TV news reports on floods, bushfires and other natural disasters usually focus on the terrible damage to homes and small businesses.

Less considered are the long-term effects of these disasters on the structural integrity of affected infrastructure and commercial buildings.

For example, what does cyclone-related flooding in Queensland mean for mine or defence infrastructure in the area? How did the Christmas superstorm on the Gold Coast, with its tornado-like winds, affect some ageing buildings?

Even small earthquake tremors can affect the structural integrity of older or poorly designed buildings, according to media reports.

Readers can form their own view on climate change and whether the frequency and intensity of natural disasters is likely to increase.

This column’s focus is on the here and now. That is, rising demand for services to and remediate damaged buildings – and what that means for a small group of ASX-listed stocks that specialise in this area.

It’s not just about natural disasters. Australia has a lot of ageing infrastructure and buildings that need to be inspected and, in some cases, remediated.

We also have too many poorly built structures that are vulnerable to general weather changes. Think high-rise apartment towers that were hurriedly built and have become urban heat islands due to lax planning rules. How will these buildings fare if temperatures continue to edge higher in summer?

Moreover, tighter regulations for the construction industry, greater penalties, and communities more aware of their legal rights should underpin rising demand for building engineering services and property remediation.

Heaven help a resource company that does not sufficiently maintain old infrastructure and damages local waterways after flooding at a mine. Or a port that damages the marine environment due to ageing dock infrastructure.

One can imagine organisations spending more on compliance in this area and acting faster to repair damaged structures. Yes, it’s taken too long, but there’s so much at stake for corporate reputation, insurance premiums and the law.

Here are two stocks exposed to this trend. One has been featured previously in this column – Johns Lyng Group. It warrants an update due to strong share-price gains since November. The other is Duratec, an interesting small-cap stock that is covered in this column for the first time.

1. Duratec (ASX: DUR)

The Perth-based company listed on ASX in November 2020 after raising almost $53 million through an Initial Public Offering (IPO).

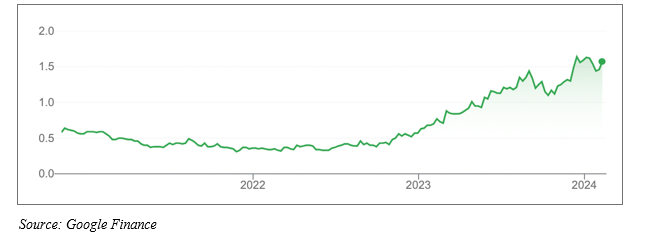

Duratec’s shares mostly traded below their 50-cent issue price for the first two years after listing, which is common for many small-cap floats these days.

Duratec shares rallied last year as the market reappraised its performance and medium-term growth prospects. Duratec currently trades at $1.51.

The national contractor provides assessment, protection, remediation, and refurbishment services to a range of assets. These include commercial buildings, marine infrastructure, mining and energy assets, defence, and heritage buildings.

Organisations pay Duratec to diagnose the condition, integrity, and degradation of their key assets. Then, in some cases, develop and deliver solutions to protect and extend an asset’s life, as part of its maintenance activities.

In its 2020 prospectus, Duratec noted that Australia has a growing number of ageing steel and concrete buildings that require remediation and refurbishment services. The company argued that its national presence and end-to-end solution were advantages over smaller competitors in its market.

Duratec is growing quickly. Revenue of $491.8 million in FY23 was 58.6% higher on a year earlier. Normalised underlying earnings (EBITDA) of $38.8 million were about double that in FY22. Staff numbers grew from 857 to 1173 at the end of FY23.

At its November 2020 AGM, Duratec said it “continued to experience favourable trading conditions”, adding that its first quarter FY24 results were in line with expectations. This helps explain the rally in Duratec over the past year.

Duratec said the value of work tendered (and not yet awarded) was $1.02 billion and that it had “strong expectations for some significant project awards in coming months”.

Duratec’s defence work – about 45% of its revenue – keeps growing. Its acquisition of Wilson’s Pipe Fabrication extends Duratec’s reach into the energy sector – a larger market with plenty of ageing infrastructure assets.

In terms of guidance, Duratec expects Fy24 revenue of $570-$610 million and normalised earnings of $45-$52 million. Duratec could extend its recent share-price gains if it achieves the high end of that guidance range.

There are three main risks to this growth story. The first is management change with managing director Phil Harcourt stepping down from the role for family reasons. Harcourt will remain on the Duratec board but appointing a new CEO during periods of rapid growth can be an issue for small-cap companies.

The second risk is labour. Like many businesses, Duratec faces staff-retention, labour-supply, and wage-cost pressures. The business has done a good job so far to recruit more staff in a tight labour market. However, greater use of subcontractors, were that to occur, would affect profit margins and possibly quality control.

The third and main issue is valuation. After recent share-price gains, Duratec is capitalised at $390 million. Assuming it lifts earnings per share (EPS) to about 10 cents in FY24, using the mid-point of guidance, the forward Price Earnings (PE) is about 15. Its EPS was 7.91 cents in FY23.

Duratec is no screaming buy and is probably due for a share-price pullback or consolidation after recent price gains. But a forward PE of around 15 looks reasonable for investors given Duratec’s growth profile and prospects, and the tailwinds in its market due to ageing structures.

Duratec should only be considered by long-term investors who understand the features, benefits, and risks of investing in small-cap stocks. More will be known when Duratec reports if first-half result of FY24 on 23 February.

Chart 1: Duratec

2. Johns Lyng Group (ASX: JLG)

Johns Lyng continues to expand through organic growth and acquisitions and build its footprint in disaster-recovery services in Australia and the US.

To recap, the Victoria-based integrated property company provides building insurance and restoration services; commercial building and property management; disaster recovery and management; and 24/7 emergency services.

Johns Lyng describes itself as “Australia’s largest national disasters responder”. Its fleet of emergency rigs is on standby for major storms or cyclones in Australia.

Sadly, that’s a growth market judging by the frequency of disasters lately.

The company’s work on the recovery process after Hurricane Ian, one of the deadliest storms to smash Florida in years, shows how building remediation after disasters can create a long runway of work for service providers, given the volume of affected properties.

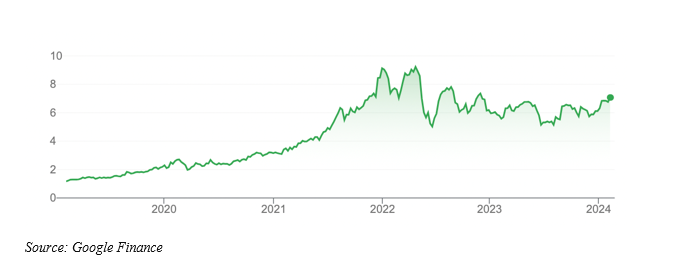

Johns Lyng has rallied this year from about $6 to $7, but still trades well below peak prices of above $9 in early 2022.

A recent trading update on its US operations has underpinned this year’s rally. Johns Lyng announced a partnership with Allstate, one of the largest US insurers. The deal covers the provision of emergency response make-safe and water mitigation for about 16 million Allstate policyholders, should these services be required.

The US is the key to Johns Lyng’s long-term fortunes. The Allstate news adds to its US momentum after Johns Lyng’s 2022 acquisition of Reconstruction Experts for US$144 million. Reconstruction Experts is a leading provider of insurance-focused repair work in Colorado, Florida, Texas, and California.

The US is a tough market for small- and mid-cap Australian companies to crack, but also a large, potentially lucrative one given it is many times the size of Australia.

At its current price, Johns Lyng trades on a forward PE of about 30 times on some broker estimates. That’s high for a small-cap services company that does not have a clear ‘economic moat’ or defendable competitive advantage. Still, Johns Lyng’s growth prospects in the US warrant a higher valuation multiple.

Prospective investors might watch and wait for better value in Johns Lyng as the market digests its recent US news and half-year FY24 results on 27 February. It’s a stock to consider for long-term investors who want exposure to the US building restoration and remediation market.

Chart 2: Johns Lyng Group

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation, and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 7 February 2024.