It was a US job shock with the numbers employed in August coming in at 235,000, which doesn’t seem all that bad, but the problem was that it was out by nearly half a million! Economists were so sure about the economic recovery that despite Delta variant challenges, they didn’t see this slowdown in job creation.

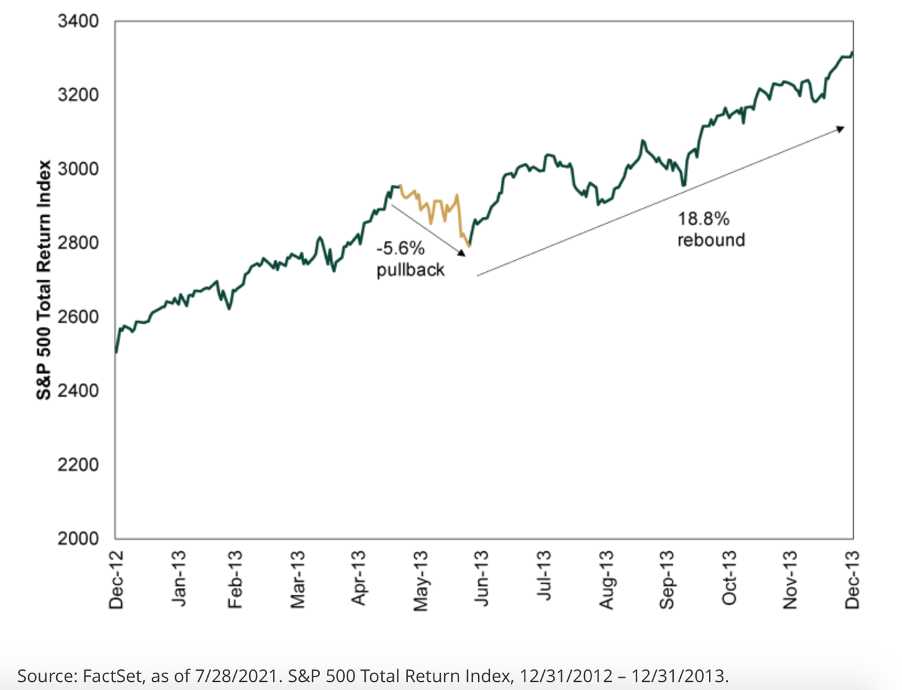

Interestingly, it didn’t lead to a Wall Street negative over-reaction, probably because the news pushes back the likely time when the Federal Reserve will start tapering or cutting back its bond purchases. In December 2013, after years of economic support thrown at the US economy, after its GFC-created Great Recession, the Fed started reducing its purchases of bonds, which gave birth to the term ‘taper tantrum’.

Taper tantrum

But what’s really important to point out is that there was a pullback. While it was only a 5.6% drop, look what followed — an 18.8% rebound. This is why the market got nervous about any huge economic improvement because in 2013 the collective reaction led to a spike in U.S. Treasury yields, which as we have seen, hasn’t been great for tech stocks, as it implies interest rates are on the rise.

This explains why this shockingly low employment result has seen the Nasdaq actually rise overnight! All this means that the news slows down the expectations of a huge economic recovery too soon, and as long as this job number isn’t a sign that a real slowdown is happening (which is possible), then Wall Street can live with current valuations, which are really high.

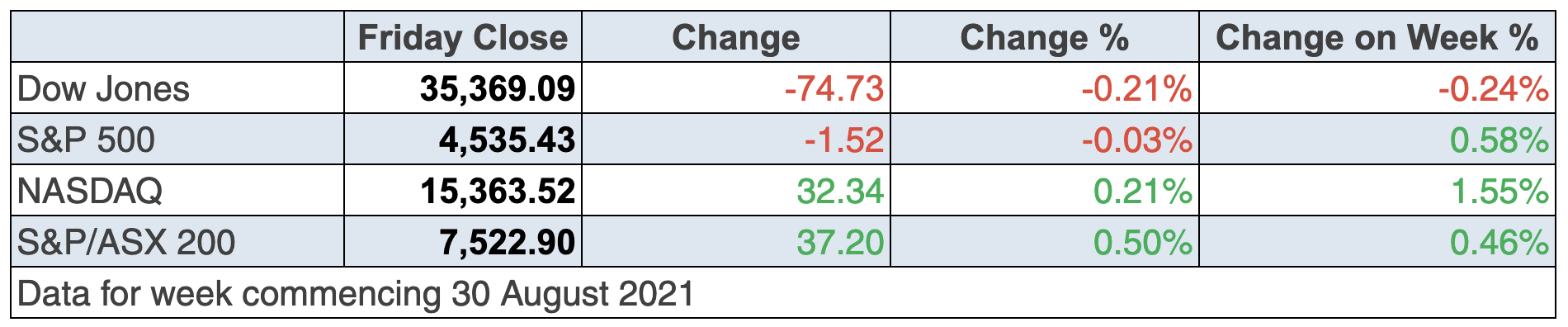

S&P 500

I made the point at our Switzer Listed Investment Conference on Thursday and Friday, that if you compare the levels of the S&P 500 and our S&P/ASX 200 Indexes just before the Coronavirus Crash and now, the Yanks were up 34% and we were up 5%! It’s why I think in 2022 our market will rise faster than US markets, with cyclical/value stocks likely to be popular.

And if you’re wondering why the market isn’t worried about these job numbers that could predict significant economic weakness ahead, then it could be that a lot of this poor report on the US labour market was because of labour shortage issues linked to the pandemic, rather than a big drop in labour demand!

