I’ve been tipping for months that when interest rates get near the top or start to fall, then growth and tech stocks will be re-loved. Throw in the red-hot enthusiasm for companies dealing in AI and you have the explanation of why tech stocks got a big lift following the booming result for Nvidia in the US late last week.

Currently the big tech companies are getting most of the new buying, but we’re now looking for any business that will benefit from AI.

On Friday, Megaport spiked 6.1% and 25.27% for the week, while Next DC rose 11.94% on Friday alone. I don’t know if they’ll benefit from AI, but they are being seen, along with Xero, as the go-to stocks when tech is in favour on Wall Street.

But what about two companies hurt by the growth and tech stock sell-off that followed the rapid rise in interest rates worldwide in 2022 into 2023? Who are these two companies? They’re ZIP and Audinate (AD8).

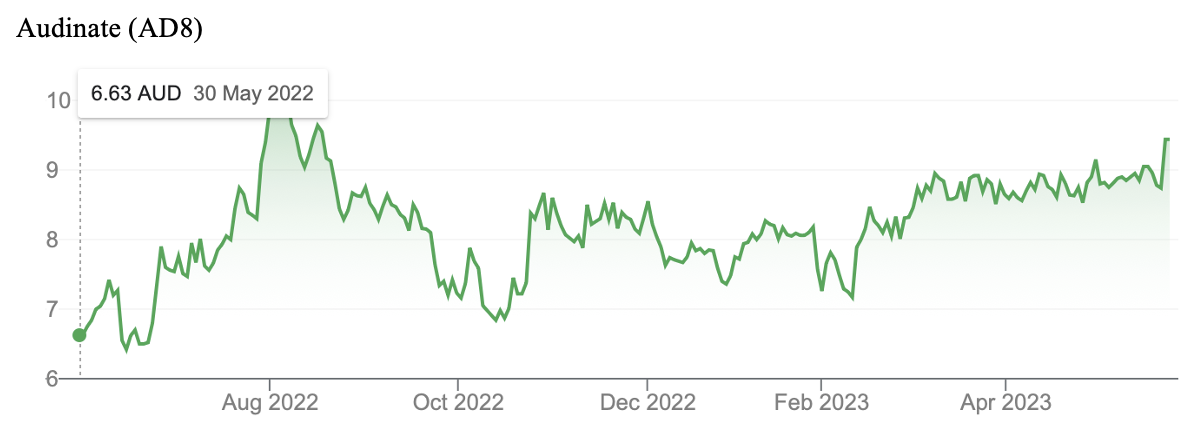

I think AD8 is a ripper company that will deliver over time as its technology is seen as world class, much the same as MP1’s intellectual property is viewed. And so do the analysts surveyed by FNArena.

The consensus average rise tipped is 11.5% but, importantly, four out of four expert company watchers like the business. The biggest fan is Shaw & Partners with a projected price target of 24.27% higher than it is today, with the other three seeing an average rise of around 7% or so.

That’s not bad considering the company’s share price is up 42.38% for the year. Given my support for the company, it’s been a nice revelation. At $9.44, AD8 is near its all-time high of around $10.50.

This company is bound to get an additional lift when the share prices of ignored tech companies make a bigger comeback later in 2023 or early 2024, as interest rates start to be peeled back. It looks like the kind of stock that should be in a lot of portfolios looking for growth.

That’s the easy-to-buy tech stock. What about the troubled child Zip Co Ltd?

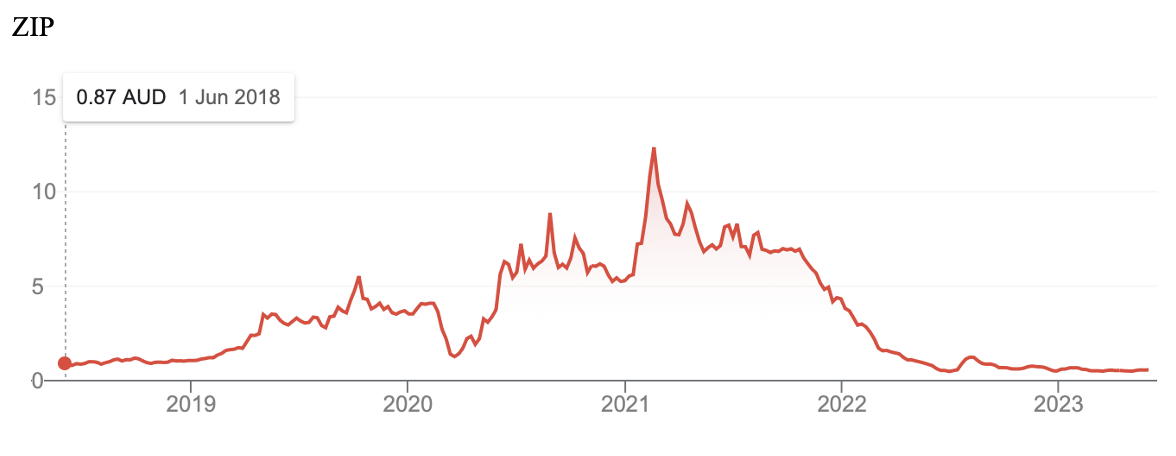

This chart says it all for those of us who were caught in the big sell-off of Buy Now Pay Later (BNPL) stocks, which weren’t helped by the rising interest rates that hit growth and tech stocks with notable borrowings.

This chart above reminded me of the ‘hat’ drawing in the book The Little Prince, which, in reality, was an elephant consumed by a big boa constrictor!

I know a guy who bought ZIP cheap, sold out at $10 and bought a farm with his winnings! However, many investors loved the all-time high of around $12.35 but have felt like they’ve been eaten alive by the boa constrictor called the stock market.

Co-founder of ZIP, Peter Gray, has promised to show up for my TV show next week. After hearing what he has to say, I hope I can find a reason to dollar cost average myself into a lower cost for my ZIP holdings, with the prevailing price at 57 cents! Nothing in that chart is telling me that this is a screaming buy. Last week I asked Michael Gable to look at ZIP’s chart and he too couldn’t find anything with the technical analysis that could talk us into giving the once second-best BNPL in Australia and possibly in the US, a reason to back it.

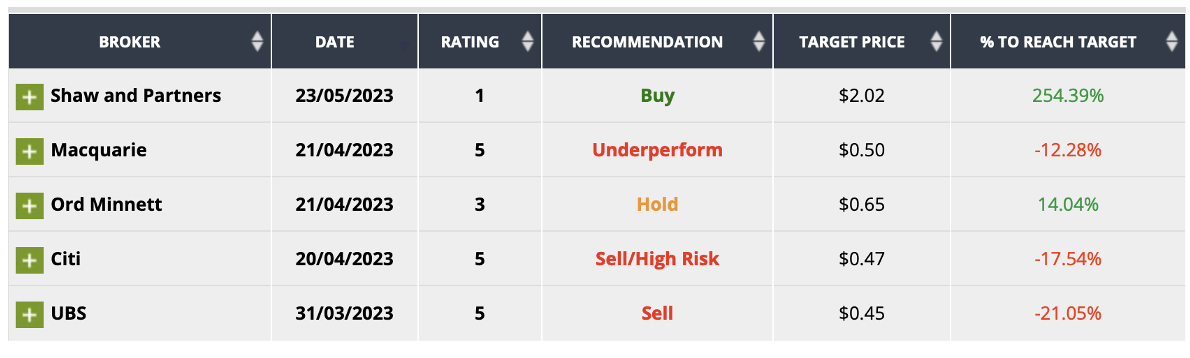

Against this negative outlook for the company’s share price, the analysts’ view is divided and complex.

Three out of five expert company watchers can’t put their reputation on the line to see a nice future for the company. The average expected fall from these guys is around 17%, but Ord Minnett can see a 14% rise on the cards and wait for it, Shaw and Partners is predicting an unbelievable 254.39% rise! Here are the different views that the analysts have on this company.

Last week we learnt that regulation is coming for the BNPL companies. The news reports all said that both ZIP and CBA (with its Klarna BNPL business) got the regulation they both argued for. But this did nothing for ZIP’s share price last week, which went nowhere.

For those looking for a “where there’s smoke there’s fire” plus, look at the chart for the past month.

That’s a 11.76% gain. I’m hoping Peter Gray can give us good reason to believe that this business has a future or else it could be a takeover target. That’s going to be my line of questioning on my TV program tonight for Dawsey, and then Peter next week — watch this space!

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances