Last month’s rise for US stocks, where the Dow Jones Industrial Average wacked on the best rise since 1976, underlined the irrepressible positivity of the Americans, and especially those occupying Wall Street! Hope springs eternal there, but, for the moment, the US statistician can’t deliver sufficient bad news on the labour market to help major market movers believe that inflation is falling fast enough to be a committed stocks buyer.

That said, after reacting negatively to the October jobs report, Wall St managed to find a reason to buy stocks before the close. God bless America!

Before going on, let’s look at that Dow bounceback for October.

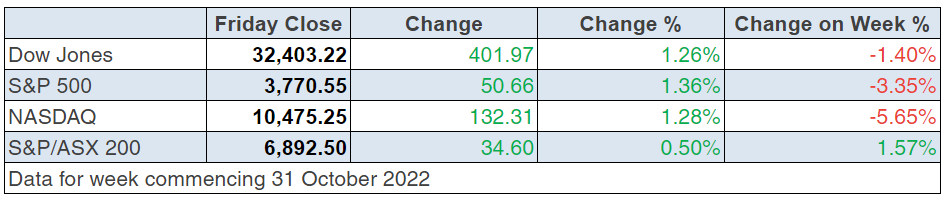

Dow Jones

In fact, we should keep 2022’s sell-off in perspective and know that the Dow is down 12.57%, the S&P 500 is off 22.5%, the Nasdaq has lost 35% and our S&P/ASX 200 has given up 9.19%.

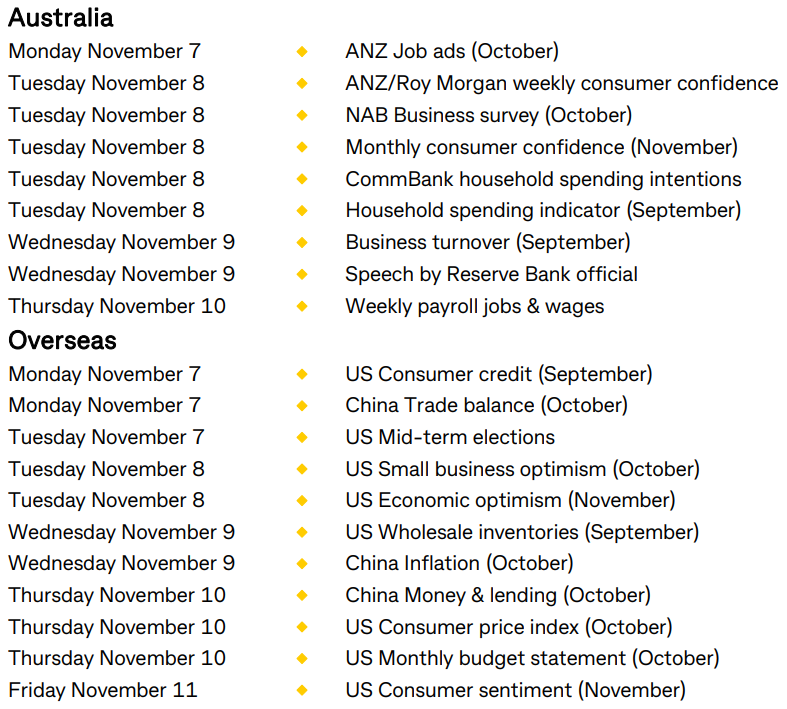

So we remain like poor old farmers waiting for the rain to come to break the drought as another US labour market report fails to help us know inflation is coming down. This now takes our internal hope-making ‘machine’ focus to next week’s Consumer Price Index on November 10, which at this stage isn’t making me as hopeful that we’ll see a notable drop in inflation. It looks like the problem is that businesses are forcing up prices to cover rising costs. In the case of local airlines, they can because they have limited competition, but there are also consumers who are willing to pay high prices for stuff. Rising interest rates are only hitting the overborrowed and until they can bite other consumers and businesses, this stubbornly high inflation could persist.

This is what the October jobs report revealed:

- 261,000 jobs were created, which was too many!

- Unemployment rose from 3.5% to 3.7%, which was good.

- The number of unemployed rose by 306,000 to 6.06 million in October.

- The participation rate remained steady at 62.2%, which ideally should fall.

- Average hourly earnings rose 0.4%, which was more than expected.

Looking at these numbers, you can see why Fed boss Jerome Powell wasn’t building a bridge of optimism during the week when he raised interest rates by 0.75%. He needs to see a slower economy before he can say “Mission complete!” on inflation. But it’s not all bad news.

