I had my car serviced this week. Ouch! Our local mechanic does a great job and is reasonably priced, but the service fee was noticeably higher this year.

That’s no surprise. With annual inflation in Australia at 6%, costs are rising everywhere. Higher costs for parts and labour for a car service are inevitable.

I thought about cyclical and structural factors affecting auto-parts demand and if it’s time to buy some high-quality parts providers for cars and trucks.

Australia has some terrific auto-parts wholesalers and retailers. For cars, they include Bapcor, ARB Corporation (SUV parts), Infomedia (parts catalogues), Super Retail Group (which has Supercheap Auto) and National Tyre and Wheel.

For commercial vehicles, there’s the high-performing Supply Network and the micro-cap MaxiPARTS, which was covered in last week’s column.

I like the outlook for parts demand for trucks and trailers as Australia’s commercial fleet ages, there are more vehicles on roads, and greater wear and tear.

Australia and New Zealand have some of the oldest heavy-vehicle fleets in the OECD with an average age of 15 and 18 years respectively, according to a 2021 Austroads report on aged heavy vehicles. Older trucks comprise 56% of the national fleet.

Supply complications for new heavy vehicles during COVID-19, and rising fuel and wage costs, will encourage some fleet operators to use vehicles for longer. That should mean continued strong demand for parts to keep these vehicles going.

After rallying this year, Supply Networks is due for a pause or pullback, but has good long-term prospects as it builds market share and expands its margin. MaxiPARTS is worth watching for investors who understand the risks of micro-cap investing.

In some respects, parts demand for personal vehicles faces similar challenges. As fuel and other costs rise, it’s a good bet that more people will keep their vehicle for longer.

New car sales in June 2023 were 25% higher than at the same time a year ago, according to the Federal Chamber of Automobile Industries. Sales would have been even stronger had dealerships been able to get enough stock coming out of COVID-19.

Much has changed in the past 12 months. Soaring interest rates, the full effect of which is yet to be felt, will affect auto demand this financial year. Fewer people will be able to afford a new car when they are struggling to meet home-loan repayments.

Rising fuel, food and other living costs will also encourage more people to keep their car for longer rather than borrow more for a shiny new vehicle.

At the same time, more workers will return to their office and spend less time working from home. That means greater daily vehicle usage and wear and tear.

Of course, a slowing economy can encourage people to delay their scheduled car service to reduce costs. Or do their own basic car service and avoid costly mechanics, a trend Super Retail has identified in some of its recent commentary.

In a May presentation, Bapor noted revenue and margin headwinds for retail parts demand due to cost-of-living pressures. This prompted share-price falls in Bapcor and ARB as the market prices in a more challenging outlook as the economy slows.

Longer term, the average age of passenger vehicles continues to edge higher (it was 11 years in 2021, according to the Australian Bureau of Statistics). IBISWorld, a forecaster, predicts 22.5 million vehicles on our roads in 2026, from 20.7 million last year.

Moreover, it’s getting harder to avoid car services due to warranties and other incentives that require vehicles to be serviced on time. Also, advanced car technologies are making it tougher for the do-it-yourself market as expert mechanics are required.

Taken together, these trends suggest solid demand for auto parts over the next few years, even with greater uptake of Electric Vehicles. Long-term investors who can look through current cyclical challenges will find parts suppliers interesting at current prices.

Here are two parts suppliers to watch:

- Bapcor (ASX: BPA)

I’ve covered Bapcor several times for this report but lost interest when it soared above $8 in late 2020. The valuation ran too far, too fast after the COVID-19 recovery.

To recap, Bapcor is a leading provider of vehicle parts, accessories, equipment and other services in the Asia Pacific. It has around 1,000 locations in Australia, New Zealand and Thailand, about 5,000 staff and had around $1.8 billion of revenue in FY22.

Bapcor says only 10% of its revenue comes from discretionary retail – that’s important as the economy slows and consumers struggle. Most of its revenue is from non-discretionary trade and wholesale (supply of parts to workshops for cars and trucks).

Bapcor’s 1H FY23 revenue was 13.3% higher than for the same period in FY21. However, after-tax net profit was almost 12% lower compared to 1H FY21 and the return on invested capital was 11% lower in that period. Bapcor has work to do.

Bapcor says it expects a slight improvement in the second half of FY23 and a “solid underlying performance” in FY23.

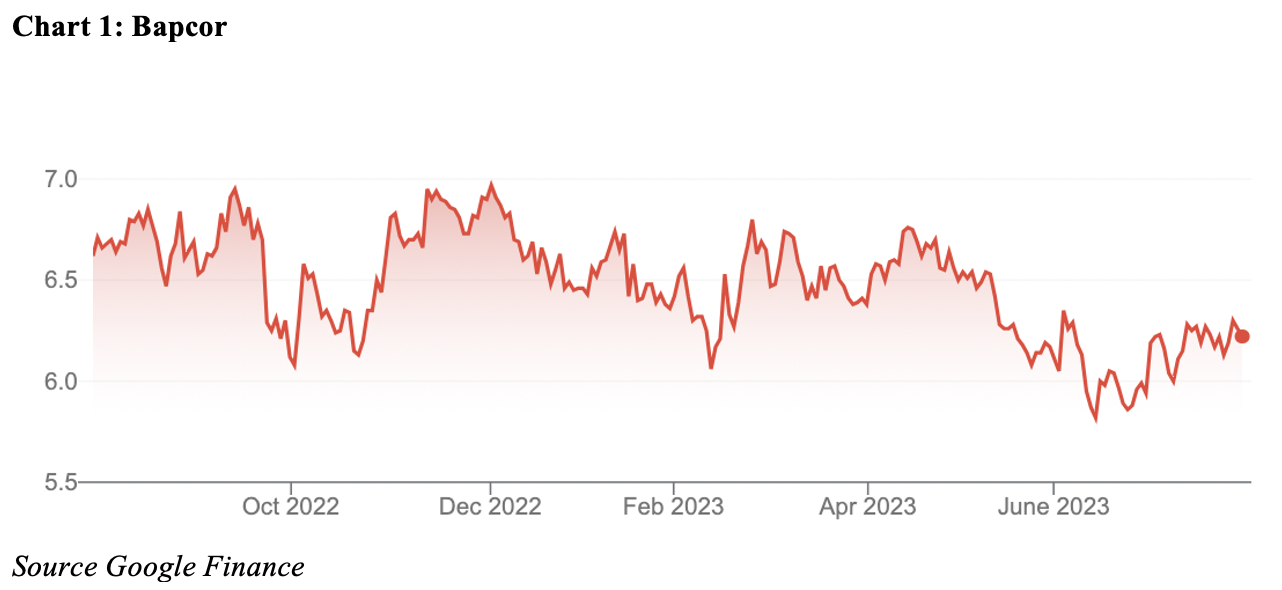

The market has priced this sluggish outlook into Bapcor’s valuation. The stock is down from about $8 in late 2021 to $6.22. Bapcor’s market performance this year has been poor by its standards – but that’s an opportunity for new investors.

At $6.22, Bapcor trades on a trailing Price Earnings (PE) multiple of about 17 times. The five-year average is closer to 21 times. Morningstar values Bapcor at $8 a share.

Clearly, Bapcor has many headwinds this year. Longer term, it has an excellent market position that provides economies of scale and a barrier to entry for new rivals.

If you believe there will be even more cars and trucks on our roads in the next five years – and that their average age will continue to edge higher – Bapcor appeals.

A recovery could take time. There is no obvious short-term re-rating catalyst as Bapcor faces a tough year. But I like Bapcor’s strategic initiatives and new energy around revamping the business for its next growth phase.

- Infomedia (ASX: IFM)

Infomedia is one of those small-caps that seem to come in and out of vogue with fund managers. I remember writing about the parts-catalogue provider when it listed on ASX in 2000 through an Initial Public Offering (it soared on debut).

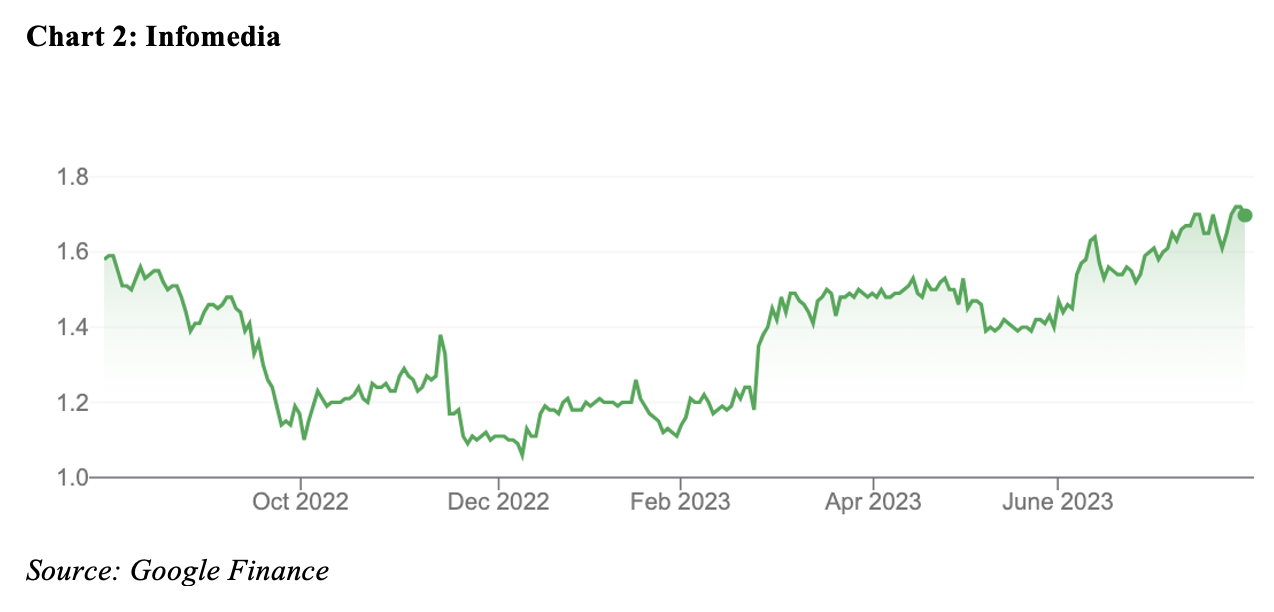

Infomedia disappointed investors for its first decade as a listed company, plumbing 20 cents in 2013 (it traded above $2 soon after listing). The stock has rallied in the past few years and has been strong this year. More fund managers I know are talking about it.

Infomedia has a global footprint. Its parts-management technology is used in 186 companies by about 250,000 daily users.

The company’s parts and services software is used in an increasingly data-driven automotive ecosystem. When your car dealer texts a reminder about a car service, a loyalty offer or warranty-expiration info, chances are it is using Infomedia software.

The key to Infomedia is its Average Recurring Revenue (ARR). This key metric for software-as-a-service (SaaS) companies shows the amount of recurring revenue for a company. Infomedia’s ARR was up almost 11% in the 12 months from December 2021.

Successful SaaS companies have a beautiful model. High margins, recurring revenue and low customer churn (due to high switching costs). Auto customers using the Infomedia technology do so for years and decades.

In March, Infomedia reaffirmed its revenue guidance for FY23 ($127-$131 million). Nearly all of that is recurring revenue – an excellent sign.

The market likes Infomedia’s improving near-term prospects and its longer-term position in the data-driven auto-parts and service ecosystem.

Infomedia is up from a 52-week low of $1.06 to $1.70. As much as I like the company’s potential, the share price has run hard this year. On a price-to-sales, or PE basis, Infomedia looks fully valued at the current price.

Still, Infomedia warrants a spot-on portfolio watchlists. I’ll be watching the company’s full-year result on 28 August to get a better sense of how it is travelling. There’s much to like about Infomedia’s recent progress and industry position.

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at July 26, 2023.