Many companies worldwide are developing products or services to help reduce global warming. Decarbonization is the biggest game in town.

From Tesla’s electric cars to wind farms, solar-panel makers and lithium miners, the list of companies working on climate-change mitigation is long and growing.

It’s good stuff. But not enough. At COP27 in Egypt this month (the 27th United Nations Climate Change conference), it’s clear that the goal of limiting global warming to 1.5 degrees Celsius is getting further away.

The Economist this month argued that the world will miss the 1.5°C target from the Paris Agreement because large emitters lack sufficient urgency on climate change.

Anybody who has read the Intergovernmental Panel on Climate Change’s (IPCC) 2021 report (IPCC AR6 WGI) knows that changes from global warming, such as melting polar glaciers, will continue for decades or centuries. Aspects of ocean warming are, sadly, irreversible over certain timeframes. Too much damage has been done.

This column’s purpose is not to add to climate alarm or encourage speculation in climate-change stocks. Rather, the goal is to highlight that investors cannot think only about companies involved in climate-change mitigation (as important as that is).

We need to do more work on climate-change adaptation and how the world responds to climate changes that are baked in. Also, which companies win and lose from adaptation as communities respond to more natural disasters, for example.

Adaptation was a theme at COP27. The IPCC describes adaptation to climate change as “adjusting our behaviour: (Where we chose to live; the way we plan our cities and settlements; and adapting our infrastructure in green or urban areas)”.

Identifying climate-change adaptation stocks is tricky. All companies will be affected in one way or another. If the IPCC’s consensus forecasts are correct, widespread societal change will be required to adapt to the effects of climate change.

For investors, speculating on what that change looks like – or when – is dangerous. Successful investing is about buying quality companies when they trade at bottom-quartile valuations. And having the patience and conviction to hold them.

In identifying “winners” from climate-change adaptation, I’m looking for undervalued stocks that can grow their earnings faster over the next few years than the market expects as they do more climate-change-related work.

I considered companies from sectors such as water, agriculture, technology, human resources and infrastructure. Global warming has obvious implications for water usage and storage, and for the agriculture sector generally.

Technology is interesting, Companies will need to think harder about how their technology infrastructure adapts to climate change. Putting more data in the cloud and facilitating remote work through technology will be good for tech-services stocks.

Human-resource companies could benefit if climate-change adaptation requires significant changes in how – and where – many people work. What happens on building sites, for example, if there are more extreme heat days that force work to stop?

My sector preference, however, is infrastructure services. If you believe natural disasters will increase in frequency and intensity, companies that repair the damage from extreme weather events will have more work in the next few years.

So, too, companies that help large organizations protect and maintain their infrastructure. Imagine organizations that have critical infrastructure in low-lying areas. They will need to ensure their assets can adapt to climate change.

Here are two stocks that could benefit from climate-change adaptation and stand out at the current price. Both suit experienced investors:

1. Johns Lyng Group (ASX: JLG)

The Victoria-based integrated property company provides insurance, building and restoration services; commercial building and property management; disaster recovery and management; and 24/7 emergency services.

Johns Lyng describes itself as “Australia’s largest national disaster responder”. Its fleet of emergency rigs is on standby for major storms or cyclones in Australia.

In October 2022, the Victorian Government appointed Johns Lyng Group to assist with Victoria’s flood disaster, where an estimated 34,000 homes were inundated or isolated.

In March 2022, Johns Lyng was awarded a contract to manage the NSW Government’s property-assessment and demolition programs. The company helped lead the NSW recovery after devasting floods in February and March.

Johns Lyng is doing more work overseas. In January 2022, it acquired Reconstruction Experts in the US for US$144 million. Reconstruction Experts is a leading provider of insurance-focused repair work in Colorado, Florida, Texas and California.

Johns Lyng is working on the recovery process after Hurricane Ian, one the deadliest storms to smash Florida in years. The rebuild effort from Hurricane Ian is expected to last several years, creating a long runway of work. Johns Lyng’s US expansion is timely.

The business is expanding rapidly through organic growth and acquisitions. Moreover, Johns Lyng has a growing footprint in disaster-recovery services in Australia and the US. That’s a growth business if ever there is one, given extreme-weather events.

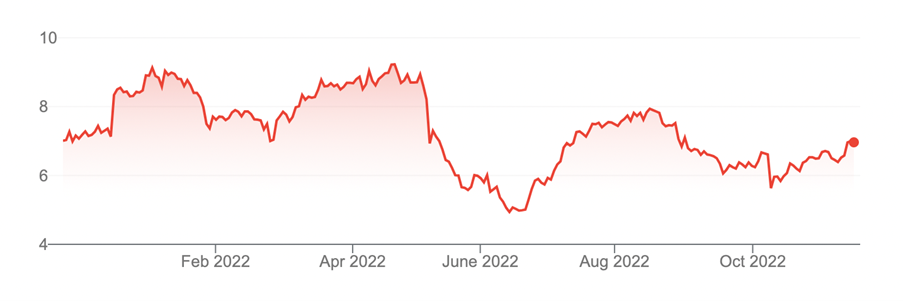

Johns Lyng looks modestly undervalued at $6.58 a share. Some brokers value the stock above $8. It’s disaster-recovery services businesses in Australia and the US should provide an earnings tailwind to support a higher valuation over the next few years.

Chart 1: Johns Lyng Group

Source: Google Finance

2.Ventia Services Group (ASX: VNT)

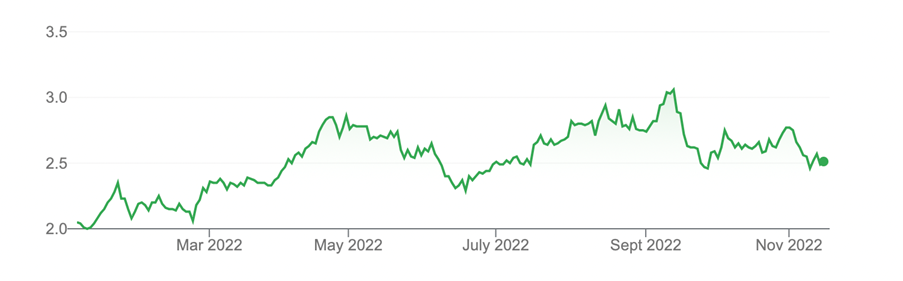

Ventia listed on ASX in 2021 in a float after raising $437 million at $1.70 a share. Ventia now trades at $2.49, having peaked at $3.12.

Ventia provides a range of infrastructure services across road and rail, telecommunications, defence and other sectors in Australia and New Zealand.

Ventia is a dominant service provider of all private motorways and tunnels in Australia, and defence sites. In NZ, Ventia services most of that country’s electricity-transmission network.

Ventia was created in 2015 through the merger of Visionstream, Leighton Contractors Services and Thiess Services – and acquiring Broadspectrum in 2020. Some of those assets have had their critics over the years, but Ventia is a key player in complex major projects and infrastructure services, including maintenance.

At its interim FY22 results in August, Ventia said it was on track to meet prospectus forecasts. It had $17.3 billion of work in hand, up 38% on the same half a year earlier.

Of course, it’s a stretch to buy Ventia based on the effects of climate-change adaptation alone. Ventia is much more a play on population growth: as cities grow, demand for essential services and other infrastructure will keep rising.

Also true is that governments and large companies will have to increase infrastructure-maintenance budgets to safeguard essential assets against climate change over the coming decade. Consider how much infrastructure could be damaged by floods and other natural disasters. Then there are rising temperatures.

More stringent environment regulations will also boost demand for infrastructure-maintenance services this decade.

Again, I don’t want to base investment decisions on climate speculation. But it’s a reasonable bet that demand for infrastructure services will be stronger than the market expects over the next few years. Ventia is well placed for this growth.

Morningstar’s valuation of $3.60 a share suggests Ventia is under-priced at the current $2.49. The stock has fallen 16% since September for no obvious reason other than general equity-market weakness. The selling looks overdone.

However, care is needed: newly listed companies can lose favour and Ventia has some big shareholders that could sell their stock next year when escrow restrictions expire. That could weigh on Ventia’s price, even though it looks undervalued.

As I have written many times for this report, the best time to buy IPOs is often a year or two after they list, when early investors are allowed to sell their shares, and when there is more information disclosed as a listed company.

For long-term investors, Ventia’s current price weakness could be an opportunity. If you believe demand for infrastructure services will rise as populations increase, and that climate change will lead to higher long-term maintenance spending on essential assets, Ventia is a stock to watch.

Chart 2: Ventia Services Group

Source: Google Finance

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at November 14, 2022.