Few investors will want to own cyclical transport stocks if Australia’s economy stalls in 2023. But I see opportunities in the transport sector for contrarians.

Yes, challenges abound. Rising fuel and wage costs hurt profit margins. Labour shortages hurt fleet utilisation. Slowing demand hurts freight volumes.

If inflation proves harder to combat than markets expect, interest rates will rise at least a few more times this year. That would increase the risk of a local recession and dissuade investors from buying transport, retail and other cyclical shares.

Problems at Scott’s Refrigerated Logistics reinforce the risks for transport companies. Scott’s, one of Australia’s largest trucking companies, entered receivership this week. It has had challenges for several years and finally succumbed to razor-thin margins.

But beneath these headwinds, I keep finding pockets of value in mid- and small-cap transport stocks, particularly those beaten-up over the past 12 month and mostly outside the trucking sector. More on them soon.

Start with the airlines. Qantas Airways recently posted a record $1.4 billion profit for the first half of FY23 on the back of surging demand. Qantas said twice as many people plan to fly domestically and 60% more plan to fly internationally this year (compared to pre-COVID-19 levels).

So much for higher interest rates. If you believe the headlines, hundreds of thousands of Australian householders are about to plunge over a “mortgage cliff” when they reset their home loan from a super-low fixed rate to a higher variable rate.

Qantas, a stock I have written on favourably for this report over the past few years, is benefitting from pent-up demand for travel after COVID-19. And, like other airlines, from charging sharply higher fares because capacity has not caught up to demand.

Then there’s Virgin Australia. Speculation is rife that Virgin will join ASX through an Initial Public Offering (IPO) that would value the airline at more than $3 billion.

Think about that for a moment. If the Virgin IPO proceeds, the airline will list when the economy risks recession and when homeowners are belted by rising interest rates. The listing will be during the worst local IPO market in two decades and amid a jittery sharemarket. Hardly the conditions for a transport IPO.

What does that tell you about transport stocks? For starters, it shows that following top-down narratives and “group think” about sectors is dangerous. Equally wealth-destroying is making investment decisions based on today’s conditions.

By this time next year, we’ll be talking about the first interest-rate cuts. The market looks 12-18 months ahead and investors should do the same with transport.

My sense is the transport story is as much a “micro” story as a “macro” one. Large and small transport companies are becoming more efficient through technology. They’re also using their balance sheet to buy small firms and consolidate their industry.

I don’t doubt transport stocks will do it much tougher as the economy slows this year and it becomes harder to pass on cost increases. Sadly, some will go bust. The question is valuation: how much of the pain over the next 12 months is already priced into transport stocks?

Here are two small-cap transport stocks that stand out. I included a third transport idea – Lindsay Australia – in my final column for this report in 2023 in “13 small-cap industrial stocks to watch in 2023”. Lindsay has rallied over 12 months.

Each stock suits experienced long-term investors who understand the features, benefits and risks of investing in small, cyclically exposed companies.

- Silk Logistics Holdings (ASX: SLH)

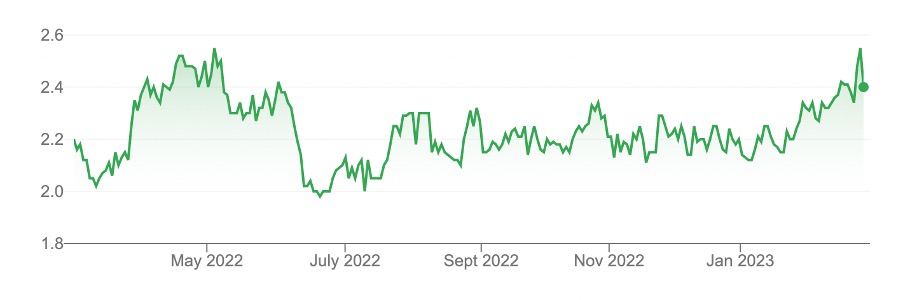

Silk raised $70 million through an IPO on ASX in July 2021, capitalising it at $151 million. The business is worth $190 million today.

I keep hearing good things about Silk Logistics, an emerging transport and logistics company that has been put together (in its current form) since 2014. Even one of its competitors recently told me Silk is doing a good job in its market.

In February, Silk announced a 39% increase in revenue for the first half of FY23. The company’s underlying after-tax net profit grew 32% to $9.8 million.

Silk won about $34 million in new contracts and renewed customer contracts worth $83 million. A big chunk of annual revenue is recurring due to contracts.

Towards the end of its latest earnings presentation, Silk outlined its five-year strategy. The plan is to get to $1 billion in revenue, from guidance of $480-500 million for FY23.

I’m always wary of big round numbers in strategic plans. Bold targets capture attention, but too few companies achieve them. In Silk’s case, a doubling of revenue within five years to $1 billion is realistic, albeit challenging.

With $34.1 million of cash on its balance sheet and strong growth in free cash flow, Silk can acquire more businesses and integrate them into its offering. Parts of the transport and logistics sector are highly fragmented with many family-owned companies. Their baby-boomer owners will look to sell as they retire and as their kids pursue other careers. There will be more opportunity to acquire firms as parts of the transport sector struggle.

I suspect Silk will raise equity capital in the next 12-18 months to quicken its acquisition strategy and bring new institutions onto its share register. Like many microcap IPOs, Silk needs to improve its share liquidity and expand its share ownership.

Silk is growing its wharf cartage, warehousing and distribution facilities in more locations. It’s building the infrastructure for a larger business and service offering.

I like Silk’s strategy and the implementation of that plan by management. After rallying this year, Silk is probably due for a pause as the market digests its latest earnings. But there’s much to like about the company’s progress and strategy.

Chart 1: Silk Logistics Holdings

- Kelsian Group

The bus-and-ferry operator also made my list of top mid- and small-cap ideas for 2023 – and recently reported an encouraging half-year result for FY23.

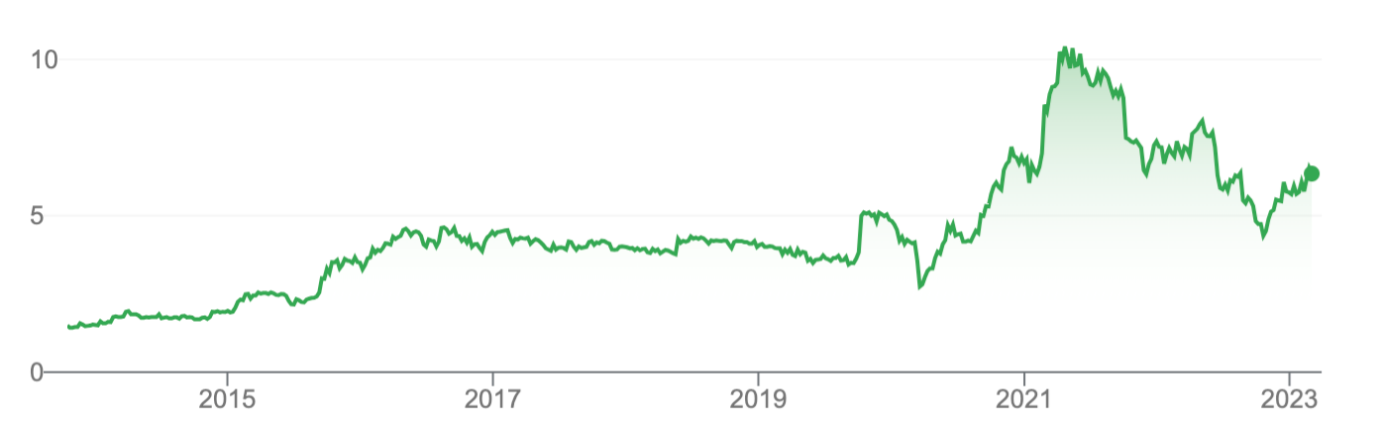

The market couldn’t get enough of Kelsian in 2020 and for much of 2021 after it acquired Transit Systems Group, a Brisbane-based bus operator. The $654-million deal was transformative for Kelsian, which had previously focused only on ferries and marine tourism. The deal tripled Kelsian’s size.

But after peaking at just above $10 in April 2021, Kelsian slumped to around $4.30 in October 2022. After losing some key bus-contract tenders, the market fretted that Kelsian’s valuation had run too far, too fast. Investors were nervous.

The negativity went too far. I included Kelsian in my small-cap list in late December at $5.87. The stock is now at $6.56.

In February, Kelsian announced 6% growth in revenue to $678 million in the first half of FY23. Underlying after-tax net profit rose 22% to $26.5 million.

Kelsian retained an important bus contract in New South Wales and signed a few new ones in that State. The company announced total contracted value in new bus contracts of around $1.3 billion over seven years. It delivered a solid result in a challenging market.

The SeaLink marine tourism and ferry business outperformed. The recovery in domestic tourism and gradual recovery in international tourism underpinned 41% revenue growth for the half, compared to a year earlier.

As to the second half of FY23, Kelsian says it has significant new bus-contract tender wins in Sydney and that forward booking in its marine tourism business remain strong.

I like that Kelsian has a large amount of contracted revenue through bus contracts with governments. These contracts are hedged for wage and fuel-price increases, meaning about three-quarters of Kelsian’s revenue is protected against inflation.

Longer term, I see rising demand for buses rising amid population growth and as more people use public transport due to higher costs of private-car ownership, or on environmental grounds (by using electric-powered buses). Fewer young people are buying cars these days, a trend that is well-entrenched overseas.

The consensus price target of $7.49 for Kelsian, based on the average of nine broking analysts, suggests the stock is undervalued at the current $6.56.

Kelsian is no screaming buy. But this well-run company has a good position in its market, a high proportion of recurring contracted revenue and defences against inflation. These are valuable traits in this market.

Many small-cap companies would love to have a big chunk of their revenue contracted through long-term, low-risk government deals that are mostly indexed to inflation.

Chart 2: Kelsian Group

Source: Google Finance

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at March 1, 2023.