“In an ironic way, a mixed report is probably a good report for the market because it shows the economy’s not falling off a cliff,” but the labor market is beginning to cool, said Keith Lerner, chief market strategist at Truist Advisory Services. (CNBC)

Helping positivity were some Fed officials who are starting to call for slower rate rises as ft.com pointed out: “Susan Collins, president of the Boston Fed, on Friday signalled her support for a slower pace of rate rises.”

This is what she said: “Smaller increments will often be appropriate as we work to determine how much tightening is needed to reach a level of the funds rate that is sufficiently restrictive.”

Another central banker, Thomas Barkin, president of the Richmond Fed, also backed a slower pace of rises. And yep, the market will seize on that but these calls will be more believable if Thursday’s inflation number shows a decent fall.

The problem with headline numbers is that they can mask what’s developing, albeit slowly but a central banker needs to see these small changes unless they get too big and say an economic slowdown becomes a recession. Charlie Ripley, senior investment strategist at Allianz Investment Management, might be seeing what Barkin and Collins are detecting.

“Today’s payroll number was the lowest figure year-to-date and while the pace of the slowdown has not been materially evident, we could be witnessing the beginning effects of policy tightening trickle into the economy,” he said. “The bottom line is that despite the employment data not showing a swift slowdown, the data appears to be moving in the right direction, but at a very slow pace.”

Looking for other good news for stocks, Chinese stocks listed on the US stock market spiked significantly, with more reports that the world’s second biggest economy will be ditching its zero-Covid policy and will soon reopen. Shares like Alibaba were up close to 11% on Friday in Hong Kong and over 5% in the US.

To the local story and Afterpay (in its new form absorbed into Block) had a good day on a very positive profit and revenue report, which took its share price up 10.9% to $97.03.

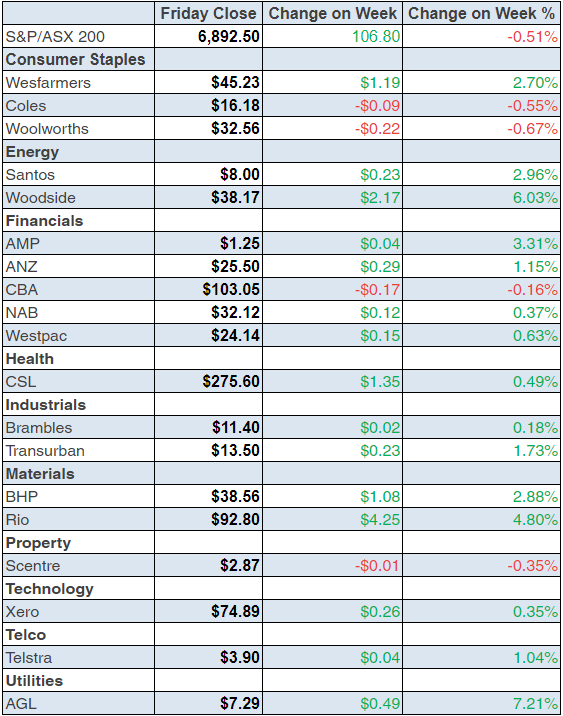

Our market defied Wall Street negativity ahead of the jobs report jumping 0.5% to 6892.5, which lifted the weekly gain to 1.57% (or 106 points). Helping was another good week for energy stocks, with Woodside (WDS) up 5.76% to $38.17. Meanwhile, Whitehaven Coal was up 6.63% for the week, which makes it a 261% rise year-to-date!