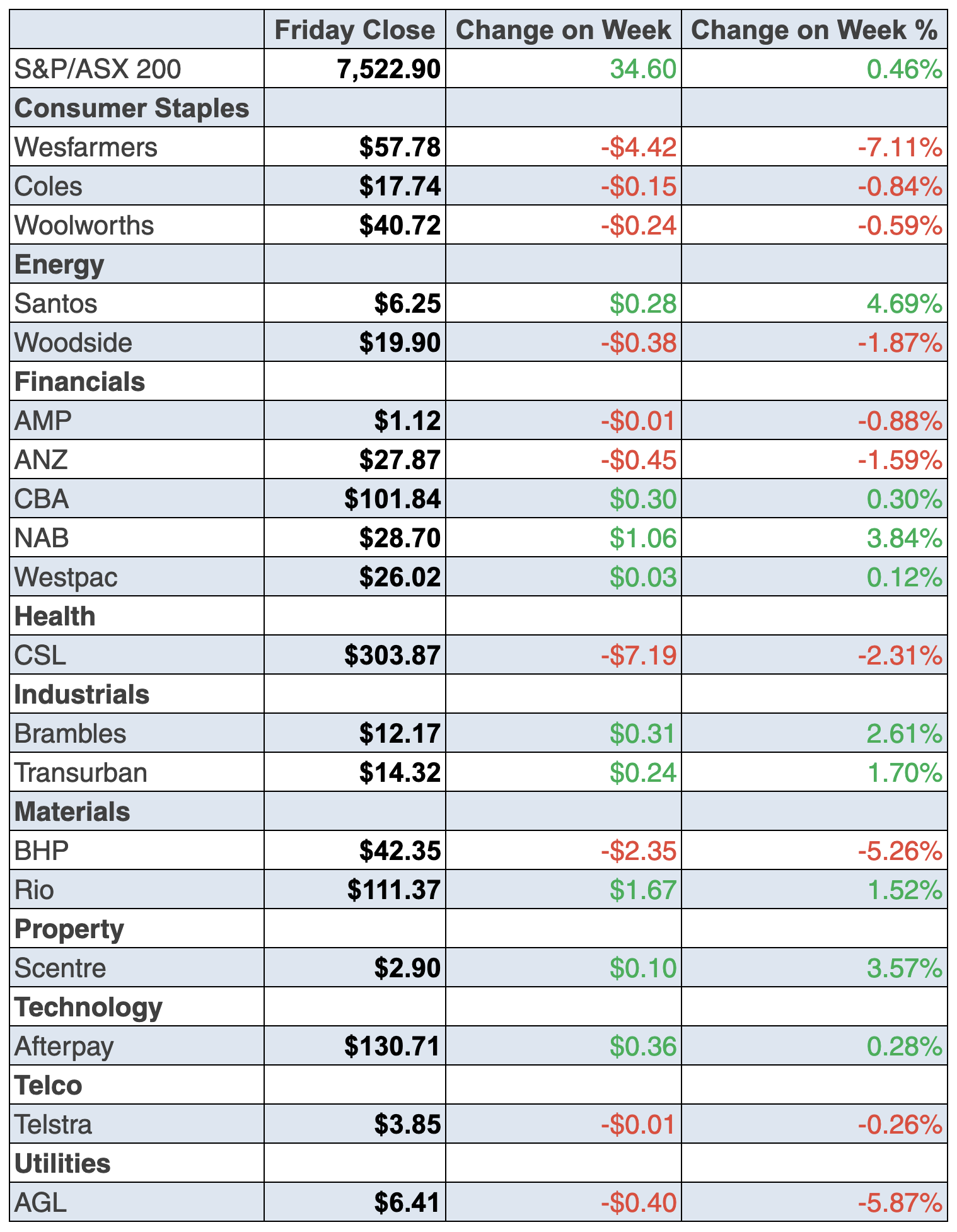

To the local story, and dodging double-dip recession headlines (with our economic growth in the June quarter coming in at 0.7%) helped stocks sneak higher this week. The S&P/ASX 200 was up 34.6 points (or 0.46%) to finish at 7522.9.

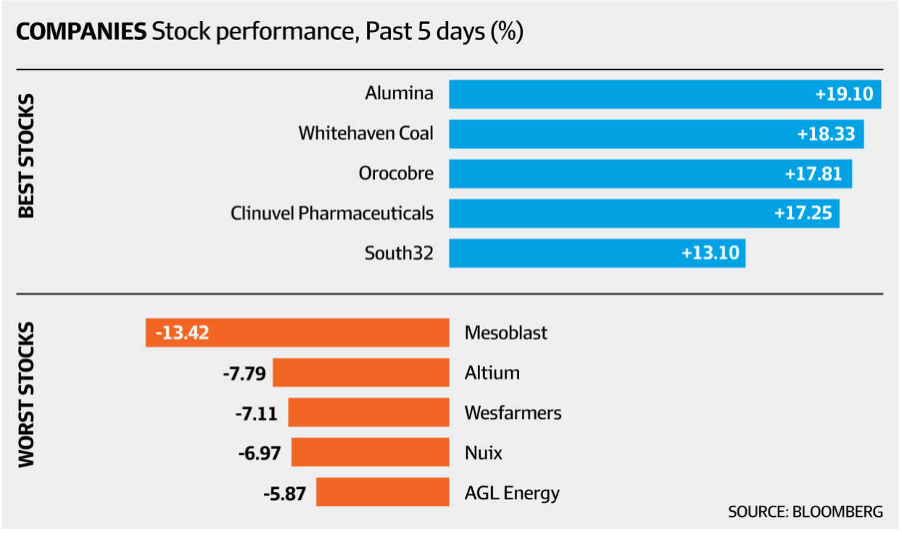

As the chart below shows, it was a good week for materials, provided your company didn’t go ex-dividend like BHP.

The big miner dropped 5.3% to $42.35, while Rio was up 1.5% and Fortescue was up 4.3%.

Smaller miners and those in lithium and rare earths were winners, with Lynas up 10.0% to $7.06 and Iluka Resources up 9.0% to $10.03.

And there was good news for those who gambled on Webjet, with the company revealing that hotel bookings overseas are spiking. The stock was up 7.6% to $5.95 over the week. Meanwhile, that constant disappointment Mesoblast got no joy from the Federal Drug Administration (FDA), with more questions about its drug for inflammation and respiratory disease, explaining its 13% plus slide.

On the bank front, NAB was the star, up 3.8% to $28.70, while ANZ gave up 1.6% to $27.87. CBA and Westpac were pretty well flat on the week.

What I liked

- The Australian economy (as measured by gross domestic product or GDP) grew by 0.7% in the June quarter, after rising by 1.9% in the March quarter. Over the year, the economy grew by a record 9.6% (records back to 1959) – admittedly off a pandemic-induced low base. Over 2020/21, the economy grew by 1.4%.

- New vehicle sales totalled 81,199 units in August and 1,073,890 over the year – a 22-month high. Notably a record 548,800 sports utility vehicles (SUVs) were sold over the year and a record 293,143 light and commercial vehicles sold.

- The weekly ANZ-Roy Morgan consumer confidence rating rose by 0.2% to a 4-week high of 101.8 (long-run average since 1990 is 112.4). How does that happen when NSW and Victoria are in lockdown? The other states must be having a ball! It must be the power of having all the footie! Vaccinations rates rising are also helping.

- The value of new loan commitments for housing rose by 0.2% in July to $32.1 billion. Owner-occupier loans fell by 0.4% to $22.8 billion but investor loans were up by 1.8% to a 6-year high of $9.4 billion. Renovation loans rose by 6.8% to a record (19-year high) $520 million. The average Aussie mortgage hit an all-time high of $593,600 in July.

- Private sector credit (effectively outstanding loans) rose by 0.7% in July to be up 4% on a year ago – the strongest annual growth rate in over two years.

- The Australian Bureau of Statistics (ABS) said company operating profits rose by 7.1% in the June quarter. In 2020/21, profits totalled a record $115 billion, up 12.6% on a year earlier. Wages and salaries (includes changes in wages and employment) rose by 2% in the quarter to be up 8.1% on the year – the biggest increase in 12½ years.

- Commonwealth Bank (CBA) Group economists reported that national household credit and debit card spending for the week ended 27 August 2021 “is tracking 5 per cent higher than the corresponding week in 2019, down from the 8 per cent pace the previous week.” Thank God for online. This has saved us from a longer and deeper recession.

- The current account surplus hit a record high of $20.5 billion in the June quarter, 3.9% of GDP.

- The trade surplus increased from $11.1 billion in June to a record $12.1 billion in July. Australia has posted 43 successive monthly trade surpluses. The rolling annual surplus hit a record high $95.6 billion in the year to July. Exports to China rose by 2.9% in July to a record $19.4 billion.

- The CoreLogic Home Value Index of national home prices rose by 1.5% in August to be 18.4% higher over the year – the strongest annual growth rate in 32 years. Home prices hit record highs in 69 of the 78 available SA4 regions across Australia in August. And prices rose in 74 SA4 regions in the month. These strong house price rises would be seen as bad news if the economy needed all the positive vibes possible to offset the negatives from the lockdowns.

- The AiGroupPerformance of Manufacturing index fell from 60.8 in July to a 10-month low of 51.6 in August. The ‘final’ IHS Markit Manufacturing Purchasing Managers’ index eased from 56.9 in July to 52 in August. These numbers show a softening for manufacturing but readings above 50 points indicate an expansion in activity, which is good considering NSW and Victoria are in lockdown.

- The ISM manufacturing index rose from 59.5 to 59.9 in August (survey: 58.5). The ‘final’ Markit manufacturing index fell from 63.4 to 61.1 in August (survey: 61.2). Any number over 50 means expansion.

- ADP private payrolls (employment) rose by 374,000 in August (survey: 625,000). Construction spending lifted by 0.3% in July (survey: 0.2%).

- Challenger job cuts in the US fell by 17% to a 24-year low of 15,723 in August (survey: 19,000).

- The Eurozone unemployment rate fell from 7.8% in June to 7.6% in July (survey: 7.6%).

- The pan-European STOXX 600 index fell by 0.4% but was still higher for the seventh straight month – the longest winning streak since 2013.

What I didn’t like

- Retail trade fell by 2.7% in July to be down 3.1% on a year ago. But online retail sales soared by 19.3% to record highs.

- The ‘final’ IHS Markit services purchasing manager index fell from 44.2 in July to 42.9 in August – a second month of contraction (index below 50 points). This is lockdown-affected data.

- Commonwealth Bank Group economists don’t expect any macro‑prudential policies to be reintroduced in the near term. But excessive household mortgage debt, a lift in investor activity and a re-acceleration in home prices after lockdowns could yet see regulators intervene in the housing market in 2022. This has to come but I hope the CBA is right and APRA waits until the economy is rocking before it goes hardball on lending.

- Council approvals to build new homes fell by 8.6% in July – the fourth successive monthly decline. And the value of approvals for new building fell by 7.6% with alterations and additions up by just 0.1%. The number of building approvals fell by 17.9% in South Australia – the most in two years – with detached house approvals down 26.2% in Greater Adelaide

- The University of Michigan consumer confidence index eased from 81.2 to 70.3 in August (survey: 70.8).

- The Chicago PMI fell from 73.4 to 66.8 in August (survey: 68).

I’m not the only market optimist out there! This from CommSec’s Craig James this week, helped keep me positive: “Unprecedented policy stimulus, rock-bottom interest rates and the eventual economic recovery are supportive of continued asset price appreciation, despite near-term virus lockdown uncertainty. Over the past 12 months, investor returns for both Aussie shares and residential property have been exceptional. In fact, total returns on national dwellings rose by 22.1 per cent in the year to August. In contrast, the S&P/ASX All Ordinaries Accumulation Index rose by 29 per cent over the year.”

Love that kind of talk!

The week in review:

- In my article this week [1], I looked at how the WAAAX stocks – Wisetech (WTC), Afterpay (APT), Appen (APX), Altium (ALU) and Xero (XRO) – and my ZEET stocks – Zip Co (Z1P), EML Payments (EML), Elmo Software (ELO) and Tyro (TYR) – are performing.

- Paul Rickard provided an update on how his “five income favourites” from the start of the financial year are travelling [2] – Amcor (AMC), Charter Hall Long WALE REIT (CLW), Coles (COL), JB Hi-Fi (JBH) and Medibank Private (MPL).

- James Dunn shared 5 oil and gas stocks that he believes look to be very nice value [3]: Woodside Petroleum (WPL), Santos (STO), Oil Search (OSH), Karoon Energy (KAR) and Senex Energy (SXY).

- Tony Featherstone said these 3 LICS are worthy of further research [4]: Spheria Emerging Companies (SEC), Djerriwarrh Investments (DJW) and MFF Capital Investments (MFF).

- Tim Miller from SuperGuardian discussed the good, bad & ugly of adding more members to your SMSF [5].

- In our “HOT” stocks this week, Raymond Chan from Morgans [6] highlighted Wesfarmers (WES) and Woolworths (WOW) while Michael Gable from Fairmont Equities [7] selected Macquarie Group (MQG).

- In the first Buy, Hold, Sell – What the Brokers Say of the week, there were 24 upgrades and 26 downgrades [8], and in the second edition there were 8 upgrades and 14 downgrades [9].

- And in Questions of the Week [10], Paul Rickard answered questions on BHP (BHP) and Fortescue Metals (FMG), Mayne Pharma (MYX), Charter Hall (CHC) and price falls when a stock trades ex-dividend.

Our videos of the week:

- Top ASX stocks out of reporting season: CAR, HUB, WTC, DMP & JHX + CEO of Tyro [11] | Switzer Investing

Top Stocks – how they fared:

The Week Ahead:

Australia

Monday September 6 – Monthly inflation gauge (August)

Monday September 6 – ANZ job advertisements (August)

Tuesday September 7 – Weekly consumer confidence (September 5)

Tuesday September 7 – Reserve Bank Board meeting

Tuesday September 7 – Credit and debit card lending (July)

Wednesday September 8 – Labour account (June)

Wednesday September 8 – Reserve Bank Deputy Governor speech

Thursday September 9 – Reserve Bank Deputy Governor speech

Thursday September 9 – Weekly payroll jobs & wages (August 14)

Overseas

Monday September 6 – US Labor Day public holiday observed

Tuesday September 7 – China international trade (August, annual)

Wednesday September 8 – New York Federal Reserve President speech

Wednesday September 8 – US IBD/TIPP economic optimism index (Sept)

Wednesday September 8 – US Federal Reserve Beige Book

Wednesday September 8 – JOLTS job openings (July)

Wednesday September 8 – US Consumer credit (July)

Thursday September 9 – China inflation (August)

Thursday September 9 – US Weekly initial jobless claims (September 4)

Friday September 10 – US Wholesale inventories (July)

Friday September 10 – US Producer prices (August)

September 9-15 – China credit growth data (August)

Food for thought:

“If you don’t stay with your winners, you are not going to be able to pay for the losers.” Jack D. Schwager

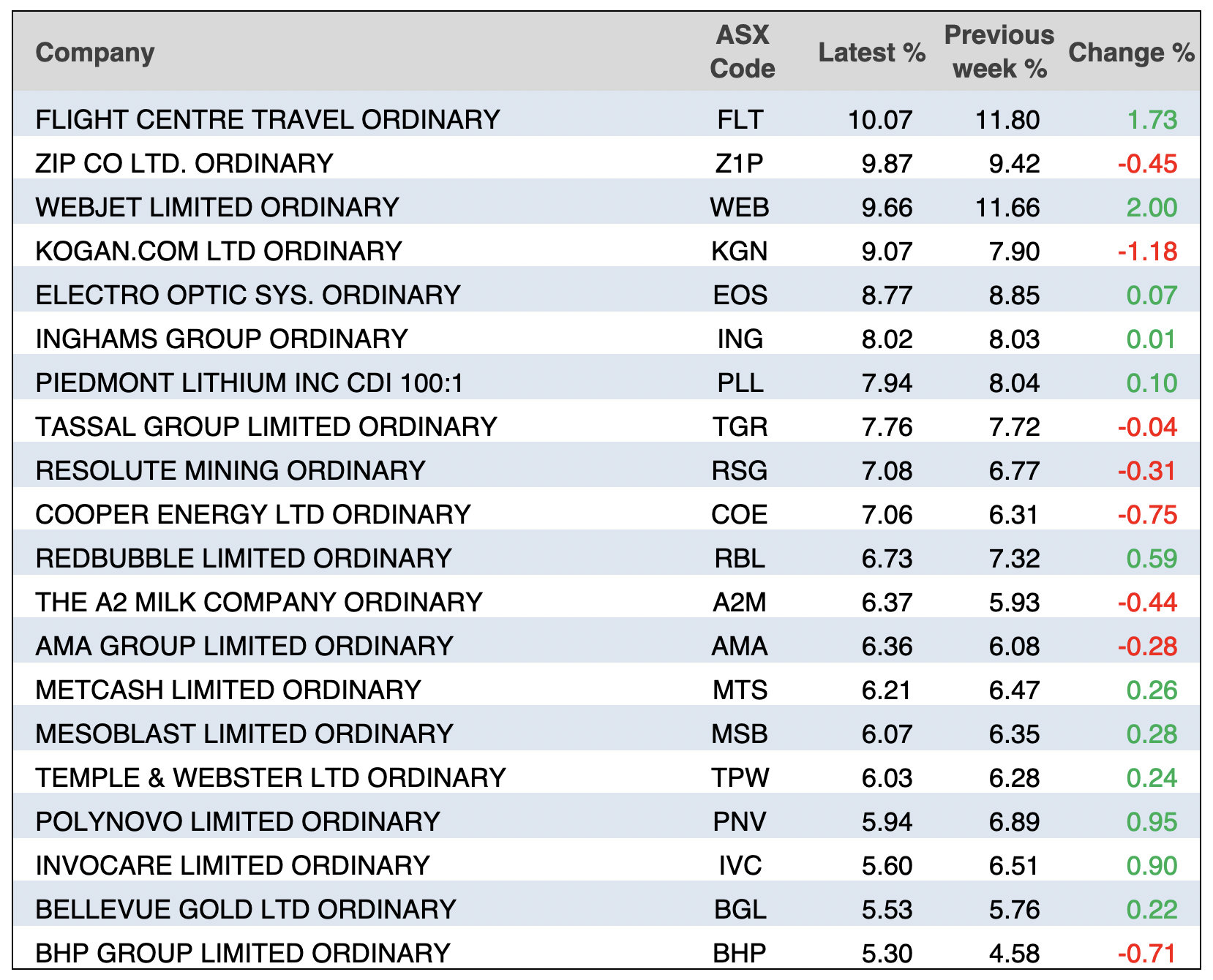

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

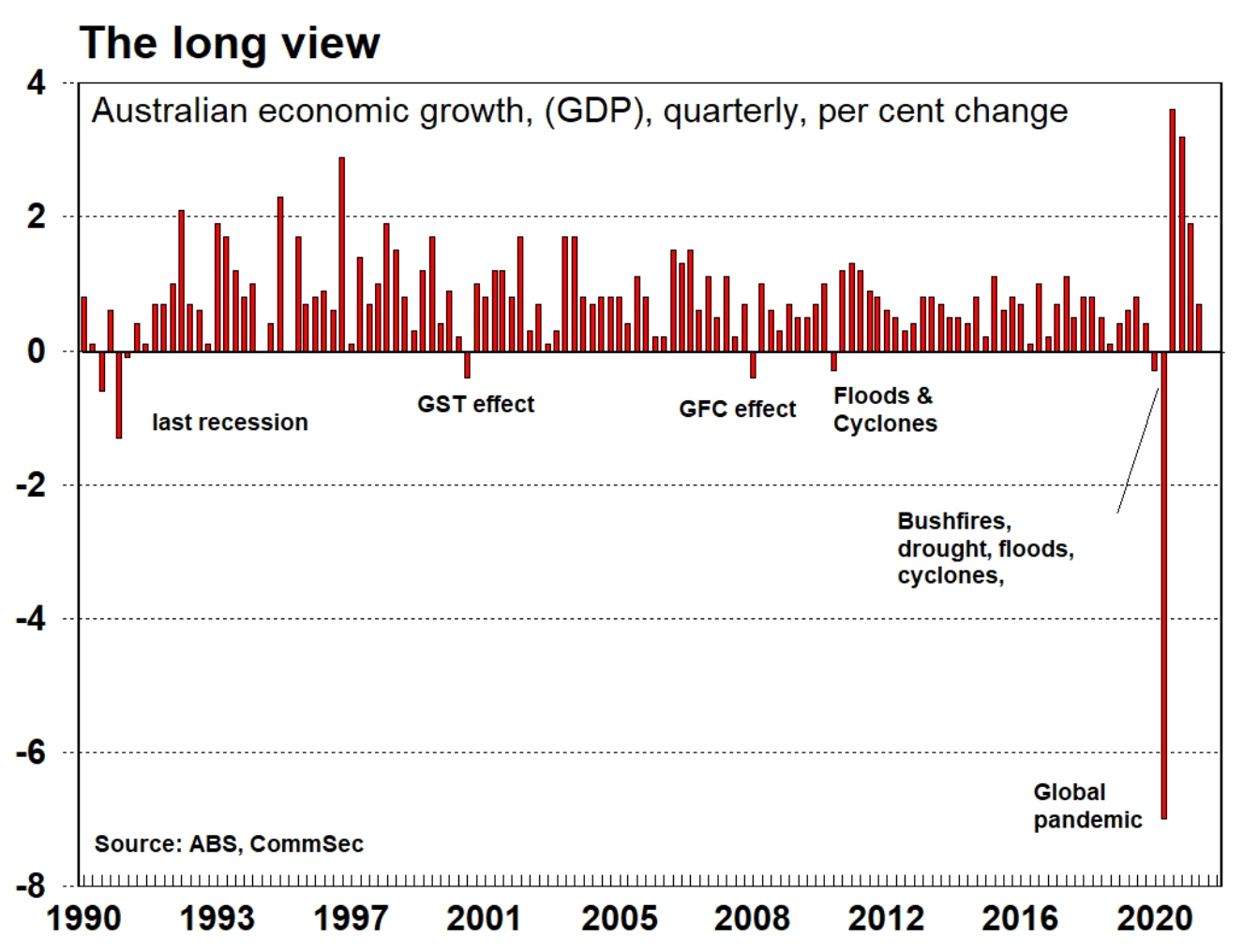

Chart of the week:

After the national accounts revealed unexpected GDP growth of 0.7% for the June quarter, CommSec shared ‘the long view’ on quarterly GDP movements since 1990:

Top 5 most clicked:

- 5 income favourites – how are they going? [2] – Paul Rickard

- Let’s inspect the performance of the WAAAX & the ZEET stocks [1] – Peter Switzer

- Have a look at these 3 listed investment companies [4] – Tony Featherstone

- 5 buying opportunities in the oil and gas sector [3] – James Dunn

- Questions of the Week [10] – Paul Rickard

Recent Switzer Reports:

- Monday 30 August: How are the WAAAX & ZEET stocks performing? [12]

- Thursday 2 September: 3 Listed Investment Companies (LICs) worth a look [13]

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.