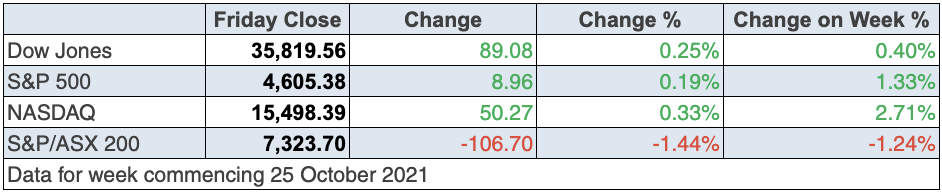

US stocks threw off concerns about weaker-than-expected reporting from Amazon and Apple and before the close they were in positive territory. In fact, Wall Street has had to cope with a number of curve balls this week with the US economy only growing at an annualised pace of 2% in the third quarter, against economists’ forecast of 2.8%.

But this from Ryan Detrick, chief market strategist at LPL Financial in the US, partly explained why stock players took this low number in their stride. “GDP told us what we already knew — the economy slowed down considerably in the third quarter,” he told CNBC. “The good news is we see the next few quarters more than making up for the slowdown, as COVID trends continue to improve.”

And it has been the overall calibre of company reporting that has been painting a picture that has excited investors and speculators alike. A part of this slow growth is linked to supply chain problems, which was at the core of Apple’s off report, which featured its revenues missing Wall Street estimates for the first time since May 2017.

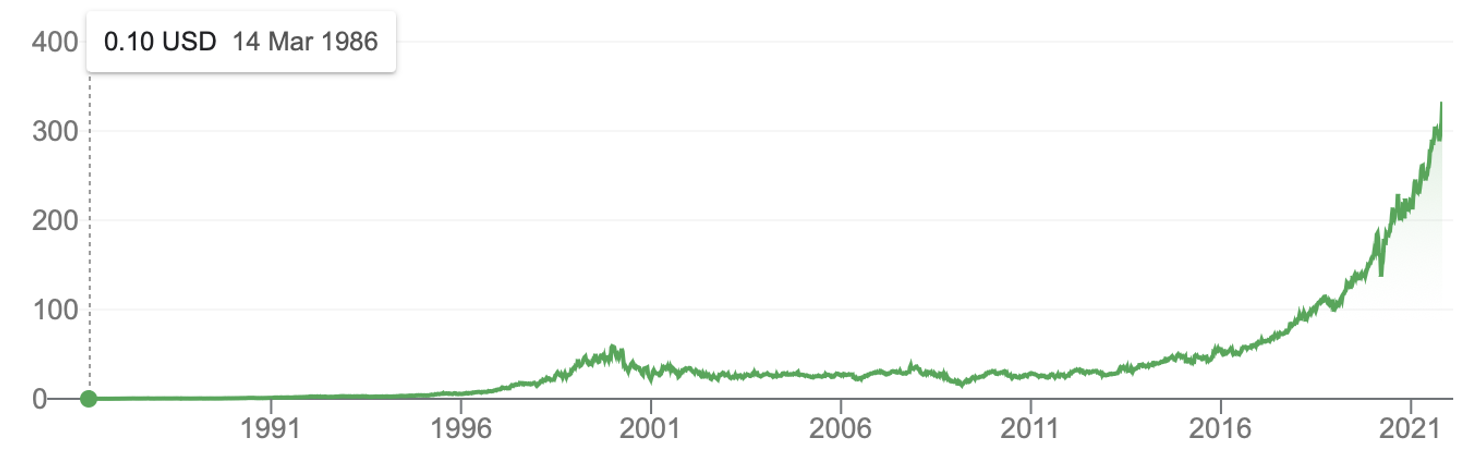

Microsoft MSFT

For those who like facts like this, Microsoft now has passed Apple as the biggest/most valuable listed company in the world. The chart above shows it wasn’t always a good play, but gee you wanted to be on this stock since 2012. And anyone who has listened to Charlie Aitken over the years knows this has been the big stock play for him and his fund.

Another headwind the US market has coped with was a big read on inflation overnight. The key inflation measure closely watched by the Federal Reserve in September posted its biggest year-on-year increase in more than 30 years.

The personal consumption expenditure (PCE) price index (the Fed’s preferred inflation measure) jumped 4.4% in September from a year ago, the largest 12-month increase since January 1991.

Reacting to the numbers, US Treasury Secretary Janet Yellen said that while the number was big, inflation is on the way down in the US, which has to be based on trends that the Biden Administration is monitoring. Certainly, on a CPI basis, the Yanks’ inflation rate last came in at 5.4% in September.

So why the persistence of optimism on Wall Street? Well, as of Thursday, about half of the S&P 500 companies have reported quarterly results and more than 80% of them beat earnings estimates from company analysts. S&P 500 companies are expected to grow profit by 38.6% year over year.

And it’s worth noting that for a month that can spell bad news for investors, the S&P 500 has gone four weeks in a row on a rise and looks set to be up 5% for the month. It was looking dodgy until October 13 but since then, company reporting, vaccination success, progress on the debt-ceiling wrangling in Washington and reduced concerns about China’s Evergrande debt ending up as a global problem has helped stocks climb higher. In contrast, our S&P/ASX 200 index is actually down 0.12% for the month. Hopefully we’ll play catch up with Wall Street in November.

Personally, I’ve always seen a stock like Caterpillar (CAT) going up as a positive sign for the global economy and even resource stocks, because this company moves a lot of dirt! And it started moving higher this week, but I must say it’s not a convincing rise just yet.

In the coming weeks, the challenge of the supply chain and what it does to costs and inflation is going to be a big watch for financial markets. If these headwinds progressively improve, then stocks will go higher and vice versa.

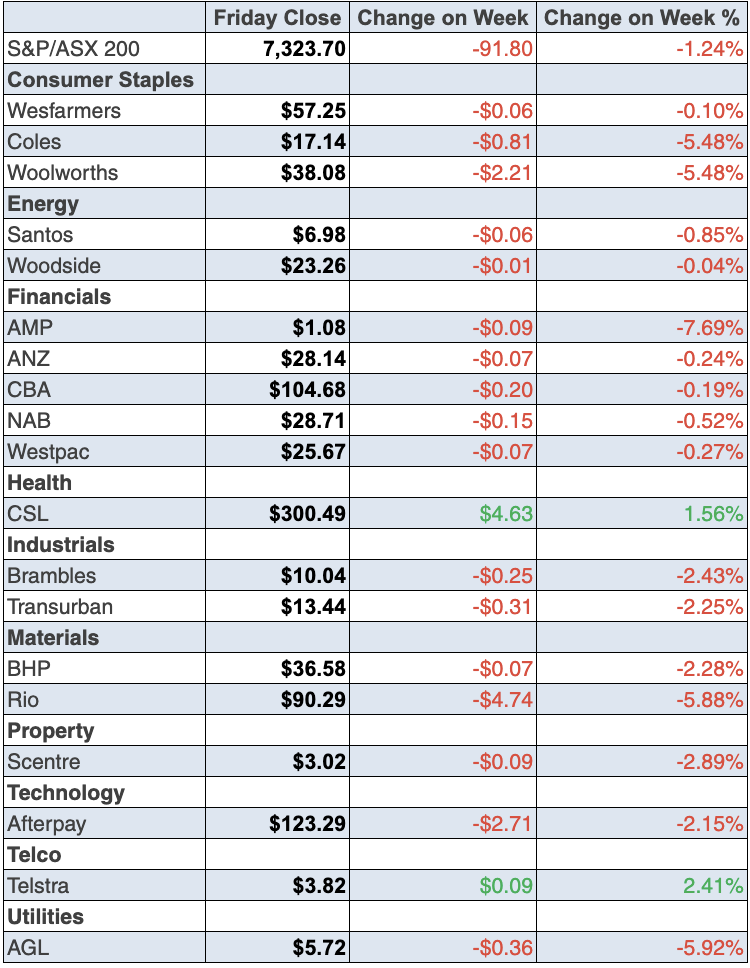

To the local story and I suspect our overall market reaction on Friday was silly but you get that with stocks. The S&P/ASX 200 Index lost 106.7 points on the last trading day of the week (or 1.44%) to close at 7323.7, which meant a 1.2% loss for the five-day trade.

Lower commodity prices and rising bond yields were big drivers of the market but I also think the poor reporting of Apple and Amazon on Thursday saw us overreact when you consider the positivity on Friday on the New York Stock Exchange (NYSE) and the Nasdaq.

Those who help explain our markets’ movements think rising bond yields linked to that bigger inflation number this week meant utilities and real estate stocks copped it as well.

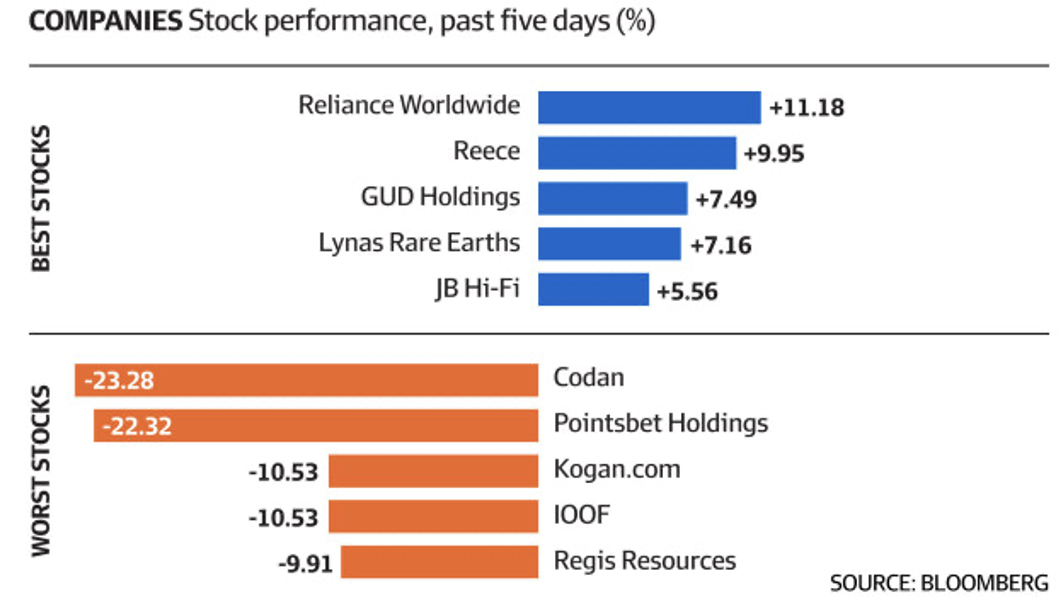

Here are Bloomberg’s big winners and losers:

Sector-wise, healthcare put in a nice one, with Resmed reporting a 20% rise in sales in the September quarter. And on a down-week, CSL was up 1.44% to $300.49.

What I liked

- Retail trade rose by 1.3% in September to be up 1.7% on a year ago.

- The Consumer Price Index (CPI) rose by 0.8% in the September quarter (consensus: 0.8%). The annual rate of the CPI eased from a 12-year high of 3.8% to 3%. It was big but was less than expected, which I liked, though the bond market reaction was excessive.

- Private sector credit (effectively outstanding loans) rose by 0.6% in September to be up 5.3% on a year ago – the strongest annual growth rate in 3½ years.

- The prices of exported goods lifted by 6.2% in the quarter to be up by 410% on the year – the strongest annual growth rate in 12½ years.

- Commonwealth Bank (CBA) national credit and debit card spending is 18.6% higher for the week ending 22 October 2021 when compared to the corresponding week in 2019. This is lockdown-release spending on an understandable rise.

- The US economy (GDP) grew at a 2% annual rate in the September quarter (survey: 2.6%).

- The Conference Board consumer confidence index in the US lifted from 109.8 to 113.8 in October (survey: 108.3).

- New home sales in the US lifted 14% in September (survey: 2.5%).

- Oil prices fell this week, which might be bad for my Woodside stocks but I don’t want too high an oil price to choke off the global economic recovery.

What I didn’t like

- The weekly ANZ-Roy Morgan consumer confidence rating fell by 0.2% to 106.8. Consumer inflation expectations over the next two years hit a 6½-year high of 5% last week.

- The “final demand” component of producer prices (business inflation) rose by 1.1% in the September quarter (the most in 8 years) to be up 2.9% on a year ago, the strongest annual growth rate in a decade. This needs to be watched.

- The prices of imported goods rose by 5.4% in the September quarter (the most in 8 years) to be up by 6.4% on the year.

- The Chicago Fed national activity index fell from 0.05 to -0.13 in September (survey: 0.18).

Interesting number

The CBA-RAI Regional Movers Index measures the number of people moving from capital cities to the regions, and it rose by 2% in the September quarter to 115.9 points, to be up 3% on a year ago.

CommSec’s Ryan Felsman watches these numbers that have spiked since the pandemic hit. “Regional coastal centres near Australia’s heavily populated east coast capital cities attracted the biggest share of capital city migrants in the September quarter,” he wrote this week. “The Gold Coast QLD (11%) was the most popular destination for city dwellers over the year to September. But the Sunshine Coast QLD posted the strongest annual growth rate in migration from capital cities (up 16%).

“And both Lake Macquarie NSW (up 17%) and Greater Geelong (up 8%) recorded the strongest quarterly growth rates, as Sydneysiders and Melburnians flocked to the regions to escape prolonged Delta lockdowns.”

If you live in these regions, this trend has to be good for your property prices.

By the way, in my Weekend Switzer story today, I look at why the smarties are investing in cryptocurrencies. Check it out here. [1]

The week in review:

- I share my thoughts [2] on whether we will see a Santa Claus rally in the stock market, and while I am confident I could pick the right direction for the ASX, I take the challenge a step further and reveal the specific stocks I think could make us money in a rally.

- Paul Rickard takes a deep dive [3] into the banking reporting season for three out of the big four banks to outline his pick for the best performer, and what dividends investors can expect to receive.

- James Dunn looks at a new wave of small-cap companies [4] that are forming part of what he calls the “quiet mining revolution”, namely potassium sulphate miners that are attempting more environmentally-friendly methods by reacting potassium chloride with various sulphate salts, to form what is called a double salt.

- With the ever-increasing global movement of the Great Resignation brought on by nation- and state-wide lockdowns over the past 18 months, employees looking to change careers, negotiate more entitlements such as working from home or just taking a year off are coming in droves. And for that reason, Tony Featherstone reveals two stocks in the HR sector that he believes will see an uptrend in 2022. [5]

- For our “Hot” stocks this week, Raymond Chan, Head of Asian Desk Retail, chose Transurban Group (TCL) [6] and Managing Director at Fairmont Equities, Michael Gable picks Goodman Group (GMG). [7]

- This week in Buy, Hold, Sell – What the Brokers Say, there were 14 upgrades and 19 downgrades [8] in the first edition, and 7 upgrades and 2 downgrade [9]s in the second edition.

- And in Questions of the Week, [10] Paul Rickard answers your questions and gives us his thoughts on a number of resources companies including Pilbara Minerals (PLS) and BHP Group (BHP), discusses the current buying potential of CSL (CSL) and QBE (QBE), and the last date investors can receive dividends from ANZ Bank (ANZ).

Our videos of the week:

- Boom! Doom! Zoom! | October 28 2021 [11]

- 5 stocks you have to own for the long-term + don’t ignore crypto + house prices slow in 2022? [12]

- Will inflation be a shocker today? + Are Crown, Woolworths and A2 milk in the buy zone? [13]

- “Buy!” stocks: Fineos, Elders, PMV, IOOF & ELO’s CEO on why its share price is up 25% since Oct 5 [14]

Top Stocks – how they fared:

The Week Ahead:

Australia

Monday November 1 – Home value index (October)

Monday November 1 – ANZ job advertisements (October)

Monday November 1 – Purchasing manager indexes – Manufacturing

Monday November 1 – Lending indicators (September)

Tuesday November 2 – Reserve Bank Board meeting

Tuesday November 2 – Speech by Reserve Bank official Deputy Governor, Guy Debelle

Wednesday November 3 – Building approvals (September)

Wednesday November 3 – New vehicle sales (October)

Wednesday November 3 – Purchasing manager indexes – Services

Thursday November 4 – International trade (September)

Thursday November 4 – Retail trade (September)

Friday November 5 – RBA Statement on Monetary Policy

Overseas

Sunday October 31 – China Purchasing manager indexes (October)

Monday November 1 – US Purchasing manager indexes (October)

Monday November 1 – US Construction spending (September)

Monday November 1 – US New vehicle sales (October)

Tuesday November 2 – US Federal Reserve meeting

Wednesday November 3 – US Purchasing manager indexes (October)

Wednesday November 3 – US ADP private sector payrolls (October)

Thursday November 4 – US Challenger job cuts (October)

Thursday November 4 – US International trade (September)

Friday November 5 – US Non-farm payrolls (October)

Food for thought: “Every great money manager I’ve ever met, all they want to talk about is their mistakes. There’s great humility there.” – Stanley Druckenmiller

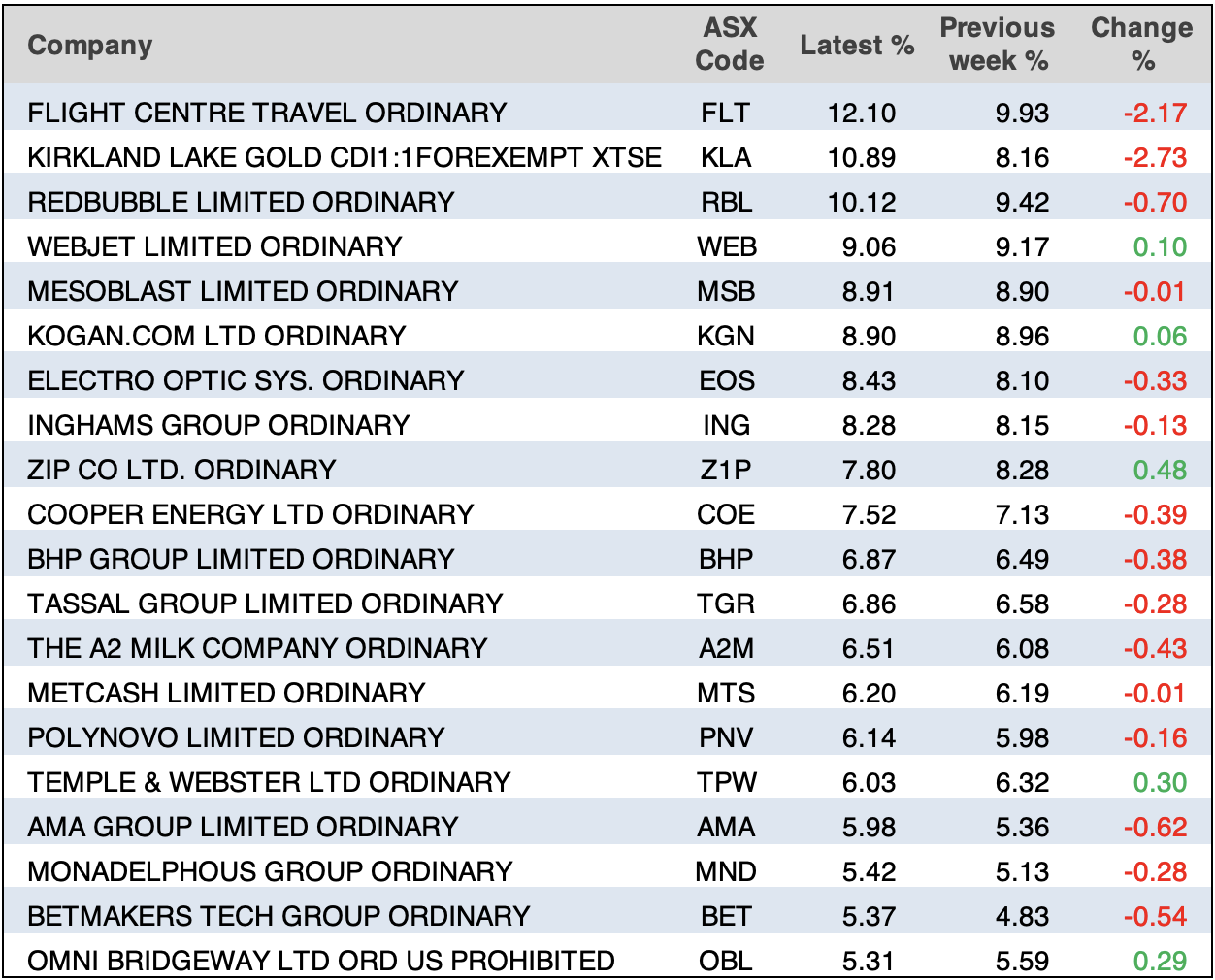

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

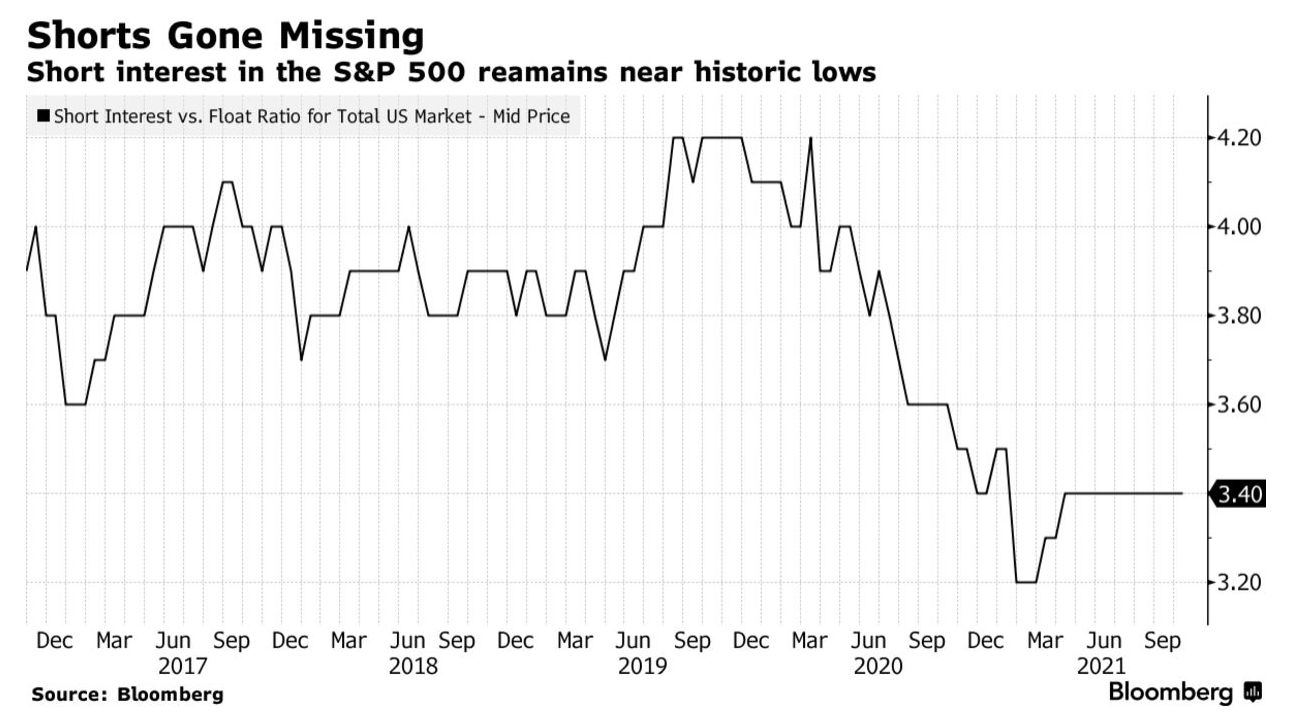

Chart of the week:

An article from Bloomberg late this week discussed how there has been a shortage of bets against the S&P 500 since the beginning of the Covid-19 pandemic last year, and why US bank Wells Fargo believes this to be a worrying trend. The chart below shows just how dramatic the decline has been in shorts against the US index since March 2020, which strategists from Wells Fargo believe is “concerning in the longer term, as higher short interest levels tend to help minimize price gapping when the market is faced with unexpected risks or shocks”. The counter according to Bloomberg, however, is that “the continued trend of low short interest suggests that investors who brushed off fears of shrinking large cap margins prior to the third quarter earnings season have largely been correct”.

Top 5 most clicked:

- If there’s a Santa Claus rally, what stocks will make us money? [2] – Peter Switzer

- Bank reporting season – who will star, and what dividends can you expect? [3] – Paul Rickard

- 6 potassium sulphate stocks forming part of the quiet revolution in mining [4] – James Dunn

- Buy, Hold, Sell – What the Brokers Say [8] – Rudi Filapek-Vandyck

- “Hot” stock: Transurban Group (TCL) [6] – Maureen Jordan

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.