There are passionate believers on both sides of the crypto debate. Some argue that digital currencies built using blockchain architecture represent the democratisation of global finance and will revolutionise the way trade is conducted. Others say they are a ponzi, built on the “greater fool theory”.

Take this from Chris Joye writing in the AFR on the weekend:

“In contrast to stocks, bonds, and property, the existential risk for cryptocurrencies is that it is impossible to value assets that have no intrinsic worth. The crypto ponzi relies on the greater-fool-theory: with no income-generating capacity and de minimis practical uses aside from money laundering and tax evasion, Bitcoin is only worth more than $0 if you can convince another person that it will one day trade at a higher value. Hence the hyperbolic crypto-to-the-moon memes.”

But despite bears such as Chris, a bitcoin today is worth about US$30,000 – up massively from the US$10,000 at the start of the pandemic, but less than half the US$67,000 it reached in August last year.

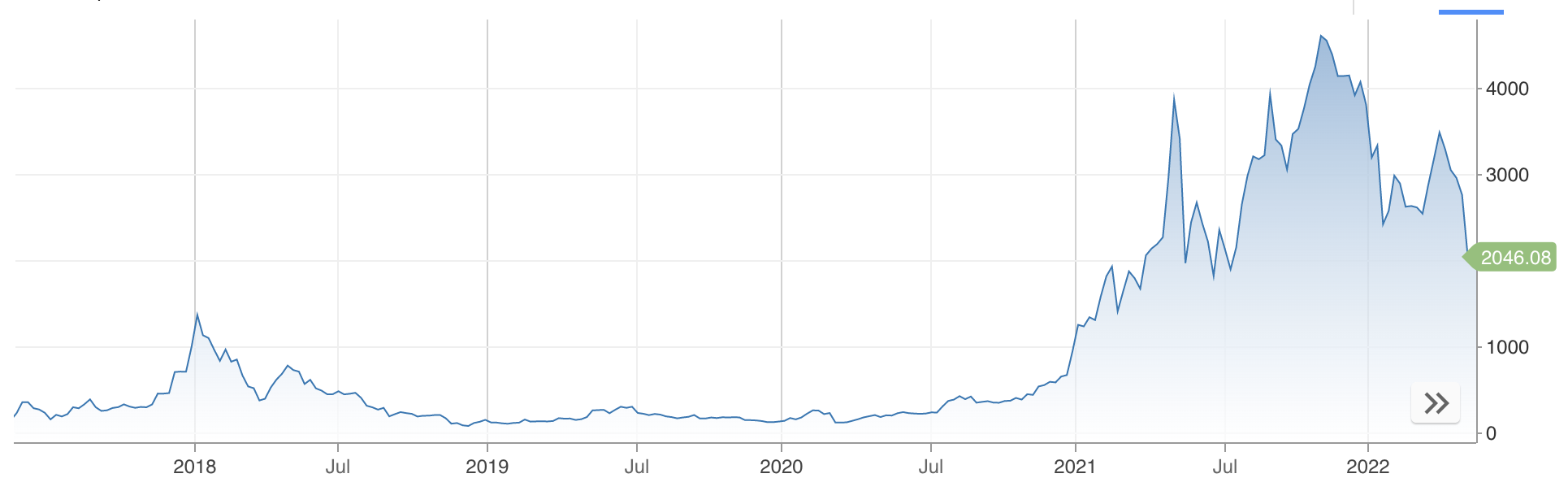

Bitcoin (USD) – 5 years to May 22

Source: cnbc.com

If you are up for the challenge, there is an easy way to invest in Bitcoin (and the second-largest digital currency, Ethereum) through three newly listed exchange traded funds. Here is a review of what is on offer, but first a quick re-cap on the digital currencies.

Bitcoin

The first and oldest digital currency, Bitcoin was created in 2009 by the pseudonymous Satoshi Nakamoto (origins unknown). It is built using the blockchain, a globally decentralised ledger that records each transaction and who owns the bitcoin.

There are about 18.9 million Bitcoins on issue, giving the currency a “market worth” of about US$570bn or A$810bn. By design, supply is finite and the number of Bitcoins is capped at 21 million. New Bitcoins are created by “mining” (essentially using massive computing power to solve complex mathematical problems). However, the reward for “mining” diminishes as more Bitcoins are added to the system (known as “halving”, which occurs on average every four years), meaning that the cap of 21 million coins might never be reached.

It is this cap that gives rise to one of the strongest arguments used by bitcoin proponents – it is a store of value, a bit like gold. That relationship has broken down a little in the last few months in that it has become part of the “risk on/risk off trade” (that is, rising in value when the US stock market rallies and falling when it falls), rather than a “gold like” asset which would go the other way (increase in value when the stock market is rattled). However, it does appear to be doing a lot of work around the US$30,000 level.

Ethereum

Ethereum is the second-largest digital currency with a market worth of about US$240bn or A$350bn. (Technically, Ethereum is the name of the blockchain and Ether is the name of the currency, but everyone refers to it as Ethereum).

Brought to life in 2014 by Vitalek Buterin, Ethereum is a fully decentralised platform. Its major advantage over Bitcoin is its transaction speed – typically 10 to 20 seconds rather than the 10 minutes it takes for a Bitcoin transaction to be updated across the network.

There are about 120 million Ethereum coins on issue. Unlike Bitcoin, there is no cap on the total supply of coins. Rather, there is an annual cap of 18 million new coins being added.

Ethereum (USD) – 5 years to May 2022

Source: cnbc.com

Exchange Traded Funds

Brokers such as CommSec offer the facility to trade cryptocurrency exchange traded funds. There are now three funds listed locally – two Bitcoin ETFs and one Ethereum ETF.

1. ETFS 21Shares Bitcoin ETF (EBTC)

The ETF Securities 21Shares Bitcoin ETF aims to track the performance of Bitcoin in Australian dollars. It invests directly in Bitcoin through the ETFS 21Shares Wholesale Bitcoin Trust. It trades on the ASX/CBOE under the ticker EBTC.

1 unit in EBTC is equivalent to 0.0001 of a Bitcoin, so 10,000 units in EBTC is equivalent to owning 1 Bitcoin and would cost about US$30,000 or A$42,500. Going the other way, if EBTC is trading at $4.25, then 1 Bitcoin is worth about A$42,500.

Upon application and payment of a fee, units in EBTC can be redeemed and exchanged for “physical” bitcoin.

The management fee is 1.25% pa (which is deducted from the value of the fund).

Liquidity in the ETF has been below expectations, On the first day of trading, 231,000 units worth $1,000,000 changed hands – by last Friday, this had fallen to 50,000 units (approx. $213,000).

2. Cosmos-Purpose Bitcoin Access ETF (CBTC)

The Cosmos-Purpose Bitcoin Access ETF, which trades under the ticker CBTC, is an ‘access’ ETF in that it invests in another ETF, the Purpose Bitcoin ETF. Listed on the Toronto Stock Exchange, the Purpose Bitcoin ETF was the world’s first spot Bitcoin ETF and has assets under management of about A$1.9bn. According to the promoter, it demonstrates a “proven track record, institutional adoption and robust liquidity”.

The all-up management fee is also 1.25% pa, but this is being waived until 11 July.

Liquidity in CBTC has been poor – with 57,000 units changing hands on the first day of trading and falling last Friday to 1,400 units worth a paltry $11,000.

3. ETFS 21Shares Ethereum ETF (EETH)

This ETF tracks the performance of Ethereum in Australian dollars. It operates like the ETFS 21Shares Bitcoin ETF above.

1 unit in EETH is equivalent to 0.001 Ethereum, so 1,000 units in EETH is equivalent to 1 Ethereum. With Ethereum trading at about US$2,050 or A$2,900, EETH is quoted around $2.90 per unit.

Upon application and payment of a fee, EETH units can be exchanged for “physical” Ethereum. The management fee is 1.25% pa.

Advantages and Disadvantages of the ETF structure

The main advantage of an ETF over buying crypto directly through a crypto exchange is investors don’t have to worry about a digital wallet and the security of storing their private keys. The custody arrangements for the crypto that the ETF issuer has arranged could also be stronger, as they are ‘institutional grade’.

Trading is also very easy – through your broker, in Australian dollars.

The main disadvantage is the management fee of 1.25% pa, plus potentially the liquidity/trading spread. If volume grows with these ETFs, that problem shouldn’t eventuate, but it will depend on investor appetite and the quality of the market making. With ASX/CBOE trading hours of 10.00am to 4.00pm, trading times are restricted compared to the 24×7 access some exchanges offer.

Investors should also be cognisant that the ETFs are quoted and priced in Australian dollars. The crypto markets are global and priced in US dollars – so in addition to crypto pricing risk, investors in these ETFs have currency risk.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.