I saw a great cartoon the other day. The first half showed a mother in the 1970s yelling at the kids to come inside after spending all day outside. The cartoon’s second half showed a mum in 2021 yelling at the kids to go outside and get off their screens!

The humour resonated with me. Like many parents, I worry that kids spend too much time online, and not enough time outdoors on their bikes, playing sport or hanging with friends.

Covid hasn’t helped. Kids in Victoria and, to a lesser extent, New South Wales, have been in lockdown for months. It’s sad seeing kids only having movie nights with their friends on Zoom, or believing that playing Minecraft with a bunch of friends is a group sport. Yes, it’s better than nothing, but digital interactions are no substitute for the real thing.

So, what happens when lockdowns fully ease, and life returns to normal? Will parents be more concerned when their kids get public transport or spend more time on their own, outside the home? Will it be harder for kids to break digital habits formed during Covid?

It’s too soon to know the answers. I do know that kids are spending more time online, meaning cyber safety will become an even bigger issue for parents. I also expect more parents will use technology to track (sparingly, I hope) where their kids are outside the home.

The safety theme led me to ASX-listed Life 360 Inc (360), which has a clever App that family members (with permission) can use to track each other’s location. The technology is not for everyone; I find it useful to time my trip to pick up kids from school events, for example.

I first covered the San Francisco-based company for The Switzer Report in early July 2020 (“2 transport small-caps that could benefit from Covid”).

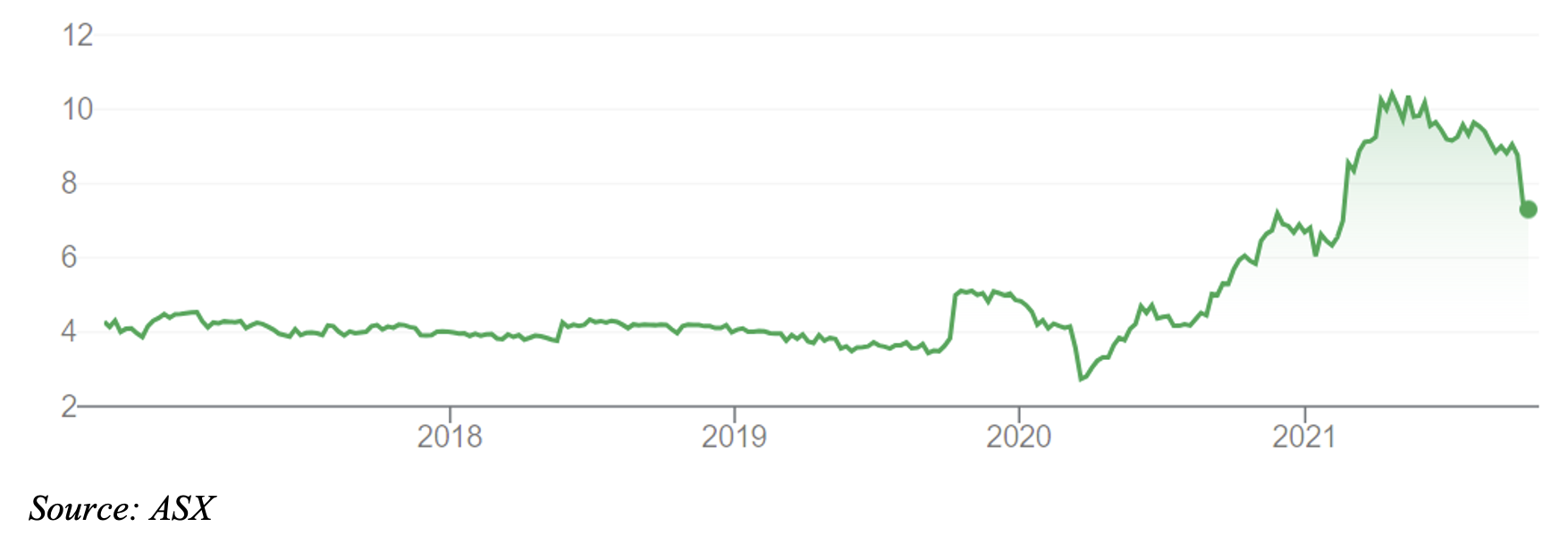

Life 360 has rallied from $2.70 at the time of that article to $9.08. The company has excellent long-term growth prospects as it adds more paid services to its tracking technology, but in broking parlance it is a “hold” for now after strong share-price gains this year.

Chart 1: Life 360 (360)

As an aside, the other transport stock covered in that July 2020 Switzer article was ferry and bus-service operator SeaLink Travel Group (SLK). Like Life 360, SeaLink rallied last year, but has been under recent pressure after missing a contract.

SeaLink, an excellent business, looks interesting after recent share-price falls. I have it on my watchlist to look at for a future edition of The Switzer Report.

Chart 2: SeaLink Travel Group (SLK)

Like Life 360, a handful of other ASX-listed stocks provide technology to help keep kids safe. Here are two that stand out:

- Family Zone Cyber Safety (FZO)

I first noted Family Zone, a provider of cybersecurity services for schools and families, in August 2019 for this Report at about 20 cents, and again in September 2020 (“Winners from the Pandemic Fallout”) at 54 cents. It is now 66 cents, having lost some ground this week.

Family Zone has rallied over the past 12 months, but the gains have further to go, albeit at a slower pace from here and with bouts of share-price volatility alone the way. There’s a lot to like about Family Zone’s technology, market position and global growth prospects.