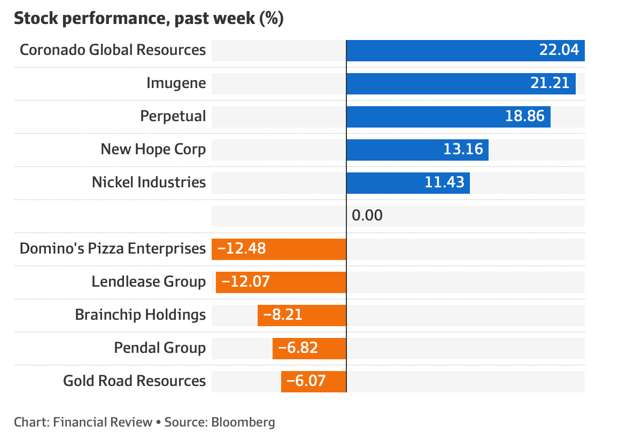

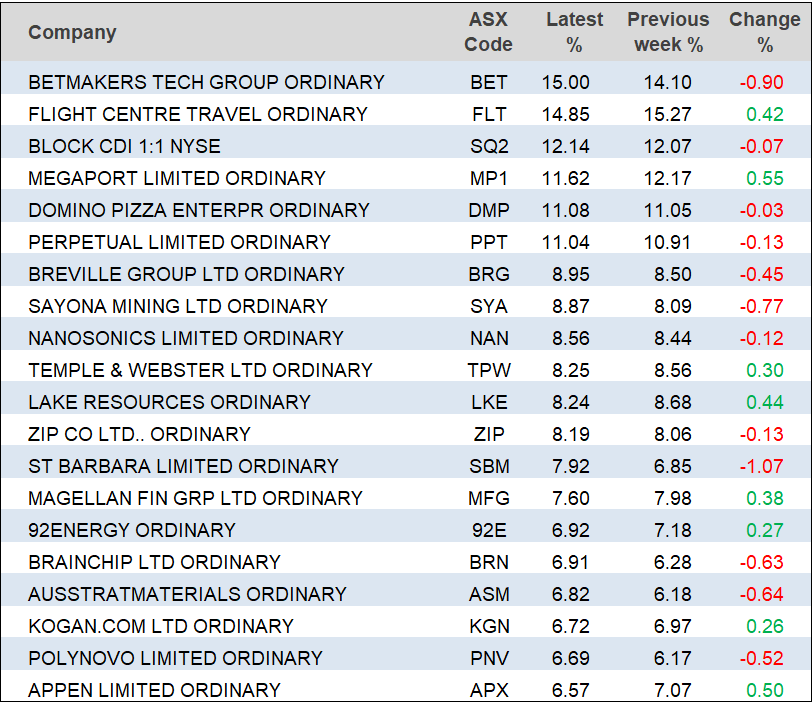

Here are the big winners and losers of the week, thanks to the AFR and Bloomberg.

And Magellan’s woes continue as this from the AFR’s Alex Gluyas explains: “Magellan tumbled 2.4 per cent to $9.56 after reporting net outflows of $2.4 billion in October. The firm’s funds under management increased to $51 billion for the month, from $50.9 billion at the end of September.”

For those wondering why Perpetual has done well, it received a takeover offer during the week, which was rejected, but the bidder is expected to try again.

What I liked

- The RBA’s 0.25% rate rise. I tipped 0.5% but I wanted a 0.25% hike. I hope Dr Phil did it because he suspects inflation is about to turn down, otherwise he will be pilloried for going soft too soon.

- The CoreLogic Home Value Index of national home prices fell by 1.2% in October, the sixth straight decline. Home prices are now 0.9% lower than a year ago. Brisbane home prices fell by a record 2% in October. Remember, when fighting inflation — bad news is good news.

- The ANZ-Roy Morgan Consumer Confidence index fell by 1.5% to 79.9 points last week, its fifth straight weekly decline. Inflation expectations rose to a decade-high of 6.6%.

- Retail trade rose by 0.6% in September. For the September quarter, retail spending rose by 0.2% in real terms – the slowest growth in a year.

- New vehicle sales in October were up 16.9% on a year ago.In the year to October, 1,057,470 vehicles were sold, an 11-month high but still 2.2% down on a year ago.

- The Performance of Construction index fell by 3.2 points to 43.3 in October, indicating contraction in activity across the construction sector for a fifth month. Readings below 50 indicate contraction in activity and we want bad news to believe the interest rate rises from the RBA are working.

- The S&P Global Australia Services Purchasing Managers’ Index fell from 50.6 to 49.3 points in October. It’s the first reading below 50 in nine months. At the same time, the survey reported that price pressures intensified in the month.

- The S&P Global manufacturing purchasing managers index (PMI) for the US fell from 52 to 50.4 in October (survey: 49.9). The ISM manufacturing PMI fell from 50.9 to 50.2 in October (survey: 50).

- The Chicago purchasing managers index fell from 45.7 to 45.2 in October (survey: 47). The Dallas Federal Reserve manufacturing index eased from -17.2 to -19.4 in October (survey: -18).

What I didn’t like

- CBA’s internal credit and debit card spending data to 28 October 2022 showed that nominal spending remained elevated through to the end of October. We need spending to trend down to believe inflation is falling.

- The US Federal Reservelifted the federal funds target by 75 basis points (three-quarters of a per cent) to a 3.75-4% range but did not imply that this was the last 0.75% rise, which the market expected.

- The Reserve Bank upgraded its trimmed mean inflation forecast to peak at 6.5% next month, up from 6% three months ago.

- The Reserve Bank tips 1.5% economic growth over 2023 and 2024, with headline inflation still elevated near 4.75% in a year’s time.I’d like growth a bit bigger and inflation a lot lower but it is what the RBA thinks it will be. At least they’re not tipping a recession!

- The S&P Global Australia Services Purchasing Managers’ Index survey reported that price pressures intensified in October.

- TheBank of Englandlifted the Bank Rate by three-quarters of a percentage point (or 75 basis points) to 3%, its biggest rate rise since 1989, as it battles the highest inflation in 40 years. The Poms must be careful as the UK looks a certainty to go into recession.

- The ISM services index fell from 56.7 to 54.4 in October (survey: 55.3) and that’s not a big enough fall to believe US inflation is falling but it is good if the Yanks want to avoid a deep recession.

What do we want: Inflation down, growth and stocks up!

US company reporting has been good for those who have fingers crossed that the US will avoid a recession. Here’s the latest score from AMP’s Shane Oliver: “66% of US S&P 500 companies have now reported September quarter earnings but with so far only 70% ahead of expectations, which is well below the norm of around 76%. Against this, earnings growth expectations for the quarter have now risen to 5.1% year-on-year and looks likely to end up coming in around 6% year-on-year. Unfortunately, earnings strength is concentrated in energy stocks – if they’re excluded, earnings are down 2.7% year-on-year. Earnings growth outside the US is running stronger than in the US.”

The US looks set for a slowdown. What the Fed does with rates in coming months will determine if the slowdown grows into a recession. If you want an early warning, then watch this space.

The week in review:

- In this week’s Switzer Report, I tell you how to play the next two weeks: buy now gambling the news will be good or wait and be prepared to miss out on another leg up for stocks? It’s your call but here’s my blockbuster high risk-high return play. [1]

- Paul Rickard discusses how Macquarie Group (MQG) is a company that some investors still loathe. Known as the “millionaires factory”, the payment of huge bonusses combined with public relations missteps around Sydney Airport, car parking and the taxi industry (to name but a few) seriously hurt its reputation in the broader community. But putting that to one side, as a company to invest in, it is a great company, and you have to own it. [2]

- Tony Featherstone believes de-globalization is starting to occur as more companies bring their production back closer to their end markets. For SMSFs and other long-term investors, thinking about such trends is important. If the world is entering a sustained period of de-globalization, what are the best ways to position portfolios for these trends? [3]

- There’s no escaping volatility. Market turmoil this year has pushed volatility levels higher. James Dunn goes through various approaches for dealing with volatility that may help you sleep at night when markets gyrate. [4]

- In our Hot Stock column this week, Raymond Chan, Head of Asian Desk at Morgans, tells us why he likes Macquarie (MQG). [5] Plus, Michael Gable, Managing Director of Fairmont Equities, reveals why he thinks Premier Investments (PMV) [6] may have some more upside in the short term.

- In Buy, Hold, Sell – Brokers Say, there were 16 upgrades and 16 downgrades [7] in the first edition and 7 upgrades and 3 downgrades [8] in the second edition.

- And finally, In Paul’s (Rickard) Questions of the Week [9], Paul answers your queries on whether ZIP Payments has a ‘buy’ rating, why does it keep dropping? Will the acquisition of ELMO Software complete at $4.85, or should you sell now? Why has metal detection technology company Codan fallen so far? What is the last day to buy ANZ shares and get the 74c final dividend?

Our videos of the week:

- Can we trust this ASX market rally? The experts like these stocks: WOW, COL, CBA, JHX & more! [10] | Switzer Investing (Monday)

- Should the reserve bank have gone 0.5% & will the Fed cause an interest rate comment surprise? [11] | Mad about Money

- Boom! Doom! Zoom! [12] | 3 November 2022

- Peter Switzer’s big-risk-big-return-play based on the tech space in the USA [13] | Switzer Investing (Thursday)

Top Stocks – how they fared:

The Week Ahead:

Food for thought: “Saving is a great habit, but without investing and tracking it just sleeps.” Manoj Arora

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Chart of the week:

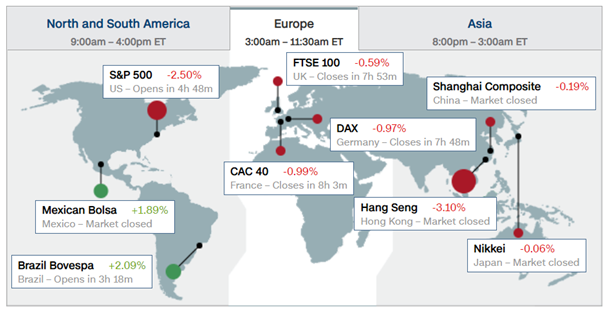

Overnight European share markets opened down, still spooked by what the Fed will do next to defeat inflation as American spending remains sticky and employment numbers defy predictions of a looming recession. In pre-open US stock futures, indicators were pointing to a negative open for US markets. – Damon Frith, nabtrade.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances