contribution is made. Additionally, the work test exemption cannot have been used previously.

Case study

Let’s talk about this person:

- Member is 66 years of age at 1 July 2021

- They turn 67 years of age on 8th February 2022

- As at 30 June 2021 their Total Superannuation Balance is $1,200,000

- They have not made any non-concessional contributions in the last 3 years

- No longer working since 64 years of age

- They will have $330,000 from an inheritance to contribute to super but unsure on timing of when the funds will be available. They will have $150,000 by 31 December 2021 and the timing of the balance is unknown pending the finalisation of the estate.

What rules do we need to consider?

- The cap needs to be exceeded in year 1 to trigger the bring forward provisions. There will be $150,000 available initially to contribute which will exceed the cap and trigger the bring forward period.

- The bring forward provisions can’t have already been triggered in one of the prior 2 financial years. They have not made any non-concessional contributions so they will meet this requirement.

- The total superannuation balance is less than $1.48 million as at the end of the previous financial year so the non-concessional contributions cap and bring forward period can be $330,000 over 3 years.

- As the member is under age 67 at 1 July 2021, they are eligible to use the bring forward provisions in the 2021/22 financial year.

- $150,000 can be contributed to super around December 2021 to trigger the bring forward provisions for 2021/22, 2022/23 and 2023/24.

- Any amounts subsequently contributed past age 67 will be subject to them meeting the work test. If the balance of approximately $180,000 is received prior to 8th February 2022 then there is no issue but if it is after this date it can only be contributed if the meet the work test requirements.

NOTE: In the 2021/22 Federal Budget the Government proposed to remove the work test for those individuals aged 67 to 74 from 1 July 2022. If this measure is passed then in this example the balance of the contribution could be made after 1 July 2022 without meeting a work test.

Conclusion

The increase in eligibility age to utilise the bring forward provisions gives individuals approaching retirement more scope to plan and better provide for their retirement income.

For those aged 66 and under on 1 July 2021 there are now opportunities to contribute larger amounts to super subject to your total superannuation balance. Individuals must be mindful that any contribution made after turning 67 will be subject to the work test or work test exemption and any flexibility about that won’t apply until 1 July 2022 at the earliest.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.