To recap, Family Zone has developed an ecosystem of cybersecurity protection for children and teenagers. Schools pay US$2.50 to $3.50 per student/per year to use its internet filtering and compliance technology. The company’s Classroom Management software (US$2-5 per student) helps teachers keep track of children in digitised and virtual classrooms.

Family Zone also has an emerging product that supports the pastoral needs of children at schools (for example, if kids are looking at self-harm material online). Then there’s the potential to sell the technology to parents who want to keep their kids safe online.

A step-change in Family Zone’s growth profile came this year with the acquisition of Smoothwall and a $146-million capital raising. Smoothwall is the UK’s leading provider of K-12 digital safety solutions, servicing just over a third of that market. It looks a good acquisition.

I doubt the market is paying enough attention to Family Zone, even after its rally this year. The stock is barely covered by brokers, and as a micro-cap was too small for many funds. Now capitalised at $469 million, Family Zone should be on the radar of more small-cap managers.

Four aspects of Family Zone appeal. Firstly, it has excellent technology. Some good judges I know who follow the company closely believe its technology solves a large and growing problem for schools: monitoring online activities of kids at school, and keeping them safe online.

Secondly, the school market is hard to crack, but lucrative for companies that build a strong foothold. Family Zone software is now used by 3 million licensed students at schools worldwide, according to information in the company’s latest annual report. About 5,600 schools worldwide have signed up as Family Zone clients – a network that is valuable and hard to replicate.

The third attraction is its business model. Education Technology (edtech) is a beautiful business when it works.

Upon signing up a school, Family Zone effectively signs up thousands of users (students) who pay (via their school) an annual subscription fee. In turn, that provides recurring, visible, high-margin annuity income for the company.

Fourthly, Family Zone is a genuinely global Australian small cap. It describes itself as the fastest-growing provider in its market in the US. The acquisition of the Smoothwall business in the UK immediately gives Family Zone a strong position in that market. Smoothwall software is used by 6.1 million students in the UK, through 12,400 schools.

If I’m right, Family Zone’s sign-up of schools should quicken in the next few years. Over time, its strategy to sell more online safety products to more schools has merit. Once schools get used to the service, there are high switching costs to leaving, meaning Family Zone has some pricing power (although it’s hard to be too aggressive on price with schools).

Family Zone’s revenue grew 76% to $8.96 million in FY21. It needs to deliver a step-change in growth to justify its higher valuation. Early signs are promising and there’s no doubt that edtech and cybersecurity for kids are long-term growth markets.

The pandemic has quickened online-learning trends. It will be great to see kids back in (real) classrooms nationwide, but hybrid learning models are the future. That means kids spending more time online in class or at home – and rising demand for cybersecurity tools.

Chart 2: Family Zone Cyber Safety (FZO)

- Spacetalk (SPA)

Spacetalk provides a range of smartphone GPS watches for kids (Spacetalk Kids and Spacetalk Adventurer) and seniors (Spacetalk Seniors). The idea is that kids have a Spacetalk wearable device (a type of smartwatch) that connects to their parents or guardian.

The Spacetalk Adventurer is designed to give parents peace of mind while their kids are out exploring. The watch has no open-access to the internet and social media, meaning kids are not at risk of exposure to age-inappropriate material. The watch allows calls to pre-determined contacts (eg parents), has an SOS Alert button, counts steps, has an in-built camera and so on.

Knowing their child can contact them, and vice versa, through a Spacetalk watch at any time, appeals to parents and guardians.

I avoided Spacetalk in the past, principally because I couldn’t identify a strong barrier to entry for its technology. Kids seem to be getting a smartphone earlier than ever these days, and that does everything a Spacetalk watch does and more.

I suspect the appeal of Spacetalk is that it is not internet or social-media enabled. The downside of a smartwatch is kids being able to access the internet – or others being able to communicate with kids through their media. For kids, Spacetalk is colourful, easy to use and fun.

Like Family Zone, Spacetalk has global ambition. This month, it announced a deal with Elisa (Finland’s largest telco) to sell Spacetalk in its 50 stores.

Spacetalk’s FY21 revenue grew 44 per cent to $15.1 million – a good effort in the pandemic. Retail distribution is key: Spacetalk is now stocked in 1,200 stores in Australia, New Zealand and the UK (and soon to be Finland).

The company launched a Spacetalk App in December 2020 for kids to have on their phone. Paying users of the App rose 80 per cent over the year.

Spacetalk this week announced 50% revenue growth in quarterly trading update (for the first quarter of FY21, compared to the same period last year). The company is growing quickly, off a low base.

Spacetalk’s share price is up from a 52-week low of 10 cents to 20 cents. As a $33-million company, Spacetalk is too small for most portfolio investors. The company has had its share of false starts and challenges over the years, and its price has been volatile. The stock suits experienced investors who understand the features, benefits and risks of investing in speculative micro-cap companies with lower liquidity.

Of the two stocks in this column, I prefer Family Zone. But speculators could have a closer look at Spacetalk as it starts to deliver on its potential. The company seems to have more momentum lately than it has in years.

I can imagine lots of parents worrying about their kids using public transport after the pandemic, or kids having to deal with unexpected disruptions (such as a venue being declared an exposure site). Those “helicopter parents” will use technology to “hover” closer than ever.

Chart 2: Spacetalk (SPA)

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.